Sundry Photography

I can’t help but shake my head when reading about yet another “get rich quick” stock like AMTD Digital (HKD), which is making recent headlines as part of the latest meme stock craze. Sooner or later, another generation of investors will learn that only few will see meaningful profits from these types of stocks, with the large majority left holding the bag.

That’s why, I will always advocate for quality over investment fads. This brings me to Abbott Laboratories (NYSE:ABT), which is a far better stock to own for risk-averse investors, especially since it’s trading well below its recent highs. In this article, I highlight what makes ABT a good buy at present for potentially strong wealth compounding over the long run, so let’s get started.

Why ABT?

Abbott Laboratories is a leading global healthcare technology company with a broad portfolio, including products in diagnostics, medical devices, nutrition, and branded generic medicines. It serves people in 160 countries, and in the trailing 12 months, generated $45.5B in total revenue.

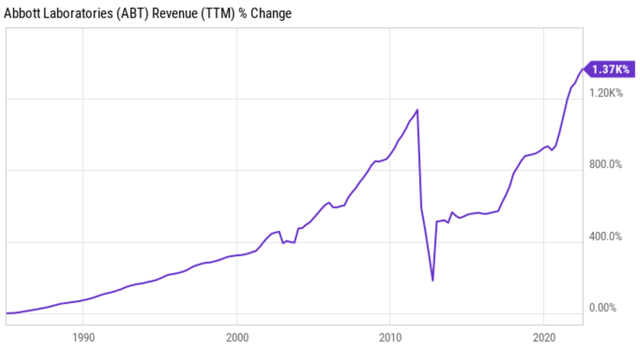

ABT has a strong track record of growing revenues throughout its history. As shown below, sales have steadily grown through various economic cycles. Revenues dipped in 2013 due to the spin-off of the now pharmaceutical giant AbbVie (ABBV), and has now well-surpassed the pre-spinoff level.

ABT Revenue Growth (YCharts)

Despite the recent downturn in its share price, ABT’s total return has still surpassed that of the S&P 500 (SPY) on a 5 and 10 year basis. As shown below, ABT’s stock has given shareholders a 142% total return over the past 5 years, far surpassing the 83% return of the S&P 500 over the same timeframe.

ABT Total Return (Seeking Alpha)

ABT is demonstrating strong growth amidst economic uncertainty, with impressive sales growth of 10.1% YoY (14.3% organic sales growth) during the second quarter. This was driven in large part by the Diagnostics segment, which saw 35% sales growth to $2.3 billion, due primarily to rapid COVID tests, including BinaxNOW in the U.S.

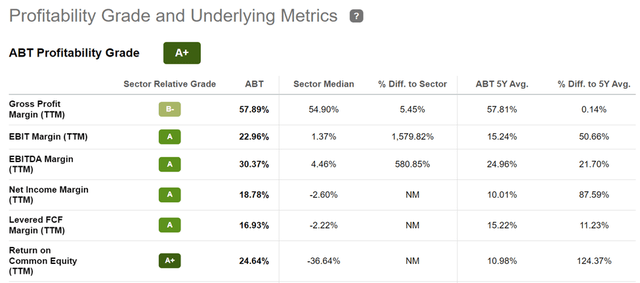

Also encouraging, ABT’s Established Pharmaceuticals segment saw 9% sales growth in the quarter, with double-digit growth in Asian and Latin America. The Medical Devices segment also saw healthy 7.5% growth led by cardiovascular devices. Meanwhile, it maintains industry-leading profitability, with an A+ grade, supported by strong EBITDA and Net Income margins of 30% and 19%, respectively.

ABT Profitability (Seeking Alpha)

This isn’t to say that ABT doesn’t come with headwinds, as it saw reputational harm and manufacturing disruptions stemming from its infant formula recall. It appears, however, that management is turning the corner, as ABT is now in the final phases of testing restarting Similac production, with the expectation of product returning to store shelves several weeks after production begins again.

Looking forward, I see reasons to be optimistic around ABT’s product portfolio, as it has plenty of greenfield in the diabetes care and cardiovascular spaces with Freestyle Libre and the recent approval of Aveir. These developments gave management the confidence to raise full year adjusted earnings guidance to $4.90, as highlighted during the recent conference call:

In Diabetes Care, sales of FreeStyle Libre grew more than 25% on an organic basis in the quarter and our user base now exceeds 4 million users globally. During the quarter, we continued to strengthen our Medical Device portfolio with innovative new products, most notably US FDA clearance of our FreeStyle Libre 3 continuous glucose monitoring system, which is the world’s smallest and thinnest wearable glucose sensor that provides results with the highest level of accuracy in the industry.

And US approval of Aveir, our leadless pacemaker for the management of slow heart rhythms. Aveir was specifically designed to be retrievable if the device ever needs to be removed and expandable to a dual chamber device, which is currently under development if the therapy needs evolve over time.

So in summary, our diversified health care model continues to prove highly resilient in a dynamic macro environment. We’re achieving strong growth across several areas of the portfolio and making good progress restarting our nutrition manufacturing facility. And as a result of our strong performance through the first six months, we’re raising our EPS guidance for the year.

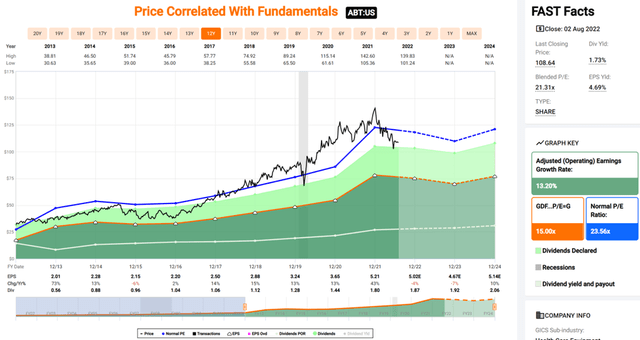

Meanwhile, ABT maintains a fortress AA- rated balance sheet. It pays a well-covered 1.7% dividend yield with a 31.6% payout ratio, and a 5-year 12% CAGR. I see value in the stock at the current price of $109.61 with a forward PE of 21.8, sitting below its normal PE of 23.6 over the past decade. Sell side analysts have a consensus Buy rating on the stock with an average $126 price target, translating to a potential one-year 17% total return.

ABT Valuation (FAST Graphs)

Investor Takeaway

Abbott Laboratories is a diversified healthcare company with strong growth prospects, an impressive track record of shareholder returns, and a fortress balance sheet. It’s moving past its infant formula recall, and has promising new products that should drive meaningful growth. The stock looks attractive at the current price with the potential for double-digit returns over the next year.

Be the first to comment