Liliboas/E+ via Getty Images

As with most SPACs, Butterfly Network (NYSE:BFLY) has had a mixed history as a public company. The digital health company has a promising technology to transform health care via a handheld ultrasound affordable by low income countries, but the financial results and questions about competitive pressures have led to disappointing results. My investment thesis is far more Neutral on the stock now following a period of weak results and high ongoing losses in a tough economic environment.

Lots Of Promise

Affordable handheld ultrasounds have a lot of promise, but Butterfly Network is still mostly a startup. The company raised a ton of cash in the SPAC deal, but Butterfly is no closer now to reaching profitable operations while being reliant on improving 2H sales in order to cut losses.

For Q1’22, the company reported revenues of $15.6 million. The numbers missed analysts targets by $2.1 million, but the revenues were mostly in line with the estimates provided by management with expectations for 2022 sales still hitting a target of $85.5 million for the year.

The bigger issue is that the promise of affordable ultrasounds comes with too much development costs. Even more important, Butterfly Network is going the wrong way on the cost structure even with revenues growing by 25% in the quarter.

The adjusted EBITDA loss in the quarter grew from $26.5 million last Q1 to $40.0 million in Q1’22. The company spent a vast larger amount on R&D expenses along with other general operating expenses during the quarter while revenues failed to reach the original financial projections when the SPAC deal was announced.

The higher expenses in R&D and S&M speak to these issues. In Q1’22, Butterfly spent ~50% more on both categories with those total expenses jumping to $38.8 million in the quarter before stripping out stock-based compensation of ~$3 to $4 million in both Q1s.

Said another way, Butterfly had to jack up costs substantially for minimal additional sales. Just those expenses far exceeded the revenues of $15.6 million and the gross profit at just $8.3 million.

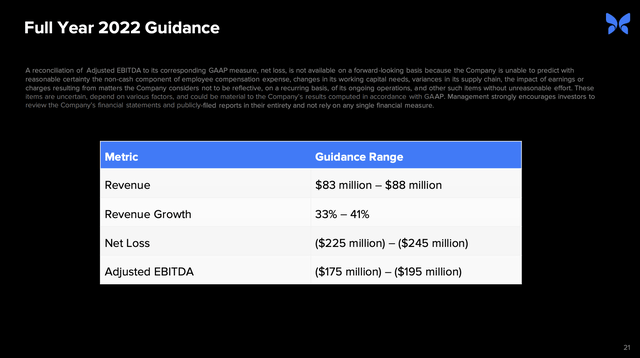

The promise has to lead to substantial sales growth. Remember though, sales growth is needed to just reach the 2022 sales target. Butterfly is still targeting quarterly adjusted EBITDA losses topping $40 million based on the internal forecast of a $185 million EBITDA loss for the year.

Source: Butterfly Network Q1’22 presentation

Competitive Threats

The biggest concern remains the impact of competition on the ability of Butterfly to hit financial targets. One only needs to do a search for handheld ultrasounds to see several options from GE Healthcare (GE) plus several other providers.

The new Vscan Air appears to have a higher price point, but GE has a much stronger brand name. Butterfly isn’t in the best financial position to compete aggressively with a competitor with far larger financials.

The University of Rochester Medical Center system deal is a promising sign medical professionals still prefer the IQ+ from Butterfly. URMC plans to implement the Butterfly Blueprint at scale with both software and thousands of probes. In addition, the Petco Health and Wellness (WOOF) deal builds on the entry into the veterinary hospital business bringing imaging systems to pet care.

Butterfly has a cash balance of $360 million. The company can clearly invest for a few years to build the business, but an annual adjusted EBITDA loss equal to half the current cash balance isn’t very ideal.

The digital health company has to hit the $27 million Q4’22 revenue target to make the story interesting. Butterfly would reach a 40% growth rate in this case to attract growth investors, but the company isn’t forecast to cut losses in the process. The subscription model is definitely positive, but quarterly subscription revenues are a very meager at $4.6 million.

The distance between the operating losses and the revenue base requires Butterfly to perfectly hit targets and the company has already struggled mightily to meet targets and even grow since going public.

Takeaway

The key investor takeaway is that Butterfly is being squeezed here between competitive threats and tough financials. Investors are best off watching the story build from the sidelines and enter a position once the worst possible outcome of a major fundraise is eliminated. In the process, the new management team will either sink or swim allowing investors to buy Butterfly based on strength or completely avoid a sinking ship down the road.

Be the first to comment