HJBC/iStock Editorial via Getty Images

Bayer Aktiengesellschaft (OTCPK:BAYZF) and Henkel AG & Co. KGaA (OTCPK:HENKY) are not the only two major German companies (Bayer is on the 8th spot by market capitalization, with Henkel is on the 22nd spot). Both companies have been struggling in the last few years, with Bayer stock declining since 2015 and Henkel since 2017.

And while Bayer might be able to turn around and is seeing an improving business (see my article from last week), Henkel is trading extremely close to its COVID-19 low (from March 2020) and also close to the lowest stock price in the last 9 years. In my Bayer article, I argued that the stock is still a “Buy,” and in the following article, I will make the same case for Henkel.

Annual Results

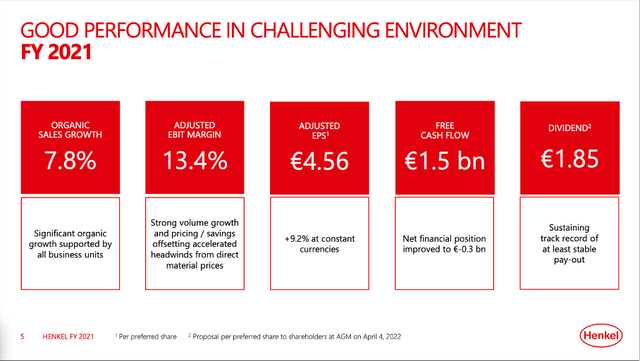

We start by looking at the last annual results, which were not perfect, but at least topline growth was solid. Sales increased from €19,250 million in fiscal 2020 to €20,066 million in fiscal 2021 – resulting in 4.2% year-over-year growth. Operating profit increased from €2,109 million in fiscal 2020 to €2,213 million in fiscal 2021 – an increase of 4.9% YoY. And finally, earnings per preferred share increased from €3.25 in fiscal 2020 to €3.78 in fiscal 2021 – resulting in 16.3% year-over-year growth. However, earnings per share are still below the results of the years between 2015 and 2019 with earnings per share as high as €5.79.

We can also look at adjusted numbers and adjusted operating profit increased from €2,579 million in fiscal 2020 to €2,686 million in fiscal 2021, while adjusted earnings per preferred share increased from €4.26 in fiscal 2020 to €4.56 in fiscal 2021. And finally, free cash flow decreased from €2,340 million in fiscal 2020 to only €1,478 million in fiscal 2021 – a decline of 36.8% year-over-year.

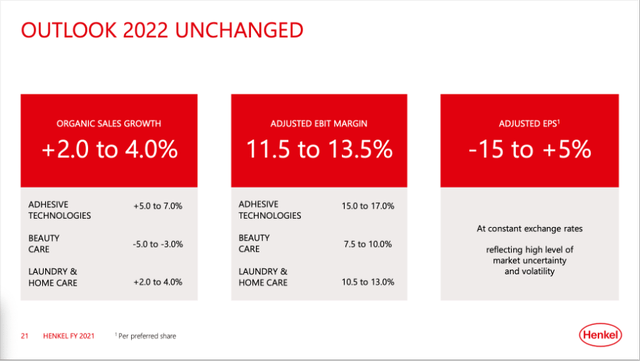

When looking at the guidance for fiscal 2020, Henkel is expecting organic sales to grow between 2% and 4%, with Adhesive Technologies growing between 5% and 7% and Laundry & Home Care growing between 2% and 4%. Only Beauty Care is expected to decline between 3% and 5%. Due to high costs, adjusted earnings per share could decline as much as 15%, but Henkel is also seeing the possibility that earnings per share will grow 5% year-over-year. This extreme range shows how much uncertainty we are dealing with. Henkel is especially pointing toward uncertainty and volatility in the area of raw material and logistics prices.

East Europe and Russia

Since Russia invaded Ukraine, many companies have ended operations in Russia. Bayer has ended its non-essential health and agricultural business in Russia but will continue to deliver essential products. Henkel, meanwhile, is one of the few German companies that is continuing its business in Russia. It was criticized quite heavily in Germany for this decision (see here and here – both articles are in German).

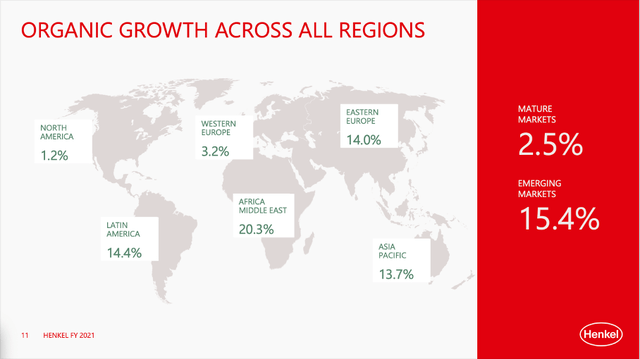

Henkel stopped investments in Russia but is continuing its business, and Henkel is generating about €0.9 billion in revenue in Russia. In Eastern Europe, Henkel generated €3,114 million in sales compared to €2,919 million in sales in fiscal 2020, and this resulted in a 6.7% growth. However, organic growth was 14.0%, and the region was extremely important for Henkel’s topline growth. And, although Eastern Europe seems extremely important for revenue growth, operating profit was only €171 million in fiscal 2021 (and even declined from €228 million in fiscal 2020).

If Henkel should decide to exit the Russian market, it will have an impact on the top line (and also on the bottom line), but it won’t generate a problem Henkel can’t deal with. And Henkel also must be careful as continued operations in Russia could damage the company’s image in many Western countries and could potentially have a negative long-term effect on the business.

Aside from a potential exit from Russia, Henkel is also facing headwinds due to cost inflation. I already mentioned this in my last article, and, when looking at the fiscal results, we can see that cost of sales increased from €10,378 million in fiscal 2020 to €11,092 million in fiscal 2021. Gross profit margin also declined from 46.1% to 44.7%. But Henkel has an economic moat around its business based on well-known brand names, and Henkel will be able to pass on the prices increases to the end customers and will offset increased expenses by increasing prices.

Long-term Growth

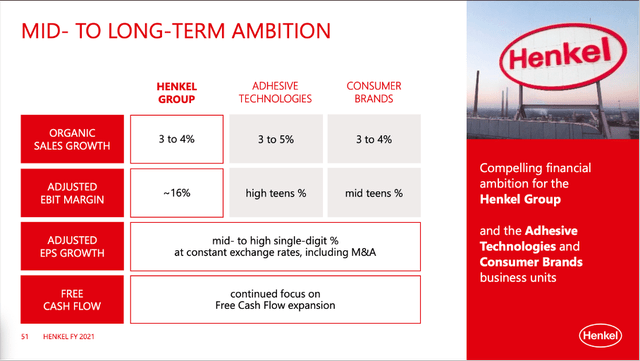

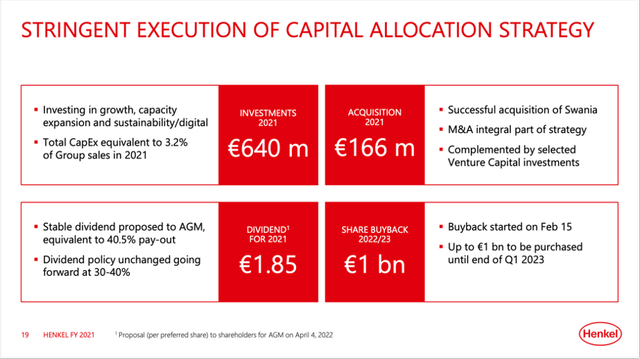

Despite the challenges Henkel is facing, the company still has the same mid-to-long-term ambitions as before. Henkel is expecting organic sales growth to be between 3% and 4%, and adjusted earnings per share growth is expected to be in the mid-to-high single digits. These high growth rates will be achieved by organic sales growth as well as mergers and acquisitions. Additionally, Henkel is trying to improve its gross and operating margin in the years to come, which will influence the bottom line.

I frequently mention in my articles that free cash flow is one of the most important metrics for us as long-term investors. And it is a good sign that one of the long-term ambitions of Henkel is its focus on free cash flow expansion.

In my opinion, these mid-to-long-term ambitions are realistic although Henkel was struggling in the last few years and could grow earnings per share only with a CAGR of 2.67% in the last ten years. But when looking at the last 20 years (since 2001), earnings per share grew with a CAGR of 6.01%. Since 1985 (the oldest data I have), earnings per share increased with a CAGR of 8.07%. And when looking at these numbers, growth rates around 6% seem realistic for Henkel.

Dividend and Share Buybacks

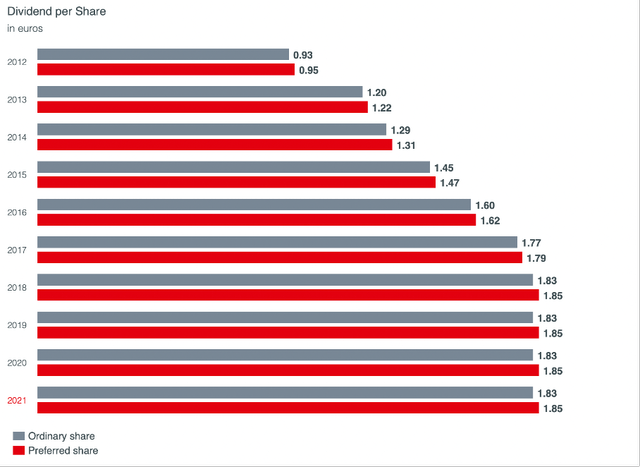

For fiscal 2021, Henkel proposed and paid a dividend of €1.85 for the preferred share and €1.83 for the ordinary share. When you are buying Henkel right now, you won’t get a dividend for this year as Henkel is paying an annual dividend and the dividend was just paid last week.

Henkel kept the dividend stable once again and is paying the same dividend for the fourth year in a row. Right now, Henkel has a dividend yield of around 3%, which is a rather high yield for Henkel and the current payout ratio is also above the targeted payout range between 30% and 40%. When using adjusted earnings per share, Henkel paid out 40.5% as dividend and when looking at a free cash flow of €1,478 million and €800 million in dividend payments, we get a payout ratio of 54%. Hence, without an improving business, we probably won’t see a higher dividend next year.

Aside from paying an annual dividend, Henkel has also announced a share buyback program. On February 15, 2022, Henkel started buying back shares and, until the end of Q1/23, management is planning to spend about €1 billion on share buybacks. With a market capitalization of €26.1 billion right now, Henkel can repurchase about 3.8% of outstanding shares. Considering that Henkel is undervalued right now, buying back shares is a smart decision.

And when looking at the balance sheet, Henkel also has the financial flexibility to buy back shares. On December 31, 2021, the company had €1,295 million in short-term borrowings as well as €1,543 million in long-term borrowings. Compared to a total equity of €19,794 million this is resulting in a debt-equity ratio of 0.14. When comparing the total debt to the operating income of fiscal 2021 (which was €2,161 million), it would take about 1.3 years to repay the outstanding debt. And finally, Henkel has €2,116 million in cash and cash equivalents, which is enough to repay 75% of the outstanding debt. When looking at these numbers, neither solvency nor liquidity should be an issue for Henkel.

Intrinsic Value Calculation

I already mentioned above that buying back shares is a smart move as Henkel seems undervalued right now. When looking at Henkel’s adjusted earnings per share of €4.56, Henkel is currently trading for a price-earnings ratio of 13.1. For a high-quality business, a P/E ratio in the low teens is not only reasonable but can often be seen as a bargain. But, of course, we also can point out that Henkel had trouble growing in the last few years. For a business that is not able to grow, a P/E ratio of 13 might not be such a bargain. When expecting a mid-to-high single-digit growth rate, however, such a P/E ratio might indicate a bargain.

Additionally, we can determine an intrinsic value by using a discount cash flow calculation. As a basis, we can take the free cash flow of fiscal 2021, which was €1,478 million, and in a first calculation, we are rather cautious and assume only 5% growth from now till perpetuity. When calculating with these numbers and assuming a 10% discount rate (as well as 434 million outstanding shares), we get an intrinsic value of €68.11.

However, we can be a little more optimistic and assume 6% growth till perpetuity. With all other assumptions unchanged, this would result in an intrinsic value of €85.14. And aside from a high growth rate for the years to come, we can also argue that the free cash flow of fiscal 2021 is rather low and not representative of Henkel’s business. The average free cash flow of the last five years was around €2,000 million. When taking this number as a basis in our calculation and assuming 6% growth till perpetuity, we get an intrinsic value of €115.21.

Maybe €115 is a bit optimistic, but, on the other hand, neither 6% nor €2,000 million as free cash flow seems unrealistic and unachievable for Henkel. And while I would not be so optimistic right now, I see an intrinsic value around €90 to €100 as realistic for Henkel. And considering that Henkel is currently trading for €60, we also have a huge margin of safety if Henkel should lose its Russia business.

Conclusion

We should not ignore, that Henkel grew only in the low single digits over the last decade and it is also facing some headwinds right now. But even when calculating with moderate growth rates, Henkel is undervalued. If the company can achieve its long-term targets of mid-to-high single-digit growth, the stock is a real bargain right now.

Be the first to comment