IvelinRadkov

Investment Thesis

EQT’s (NYSE:EQT) investment thesis is relatively straightforward. EQT is very cheaply valued, with strong natural gas prospects. As we go through, I’ll discuss some of the positive and negative considerations at play. Yet ultimately, I’ll demonstrate that all considered, there are mostly bullish reasons for EQT to work out favorably.

I continue the overall bullish theme that I’ve been discussing for some time now, that natural gas prices are going to remain very stable at around $5 to $6 mmbtu, if not higher in 2023.

What’s Happening Right Now?

The past few weeks have been really challenging for energy equity investors. On the one hand, we can start to foresee that 2023 is likely to be another strong year for energy stocks, given that all the reasons that lead us to be here in the first place, have not been resolved. Namely, that demand continues to outpace supply.

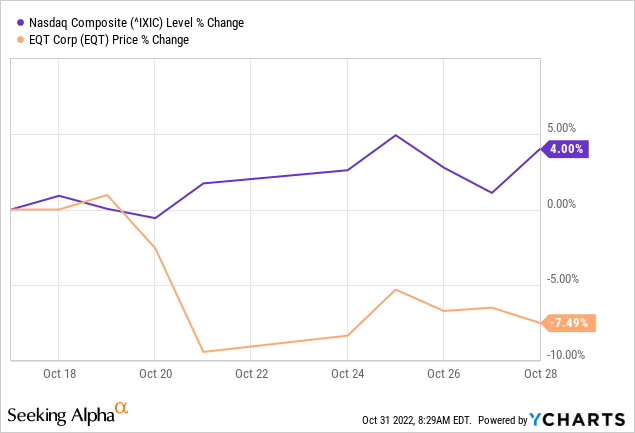

Yet, many energy stocks have not participated in the stock market rally that has taken place in the past couple of weeks.

And that’s a theme that has largely been echoed throughout the whole of 2022. When tech has been strong, the energy market has seen stocks wither.

Indeed, last week, even though there were some large-cap tech stocks that fell out of favor, overall, many pockets of tech showed strength.

The reason for this is that investors are simply too eager to return capital flows into tech. And only too quick to move away from the energy sector.

Capital Allocation Policy

Before delving further into EQT’s capital allocation, allow me to digress for a moment and note two items. EQT’s breakeven price and its hedges.

Firstly, EQT recently embraced two acquisitions that brought down its breakeven price from $2.30 mmtbu to $2.15 mmbtu.

I believe this is a meaningful bullish consideration given that since investors have been so quick to observe that natural gas service companies are reporting huge profits, one would have expected to see EQT’s ”post-inflation” breakeven prices climbing higher. And certainly not to move in the opposite direction, by nearly 5% to 10%. That provides EQT with a substantial margin of safety.

And this leads me to discuss the second point, EQT’s hedges. Looking out to 2023, EQT is approximately 45% hedged at an average strike price of $5.65 per mmtbu.

For investors that are keen to buy into the natgas story, but don’t want the volatility of investing in a natgas company, EQT is a very happy medium.

EQT Stock Valuation – 4x Next Year’s FCF

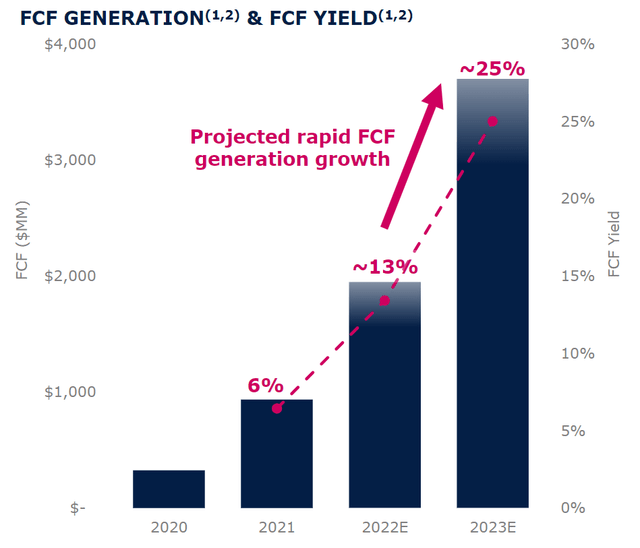

The graph that follows neatly surmises EQT’s valuation:

Looking out to next year, EQT is priced around 4x next year’s free cash flow. Given that nearly half its book is hedged, I suspect that if natgas prices stay around $5.50 per mmbtu, EQT will more likely than not reach $3.5 billion of free cash flow in 2022.

What’s more, EQT has announced together with its Q3 results that it will be buying back $2 billion worth of stock. And then, we also have to keep in mind that EQT has a 1.6% dividend yield.

The Bottom Line

EQT is well positioned for the structural undersupply of natural gas, not only in Europe but also in the US. There’s going to be a slow shift in investors’ expectations.

For now, investors are focused on the fact that this winter there is unseasonably warm weather. That is leading to a delay in many households in the US turning on their heating. This is called a prolonged shoulder season. But this does not detract from the core problem at hand. That even in the US electricity prices remain elevated compared with normal prices.

Looking beyond winter 2022, there’s still abnormally high pricing deferential between natgas in the US and the rest of the world.

Put another way, despite the unseasonably warm winter, plus the Freeport export LNG facility being out of use, as well as, other exporting facilities being out for maintenance, demand for natgas in the US remains high. What happens when all those elements return to normal? And what happens when Cheniere (LNG) ramps up LNG exports in 2025? All these factors will likely come together to push US-based LNG prices much higher.

All these considerations are going to support US Henry Hub natgas prices and could even see natgas prices move beyond $6, and return to a $7-$9 mmbtu range before long. In sum, there are a lot of reasons to stay bullish on EQT.

Be the first to comment