Ron and Patty Thomas/E+ via Getty Images

What Happened?

Once again, I am hearing murmurs from the peanut gallery that AT&T (NYSE:T) is a dying company and the dividend is in danger of being cut. Well, this reminds me of the famous quote by Mark Twain:

“The reports of my death are greatly exaggerated.”

The unsubstantiated quote was sent in a cable by Twain from London to the press in the United States after his obituary had been mistakenly published, so the story goes. Let’s dive in.

Why Now Is An Ideal Time To Buy AT&T

Yes, yes, I know you can’t time the markets. Yet, you can make an educated determination as to when the best time to start/increase a position in a stock may be. The following are the primary reasons I feel now may be an ideal time to start or increase your position in AT&T (T). The fact of the matter is, AT&T is actually growing at present. Furthermore, with a 6% yield to boot, the stock presents a fantastic buying opportunity for prospective dividend and income investors looking to lock in a superior and safe yield.

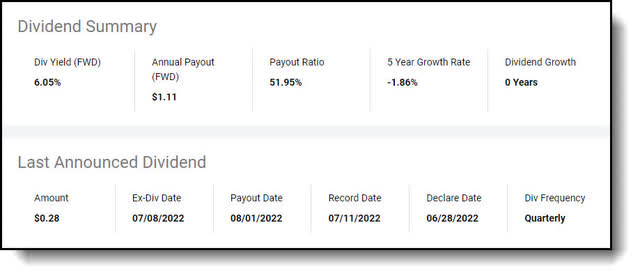

Dividend Summary (Seeking Alpha)

The current quarterly dividend per share is $0.2775. The quarterly free cash flow required to cover dividend is approximately $2 billion. Come hell or high water, AT&T will pay the dividend, as we say in Texas. The current payout ratio is 75%.

AT&T Is A Mature High Yielder

Let’s get something straight right off the bat. AT&T isn’t a dividend growth play, it’s a mature high yield income play. The yield of 6% is threefold higher than the current yield of the S&P 500 of approximately 2%. So, arguing that AT&T is a “dying dividend growth stock” really doesn’t make any sense, it’s a mature high yield income generator.

I chose the picture of the oak tree to help illustrate this. Think of AT&T as a giant mature oak tree that has been growing for years. It has grown into a majestic tree with a large canopy (6% dividend yield) that creates substantial shade (income) for you to enjoy during your golden years It’s not dying, it’s reached its zenith.

Would this be the time to cut the tree down to use for fire wood? I think not. Now is the time to sit back, sip on your lemonade, and enjoy the dividend dollars rolling in each quarter. What’s more, AT&T isn’t dying at all, it’s actually growing like a weed. The company’s subscribers actually grew last quarter by 800,000. Let’s take a closer look at the latest results to get the real story, not the nincompoop narrative alleged by the nattering nabobs of negativity.

AT&T Has Strong Growth Potential

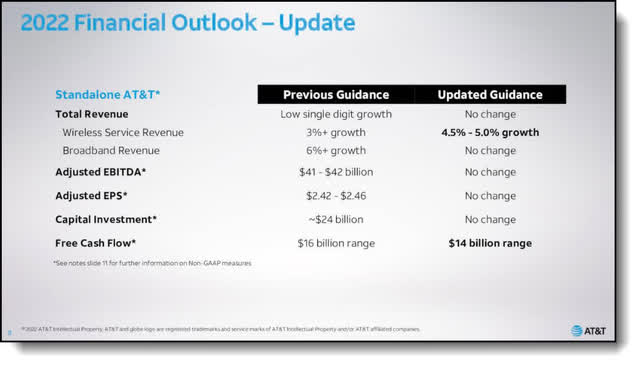

AT&T (T) fell 10% on earnings after they beat on the top and bottom line, yet lowered free cash flow guidance going forward by $2 billion.

Given the combination of elevated success-based investment, the potential for further extension of payments by customers, inflation and the more challenging environment facing the company’s Business Wireline unit, AT&T’s management made the prudent decision. They took a more conservative stance on free cash flow for the remainder of the year by lowering the estimated free cash flow guidance from $16 billion to $14 billion. I actually like this approach. It’s the “under promise to over deliver” method. Lowering the bar is never a bad idea under current market conditions. What’s more, the 10% drop in the stock just gave savvy income investors the chance to lock in a safe 6% yield.

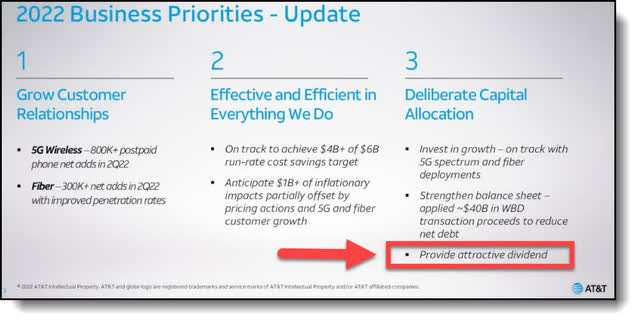

Substantial Dividend Top Priority (AT&T)

The company is basically a utility at this point, with our phones becoming a vital part of our daily lives. My primary focus is on the income provided by the substantial dividend. Any time the stock begins to yield 6%, it gets bought. The 6% yield acts as an excellent backstop in regards to downside protection. Whenever the stock’s yield gets a 6 handle, income buyers swarm in and buy up shares, providing quite a sturdy safety net for those looking for a solid safe haven play, as well as an income producing machine. The following are some of the second quarter highlights.

Second-Quarter Highlights

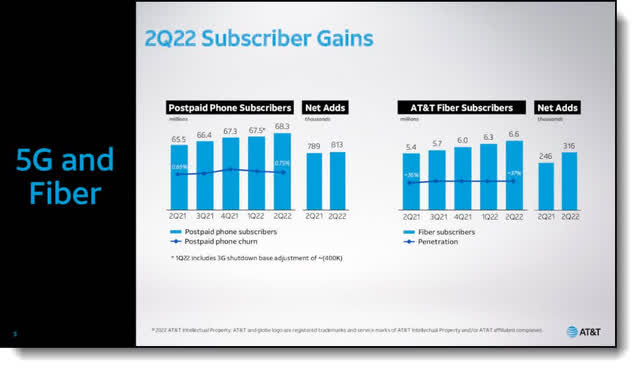

- MOBILITY: AT&T continues to see record levels of customer additions, including the best second-quarter postpaid phone net adds in more than a decade and more than 6.1 million postpaid phone net adds over the past two years. We have already achieved our end-of-year target of covering 70 million people with mid-band 5G spectrum and are on track to approach 100 million people with mid-band 5G spectrum by the end of the year.

- AT&T FIBER: AT&T delivered subscriber growth near second-quarter record levels with 316,000 AT&T Fiber net adds. This brings total net additions over the past two years to nearly 2.3 million, including 10 straight quarters of more than 200,000 net adds. We now have the ability to serve 18 million customer locations in more than 100 U.S. metro areas with AT&T Fiber.

- TRANSFORMATION: AT&T has confidence in its ability to achieve more than $4 billion of its $6 billion run-rate cost savings target by the end of the year.

Here are some key quotes from CEO Stankey on the conference call:

“We’re finding success in serving more customers in new and existing markets, with what we believe is the best wired Internet offering available. This is evidenced by our more than 300,000 second quarter AT&T Fiber net adds, marking our 10th straight quarter with more than 200,000 Fiber net adds.

Over the last 8 quarters, we’ve achieved an industry-best 6 million postpaid phone net adds, while adding nearly 2.3 million AT&T Fiber customers, increasing our Fiber subscriber base by more than 50%. In the quarter, we had a remarkable 813,000 postpaid phone net adds, our best second quarter in more than a decade.

We have strong visibility on achieving more than $4 billion of our $6 billion transformation cost savings run rate target by the end of this year. As we shared before, we’ve initially reinvested these savings to fuel growth in our core connectivity businesses. However, as we enter the back half of this year, we expect these savings to start to contribute to the bottom line.”

Let’s now wrap this up.

Key Investor Takeaways

AT&T is not a dividend growth stock. It is a mature high yield income generator. Making the argument that the company is dying because dividend growth is slowing is specious. Of course, the growth of the dividend is slowing, it’s already grown to 6%, what do you expect?

You aren’t buying AT&T for dividend growth; you are buying it for the abundant income its superior dividend yield provides. What’s more, the company paid the price, with a 10% drop, for continuing to invest in the growth of its fiber and 5G businesses. Nevertheless, they are taking market share as well. At some point in the future, the tide will turn, and you will want to be long on that day. AT&T shareholders will be richly rewarded with an excellent total return opportunity, and paid 6% while they wait. You can’t beat that deal.

My 12-month price target is $21.50 providing 12.88% upside from the time of this writing. There is strong support at this level, which substantially increases your margin of safety. The stock rarely trades with a 6 handle on the dividend yield. Finally, high yield dividend buying opportunities are often created by situations such as these. Remember, the time to buy is when the stock is out of favor, not when everyone is in love with it. One of my favorite quotes from investing icon Sir John Templeton is the following:

“Invest at the point of maximum pessimism.”

Templeton is known as a contrarian investor. He referred to his investment philosophy as “bargain hunting.” Templeton’s guiding principle was:

“Search for companies that offered low prices and an excellent long-term outlook.”

I feel this statement perfectly illustrates where AT&T’s stock is at this time. The reward far outweighed the risk with the stock yielding 6%. Our innate instincts encourage us to depart a sinking ship. This survival tactic impacts the way we invest. The herd running for the door is what creates the opportunity to buy a fundamentally solid company like AT&T with sound prospects at a discount. Hopefully, you have some dry powder and a long-term time horizon and take advantage. Those are my thoughts on the matter I look forward to reading yours.

Your Input Is Required!

The true value of my articles is provided by the prescient remarks from Seeking Alpha members in the comments section below. Do you think AT&T is a Buy at current levels? Why or why not? Thank you in advance for your participation.

Be the first to comment