krblokhin

It’s been a rough year for the Retail Sector (XRT), with many companies over-buying and now having to clear inventory at less favorable prices due to a pullback in demand from a weakening consumer. While one might expect off-price retailers to shine in a recessionary environment with consumers looking for deals, this hasn’t been the case, and Burlington’s (NYSE:BURL) results have been evidence of this state of affairs. The reason? With retailers flooding the market with excess inventory and heavy promotional activity, Burlington’s value spread has been less significant, with its hangers going from being great deals to only moderately attractive deals.

The good news is that this trend cannot last forever, we appear to be seeing some improvements from a cost standpoint (fuel, freight, wage rates), and Burlington’s earnings estimates have been slammed, suggesting lots of negativity is priced in here at $112.00 per share. If Burlington were a mediocre company with a less desirable long-term track record, it might make sense to stand aside and let the stock fall much further. However, with industry-leading unit growth, and a valuation that has become much more attractive, I would view pullbacks below $101.25 as buying opportunities.

Burlington Stores (Company Presentation)

Q2 Results

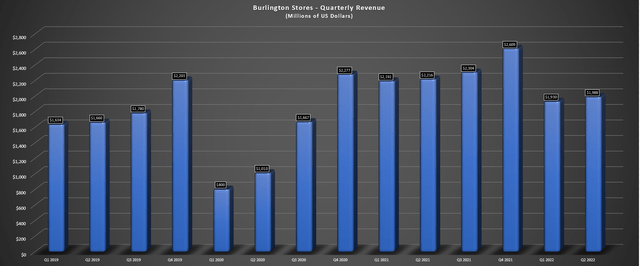

Burlington Stores (“Burlington”) released its Q2 results in late August, reporting quarterly revenue of $1,988 million, a 10% decline from the year-ago period. From a headline standpoint, this was a very ugly figure, and the company admitted that the results were disappointing and well below expectations. However, it is important to note that Burlington was lapping very difficult year-over-year comps due to the benefit of government stimulus, with ~40% of its shoppers being less affluent and a wardrobe refresh after a year of being kept out of stores due to COVID-19-related lockdowns. That said, difficult comps or not, the results were very ugly.

Burlington Stores – Quarterly Revenue (Company Filings, Author’s Chart)

Looking at the sales from a comp standpoint, comp sales fell 17% year-over-year, wiping out the 19% comp sales increase in Q2 2021. On a three-year geometric stack basis, sales worsened during the quarter, up 4% in May, dropping to flat in June, then heading to negative 7% in July, and ending Q2 at (-) 1%. This was well below the guidance of a positive low single-digit three-year geometric stack. The company is now expecting its three-year geometric comp sales stack to be down 1% to 3% vs. FY2019, which is certainly not what investors wanted to see and is a massive miss vs. expectations.

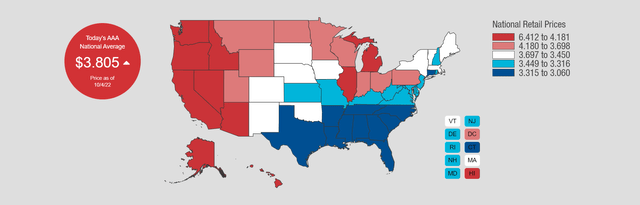

Burlington noted that two things contributed to this poor performance in the industry’s very unusual setup. For starters, Burlington has a significant amount of exposure to lower-income consumers (~40% of shoppers have sub $50,000 household incomes), and this consumer has been hit the hardest by rising gas prices, rising grocery prices, and rising utility costs, among other things. This has left this portion of its shoppers with considerably lower discretionary budgets, putting a dent in demand. Fortunately, gas prices have cooled since Q2, but this could be partially offset by higher utility costs this winter, and grocery prices remain elevated.

Retail Gas Prices (AAA Gas Prices)

The second piece, which was more unusual, is that retailers have had such abundant inventory positions that they’ve been cleaning out their inventory positions at significant markdowns. This has been very negative for Burlington, given that it has squeezed the company’s value spread vs. retailers, which is the heart of Burlington’s business. The reason is that while Burlington offers lower prices than retailers in normal times, which makes shopping there compelling (especially when consumers are tight), the spread deteriorates when retailers discount heavily. The good news is that this will correct itself, but the difficult dynamic could persist into year-end.

Combined with higher freight expense, above-average wage inflation, and supply chain headwinds, Burlington saw its quarterly earnings per share plunge from $1.94 in Q2 2021 to $0.35 in the most recent quarter, an 82% decline. This has led to a revision in earnings estimates from $3.70 to $4.20, translating to a nearly 50% decline even at the high point vs. record annual EPS of $8.41 last year. Not surprisingly, this has put a massive dent in the stock, with Burlington down over 65% from its highs above $340.00 per share.

Unit Growth & Long-Term Track Record

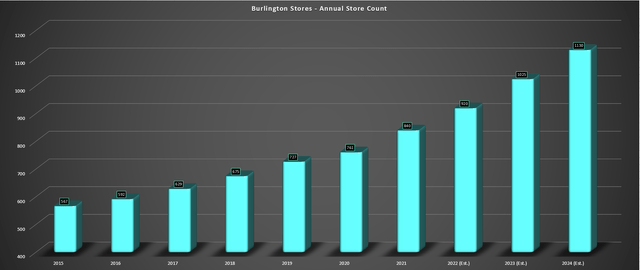

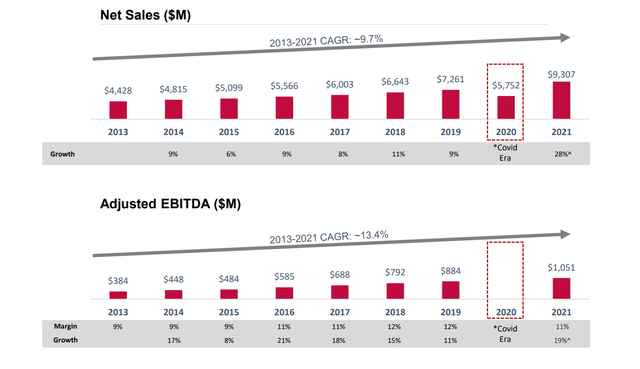

The good news for Burlington is that the lower comp sales this year are being partially offset by strong unit growth, with the company planning to open 90 net new stores in 2022 and up to 120 in 2023/2024. This would translate into nearly 10% growth in FY2022 and similar growth in FY2023/FY2024, helping to pad sales and earnings in this difficult period for the company short-term. While growth for the sake of growth is never attractive, Burlington is a company that has a phenomenal long-term track record (9.7% sales CAGR, 13% EBITDA CAGR since FY2013), and this is what investors should be focused on during the tough times, and underweight the unusually bad FY2022 results.

Burlington Stores – Annual Store Count (Company Filings, Author’s Chart)

Burlington – Historical Sales & Adjusted EBITDA (Company Presentation)

The other piece of good news is that Burlington is managing inventory levels well, is working hard to be disciplined from a cost control standpoint, and is also being disciplined from a buying standpoint in what the company has defined as a buyer’s market for goods. In FY2022, this discipline hasn’t really shown up from a margin standpoint, with margins pressured due to weakening merchandise margins and higher freight, supply chain, and wage costs. However, Burlington is now mostly past these difficult comps.

The result is that we’ve seen a flip in the setup from an overvalued stock (above $300.00) with tough comps to an undervalued stock with easier year-over-year comps as it enters FY2023. This outlook is based on lower ocean freight spot rates, improving domestic freight rates, and less bonus pay. Finally, we could see Burlington able to raise prices a little in FY2023 and work on better mark-ups once some of the inventory held by retailers is cleared out and the sales cool down in the space. To summarize, while the current performance leaves much to be desired, there is a light at the end of the tunnel.

Earnings Trend & Valuation

Looking at Burlington’s earnings trend below, these improvements and unit growth are reflected in current estimates, with FY2023 annual EPS estimates sitting at $6.05, recovering a significant portion of the expected drop this year ($4.18 vs. $8.41). Meanwhile, FY2024 annual EPS estimates are sitting at $8.26, which would translate to 28% growth vs. FY2019 levels, and annual EPS would be knocking on the door of its record year in FY2021, which of course, benefited from significant tailwinds. Hence, I see the sharp decline in annual EPS this year as merely an aberration in what’s been a strong long-term earnings trend.

So, is this decline priced into the stock yet?

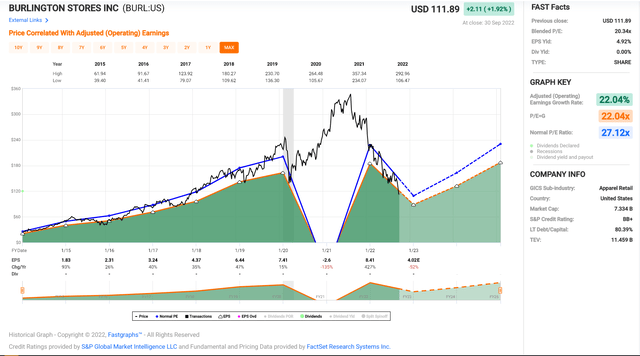

Burlington Stores – Historical Earnings Multiple (FASTGraphs.com)

If we look at the chart above, we can see that Burlington has historically traded at ~22.0x earnings and a 5-year average of 27.0x, which I would argue is a generous multiple, even if it sports industry-leading unit growth. Based on the difficult macro environment in and the lower compound annual EPS growth rate, I believe a more conservative multiple for the stock is 20.9x earnings, a 5% discount from its historical multiple. Even using this more conservative multiple and FY2023 earnings estimates, I see a fair value for Burlington of $126.45. This points to an 11% upside from current levels but is based on relatively depressed earnings estimates that look easily achievable.

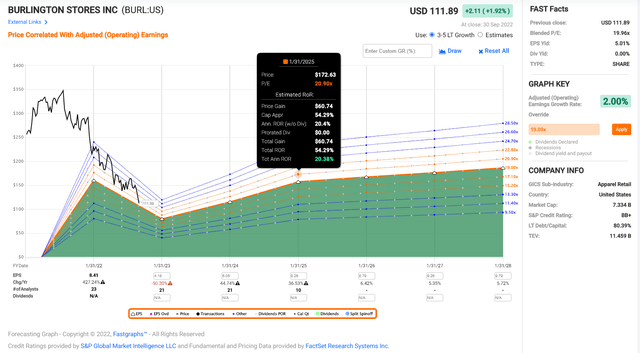

Burlington Stores – Fair Value 2025 (FASTGraphs.com)

If we look further to FY2024 and apply this earnings multiple of 20.9, Burlington’s fair value comes in at $172.60, based on FY2024 earnings estimates of $8.26. This represents more than 50% upside from current levels and a more than 20% annualized rate of return. So, for investors waiting for an opportunity to start a position in Burlington at a reasonable valuation, this setup appears to have finally arrived.

That said, I prefer a minimum 20% discount to fair value to justify entering new positions, and from a current fair value (12-month price target) of $126.45, this would require a dip below $101.25, meaning BURL would need to undercut its March 2020 low to bake in enough margin of safety. So, while I think Burlington is undervalued, I don’t see enough margin of safety just yet.

Technical Picture

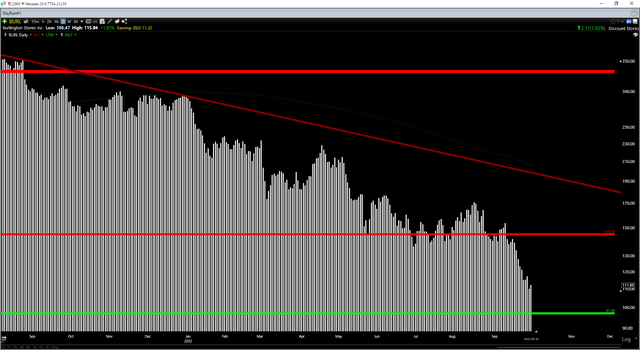

Finally, if we look at the technical picture, we can see that the reward/risk outlook has improved considerably, with BURL having strong support at $97.00 and no strong resistance until $145.00. From a current share price of $112.00, this represents a more than 2.0 to 1.0 reward/risk ratio, with $33.00 in potential upside to resistance and $15.00 in potential downside to support. However, if the stock were to decline below $101.25, the reward/risk ratio would improve to better than 9.0 to 1.0, making for a very compelling long setup. So, similar to the fundamental picture, I don’t see a low-risk buy point just yet, but we are getting very close after this recent correction.

Summary

Burlington has had a rough H1 2022, and it doesn’t look like the back half of the year will be much better with retailers still sitting on a boatload of excess inventory, impacting the value spread for off-price retailers. That said, Burlington has a phenomenal business model, and this period shall pass, providing investors the opportunity to start a position in the stock at depressed levels if this weakness in the stock persists. To summarize, I see BURL as a name to keep a close eye on, and I would view any pullbacks below $101.25 as buying opportunities.

Be the first to comment