Vivien Killilea

Overview

Bumble is a dating app. It also has an in-app offering for meeting people and networking with professionals. They operate a freemium business model, where users are able to access the service for free but are able to pay for improved visibility. Additionally, they have begun to sell merchandise direct to consumer via their website.

Founded in 2014, Bumble was a unique entrant into the online dating space at the time. Built in response to the notable failings of Tinder and similar applications, Bumble was created to ensure a healthy digital environment for women. The way that the app functions is similar to Tinder, with people swiping through profiles; however, a woman must always ‘make the first move’ on Bumble by contacting someone that she has matched with.

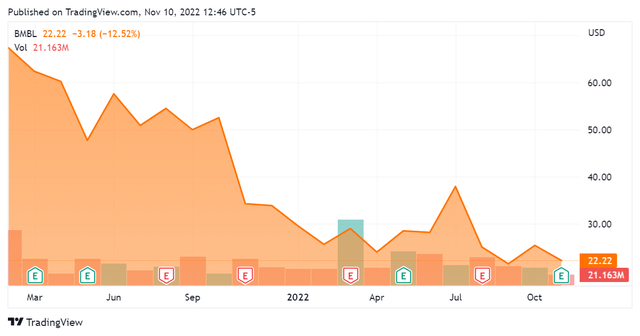

The concept proved itself and rapid user acquisition followed, with Bumble quickly becoming the 2nd most popular dating app in the United States after Tinder. Bumble conducted an initial public offering in Q1 2021 at $43 per share, closing the day out with a market capitalization of $7.7B. The stock’s performance, along with the rest of the market, has been rocky since then:

SeekingAlpha.com BMBL 11.10.22

The stock is now trading at roughly half of its IPO price. Yesterday, on 11/10/2022, the company released earnings for Q3 2022. This article will examine the company’s recent performance as well as its financial picture more generally.

Earnings & Financials

Bumble’s latest earnings report missed on non-GAAP EPS by $0.17, coming in -$0.08 as opposed to $0.09. The GAAP EPS was actually positive, although we will not try to reconcile these two figures within this article. Revenue was a close miss as to Wall Street estimates, at $232.64M for the quarter versus $237.69M expected.

As per the earnings transcript, this represented revenue growth of 17% YoY. Notably, foreign exchange pressures due to the appreciating dollar decreased this metric by $14M. Along with this, cost of revenue was $64M, an increase of 17% that remained flat as to its proportion of revenues (27%). Sales and Marketing expense grew 16% but also remained steady as to proportion of revenue (26%).

As to earnings, Q3 adjusted EBITA was $62M at a gross margin of 27%, along with the EPS figure cited above.

Notably, Bumble generated $34M of free cash flow during this past quarter, and maintained Cash & Cash Equivalents of $365M.

Overall I would say that this represents a healthy quarter as to financial performance. It is worth taking a broader look at the financials to see how the firm has performed since its IPO in Q1 2021; note that these financials also include numbers from when it was a private company.

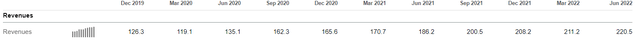

Revenue wise, we see a consistent picture of growth, with the latest figure of $232M representing the most significant quarter-over-quarter growth that the company has had since its Q4 2021 fiscal quarter:

SeekingAlpha.com BMBL 11.10.22

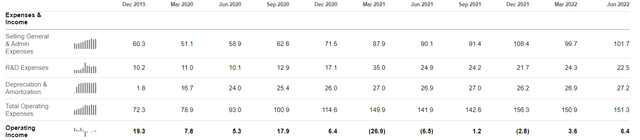

On the expenses side, Bumble presents a more complex picture. Expenses have increased in line with its revenue growth. Nonetheless, the recent quarter shows that expenses have been kept steady on a YoY basis; the earnings report makes clear that they have now arrived at a steady state and should not be expected to increase much further in the immediate.

SeekingAlpha.com BMBL 11.10.22

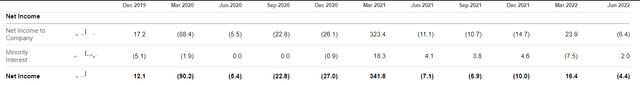

This is corroborated by the decreasing variance in the firm’s net income:

SeekingAlpha.com BMBL 11.10.22

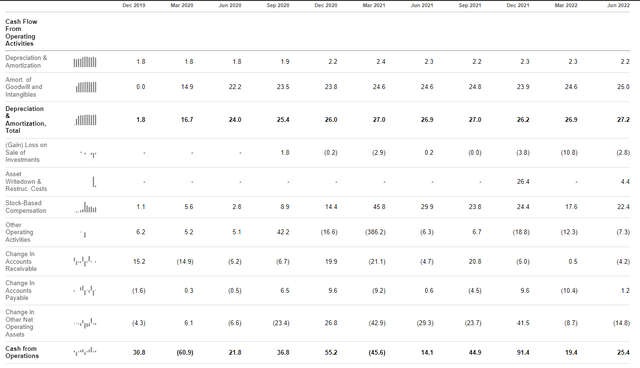

As to cash flow, Bumble looks to be consistently performing. Only two of the last ten quarters had negative cash from operations, so it stands to reason that the business model is proven.

SeekingAlpha.com BMBL 11.10.22

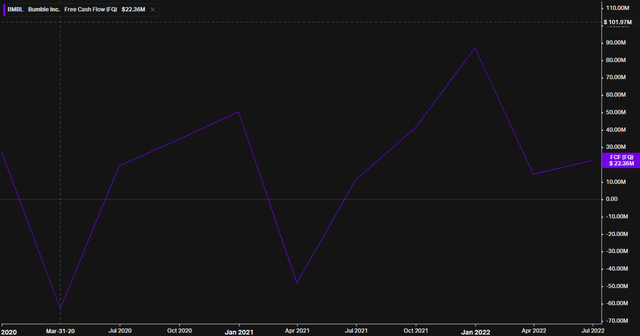

Although beyond the scope of this article, these materially cash flow negative quarters are likely due to the several acquisitions that the company has made throughout this time. This is also reflected in free cash flow. The latest quarter is not reflected in the chart below but represents an increase of 52% quarter over quarter.

As a technology business I am of the opinion that Bumble looks solid all around. An early EPS miss, or several, is a common thing indeed. More importantly, consistent revenue growth as well as the capacity to generate free cash flow each represent a good signal, made that much stronger by them being both present.

Additionally, consistently positive cash from operations indicates that the business model is already well proven. While the firm was not able to produce the positive non-GAAP EPS that Wall Street expected, it seems reasonable given the firm’s continuing expansion and diversification across product lines.

Conclusion

Reading through the earnings report, Bumble is in the process of establishing itself across a variety of geographic markets as well as new business areas. In the course of this the financials that it is producing are nothing to scoff at.

Additionally, it remains the 2nd most popular dating app in the United States as well as several western European countries. Anecdotally, any younger person will tell you the material difference in reputation/quality perception between the leading player and Bumble.

While the product side of the picture requires more significant investigation, the financial picture as well as a preliminary look at the product & platform metrics make me optimistic. Additionally, the long-term focus of the company as well as its strong brand perception are factors that should be considered. Taken together, I am inclined to call this a buy.

Be the first to comment