jetcityimage

Kroger (NYSE:KR) is set to report earnings on Friday September 9th before the market opens. While grocery store stocks historically have performed fine in times of inflation due to their ability to pass on costs to customers, KR stock has nonetheless seen its stock dip from recent highs. This is a stock which has done very little over the past 7 years – in spite of reducing shares outstanding during that same time period and exiting the pandemic with a much stronger balance sheet. The stock trades at just 12x forward earnings, a conservative multiple considering the potential for leveraged stock buybacks in the future. The stock looks like a buy heading into the earnings print.

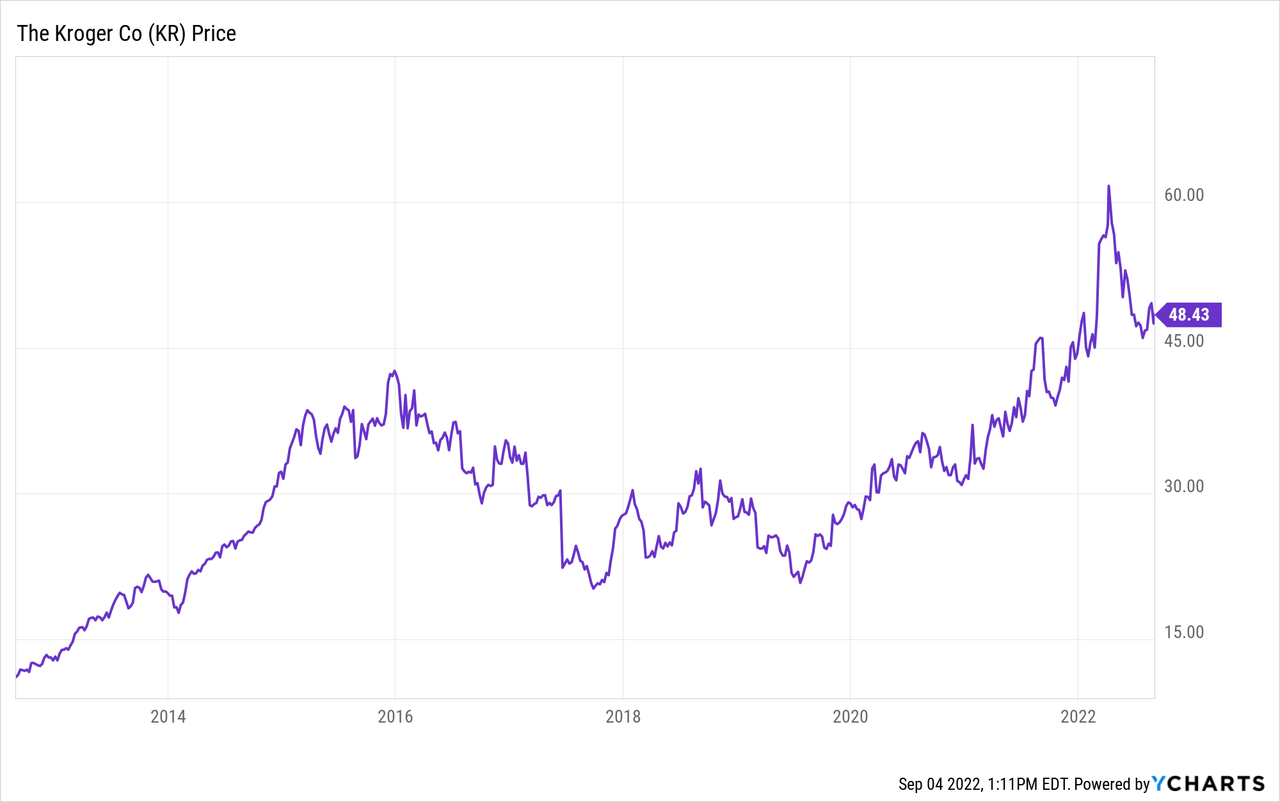

KR Stock Price

After peaking above $62 per share earlier in the year, KR has fallen over 20%.

While the stock remains a strong performer since the pandemic, it has delivered muted returns since 2015. I last covered KR in December where I discussed the company’s prospects after releasing 2021 Q3 results. The stock has since returned 7%, outperforming the broader market by 22%. The stock remains compelling at current levels.

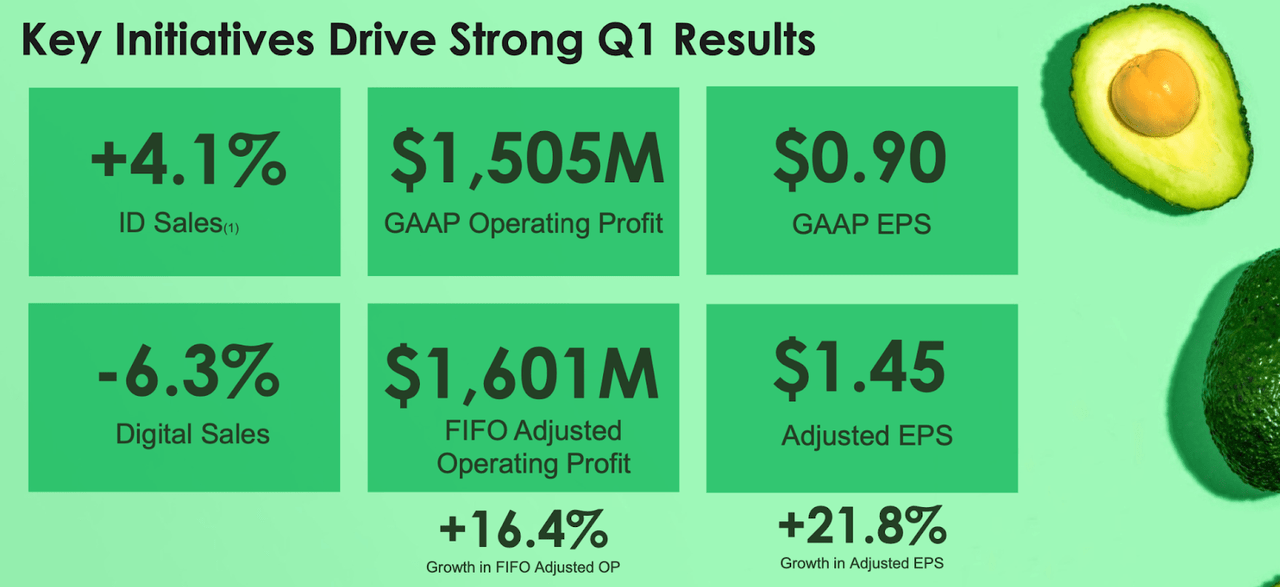

KR Stock Key Metrics

Grocery stocks were key beneficiaries of the pandemic, but KR continues to deliver strong results. The company generated 4.1% identical sales growth which led to 16.4% growth in adjusted operating profits and 21.8% growth in adjusted earnings per share.

2022 Q2 Presentation

Some readers might be wondering if it makes sense to be chasing KR stock now that it is so much higher than it was pre-pandemic. Here are some factors to consider. First, earnings have grown considerably: whereas KR earned $2.19 in adjusted EPS in 2019, the company is now guiding for up to $3.95 this year. Second, leverage has declined as well – debt to EBITDA stood at 2.5x pre-pandemic and stands at 1.68x now. The company has stated its target debt to adjusted EBITDA ratio is 2.3x to 2.5x.

The strong balance sheet has allowed KR to generously reward shareholders. Dividends have increased by over 50% since pre-pandemic levels and the company repurchased $665 million shares in the quarter.

On the conference call, management noted that while their business is inflation-resistant, some customers have been shifting their spending from premium products to more value products. Inflation did lead to increased costs like increased employee wages, but the company tried to offset some of that by reducing costs elsewhere, such as introducing a bakery forecasting tool to streamline ordering and reduce waste.

Is Kroger Expected To Beat Earnings?

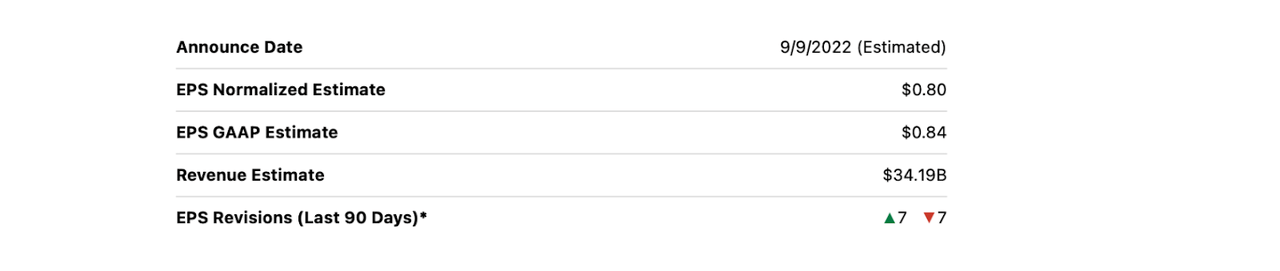

KR is expected to report earnings on Friday, September 9th before the market opens. The company is expected to report $0.80 in adjusted EPS and $34.19 billion in revenues.

Seeking Alpha

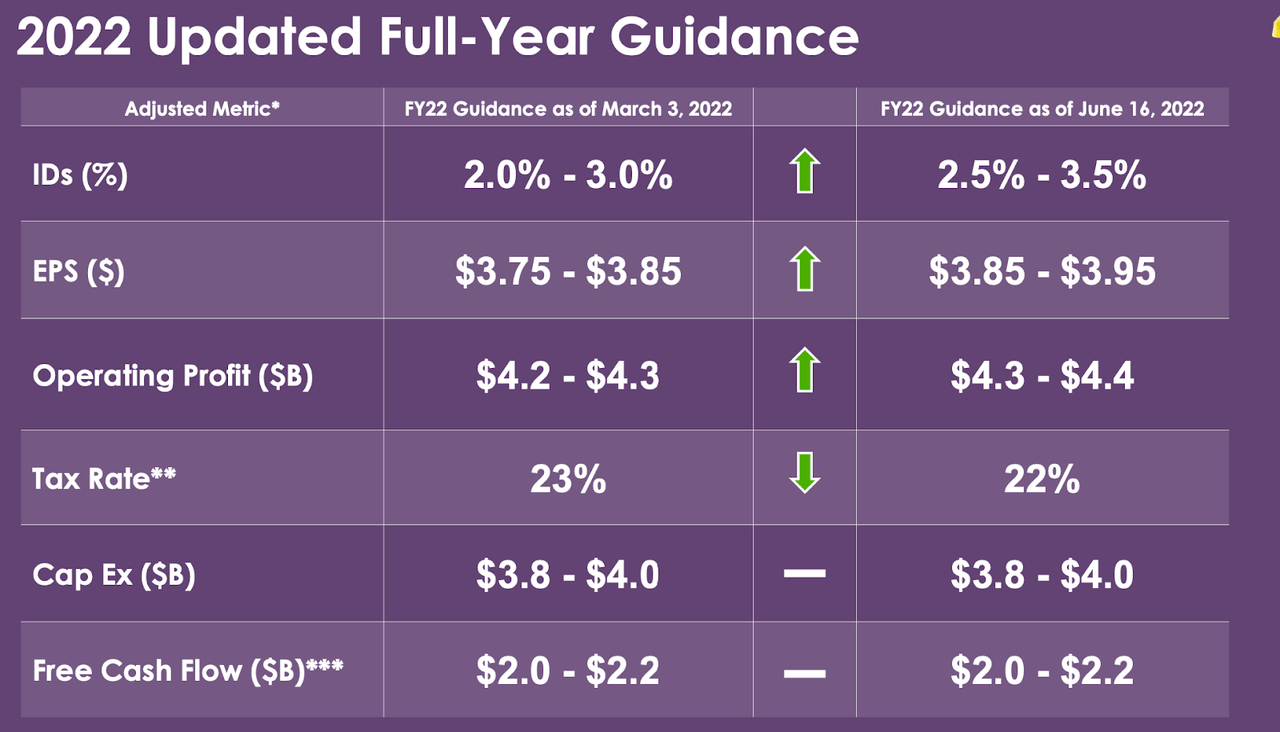

KR had already increased its guidance for the full year to show up to 3.5% identical sales growth and $3.95 in adjusted earnings per share.

2022 Q2 Presentation

Based on that strong guidance boost, it seems likely that KR might deliver a strong second quarter, though it remains to be seen if inflationary pressures will lead to weaknesses in the second half of the year.

Is KR Stock A Buy, Sell, or Hold?

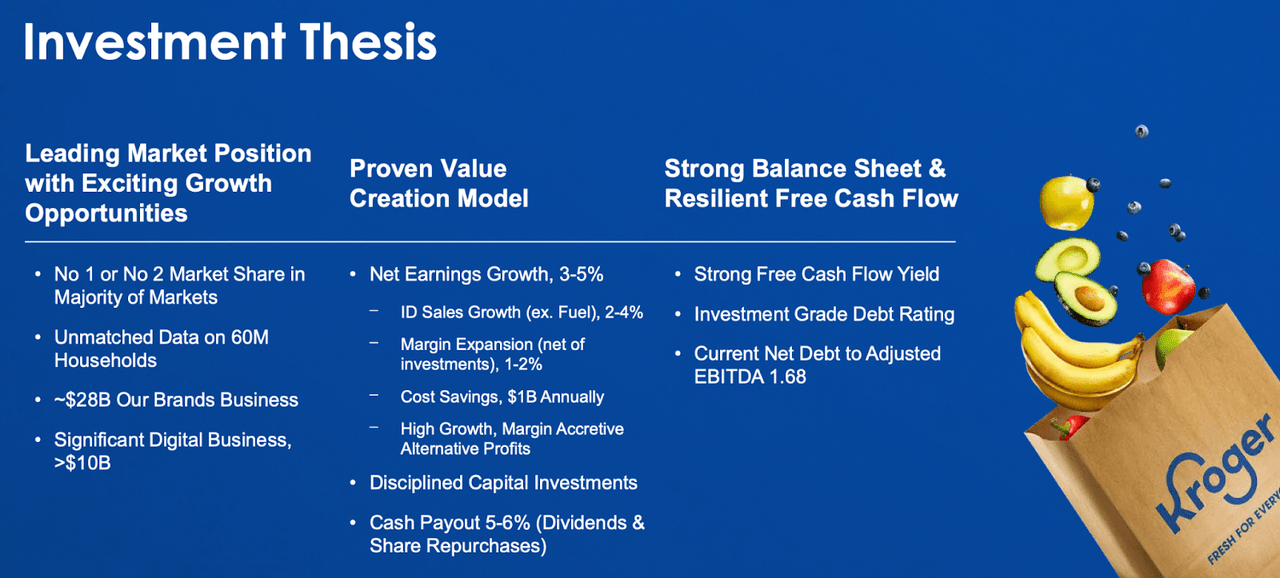

KR has given its investment proposition as follows. The company expects to generate around 3% to 5% annual earnings growth as it combines identical sales growth and cost savings. Between dividends and share repurchases, the company expects to return up to 6% of cash to shareholders which in turn might lead to 8% to 11% total returns.

2022 Q2 Presentation

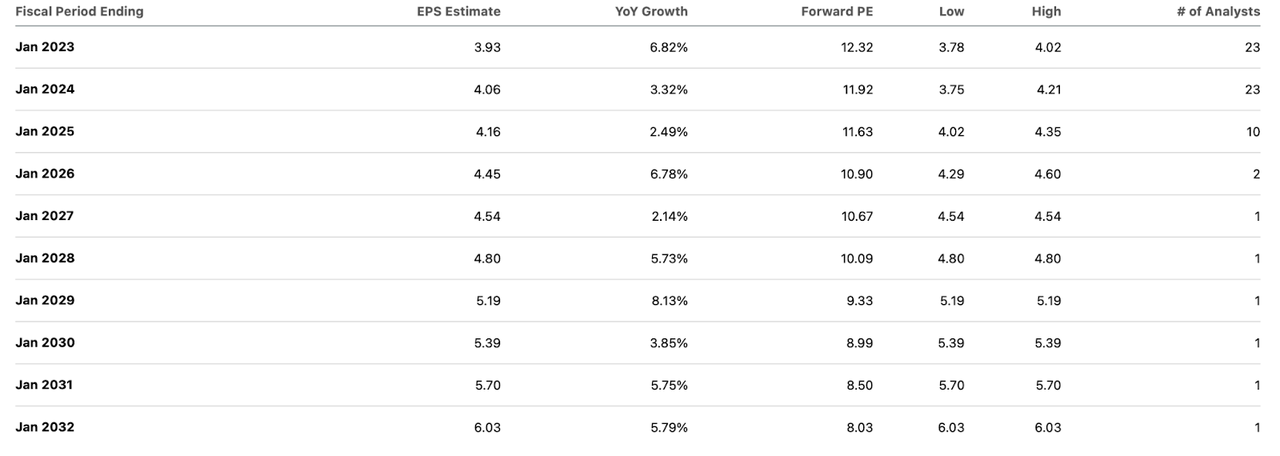

With the stock trading at just 12.2x forward earnings, that kind of projection looks reasonable, as the company needs only to deliver mild earnings growth to reach a double-digit return profile. Consensus estimates call for low single-digit earnings growth over the next decade.

Seeking Alpha

That might not be so exciting, but the key metric here to focus on is the low debt to EBITDA ratio, which stood at just 1.68x in the quarter – far lower than the 2.3x to 2.5x target range. Based on that, I could see shareholder returns being stronger than expected. Consider that KR generated $2.8 billion net income in 2021 and returned $2.2 billion to shareholders through dividends and share repurchases. If management determines that it can allow leverage to steadily increase to the 2x range, then the company might end up returning all if not more of net income back to shareholders through dividends and more aggressive share repurchases. I would expect that outcome to lead to multiple expansion, as I have not seen many stocks continue to trade at conservative multiples in the face of consistent growth and aggressive share repurchases. I could see KR eventually re-rating to the 15x to 18x earnings range. At the low end, that presents around 25% potential upside from multiple expansion alone, which nicely complements the roughly 11% total return profile implied by the 12.2x earnings multiple and single digit growth rate.

The biggest risk here is that of competition. Grocery stores are arguably a commoditized industry, with consumers placing a strong emphasis on price. It is possible that KR will not be able to offset competitive pressures with cost-saving initiatives indefinitely which might eventually lead to margin contraction. This might result in KR deciding to invest more heavily in capital expenditures to remodel their stores, which might prevent the company from more aggressively leaning into its share repurchase program as expected. Furthermore, my personal view is that online grocery delivery will become more and more commonplace – that assessment is based on the rapid growth of food delivery. Online grocery delivery has lower margins than in-person shopping and a greater mix of online grocery delivery would place downward pressure on overall margins.

I rate KR stock a buy due to the conservative valuation and consistent return of capital to shareholders.

Be the first to comment