Paul Morigi

Warren Buffett would rather buy great companies at decent prices, than decent companies at great prices. I’d rather buy great companies at great prices. – Me, myself, and I.

Written by Sam Kovacs

Introduction

Everything is bad.

Inflation’s high. Rates are high. Credit card spending is on the rise. Putin might nuke Ukraine. A deep recession is looming.

At least this is what you see when you read the news.

Here are a few selected headlines from Seeking Alpha, Bloomberg, and The Wall Street Journal.

Rate Hikes Bring A Fixed Income Bloodbath.

Stocks Plummet to 22-Month Low as Fed Hawks Circle

Gold, silver, copper and oil prices could all fall 13% or more, Credit Suisse says

Stocks Fall as Bond Yields Resume Climb

Investors Fear New Phase in Bond-Market Turmoil

The level of bearishness in the market has not occurred in a long time.

Let’s look at a few measurements.

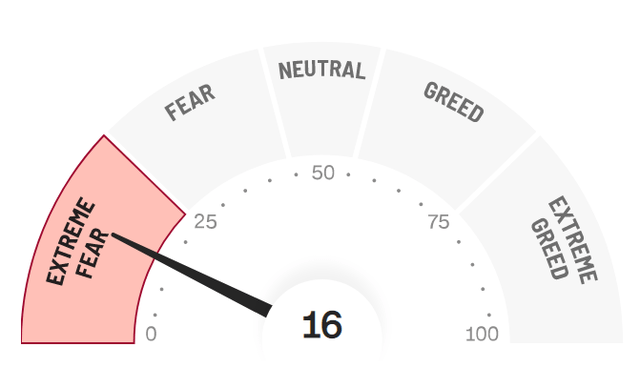

The CNN Fear & Greed index tracks 7 indicators that range from the yield spread on junk bonds vs investment grade, to the VIX, to market momentum indicators.

Today, 5 of the 7 indicators are flashing extreme fear, with the other two signaling fear.

This surely tells us the investment community is predominantly bearish.

Next, let’s turn to the AAII sentiment survey, which has been conducted weekly since 1987, to gauge whether American investors are bullish, neutral, or bearish.

In the past two weeks, we’ve had very little bulls. Last week, only 17.7% of US investors were bulls. This week, only 20%. Since May, we’ve had 4 readings sub 20%. This piece of information alone has little weight, as it is frequent for investors to wrongly have a negative bias to markets.

News is predominantly negative, because bad news triggers stronger psychological responses, which in turn trigger more clicks. This is scientifically proven, although you know it from the news you read.

Bad news sells, people read bad news, become naturally negative.

Then there is the amount of bears.

In the past two weeks these have been constant at 60.8% to 60.9% of Americans. Since May we’ve had 10 weeks during which a majority of Americans are bears.

There are only 3 years in the history of the AAII which have recorder 60%+ bears: In 1990, in 2008, and in 2009.

All of these readings preceded massive 10 year rallies in equities.

The balance of Americans are neutral, so about 20% don’t really have an opinion. Let’s forget about them. Yes if you don’t have an opinion, nobody cares about you.

If you take the amount of bulls, and subtract the number of bears, you get what’s known as the “bull -bear spread”.

It is -41% this week, and was -43% last week. (It was also -41% in June as markets were starting to rally).

This spread has only been so big twice in the past 35 years. In 1990, and in 2009. Mind you the largest spreads were around the -50% mark.

So things are bad according to the investment community. Maybe as bad as they’ve ever been.

Whether this is the bottom or not is yet to be seen. Technically, If we get close to SPX 3,600 and rebound, it could be very bullish. If we break below, the bottom could be 3,500, 3,200, or even 2,800.

All these outcomes are possible, which is to say, my crystal ball doesn’t work.

But one important message I want to get through, is that the bottom is most likely closer than you think. Whether we crater to 2,800 or stabilize just a few points lower than we currently are, the rebound is within sight.

Many will be shocked at this idea. After all the recession is only just upon us. Yes but the market is forward looking. And while things could get worse, if you look at the half full glass, they might be on the verge of getting better.

Now is a great time to make sure your portfolio is full of undervalued, high quality stocks with good dividend yields.

Note that these stocks will not be the stocks which lead the recovery.

Instead they will provide you with income you can rely on, and will invariably manifest capital gains which you can exploit later in the recovery.

These are All Weather stocks, which will most likely do very well even in the upcoming economic crisis, because of the nature of their business models.

Recession Resistant Idea 1: Tobacco

This one is such a layup. Everyone has become so woke, and pension funds are shunning tobacco investments (despite it not being the leading cause of death, obesity is). This is the perfect environment to create a “sin discount”. And while this discount might persist in the valuation, for the income oriented investor, it means you can get a superior stream of income at a brilliant price.

Tobacco sales tend to be inelastic, less impacted by inflation, and exacerbated during recessions. Exactly what we need!

Philip Morris

Philip Morris (PM) is the best tobacco stock out there. I write about the company very often because they are doing everything right.

They shifted their strategy years ago, when they realized that the endgame for tobacco wasn’t great when nations seriously started locking down on cigarette taxes and prevention.

They realized they had an incentive to align with the government and create products which reduced the health risk, all while delivering users their desired nicotine hit in ways which they enjoyed.

Anyone who has ever smoked knows how enjoyable it is. The IQOS is the device which comes the closest to this.

The device is seeing major adoption world wide, and there are plans for a reintroduction in the US, after one of the devices got banned for patent infringement, despite PM having been on the winning side of these lawsuits in many nations throughout Europe.

As IQOS market share takes over, there will be a case for Philip Morris to lobby governments, or municipalities, to increase taxes on combustibles and eventually phase them out.

This is the endgame. If the company can follow through on this, then they’ll do very well, by dominating the markets they are in.

The stock currently yields 5.9%, which is a steal. Any amount of dividend growth will be welcome at these levels.

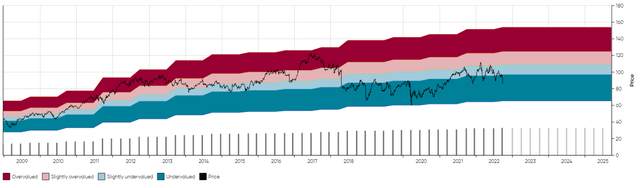

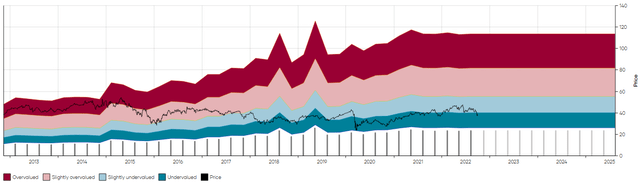

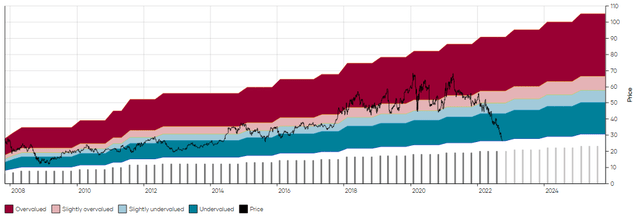

As you can see in the MAD Chart below, since initiating its dividend in late 2008, PM has been historically undervalued when it yields more than 5.25% (the edge between the blue and light blue areas).

PM 14 year MAD Chart (Dividend Freedom Tribe)

To learn more about MAD Charts, you can read this post.

PM is being under appreciated. The markets are ignoring how it will influence the shaping of the tobacco industry in the next decades. You can choose to see things differently.

Recession Resistant Idea 2: Pipelines

Pipelines are a brilliant business model. You’re basically a toll booth for energy. As long as energy flows through, you get paid. There is some upside linked to energy prices, but mostly it’s just an All Weather, around the clock cashflow monster.

There are two pipelines I like a lot, which give good exposure to both crude and natural gas.

Enbridge

Enbridge (ENB) is a pipeline which is essential to the US economy. Politicians keep trying to bash it, but the truth is, it is such an indispensable source of energy to various reasons, that the pipelines just stay live and continue flowing.

As such the company just grows like clockwork, by adding ad hoc projects and marginal improvements.

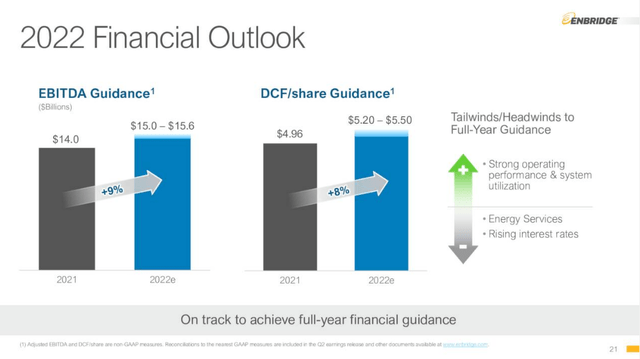

Enbridge Earnings Presentation

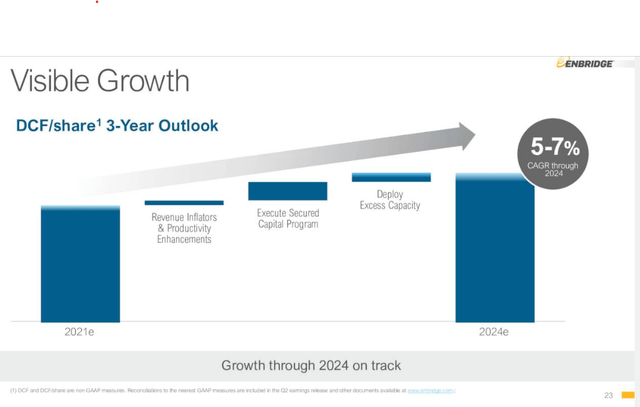

The company is on track to grow distributable cashflow by 5% to 10% this year, and believes they will average 5-7% growth for the next 3 years.

Enbridge Earnings Presentation

As a Canadian stock listed on the NYSE, the dividend fluctuates depending on the US – CAD exchange rate, which has held dividend payments lower recently. Over time this will swing back and forth, so I’m not too concerned about it.

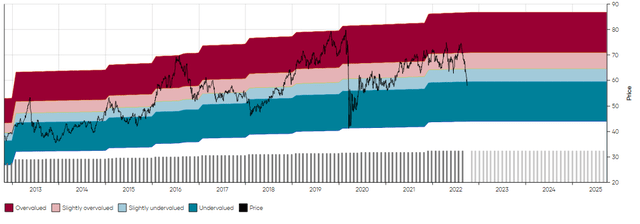

ENB currently yields over 6%, which is way too much for a stock which will likely average 4-6% dividend growth over upcoming years.

ENB MAD Chart (Dividend Freedom Tribe)

EMB’s price does not match the market’s fundamentals, I think this can only last for so long.

Recession Resistant Idea 3: Top Notch Real Estate

Location, Location, Location. So they say. Beyond Location, I’d say: tenants, tenants, tenants. Of course the latter is likely dependent on the former.

But the best real estate businesses have the best tenants. It’s easy as that. If your tenants cannot leave because they need the real estate you rent, then you’re in a situation which can see it through any recession.

We already got a small taste of this during the pandemic, when lockdowns made many real estate locations useless. A phenomena which has yet to fully recover in major central business districts, as evidenced by the still high vacancy rates on commercial buildings in Manhattan.

Here are two great real estate companies which have amazing tenants.

Realty Income

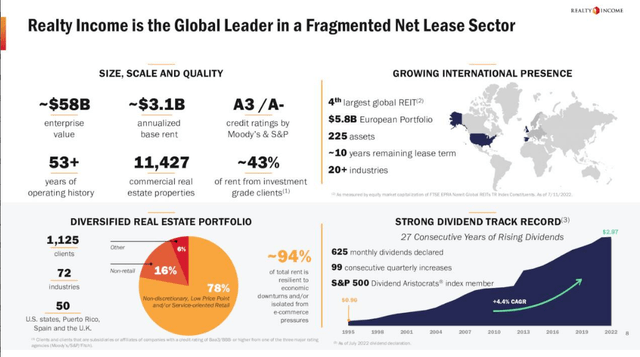

Realty Income (O) prides itself in providing real estate only to the best tenants, and focuses on locations which are non negotiable to operate their business.

The dividend company has been raising dividends for 27 years. 94% of its rent is near guaranteed even in the case of a severe economic downturn.

After more than 50 years of operating history, the company still has an A- credit rating, and is now tackling real estate markets across the globe as it seeks to continue scaling its triple net operating model.

A recent article by KCI Research, an author which I like a lot, has highlighted that O’s price has gone nowhere in 6 years.

While that is true, it excludes two factors: Dividend income and active position management.

The dividend income from O has contributed to 5% annual returns. Actively managing the position (eg: buying below, selling above 70) increases returns significantly.

We sold one quarter of our position at $70 in April last year. Should we have sold more? Sure, with hindsight.

Although other top authors who were covering the stock told us we were making a mistake in selling any of the position. I wont call them out, because I like them too.

Nonetheless, being able to have locked in the gain on a portion of the position, and now having the opportunity to once again buy in at an attractive price is where returns are made.

If you buy and hope for the best, you end up with your O position which is going nowhere after 6 years.

If you buy low, sell high, and get paid to wait, then you stand a much better chance of outperforming.

O is currently yielding 5.1%, which places it in its historically undervalued range, and makes it a fantastic buy.

O MAD Chart (Dividend Freedom Tribe)

Long term, the dividend might grow at a 3-4% CAGR, and while it could still go lower, as all stocks in this article could, its business will do great during any recession, and come out on the other side having potentially bought competitors at much depressed prices.

American Tower Corporation

How would you feel if we cut your internet? Probably not too good. Turns out the companies that sell you internet data don’t want your internet to be cut either.

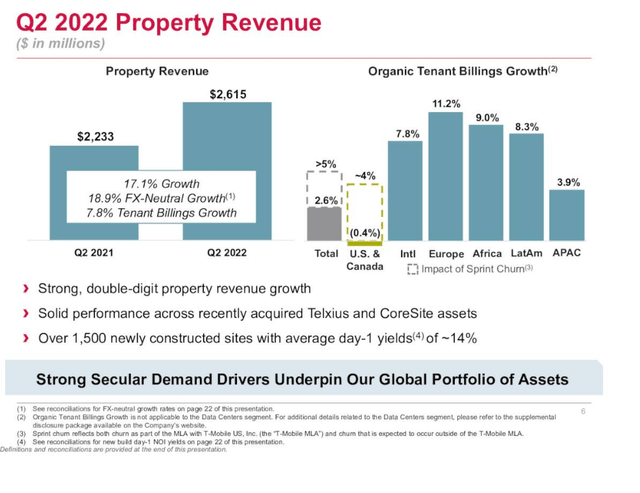

And they need American Tower Corporations (AMT) cell towers to deliver the service to you. The case for their business is as simple as that. The company increases the dividend every quarter, and has been growing at double digit rates.

At $213, it now yields 2.75%, the most it has yielded in the past decade, since it started paying a dividend.

AMT MAD Chart (Dividend Freedom Tribe)

As the company continues to grow aggressively as secular tailwinds remain across its global portfolio, we foresee more years of double digit dividend growth ahead.

Nothing can really stop this from happening. Just check out the organic increase in tenant billings in every geographic region bar the US (due to one churning customer).

AMT’s business will continue growing, it offers services which translate naturally into high yields. I can’t see it going anywhere anytime soon. An easy buy.

Recession Resistant Idea 4: High Quality Insurance Companies

Insurance is a classic business which does well in recessionary times, because you don’t stop insuring your home, your health, or your life, just because we’re in a recession.

Insurance companies get a boost from inflation when tied to rate hikes. This tailwind has yet to totally come through in the results for many of these companies, but there is one insurance pick which just dominates the dividend investing scene, for its reliability, growth, and valuation.

Aflac

Aflac (AFL) is a brilliant company. It sits about 5% above its prepandemic price, despite the dividend having increased 42% since then.

The company pays out only 23% of its earnings, and is posting amazing results.

Mike Zaccardi, who also writes a macro column for the Dividend Freedom Tribe, said in a recent article of his:

Rising interest rates tend to be good for life insurance companies because rising (falling) rates reduce (increase) the net present value of future liabilities. The discount rate applied to future payments and liabilities rises and falls with interest rates.

Like I said, you want to have exposure to insurance companies in this sort of environment.

As the stock now yields 2.8%, it is priced very attractively, relative to its historical range.

Aflac MAD Chart (Dividend Freedom Tribe)

The pandemic made the stock tank for a short while before AFL came roaring back to new highs.

Given the high growth of its dividend, which is expected to continue next year, it is hard to discard AFL as an all weather, safe haven pick.

Recession Resistant Idea 5: Necessary American Infrastructure

Now what is necessary American infrastructure? Any company whose disappearance would cause significant strife to the entire nation.

Naturally, one will think of defense stocks. Without its military, the US would not have the position it has on the geopolitical scene.

The trouble is, many of these defense companies like Lockheed Martin (LMT), L3Harris (LHX) and General Dynamics (GD) are on the pricier side now. It would have been better to buy them following Biden’s election, when everyone thought that a Democratic government would mean less military, despite compounding geopolitical tensions. We highlighted these as an investment opportunity in January ’21.

Pipelines are a sub category of this section which I isolated. Let’s think out of the box of which companies are necessary to the economy.

Intel

How can Intel (INTC) be part of necessary American infrastructure?

It is overly exposed to the consumer, and has been losing market share to AMD (AMD) in past quarters.

Yes this is true.

The company is also the prime benefactor of the CHIPS act, and is building new chip foundries in the US.

As geopolitical tensions continue to escalate, we continue to leave further behind us the world of globalization. Since the beginning of last decade, slowly the goldilocks era for globalization ended.

Geopolitical risk is now a necessary component of equity analysis and market analysis.

We are on trend for more nationalization, as China wants to flex that it has the better model, and the US continues to defend its position as the incumbent.

When China performed a series of military operations outside of Taiwan earlier this year, it became obvious to everyone that depending on the island nation for semiconductors was not a responsible management of geopolitical risk.

Over the next few years, we’ll see ramp ups in the spend in Europe and in the US in their own foundries, in an effort to become more self sufficient.

In this digital economy, we cannot function without chips. More and more of these will be built in the US.

Intel will be the foundry of choice, facing little competition.

The market is placing absolutely no value on the company’s role as the nation’s foundry, focusing instead on it losing market share to AMD.

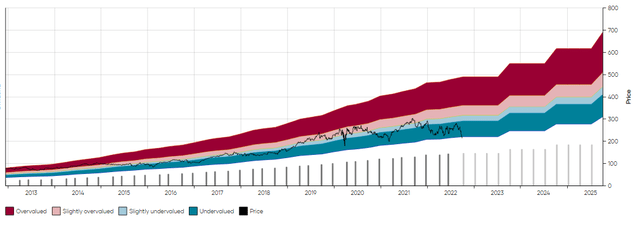

This has created a perfect storm whereby the stock is more undervalued relative to the dividend than it has ever been in the 29 years since it has paid a dividend.

INTC MAD Chart (Dividend Freedom Tribe)

How much lower can Intel go?

Quite a bit lower, as there is no limits to how irrational the market can get.

But 5 years from now, Intel could be a $80-$100 stock, as its foundry will drive growth.

Because of the long term geopolitical tailwind, it’s likely not a question of if Intel becomes a successful foundry, only of when.

Who knows, they might even get their act together and take market share back from AMD. But it doesn’t even need that to be successful.

Union Pacific

The final pick in this list is Union Pacific (UNP).

When we think of UNP, we think of an essential part of American infrastructure in the west coast, where it operates as a duopoly.

There is no surprise that Berkshire Hathaway (BRK.B) (BRK.A) owns UNP’s competitor, in what forms a duopoly in the West of the US.

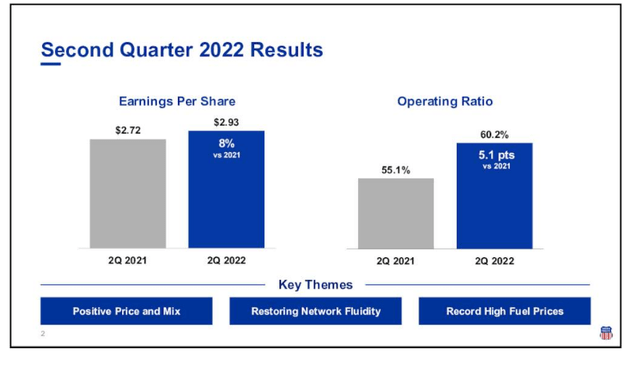

In the second quarter, UNP increased its EPS by 8% YoY, which is very good considering the various inflationary inputs in its business model.

Union Pacific Earnings Presentation

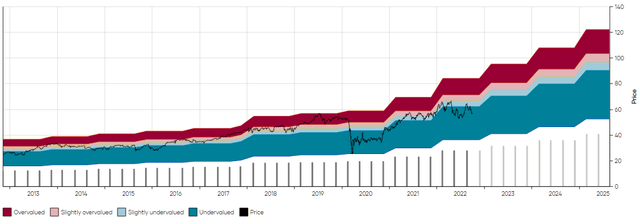

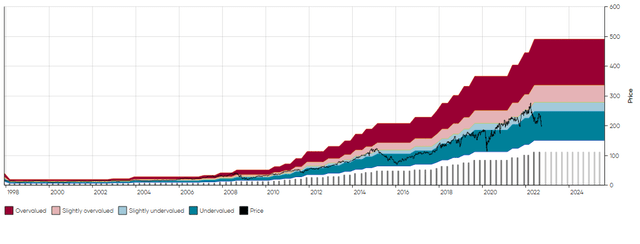

The company now yields 2.6%, which is well below their normal valuation ranges.

UNP 25 year MAD Chart (Dividend Freedom Tribe)

Things could get worse though. If we look at the stocks historical lows in 2015 and 2020, the stock could yield as much as 3.4% in a worst case scenario. This would cause the stock to drop another 25% from current levels.

However, the business isn’t going anywhere, and investors should definitely consider easing into the stock gradually now that it offers value.

Conclusion

You can’t buy low if you’re too chicken to buy when stocks are low.

The upwards bias in markets means that you should be a net buyer of stocks in all market environments, taking the time and effort to trim stocks when they are overpriced, and add back to the positions when they are underpriced.

It’s as simple as that.

If you skew towards quality, focusing only on the most resilient businesses, then buy them at bargain prices, you’re near guaranteed to come out on top.

Doing so will allow you to get the most out of the markets, and live a retirement full of dividends, where recessions, growing economies, peaks and troughs, will never bother you again.

And if you want to boost results, next cycle, consider selling your overvalued names.

Be the first to comment