jetcityimage/iStock Editorial via Getty Images

Editor’s note: Seeking Alpha is proud to welcome Ibrahim Yousuf as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Thesis

Burlington Stores (NYSE:BURL) has posted a strong recovery in both revenue and earnings following a series of losses stemming from store closures and muted in-store shopping during the Covid-19 pandemic. Further, Burlington has launched an aggressive growth campaign, dubbed Burlington 2.0, aimed at increasing operational efficiency and rapidly expanding store count. Consequently, I believe Burlington has attractive growth prospects and I rate it a buy.

Company Overview

Burlington Stores is a New Jersey-based fashion-focused discount retailer with over 832 stores in 45 states and Puerto Rico as of October 31, 2021. Burlington purchases excess inventory from clothing manufacturers and department stores and sells this merchandise at large markdowns to consumers. Major categories of merchandise sold by Burlington include: women’s ready-to-wear apparel, menswear, youth apparel, baby clothes, home goods, beauty, footwear, accessories, toys, and gifts.

Macroeconomic Overview

Rising American vaccination rates should prompt consumers to shop in retail stores, which presents an opportunity for discount retail stores like Burlington. Additionally, recent employment figures should favorably affect consumer spending habits as people return to work. Finally, headline consumer inflation has reached 7% for the first time in four decades; it can no longer be deemed merely transitory. Inflation inherently leads to benefits for discount stores as consumers seek cheaper goods as prices rise.

Macroeconomic risk factors include global supply chains and labor shortages. Global supply chain issues are forecast to persist into 2022 driven by pent-up demand and labor shortages. Congestion at ports and higher freight costs should adversely impact gross margins in the near term. Finally, labor shortages pose as a bearish factor on Burlington’s operating capacity.

Industry Overview

The Off-Price Retail industry was estimated at $236.08 billion in 2020 and is expected to grow at a CAGR of 8.7% during 2021-2027. The industry is driven by consumer desires for value below market price and the ‘fun’ in-person environment of searching for deals. Also noteworthy is that many retailers in the industry have built e-commerce platforms (e.g., TJ Maxx), indicating the growing dominance of e-commerce. Burlington has lagged behind in this respect. Finally, in light of recent economic uncertainty, the discount retail industry offers the added benefit of being relatively resilient to economic downturns in comparison to the rest of the retail industry.

Competitive Landscape

Burlington’s biggest competitors are Ross Stores (NASDAQ:ROST) and TJX Companies (NYSE:TJX). Compared to its competitors, Burlington is a much smaller company with a market capitalization a mere 40% of its next smallest competitor, Ross. However, this presents a greater opportunity for growth as Burlington’s management undertakes ambitious plans to expand its geographic footprint and capitalize on earnings of scale.

Drivers/Catalysts

Burlington has drastically increased its number of stores over the past few years. In fact, Burlington opened 93 stores during the 9-month period ending Oct. 31, 2021. Further, Burlington’s long-term expansion plan, dubbed Burlington 2.0, will introduce smaller 25000 square-foot stores (as opposed to current 48000 square-foot stores). These stores will be set in high-traffic locations and will have a lower operating expense structure. These attractive store economics led Burlington to double their long-term goal of 1000 stores to 2000. Per its investor presentation, Burlington is targeting net store growth of 100-120 per year.

Another key target of Burlington 2.0 is tighter inventory management. As previously mentioned, Burlington is opting for smaller stores with leaner inventories, which would allow customers to find more fresh pieces in their stores. This, in turn, should enhance the customer experience and enable higher inventory turns. Burlington’s recent purchase of a 900,000 square foot distribution center in California is indicative of its focus on efficiently meeting demand for inventory.

Additionally, Burlington intends to expand the depth and breadth of its merchandise, prioritizing fast-turning categories as lady’s apparel. As it stands, Burlington works with 500+ vendors, compared with TJX’s 20,000 and Ross’ 8,000. Clearly, there is a large opportunity to work with new vendors and expand Burlington’s merchandising capabilities. Moreover, Burlington’s rapid store growth should enable it to realize economies of scale and build stronger relationships with existing vendors.

Finally, Burlington has a strong balance sheet to back up its growth. After issuing $805 million of 2.25% convertible notes in 2020, Burlington has $1.6 billion in total gross debt. Additionally, they added $1.2 billion in unrestricted cash in Q3, leaving them on a net debt basis with $400 million. As such they are in a comfortable place with their gross leverage being down to 1.6x gross debt-to-EBITDA and net debt ratio is 0.4. This sets them up to always be ready for any opportunistic buys and deal with financial downturns. Lastly, Burlington initiated a $400 million share repurchase program to be executed through August 2023. During FY 2021, $150 million of shares have already been repurchased through this program.

Risks And Mitigants

1) Supply Chain And Labor Issues

Burlington’s margins depend heavily on freight and supply chain costs. Current issues will likely add to these costs. Extended labor shortages represent a significant risk to the undermanned discount apparel industry. Finally, negative real wage growth will likely be a major catalyst that drives workers away.

Mitigant: Excess of products in the market stemming from supply chain hold ups in Q4 ’21 will lead to low gross costs in the interim. Additionally, Burlington, boosted with a healthy supply of apparel, is better poised to deal with these issues than competitors. Supply chain issues should only be short-term detractors, so the fundamentals of my thesis remains intact. Finally, an end to stimulus should boost labor supply as decreasing non-wage income boosts one’s incentive to work.

2) Lack Of Consumer Interest

According to the 2020 10-K, the company stated, “While opportunistic purchasing provides our buyers the ability to buy at desirable times and prices, in the quantities we need and into market trends, it places considerable discretion with our buyers, which subjects us to risks related to the pricing, quantity, nature and timing of inventory flowing to our stores.” In simple terms, consumers may not want to shop at Burlington.

Mitigant: Consumers desire more in-person shopping as a result of prolonged prevention-from-access due to the pandemic. Additionally, increased operational flexibility will allow Burlington to chase sales trends more effectively and provide lower markdowns to attract customers.

3) Rising SG&A Expenses

The company sees rising selling, general, and administrative expenses owing to its small-store model.

Mitigant: Comparatively, Burlington’s SG&A rises are lower than those of its main competitors, Ross and TJX, indicating an outperformance of industry SG&A trends.

Financials

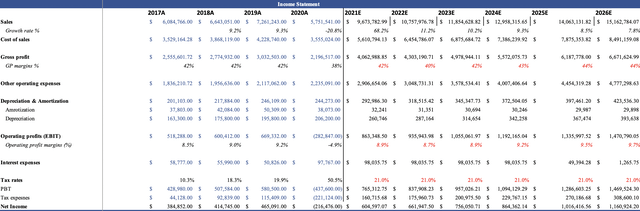

Author generated using company data

Pictured above is a recap and projection of Burlington’s income statements. Extended store closures during Q1 2020 and falling foot traffic owing to the pandemic devastated Burlington’s sales to fall nearly 20% in 2020, and resulted in a $220 million loss. However, Burlington experienced a V-shaped recovery in 2021, with Q1-Q3 ’21 annual sales, which excludes the busy holiday season, topping $6.7 billion (vs. $7.2 billion for the ENTIRE 2019 fiscal year). Further, Burlington reported earnings of $287 million during this nine-month period. Clearly, the company has been able to regain its footing once in-store shopping resumed.

To create the sales projection into 2026, I conservatively assumed net store growth of 75-100/yr (as opposed to the 100-120 net stores/yr projected by management). Additionally, I assumed a continuation of the historical 3% comparable same store sales growth that will eventually slow down to 2% in the long run. Finally, I assumed that the new smaller stores opened by Burlington will generate approximately 80% of the revenue of older, larger stores.

In addition, I conservatively estimated that operating margins will improve by 80 bps from the historical average of 8.9%. This assumption is far below the estimated 200-300 bps of potential operating margin expansion outlined in Burlington’s most recent investor presentation. I assumed a gradual improvement in gross margins to 44% as a result of economies of scale, improved flexibility of operations, and better markdown strategies. However, I forecast a drop in gross and operating margins in 2022 to reflect industry-wide supply chain issues and labor shortages. Nevertheless, I believe that Burlington will be resilient against macroeconomic tailwinds beyond 2022.

In forecasting depreciation expense, I estimated the rate of depreciation will remain at the historical 12.4% and that fixed asset turnover will increase from the historical average of 4.63 to 4.78 by 2026 (annual increase of .03).

I assumed that the debt principal will be repaid at maturity and that the interest rate will remain at 5.1%. Finally, I assumed that the prevailing tax-rate will be 21%.

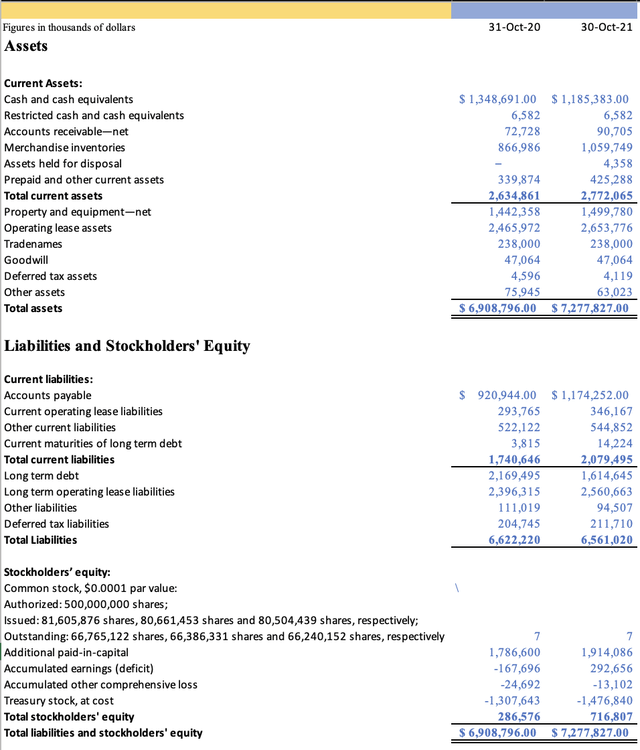

Author generated using company data

Burlington boasts a strong balance sheet (above) that should remain fortified in the coming years. Between Q3 ’20 and Q3 ’21, current assets have increased by $137 million. Also, as previously described, Burlington managed to cut down debt occurred during the pandemic with long-term debt falling from $2.2 billion to $1.6 billion. This leaves Burlington with a comfortable debt position to support its continued expansion.

Valuation

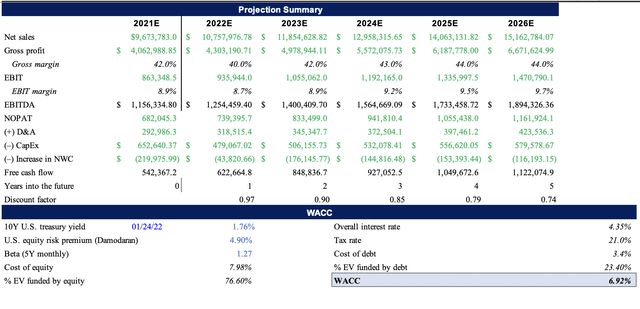

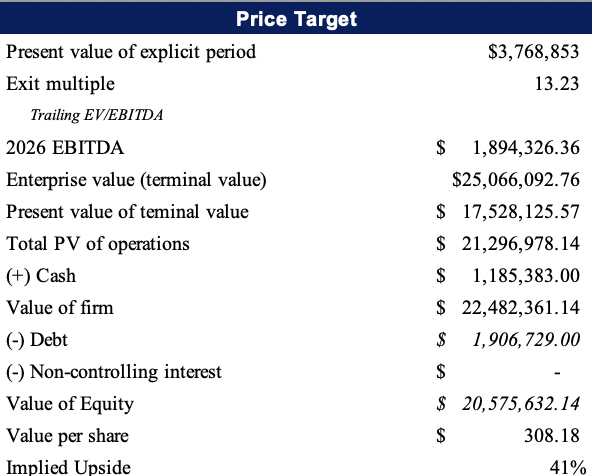

Author created using company data Author created using company data

To calculate the present value of operations, I discounted my 2022 – 2026 free cash flow projection using a WACC of 6.92%. Additionally, I used the trailing EV/EBITDA as my exit multiple in calculating the terminal value, which is done by taking 2026’s expected EBITDA and multiplying it by the exit multiple. I subsequently discounted this terminal value to the present using the same WACC of 6.92%. Adding together the present value of the explicit period, the present value of the terminal value, and Burlington’s current cash position less debt, I arrived at a value of equity. Ultimately, after dividing the value of equity by the number of shares outstanding, I calculated the intrinsic value of a share of Burlington to be $308.18, which represents a 41% upside from the current share price of $218.37 (as of February 25, 2022).

Bottom Line

Burlington is well positioned to grow earnings in the coming years owing to the combination of a solid balance sheet, expanding retail base, improving margins, better store economics, vendor expansion, and an improving long-term macroeconomic outlook. As Burlington 2.0 pairs greater customer visibility and lower operating costs, the company should produce significant cash flow as it capitalizes on the further return of in-person shopping. Finally, with a price target of $308.18, calculated using conservative assumptions below management’s guidance, Burlington stock has plenty of upward room for an increase in the share price.

Be the first to comment