gorodenkoff

Investment Thesis

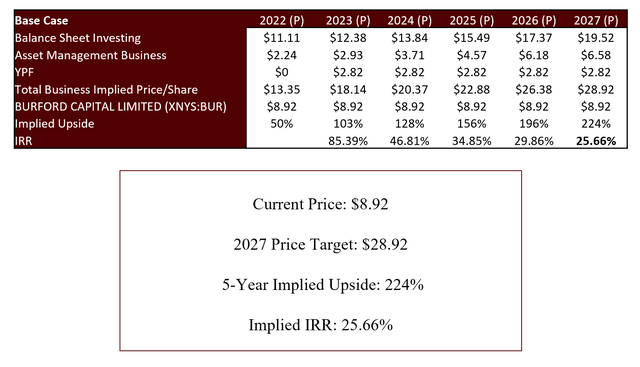

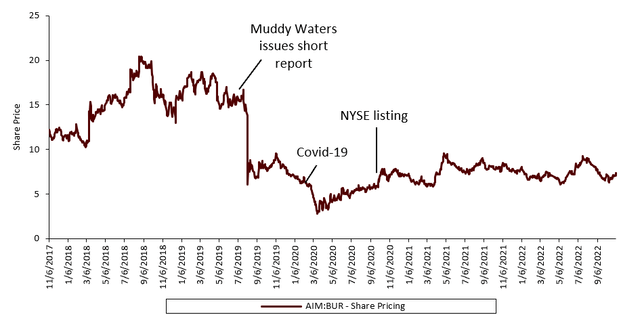

Burford Capital is the largest player in the rapidly growing litigation finance space. The rise of litigation finance has created an opportunity for investors to receive alpha-generating returns that are completely uncorrelated to the broader market. Burford appears to have a competitive advantage in the space through its scale, brand, and underwriting process. Additionally, Burford has seen its stock fall over 50% since 2019, following a short report by Muddy Waters coupled with court closures due to the covid-19 pandemic. However, the underlying business has only improved over the last couple of years, creating a deep value play. As courts have opened back up, litigation will continue to proceed as normal, returning financials to pre-covid levels. Additionally, Burford’s private funds entering harvesting mode and the YPF case serve as additional catalysts for Burford’s stock. Through a sum-of-the-parts analysis (Asset Management, Balance Sheet Investing, YPF), I found an implied 5-year price target of $28.92, implying a ~25% IRR over the next 5 years.

Litigation Finance

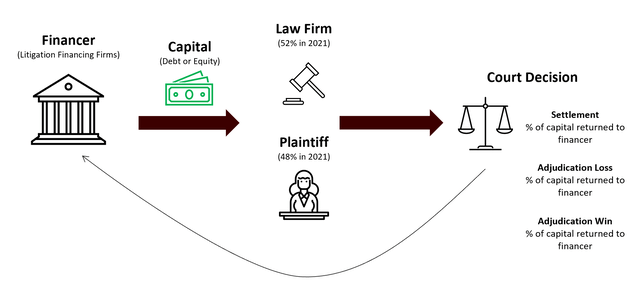

I think it’s worth giving a quick background on litigation finance’s history, and its development as an asset class. Litigation finance is the process of litigants (parties involved in a lawsuit) financing their litigation costs through an uninvolved 3rd party. In doing so, the 3rd party receives some sort of return from the settlement or an adjudication win. If they lose, little to no funds are returned. (Sort of like Venture Capital right?) Here’s how it works:

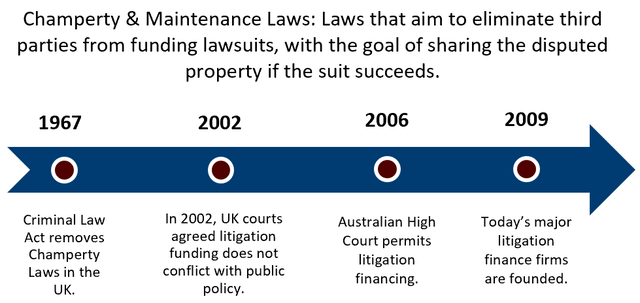

So why are we just recently hearing more about litigation financing? It’s actually because it used to be illegal. Dating back to the middle ages, Maintenance and Champentry laws forbade the financing of lawsuits by third parties. This started to change in the latter half of the 20th century, starting in the UK and Australia. In 1967, the Criminal Law Act removed Maintenance and Champerty laws in the UK. This was further solidified by a court case in 2002, which stated that litigation finance did not conflict with public policy. In 2006, the High Court of Australia permitted litigation financing. In the US, some states still do have these laws, some repealed them, and some never had them.

Today, there are 47 active litigation funders in the United States. However, there are much fewer “dedicated funders” who focus solely on litigation funding. Many of these 47 are simply hedge funds or other asset management firms that have a litigation financing desk. With that being said, as of 2021, US litigation funders had a combined $12.4 billion of AUM. Burford currently has $3.4 billion of AUM through its private funds, with an additional $2.9 billion on its balance sheet. This makes Burford the largest litigation finance player in the world.

Burford Capital

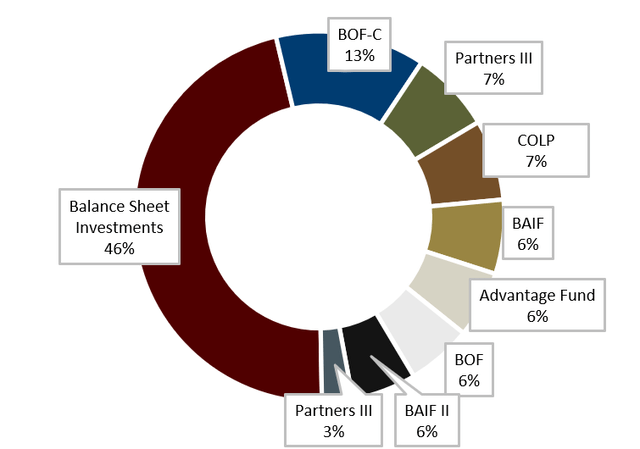

As stated above, Burford was founded in 2009 and has become the largest litigation funder in the world. Burford is headquartered in the UK, and initially went public in the UK, but has since listed on the NYSE (2020). They currently manage $3.4 billion through their 9 private funds, and another $2.9 billion on their balance sheet.

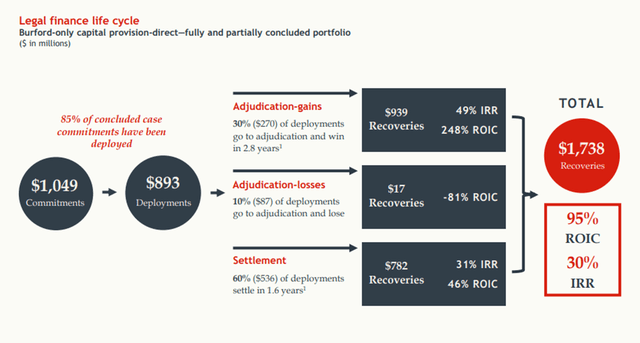

Burford provides capital to both law firms and internal legal teams at major corporations to cover the cost of litigation. In return, Burford reaps the rewards of any settlement or adjudication win. I won’t spend too much time on this, but Burford has historically created astronomical returns through their investments. It is important to note that Burford only invests in corporate litigation, and does not involve itself in personal liability litigation, or anything of that matter.

Through all of Burford’s concluded cases, they’ve generated a 30% IRR! Settlements generally come with lower ROICs but higher IRRs, while adjudication wins generally come with higher ROICs but lower IRRs. On the other hand, almost no capital is returned in an adjudication loss. This leads in to one of Burford’s competitive advantages…

Competitive Advantages

I see three different competitive advantages that Burford holds within the litigation finance space: scale, brand, and the underwriting process.

Scale

Scale is vitally important within the litigation finance industry for several reasons. I’ve already alluded to the first. 10% of all of Burford’s investments result in permanent capital loss. Clearly, these investments hold a lot of risk. However, these risks can be effectively removed by creating a large and diversified portfolio. Diversified portfolios can not be constructed in this industry without a large amount of capital. Burford’s average investment is $10 million and has recently become as high as $20+ million. With a small amount of capital, it is simply impossible to create a diversified portfolio of investments. However, at scale, Burford is able to create a highly diversified portfolio of uncorrelated litigation. The bottom line is that the litigation finance industry has high barriers to entry given this dynamic. Blackrobe Capital Partners deployed $32 million among individual cases, before shutting down 2 years later. The inability to attract new capital and a big loss in a case led to their decision to close the doors.

Brand

Yes, brand name is in fact a competitive advantage for Burford. First off, 94% of the American Lawyer 100 (Top 100 Law Firms in the US) have worked with Burford in the past. Additionally, 86% of interviewed lawyers were able to identify a legal finance provider named Burford first or solely. These two data points show Burford’s clear domination in the space. Now the question of, “Does brand matter?”. I give you this:

“I would be willing to pay a premium to work with a trusted funder. I would need to have a lot of confidence in the company providing the financing.”

-Senior in House Lawyer

Clearly, Burford’s strong brand recognition matters.

Underwriting Process

There are two main components that I believe offer Burford an edge in the underwriting process:

- Team: Burford has an A+ management team that has brought in incredible talent from both finance and law. Both the CIO and CEO founded the company in 2009, and have been with the company ever since. CEO Christoper Bogart previously served as the CEO of Time Warner Cable Ventures, CEO of Glenavy Capital, and a litigator at Cravath before starting Burford. CIO Jonathan Molot received his JD from Harvard Law, founded Litigation Risk Solutions, and is currently a Professor of Law at Georgetown University. Needless to say, this is an A+ team that does all of the underwriting and research for investments in-house. And who doesn’t like a company where the cofounders each have over 4% ownership 13 years later?

- Data: Data is the second component to Burford’s advantage in the underwriting process. Burford uses quantitative and probabilistic modeling and considers it a “proprietary trade secret”. The real advantage is that Burford is able to collect private data from all of their previous cases and input these into their models. No other business can use their data from settlements, because it is simply not publicly available. This may be one of the factors that have allowed Burford to increase their ROIC over the past decade.

Valuation

Now to the fun part. I did a sum-of-the-parts analysis with three different segments: Balance Sheet Investing, Asset Management, and the YPF Case. Let’s take a look at each.

Balance Sheet Investing

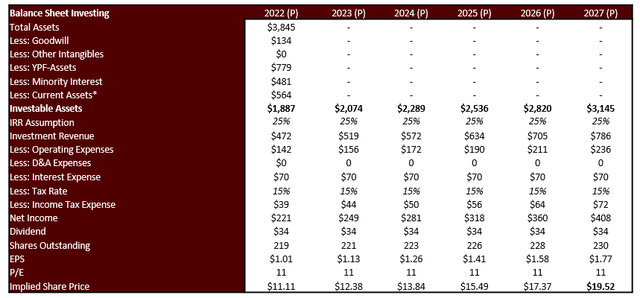

As you can imagine, the balance sheet investing business is pretty straightforward. Burford holds these assets on their balance sheet, receives the cash proceeds from them, and then reinvests the profits into new cases. To find the value of the balance sheet business, I took out all assets that weren’t legal assets and additionally removed the YPF assets (which will be valued separately). I then took the legal assets, attached an IRR to them, subtracted all expenses and taxes, and arrived at a net income. I then took out the dividends and added that number (retained earnings) to the next year’s legal assets.

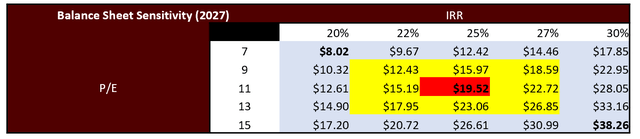

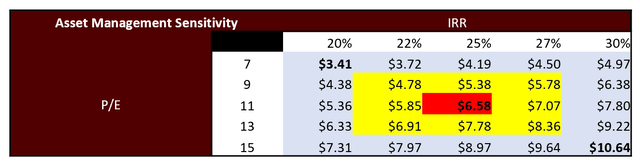

The two largest assumptions are IRR and P/E multiple. Given that Burford’s historic IRR is 30%, a 25% IRR seemed like a good conservative number. The P/E multiple of 11 was found through a comps analysis of other private equity and asset management firms.

Asset Management

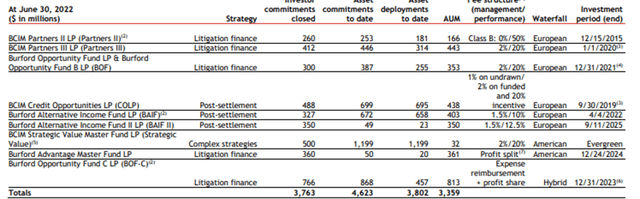

Burford operates 9 private funds that all have their own fee structure.

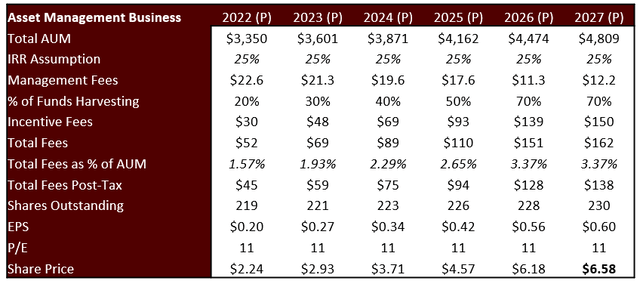

Using an IRR assumption, I calculated both management and incentive fees for the overall asset management business. Burford will only earn management fees during the investment period, and will only earn incentive fees during the harvesting period. Therefore, I created assumptions on how many of the funds would be in harvesting mode, and generating incentive fees. (I’ll touch on this more in the catalyst section)

Key assumptions include the IRR, % of funds harvesting, and the growth rate of AUM. The recent growth of AUM has been around 10%, but I projected 7.5% to be conservative.

YPF Case

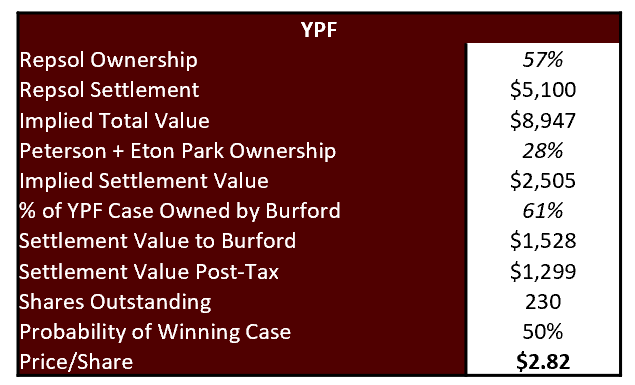

I won’t talk too much about the merits of the YPF case, but simply paint the backdrop of the case. The Argentinian government privatized the oil and gas company YPF in 1993. In doing so, they wrote in a clause which stated that if they were ever to re-nationalize the business, they would make a tender offer to all shareholders. Fast forward to 2012, Argentina re-nationalized the business. However, they didn’t make an offer to all shareholders. In 2014, they eventually paid Repsol $5.1 billion in Argentinian bonds. However, they failed to make an offer to Peterson, the second-largest shareholder of YPF at the time. Peterson defaulted back in 2012 as they required YPF dividends to pay off debt, however, the re-nationalized business stopped paying dividends. Peterson decided to take it to court, and in 2015 Burford put up $50 million to fund the litigation. To date, Burford has sold 39% of the YPF asset to third parties for a total of $236 million in cash proceeds. Burford still owns 61% of the YPF case, which is now sitting on Burford’s balance sheet at $779 million. This is being valued simply by public market transactions, not by what Burford believes the case is worth. Now I’m no legal expert, so I’m not going to go any further into the case. Here’s a highly conservative and basic model for the YPF case:

Author

Essentially, I simply took the Repsol settlement back in 2014 and applied the value of the settlement in accordance with YPF ownership. I also assumed a 50% probability of winning the case/settling. This is likely a conservative valuation, with some authors arguing a value of up to $5 billion.

Bringing It All Together

Catalysts

I see three main catalysts for Burford: the YPF case, asset management harvesting, and court reopenings.

- The YPF case is pretty straightforward. Winning the case would add $1+ billion to Burford’s balance sheet. In accordance with the model above, Burford could receive $1.3 billion which equates to roughly 70% of Burford’s current market cap.

- Asset management harvesting is a bit more complex than the YPF case. Burford’s private funds can be broken down into two different stages: the investment stage and the harvesting stage. During the investment stage, Burford is doing due diligence on investments and investing in various litigation throughout. During this time period they earn management fees, but no incentive fees. Once we get to the harvesting period, Burford will earn incentive fees but not management fees. Burford has structured their fees to favor performance rather than management fees. One of their funds actually has a 0% management fee and a 50% incentive fee. Additionally, Burford funds mainly use a European waterfall rather than an American waterfall. This means that Burford will not realize any incentive fees until the entire fund has generated preferred returns for the private investors. This even further delays incentive fees for Burford. To date, Burford has collected very little from their asset management business, which investors have started to believe is status quo. However, as these funds start to reach the latter half of their harvesting period, we should see a large increase in revenue from the asset management arm.

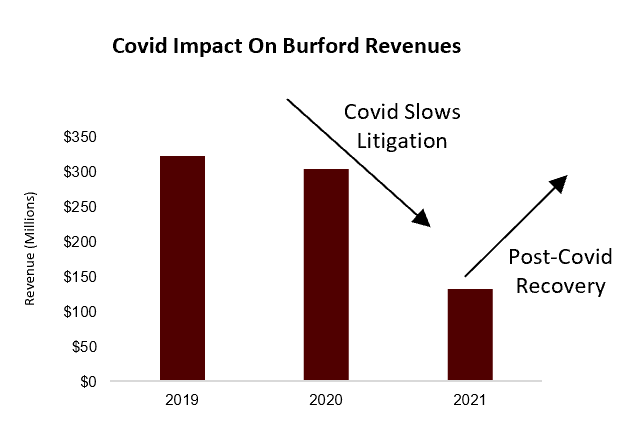

- Court reopenings will serve as another catalyst for Burford stock. The litigation process came to a halt during covid and has been trying to recover ever since. As a result, Burford’s top and bottom lines severely suffered. However, we should expect a V-shaped recovery as litigation continues and cases are closed.

Author

Risks

The 3 major risks I see for Burford are investor confidence, a potential covid resurgence, and competition.

- Investor confidence is likely the biggest concern for Burford. Following the 2019 Muddy Waters short report, Burford has failed to recover from those highs.

A failure to restore investor confidence could lead to a sustained low earnings multiple. Management could restore investor confidence by winning the YPF case, returning capital to investors, and rebounding from covid with top and bottom-line growth.

2. Another big risk for Burford is competition. As I stated earlier in the article, I do believe that Burford has a potentially sustainable competitive advantage. However, I could be wrong. If a large amount of asset management firms and/or banks enter the space, returns could be pushed down. This could send Burford IRRs down substantially from 30%. However, Burford has been generating these returns since 2009, which I believe validates its advantage within the space.

3. Lastly, a resurgence in covid serves as another potential risk. I honestly don’t see this as a huge risk, as I think the chances are pretty low. However, it would be highly detrimental to Burford if courts were once again shut down.

Final Thoughts

Overall, I believe that Burford presents a highly compelling investment opportunity. Not only are they a leader in the highly attractive litigation space, but their price/valuation has been slashed recently. However, there have been no changes in the underlying business. Even without the YPF case, it appears that Burford offers an attractive upside, with YPF just serving as the cherry on top. With a 5-year price target of $28.92, Burford has an implied IRR of 25.66% over the next 5 years. If Burford’s competitive advantage proves to be sustainable, I think Burford could create alpha-generating returns for decades to come.

Be the first to comment