ipopba

Aviva (OTCPK:AIVAF) has performed a wide-ranging restructuring program, which has seen significant disposals, a strengthened balance sheet, and improved cash remittances. The company is now in a solid position to deliver a sustainable dividend, which now yields about 7.5% as its shares are undervalued.

Company Overview

Aviva is a U.K. insurance company, operating both in the life and non-life insurance segments, plus retirement and wealth solutions. The company was founded in 2000, through the merger of GGU Plc and Norwich Union. Currently, its market value is about $13.5 billion and trades in the U.S. on the over-the-counter market.

The company has five main business segments, namely life insurance, general insurance, retirement, annuities, and asset management (Aviva Investors). It has more than 18 million customers across its markets, and top-three market positions in the majority of its core segments.

Aviva has been in restructuring mode for several years, disposing of units that were not considered to be core, and performed some acquisitions in growth areas. This means that its business profile is quite different from what it was some years ago, and Aviva is now currently focused on three core markets, in which it has leading positions, namely in the U.K., Ireland, and Canada.

Business Strategy

Aviva’s business profile has changed considerably in recent years, as the company embarked on a restructuring program to focus its operations in countries where it has stronger market positions. This led to several disposals, reducing the company’s size and complexity, namely exiting several operations across Continental Europe and Asia.

This also led to a much stronger financial profile, as the company was able to reduce debt levels and considerably increase its capitalization, being now in a strong position to grow its business and distribute excess capital to shareholders.

Due to several disposals realized as part of its portfolio reshuffling strategy, the company was in an excess capital position at the beginning of this year. Indeed, Aviva has received some $8.7 billion in the disposal process over the past few years, which led to a solvency ratio of 244% at the end of 2021, well above its 180% target.

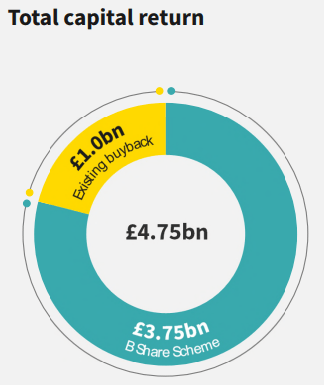

Due to this excess capital position, Aviva decided to return some $5.5 billion to shareholders, through share buybacks ($1.16 billion) and the rest from a B-share scheme. This last part was the distribution of additional shares to existing shareholders, which were later consolidated into ordinary shares, with each B share representing one ordinary share. This can be considered like a special dividend paid in kind instead of cash, allowing the company to distribute excess capital in a tax-efficient way for shareholders.

Capital return (Aviva)

Beyond its $5.5 billion capital return policy, Aviva also used the disposal proceeds to reduce debt, invest in the improvement of its operational efficiency, and to make a small bolt-on acquisition (about $450 million) in the Wealth segment.

Going forward, the company wants to further de-lever its balance sheet by some $1.16 billion in the next couple of years, and grow its business organically in its existing operations by offering better customer service. Other potential earnings growth sources are further efficiency gains and cost cutting initiatives, namely through the digitalization of its product offering and operational processes.

Financial Overview & Dividends

Regarding Aviva’s financial performance, considering that its business profile has changed considerably in recent years, looking at its historical performance does not mean much regarding its future prospects. For instance, its top-line last year was above $44 billion, while for this year it is expected to be around $27 billion, which is explained by disposals rather than some fundamental issue.

Nevertheless, as the company’s disposal program was completed during 2021, Aviva’s most recent earnings already reflect its streamlined operating profile. During the first six months of 2022, Aviva reported a positive operating momentum, with premiums up by 5-6% in insurance, assets under management grew 7% YoY in the retirement segment, and overall operating profit was up 14% YoY.

Additionally, its financial profile was also improved by the company’s disposals strategy, as Aviva reduced its debt levels, reflected in its lower debt leverage ratio of 28% at the end of June. Its Solvency II ratio, adjusted for its total capital return policy, was 213% at the end of the semester, still well above its own target of more than 180%.

Cash remittances, which reflect cash generated by operating units that flow to the holding level, were about $930 million in the semester, increasing liquidity at the corporate centre to more than $3 billion.

This is important because dividends are paid from cash at the corporate centre, and usually insurance companies measure their dividend sustainability against cash remittances, thus for the dividend to be well covered, annual cash remittances should be above dividend outflows. Aviva’s position in this respect is quite good, considering that it expects to generate some $1.8 billion in cash remittances in 2022, while cash dividends are expected to represent a cash cost of $1.01 billion in 2022 and $1.06 billion in 2023.

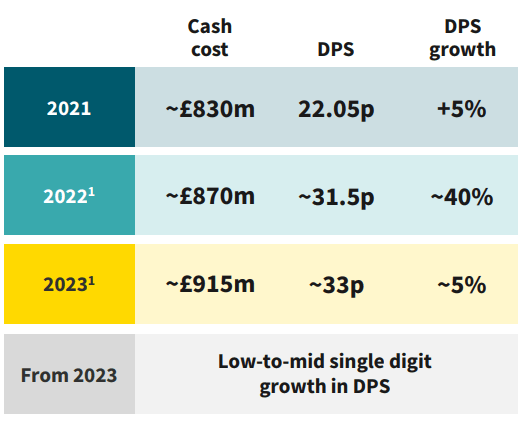

Cash Dividend (Aviva)

This means that Aviva’s annual dividend is sustainable and well covered by cash remittances, allowing it to deliver a growing dividend in the next few years. Due to its extraordinary capital return policy, its 2022 dividend is expected to increase by 40% YoY, while going forward its annual growth should be much more moderate and more in-line with its earnings growth.

Aviva already paid an interim dividend in September of £0.1030 ($0.12) per share, while its total divided related to 2022 earnings is expected to be £0.315 ($0.37) per share (note that in the previous table the DPS is pence per share). This means that, at its current share price, Aviva is currently offering a forward dividend yield of 7.5%, which is very attractive to income investors.

Moreover, this yield is likely to increase in the coming years, as Aviva is expected to report higher earnings and improve profitability in the near future, and management is committed to deliver an attractive shareholder remuneration policy going forward. Beyond dividends, Aviva has already signaled that it intends to start a new share buyback program in early 2023, if its capitalization remains well above its medium-term target.

Conclusion

Aviva has changed its business and financial profile considerably in recent years, being now in an excess capital position that allows it to provide an attractive and sustainable shareholder remuneration policy. It offers a high-dividend yield and its shares are trading at less than book value, at a discount to its closest peers, making it a good play both for income and value.

Be the first to comment