gorodenkoff

A Quick Take On Bullfrog AI Holdings

Bullfrog AI Holdings (BFAI) has filed to raise $8.4 million in an IPO of its units of common stock and warrants, according to an S-1/A registration statement.

The firm is developing a machine-learning platform to assist in the discovery and development of drug treatments.

BFAI is still at an extremely early stage of development, so the IPO is ultra-high risk.

My outlook on the IPO is on Hold.

Bullfrog Overview

Gaithersburg, Maryland-based Bullfrog AI Holdings was founded to develop its bfLEAP AI/ML platform from technology created at the Johns Hopkins University Applied Physics Laboratory to create efficiencies for internal and external drug development purposes.

Management is headed by founder, Chairman and CEO Vininder Singh, who has been with the firm since inception in 2017 and was previously an executive at GlobalStem and Thermo Fisher Scientific.

The company’s technology is being developed to assist with:

-

Discovery phase drug development

-

Pre-clinical data

-

Clinical trials

As of June 30, 2022, Bullfrog has booked fair market value investment of $2.1 million in equity and convertible promissory notes from investors, including Tivoli Trust, Green Tree Financial, TEDCO and others.

Bullfrog’s Market & Competition

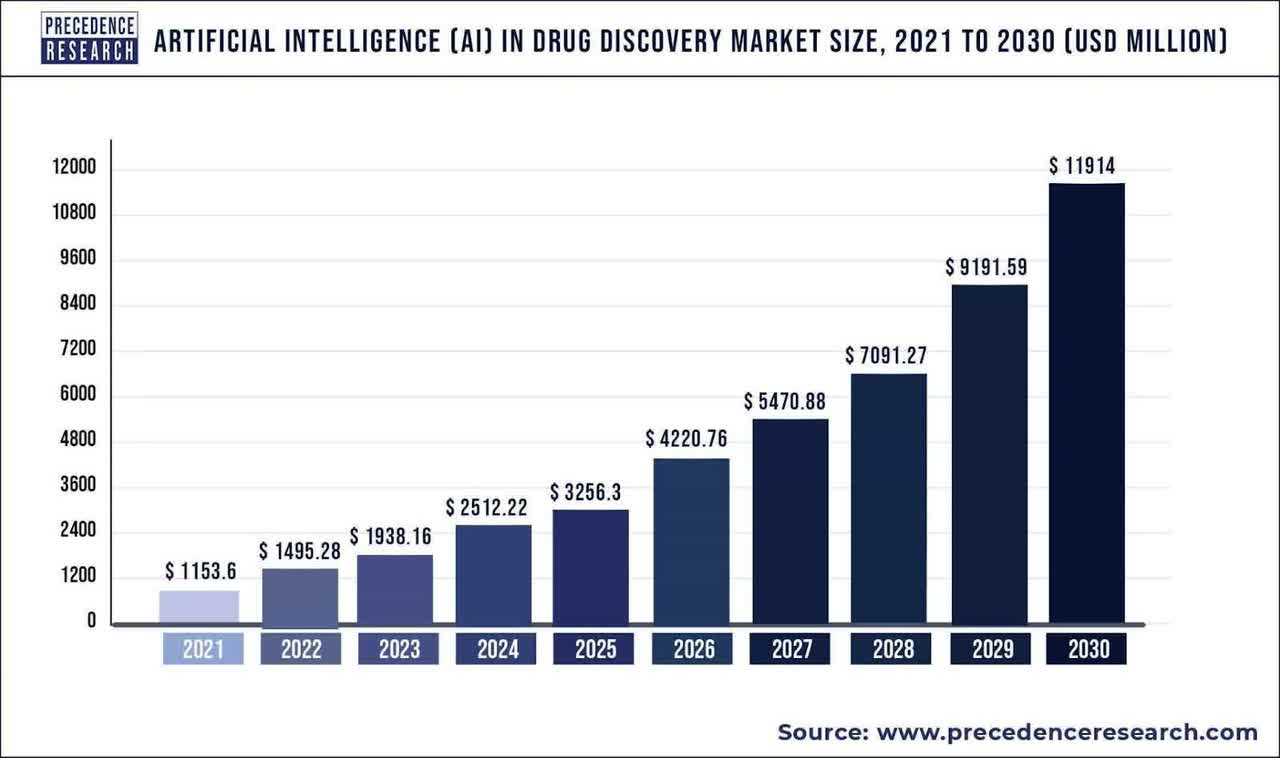

According to a 2022 market research report by Precedence Research, the global market for AI in the drug discovery process was an estimated $1.15 billion in 2021 and is forecast to reach $11.9 billion by 2030.

This represents a forecast CAGR of 29.6% from 2022 to 2030.

The main drivers for this expected growth are the potential for speeding up the process and reducing costs for drug development throughout all stages of drug development.

Also, the chart below shows the historical and projected future growth trajectory of the industry:

A.I. In Drug Discovery Market (Precedence Research)

Major competitive or other industry participants include:

-

NVIDIA

-

Microsoft Corporation

-

INSILICO MEDICINE

-

Schrödinger

-

EXSCIENTIA

-

Cloud Pharmaceuticals

Bullfrog AI Holdings Financial Performance

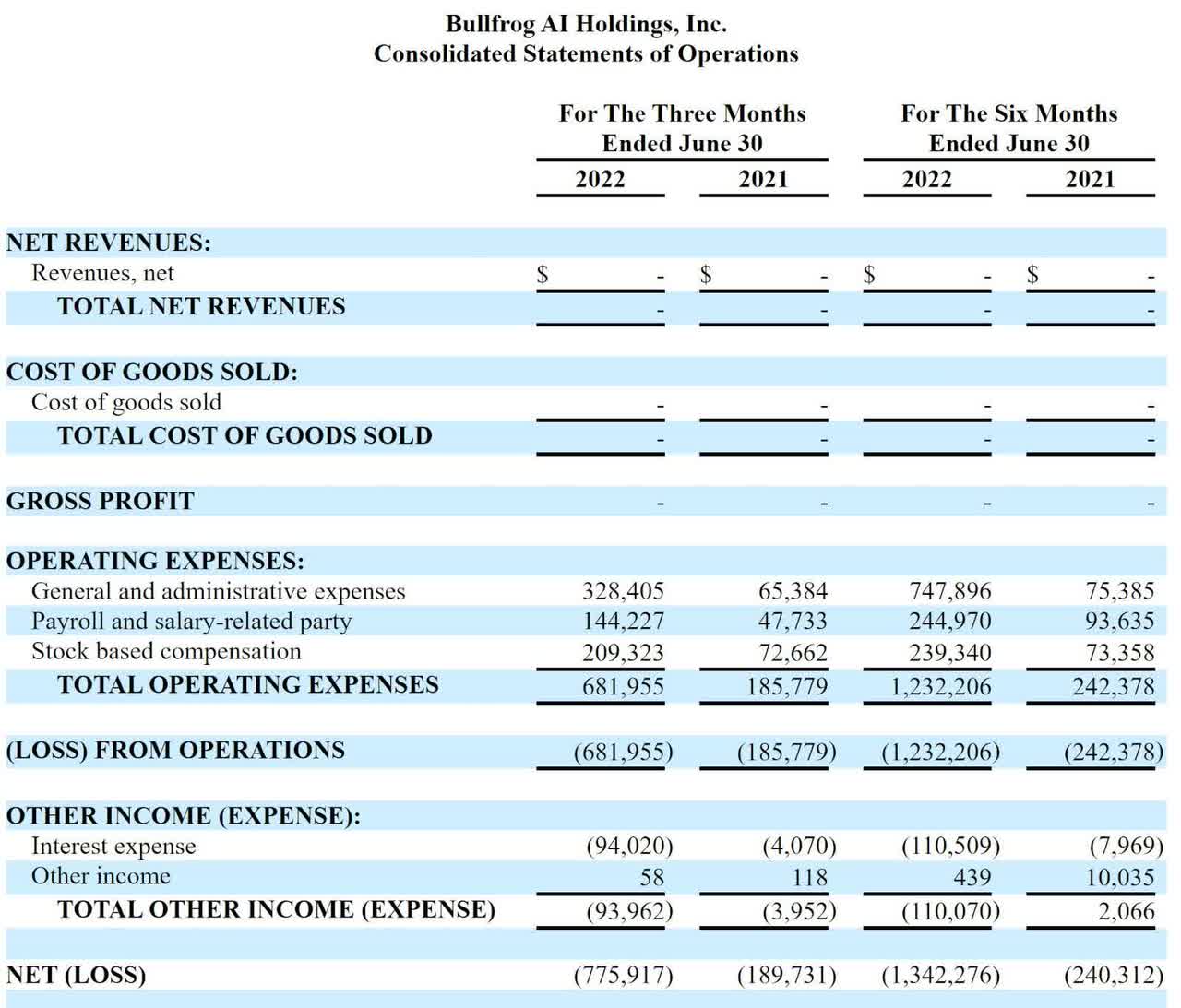

Below are relevant financial results derived from the firm’s registration statement:

Company Statement Of Operations (SEC)

As of June 30, 2022, Bullfrog had $238,453 in cash and $2.2 million in total liabilities.

Free cash flow during the twelve months ended June 30, 2022, was $620,751.

Bullfrog AI Holdings IPO Details

Bullfrog intends to raise $8.4 million in gross proceeds from an IPO of approximately 1.3 million of its units of common stock and warrants at a proposed price of $6.375 per unit.

The warrant exercise price will be $6.75 per share, assuming the IPO price of $6.375 per unit, and will be immediately exercisable upon separation.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $27.3 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 24.7%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Management says it will use the net proceeds from the IPO as follows:

Approximately 25% to initiate development activities on the licensed Mebendazole and siRNA drug programs. While we intend to seek partners for our licensed R&D programs, we will use some of the proceeds from this offering to advance these programs while seeking partners to advance into clinical development. We anticipate initiating IND-enabling preclinical studies under each of these programs.

Approximately 10% for repayment of debt incurred related to the engagement of consultants and employees directed at developing the operations and supporting our public listing as well as other trade liabilities. Further, the Company has borrowed working capital to support the public listing initiative under a convertible bridge note agreement. The note, with a $195,000 face value with a 9% interest rate and maturity on August 9, 2022 has a current balance with accrued interest of approximately $208,000. The holder has the right to convert the note into equity but has not confirmed their intent to convert therefore we anticipate repaying the debt from proceeds.

The remainder for working capital and other general corporate purposes.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is ‘not a party to any legal proceedings.’

The listed bookrunners of the IPO are WallachBeth Capital and ViewTrade Securities.

Commentary About Bullfrog’s IPO

BFAI is seeking public capital market investment to fund initial development on its in-house drug program and to pay down debt.

The company’s financials show no revenue and significant R&D and G&A expenses associated with its product development efforts.

The firm currently plans to pay no dividends and to retain any future earnings for reinvestment back into the company’s growth initiatives.

The market opportunity for AI/ML-enhanced drug discovery technologies is expected to grow at a high rate of growth in the coming years, so the firm has positive industry growth dynamics in its favor.

WallachBeth Capital is the lead underwriter and there is no data on the firm’s IPO involvement over the last 12-month period.

The primary risk to the company’s outlook as a public company is the extremely early stage of development of the company and its thin capitalization.

As for valuation, management is asking investors to pay an Enterprise Value that is very low for a company at IPO.

While I wish Bullfrog AI well, my outlook for this ultra-high risk IPO is on Hold.

Expected IPO Pricing Date: November 14, 2022

Be the first to comment