Euro Stoxx 50, European Equities, ECB, US CPI Talking Points:

- Euro Stoxx 50 pushes to a fresh post-pandemic amid broad USD weakness on Monday

- All eyes remain focused on Thursday’s ECB policy meeting and the US CPI print

- European stocks appeared to shrug off the impacts of G7 agreement on minimum corporate tax

The Euro Stoxx 50 edged higher on Monday by 0.20%, continuing what has been an impressive run despite the growing fears of inflation. Bullish momentum carried over from Friday’s employment print in the US, which reaffirmed confidence in the American recovery but also did not stoke any fears over hawkish Fed policy.

Markets also shrugged off the impacts a potential global corporate tax may have on corporate earnings, following G7 approval. European equities were also buoyed by strong performance from the auto and banking sectors, amid improved outlook and expected ECB dovishness.

Inflation remains the primary focus of global traders, as fears remain that a strong rebound may cause central banks to taper and tighten much sooner than expected. Significant moves in consumer prices may dampen risk appetite significantly, making Thursday’s CPI print all the more important for global equity indices. However, until the ECB and Federal Reserve become more vocal about “tapering,” investors may continue to remain confident and buy any dips.

Important Economic Events

Courtesy of DailyFX Economic Calendar

This week’s European Central Bank (ECB) meeting will also weigh significantly on the short-term direction of European indices. While the ECB is expected to remain dovish, investors will be looking for any hint of a taper given the ambiguity of the ECB’s position on asset purchases. The bank is on record saying that it will end the Pandemic Emergency Purchase Program (PEPP) “once it judges that the COVID-19 crisis phase is over, but in any case not before the end of March 2022.”

Despite the sharp drop in COVID cases in the EU, the ambiguity of when the ECB judges the COVID-19 crisis to be over may leave investors wondering when exactly the continent has put the pandemic in the rear view mirror. With the ECB revising inflation outlooks downward at its March policy meeting, the bank has increased its bond purchases in the weeks following. Current bank forecasts show that the ECB may not hit its inflation target until 2023, sparking concerns over just how long the central bank will remain accommodative.

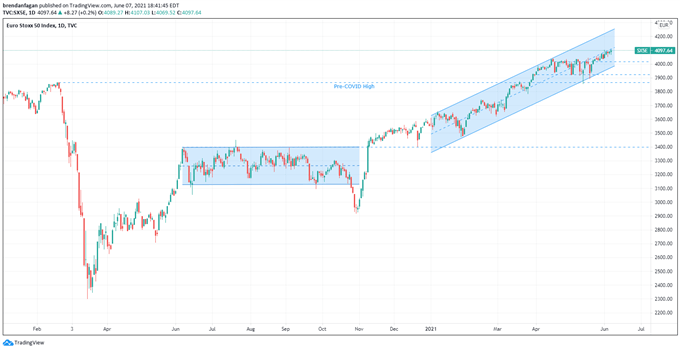

With the expectation that the ECB will remain accommodative for the near-to-medium term, traders may have the catalyst they need to remain bullish on European equities. As the EU struggled to deal with COVID in 2020, major equity benchmarks also struggled to sustain any momentum. The Euro Stoxx 50 remained channel bound from June to November, bouncing between 3,100 and 3,400. A sustained breakout of the channel following vaccine-related developments helped propel the index towards 4,000.

Euro Stoxx 50 Daily Chart

Chart created with TradingView

Following the breakout in the closing months of 2020, the Euro Stoxx 50 has remained nicely within an ascending channel following continued bullish momentum surrounding the reopening of the European Union. Following a period of consolidation in April and May around the 4,000 level, the index was able to reclaim its upward momentum and breakout toward 4,100. Since the breakout beyond 4,010-4,020 occurred, the index has bounced below the midpoint of the ascending channel. With the consensus being that the ECB will remain extremely accommodative and not taper, the Euro Stoxx 50 may be poised for a serious run at 4,200 following the conclusion of Thursday’s events.

A serious break above the midpoint of the channel may see the Euro Stoxx 50 stride higher towards 4,200. The catalyst for such a move could come as soon as Thursday, should the ECB remain dovish and remain silent on the topic of tapering. With EU inflation not running as hot as it is in America, European equity benchmarks may stand to benefit from much lower levels of fear and angst over consumer prices. However, taper talk on Thursday could see the Euro Stoxx 50 revisit the bottom of the 2021 channel, and test support at 3,920. A significant correction could bring the pre-COVID high of 3,865 into play should risk appetite deteriorate following the key economic events over the next few weeks.

— Written by Brendan Fagan, Intern for DailyFX

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter

Be the first to comment