ipopba/iStock via Getty Images

Turning back the clock on cannabis investing

As cannabis investors it would be great to go back in time five years or so, when legal cannabis was just starting to gain momentum. With what we now know, we might approach the sector quite differently. Even the challenging market of early NA cannabis had opportunities for profitable investing. We can’t go back in time, of course, but there is an opportunity today very similar to North America five years ago (for this article, NA refers to the US and Canada). That area is the Europe, excluding Russia. Like early North America, the European Union [EU] is just starting legalization. They have a large population, 447 million vs. 369 million in the US and Canada. It includes many rich, stable, highly developed economies, and a strong rule of law. They are legalizing on a model of medical first, which will expand to adult use later. Public opinion towards cannabis is steadily moving in a positive direction. Finally, as in North America, the market is divided into many separate legal jurisdictions. Each has its own regulatory regime, although there are some commonalities.

Continuing our imagining, if we could go back those five years, we would have a more informed idea about what to look for in a cannabis company. We would look for an operator with an established business base to build on, management with experience in the industry, proven ability to make a profit, and an ambitious but disciplined approach to growth. In short, we would look for a company like InterCure Ltd. (NASDAQ:INCR).

Introduction to InterCure

InterCure is based in Israel, where medical cannabis has been legal for a number of years. Israel has the highest percentage of cannabis users in the world. In a report by Statista.com, in 2020 the percentage of Israelis using cannabis in the past 12 months 27%. Jamaica was second with 18% and the US was third at 17.4%. InterCure does not do business in the US, which means it is not subject to confiscatory 280E taxes, does not have banking restrictions like those in the US, and there are no barriers to uplisting (INCR is listed on the NASDAQ). These factors alone make the path to success much easier than in the US. InterCure went public in 2021, but has been doing business since 2008. They have the country’s largest chain of cannabis pharmacies, which is the way cannabis is distributed there. Their seed-to-sale model allows them to earn the whole margin of the entire operation.

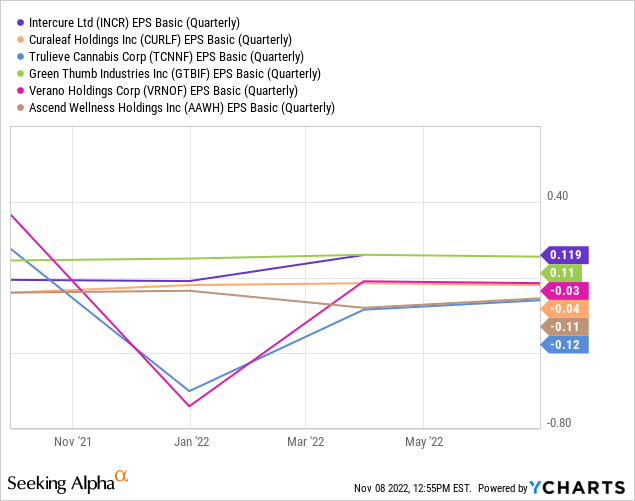

InterCure’s financial results are equal to or better than North American cannabis operators. As an informative example, the chart below compares InterCure’s EPS to that of five prominent US companies. The table omits some popular names, like Cresco (OTCQX:CRLBF), Tilray (TLRY), and Aurora (ACB), because those companies’ steep losses would make it difficult to read.

As the table below shows, revenues have been tripling every year and their level of profitability is unmatched. The table is in Canadian dollars because the company is domiciled there and because operating performance would be obscured by using the appreciating US dollar. Numb

| Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | |

| Revenue (millions CAD) | 4.4 | 8.8 | 10.7 | 13 | 13 | 17.8 | 31.3 | 34.3 | 37.4 |

| Net Income (millions CAD) | -0.4 | 0.7 | 3.7 | 1.2 | 2.4 | -0.6 | -1.3 | 5.2 | 5.8 |

| EPS (CAD) | -$0.01 | $0.03 | $0.14 | $0.06 | $0.05 | -$0.02 | -$0.05 | $0.15 | $0.13 |

| EBITDA (millions CAD) | -0.2 | 1.7 | 2.1 | 2.6 | 3.8 | 2.4 | 5.1 | 8.8 | 7.5 |

Source: Seeking Alpha and InterCure

1.3% of Israelis have medical cannabis monthly prescriptions. In the latest earnings call, InterCure CEO Alex Rabinovitch estimated that number will eventually be as high as 5%, which would be 400% market growth.

InterCure international strategy

InterCure has a strong and thriving domestic business base, but in a country with a population of 8.8 million there are limits to growth. CEO Rabinovitch has stated that their long-term strategy is international expansion. In fact, Israel has a long history of turning local successes into international powerhouses, with Teva (TEVA) and Wix (WIX) being two of many examples.

InterCure will be a formidable force in the international market, having built up its international capabilities for years. They are currently number one in pharma cannabis sales in the world. They have six cultivation sites around the world and a supply chain reaching four continents. There are business relationships with a number of companies, including OrganiGram (OGI), Charlotte’s Web (OTCQX:CWBHF), Tilray, Teva, and Cookies. The meaning of the partnership with Cookies, the most powerful cannabis brand in the world, cannot be overstated.

Companies hoping to do business in Europe will have to navigate numerous highly regulated national markets, with learning curves that are expensive, time consuming, and by no means guaranteed. Each product must be continuously tested and monitored from seed to sale, and companies must adhere to rigorous Good Manufacturing Standards [GMP]. InterCure has done exactly this in the Israeli market, and they are confident they can repeat this success as they move further into Europe. They are currently targeting four core target markets for growth: Germany, UK, Australia, and Austria. In addition, there is high demand for their branded products in other countries, including Switzerland and China. They have already opened a flagship Cookies-branded store in Vienna and will open a second in the UK by the end of the year.

InterCure’s singular asset

The Chairman of InterCure’s board of directors is Ehud Barak. Barak is a former general, war hero, and prime minister of Israel. Not just a figurehead, Barak has a long-time interest in cannabis and is an active participant in the direction of InterCure’s business. His leadership abilities are beyond question, his prominence in Israeli can open doors and facilitate business to a degree InterCure’s competitors can only dream of. In addition, Barak’s reputation is global, which will be an asset as InterCure extends its business beyond Israel.

What others are saying about InterCure

One advantage of investing in InterCure is that it is relatively little known. With 734 followers on Seeking Alpha, far behind a company like Trulieve, which has 24,000 followers. As a foreign company it has not been on the radar of most investors. Fortunately, financials from its time as a private company are available, and its track record is as long as many of the well-known cannabis names. Informed investors have the opportunity to get in early before it is discovered.

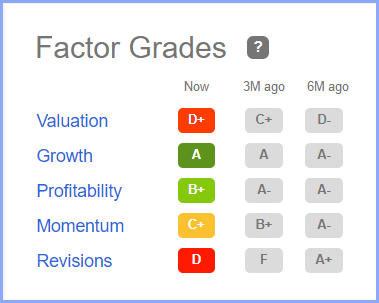

Seeking Alpha authors give INCR a BUY rating, Wall Street a STRONG BUY, and a Quant Rating of HOLD.

Seeking Alpha

SA Factor Grades give INCR high marks for Growth and Profitability, and lower marks for Valuation and Revisions.

Seeking Alpha

These ratings are useful but must be viewed in light of the fact that a small number of analysts follow the company. For example, there are only two analysts responsible for the Revisions grade, so a change by a single analyst can cause a large change in the score.

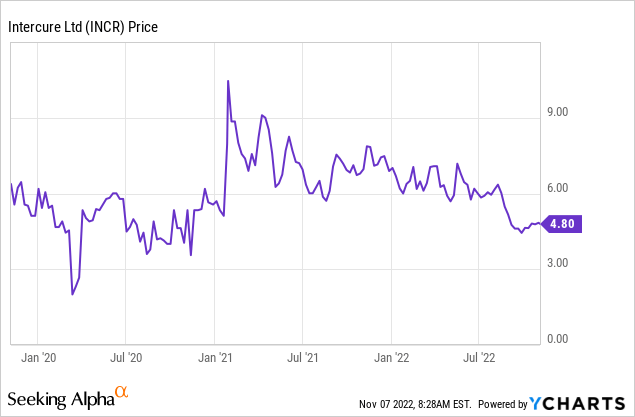

InterCure share prices have declined 31% over the past 12 months. For comparison, the big five US cannabis stocks: Green Thumb (OTCQX:GTBIF), Trulieve (OTCQX:TCNNF), Cresco, Curaleaf (OTCPK:CURLF) and Verano (OTCQX:VRNOF) have declined and average of 46%. As the three-year chart below shows, InterCure participated to a degree in the great sector runup of 2021.

Projected earnings for 2022 are $0.36 USD per share, giving a projected PE of 13. With $0.20 on the books for the first two quarters, this seems easily achievable. Earnings for 2023 are projected at $0.60 USD per share. This gives a projected 2023 PE of 8, very low for a profitable company with expected revenue growth of over 30%.

Risks

Israel, InterCure’s home market, has a changing regulatory environment and the market is very competitive. Everyone wants to do business in the country with the highest per centage of cannabis users in the world. InterCure is doing very well but is naturally vulnerable to regulatory changes and competition. Similarly, the huge potential of the European market will attract many competitors. Tilray, Curaleaf, Canopy (CGC) already have a presence, in Europe, in addition to many local firms aiming to establish themselves. In addition, InterCure has the risks attendant to every small emerging growth company. Financial results and stock prices can vary widely from quarter to quarter, and changes in growth prospects will have outsized effects on any company whose strategy depends on growth. Finally, InterCure is based in a politically volatile part of the world. Negative internal or external political developments could threaten operations in the company’s domestic business.

InterCure is a BUY for global cannabis growth

The European legal cannabis market is an exciting point. Much like the nascent North American market of five years ago, it is just getting started and has huge untapped potential. Unlike NA, companies will not be hamstrung by confiscatory 280E taxes, banking restrictions, uplisting barriers, and a dysfunctional system of illegality on one level (national) and legality on another (state). Cannabis is still a difficult business, but profitability will not be nearly as elusive as in the US and Canada.

By drawing on their NA experience, investors in the European market can have an informed idea on how the industry might develop there. They will also have a leg up on identifying which companies have the best chance of success. Successful companies will have an established business base to build on, management with experience in the industry, proven ability to make a profit, and an ambitious but disciplined approach to growth. InterCure, already the global leader in pharmaceutical cannabis, has all those characteristics, and is worth serious consideration by all investors interested in participating in the inevitable huge growth of legal cannabis around the world.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition.

Be the first to comment