Christine Wolf Gagne

Thesis: Durable Income Machine

The Bank of N.T. Butterfield & Son (NYSE:NTB) is the holding company for an offshore banking enterprise spread across 10 locations around the globe but with leading market positions particularly in Bermuda and the Cayman Islands.

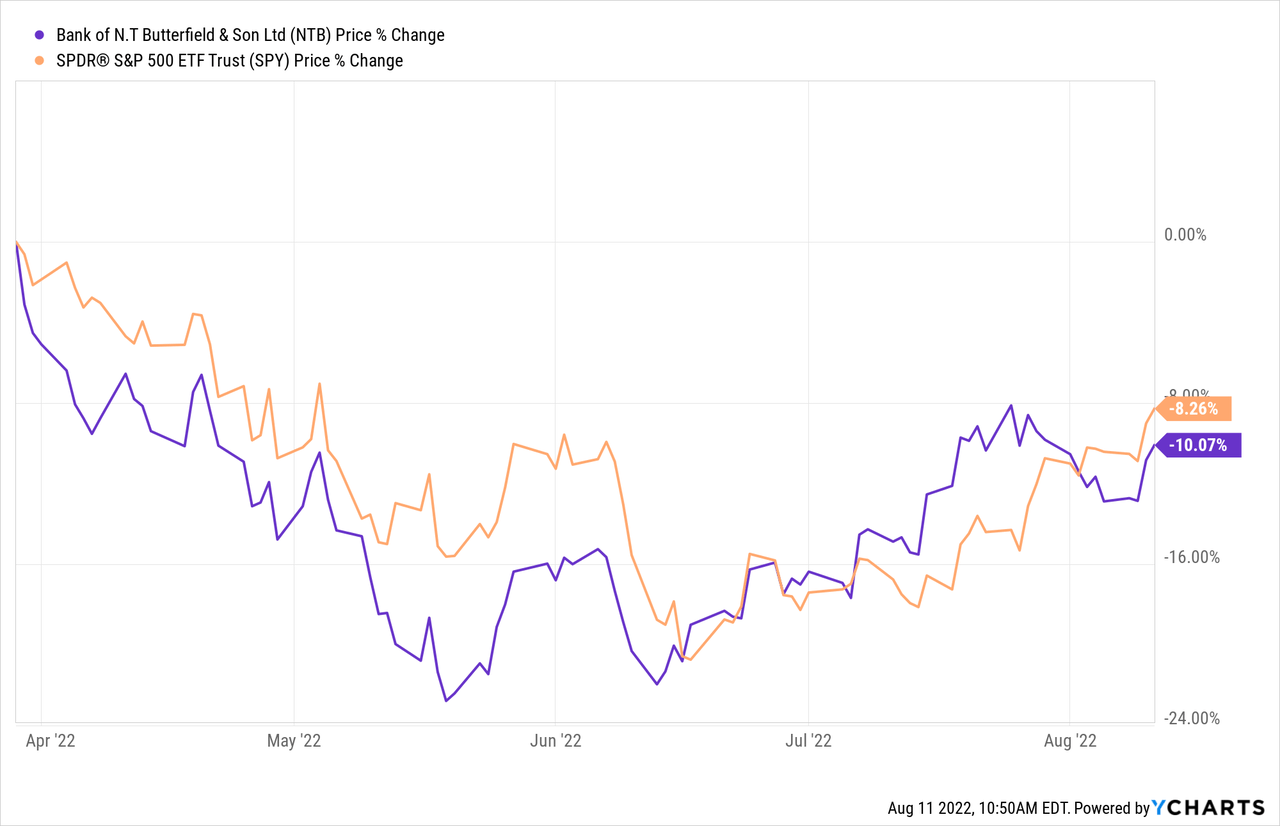

Back in March 2022, I pitched NTB as a good dividend-paying play on rising interest rates, because NTB’s loan book is heavily concentrated in floating rate debt. I expected NTB not only to perform well from an earnings standpoint but also to see some valuation upside. Well, the second part of that call didn’t exactly work out as I predicted. NTB’s stock price has performed slightly worse than the market since the article was published.

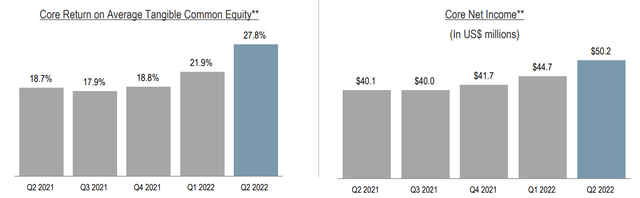

And yet, the bullish thesis about NTB’s fundamental performance has proven accurate. Core net income per share in Q2 2022 reached $1.01, which represented 12.2% growth over Q1 2022’s number and 26.3% growth year-over-year!

In the first half of 2022, NTB has earned $1.91 in core net income. Comparing that to the quarterly dividend of $0.44, we arrive at a year-to-date payout ratio of 46.1%. This is a very comfortable payout ratio.

Combining the fact that NTB’s payout ratio never climbed higher than 60% in 2020 with the increasing conservatism of the bank’s asset portfolio, I believe it uncontroversial to state that NTB makes a solid and durable, 5.2%-yielding dividend income machine.

Will NTB have its breakout rally that I predicted back in March? Maybe, maybe not. But for conservative dividend investors holding primarily for the relatively high and safe yield, NTB has proven its ability to continue paying its dividend through thick and thin – strong economies and weak ones, rising rate environments and low-rate ones.

In what follows, we perform a midyear vitals checkup on NTB and finish with a discussion of whether it is a good buy today.

N.T. Butterfield Midyear Update

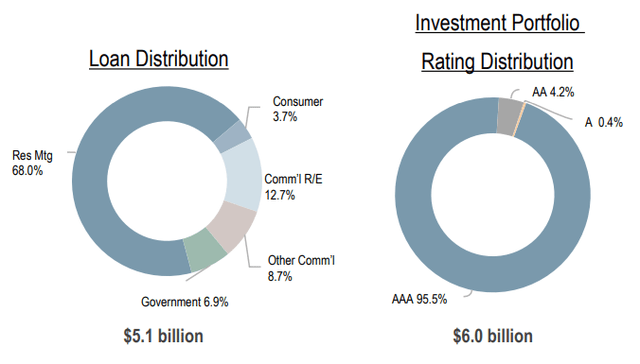

NTB’s loan and securities investment portfolios are extraordinarily conservative. Over 2/3rds of the loan book is in residential mortgages (mostly in the UK, Channel Islands, and the Caribbean), and underwriting standards for these mortgages were quite strong.

NTB Q2 2022 Presentation

Another ~7% of loans are made to government entities, which makes them highly secure. And nearly 13% of loans are backed by commercial real estate. A mere 12.4% of loans are made either to commercial and industrial customers or for consumers, which are generally considered the riskiest categories of loans.

Notably, over 95% of the securities portfolio is rated AAA, signifying the highest level of credit safety.

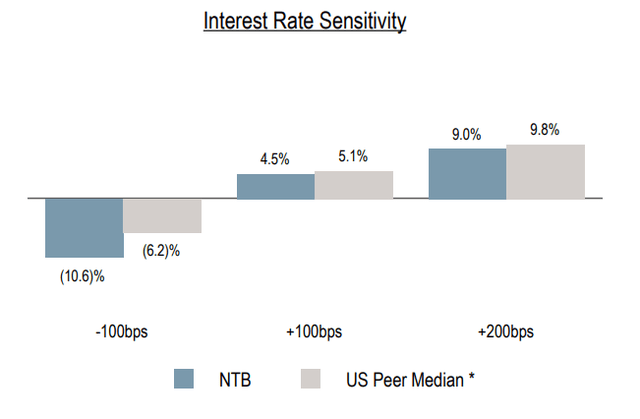

The quality and conservatism of NTB’s assets explains why the bank has below-average interest rate sensitivity despite a majority of its loans having a floating rate component.

NTB Q2 2022 Presentation

During the last rising interest rate environment from 2017 to 2019, NTB’s core earnings doubled, driven by loan portfolio growth in addition to rising asset yields:

| Quarter | Q2 2017 | Q4 2017 | Q2 2018 | Q4 2018 | Q2 2019 |

| Loan Yield | 5.11% | 5.23% | 5.44% | 5.56% | 5.67% |

| Securities Yield | 2.2% | 2.27% | 2.67% | 2.87% | 2.92% |

In the current rate-hiking cycle, NTB’s average loan yield bottomed at 4.18% in Q4 2021, then ticked up to 4.26% in Q1 2022 and 4.48% in Q2 2022. The bank’s average securities yield followed the same pattern.

Here’s NTB’s net interest margin over time:

- 2016: 2.45%

- 2017: 2.73%

- 2018: 3.25%

- 2019: 2.86%

- 2020: 2.42%

- 2021: 2.02%

- Q1 2022: 2.03%

- Q2 2022: 2.26%

Meanwhile, NTB’s cost of deposits ticked up only very slightly from Q1 2022’s 0.12% to Q2 2022’s 0.16%.

Between a reduction in the total share count due to buybacks and rising effective yields on loans and investments, NTB’s core return on equity has risen by nearly 50% since the end of 2021.

NTB Q2 2022 Presentation

What’s more, core net income has likewise increased nicely as interest income has come in higher.

Meanwhile, non-performing loans as a percentage of total loans stayed steady at 1.2% in Q2, flat against Q1 as well as Q3 and Q4 of 2021. But even in Q3 and Q4 of 2020, at the peak of COVID-19 lockdowns, non-performing loans only reached 1.5% of total loans. This demonstrates the quality and defensiveness of NTB’s loan book.

Total deposits did drop from $13.9 billion in Q1 to $13.1 billion in Q2, driven by “client deposit activation” and the strong US dollar’s impact on foreign currency deposits. Over the long term, NTB aims for deposit growth in the low single-digits.

Total assets likewise fell from Q1’s $15.3 billion to Q2’s $14.3 billion, but that change was driven almost entirely by a drop in cash & equivalents. Again, the drop in cash levels is largely driven by the strong US dollar against the cash held as foreign currency in banks around the world.

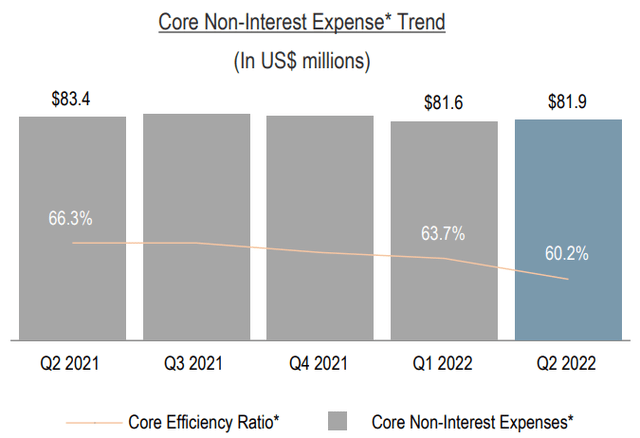

On the expenses front, NTB’s core efficiency ratio (paradoxically, the lower the better) has improved markedly over the last year, driven by a slight reduction in non-interest expenses combined with an increase in non-interest income.

NTB Q2 2022 Presentation

From an operational standpoint, NTB’s management team appears to be keeping everything steady and stable.

Bottom Line: Buy Today?

So, is NTB a good buy today?

I think the answer to that question depends on one’s view of the direction that interest rates are going, and whether the Federal Reserve’s key Funds rate will rise higher and/or remain elevated for a while yet to come or will it have to drop with the onset of a recession in the coming year or so.

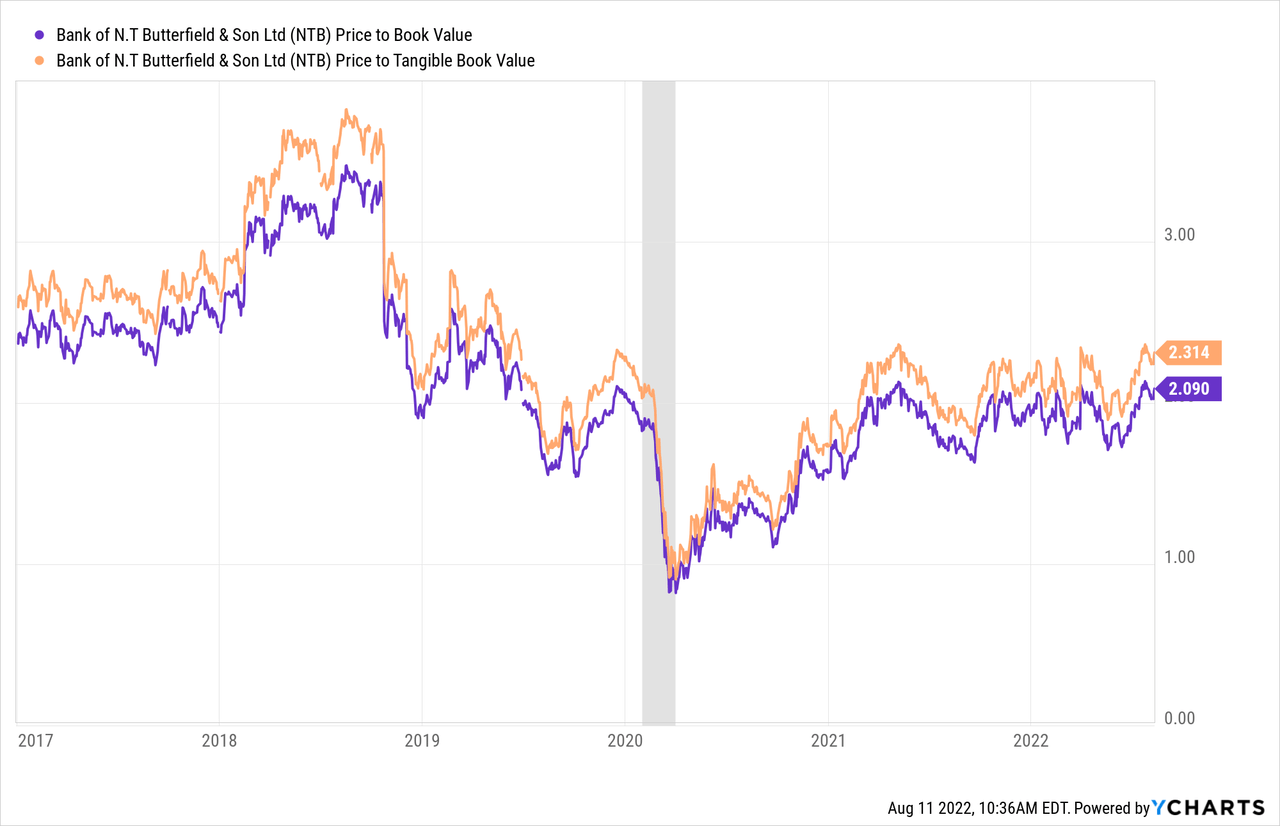

That said, NTB’s price to book value (basic and tangible) is around the same area it was during the low interest rate environment in 2019. That would seem to signify that NTB does not have a large amount of downside if rates were to drop again from here.

In my view, that makes NTB a buy for the dividend investor that is primarily interested in collecting a relatively high-yielding income stream from NTB’s business of offshore banking.

I no longer expect to see a big rally in the midst of rising interest rates, as the increasing likelihood of an oncoming recession has thrown cold water on that idea. But NTB is not an expensive stock. What’s more, its 5.2%-yielding dividend is well-covered by core earnings and has proven its resiliency during low interest rate environments.

For some investors, the dividend in addition to the possibility of future upside via rising rates, stock buybacks, or M&A is enough. As for me, I will remain on the sidelines for now, as I see better opportunities elsewhere in the market.

Be the first to comment