PhonlamaiPhoto

A microcap semiconductor materials and related equipment maker, CVD Equipment (NASDAQ:CVV) just reported a double in orders during Q2 2022 YoY, alongside a 73% jump in bookings for the first half. This stock has popped in and out of some of my favorite momentum formulas as a buy candidate this year. Now we have the major news announced in mid-July that demand for equipment related to electric vehicle (EV) charging stations is heating up. According to the press release:

CVD’s orders in the first half of 2022 were attributed to the strong demand for the PVT-150 system developed to support the manufacturing of Silicon Carbide wafers used in high power electronics for EV charging & power transmission. Also contributing to the order flow is the need for nanotechnology materials.

To highlight CVD’s accelerating growth, total equipment systems ordered rose from 9 in 2020, to 23 in 2021, to 20 in the first 6 months of 2022.

At a quote under $5 per share today and an equity market capitalization around $33 million, the stock trades not far from its liquid book value of $4.20 per ownership unit. Sales were $17 million on a trailing basis, with operating losses as the rearview mirror story. On the positive side of the investment equation, CVD Equipment sold a building in late 2021, and captured a large gain on the transaction, offsetting several years of business losses during the pandemic. Looking forward, the outlook for sales growth and hopefully operating profitability is improving rapidly.

Balance Sheet Ready for Growth

Despite weak sales and minor operating losses for years, a $2.4 million gain was recorded in early 2021 on its government PPP loan to deal with COVID-19-related shutdowns. In addition, a $6.9 million gain was recorded in the September 2021 quarter on the sale of a building. The net result is CVD’s balance sheet is in terrific shape today, especially if sharply higher sales bring operating income later in 2022.

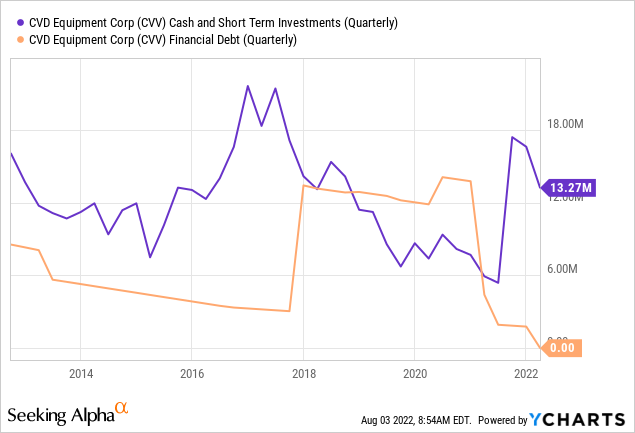

At the end of March, the company held ZERO debt, with $13 million in cash and nearly $20 million in total current assets. Owning a similar building at depreciated cost to the one just sold for a large market-based gain, and with just $4 million in total liabilities, today’s $28 million in tangible book value (mostly liquid) is very desirable in a recessionary macroeconomic environment.

YCharts

Overall, the financial setup provides a unique downside “margin of safety” for investors and can support immediate funding for growth. I rate the balance sheet as excellent for new investment, assuming management doesn’t deviate from the simple operating plan of the last couple of years.

Bullish Valuation Story

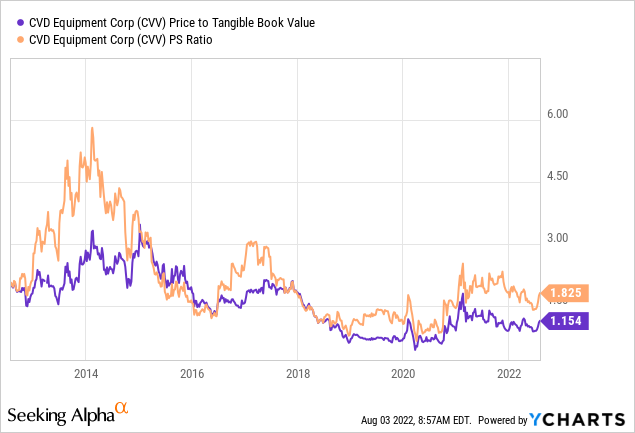

With little in the way of operating cash flow and earnings in 2020-21, my valuation focus is on underlying book value in a going out of business situation, and sales now prepped to rise markedly from last year. The good news is price should be supported by both fundamental valuation concepts.

Below is a 10-year graph of price to tangible book value and “trailing” annual sales. You can see CVD Equipment is trading well under long-term averages, with price just above its liquidation asset value.

YCharts

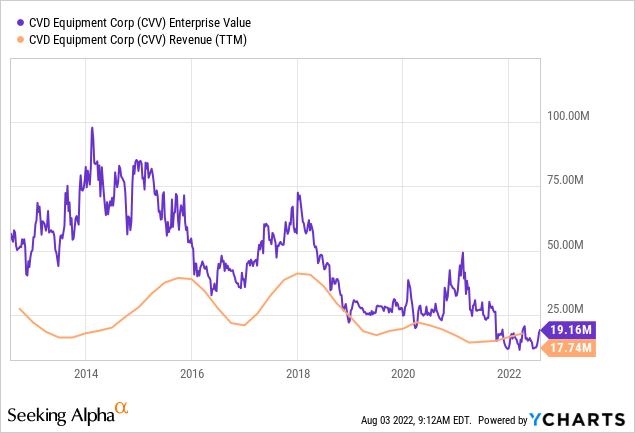

Even better news revolves around enterprise value calculations. After adjusting the stock price for its large net cash position, the 2022 EV valuation around trailing sales is ultra-cheap. It has not been this low in the last decade. So, if this ratio remains constant or rises back to normal levels between 1.5x and 2x, a double in sales should open the ability for share gains in the 50% to 100% area over the next 12-18 months. Of course, the final performance percentage will depend on what level of income can be achieved on growing, specialized semiconductor equipment sales.

YCharts

Building Chart Pattern

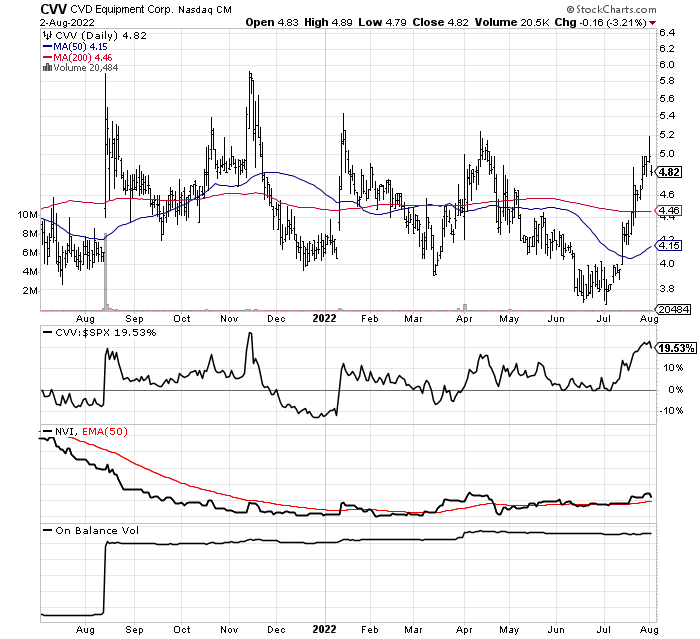

What makes me particularly bullish on CVD is the December-January reversal in trading momentum. The stock has moved from an underperforming market posture to an outperforming one. The flip in many momentum trading indicators near the beginning of 2022 is drawn below.

From the December price low, CVV’s “outperformance” of the S&P 500 bear market has been around +30%. The Negative Volume Index was in steady and steep decline in late 2021 but morphed into a rising trend around February. A climbing NVI is much preferred, as it can signal a lack of overhead share supply and/or decent buying interest after high volume sell days. Lastly, On Balance Volume has been in strong advance mode since August, even with price stuck in a range.

StockCharts.com, Daily Values over 12 Months, CVV

Final Thoughts

Is this the type of undiscovered growth name to put all your money into, bet the farm, so to speak? Heck NO! It deserves only a very minor fraction of your investment dollars, with its small size and still unknown income level on future revenues. However, CVD Equipment is the kind of vehicle that could deliver many multiples on your money over the next year or two, if sales double and triple AGAIN on top of an expected double in the coming quarters (when actual system builds are delivered).

It is entirely possible an improved balance sheet, with sales and income approaching 2017 levels ($40 million in revenue and $5 million net profit) could be a reality in 2023. During 2017 its share quote high was $13 vs. the current sub-$5 number. So, projecting considerable upside in CVD Equipment is not a stretch historically.

The best news of all is its equipment appears to be important in more advanced power supply devices/charging for electric vehicles. As EV demand is exploding and projected to be a leading engine for the global economy in the decade ahead, CVD Equipment could be in the early stages of a huge growth phase in the business.

What are the risks? Outside of normal cost pressures and management focus on the operating business, future EV power demands are the primary catalyst and variable to watch. CVD’s products have usually been sold to universities and research labs as its main customer base. The EV power angle is newer and could be opening a long-term growth avenue for the business.

Assuming a major recession does not dent EV demand forecasts, and a stock market crash is not approaching in the autumn, I rate CVD Equipment a Strong Buy around $5 per share. Risk may be limited back to $4, nearer its liquidation book value. Upside to $10 or even $15 in 2023 cannot be ruled out, if sales and orders continue to expand rapidly. Potential risk of -25% balanced against reward of +100% or greater over the next 12 months leads me to this ultra-bullish view.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment