Olemedia/E+ via Getty Images

Thesis

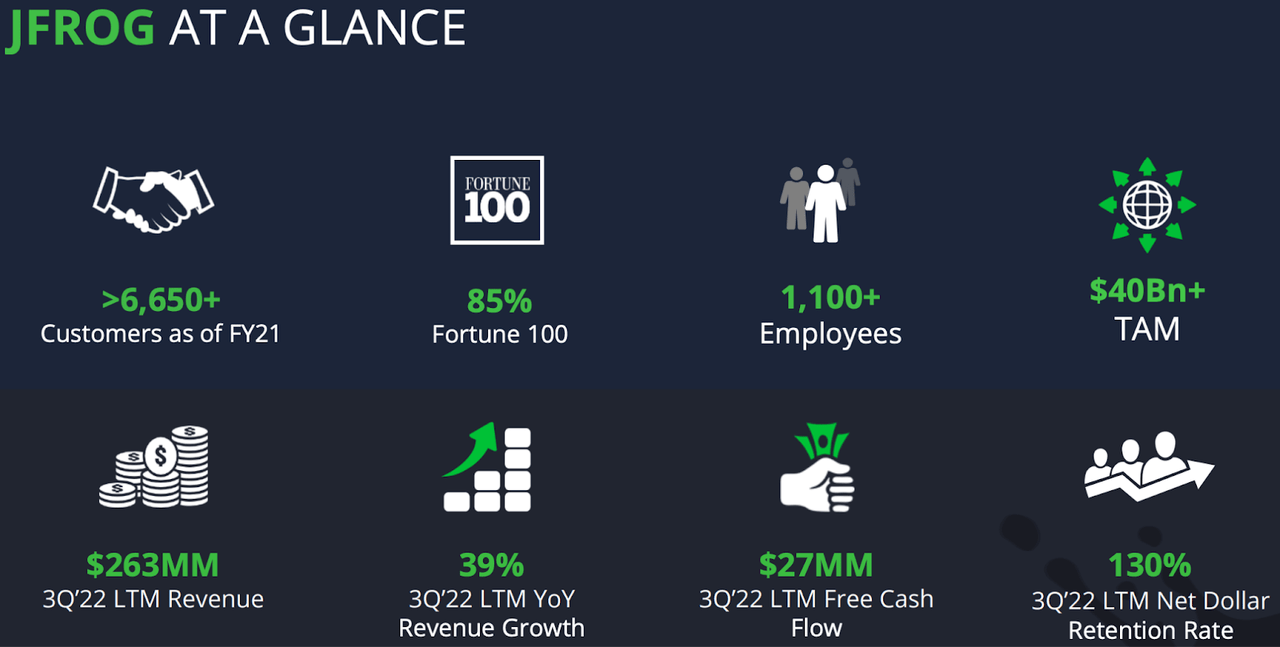

JFrog (NASDAQ:FROG), which markets itself as a “liquid software firm,” is just what it promises to be. It was the first business to implement the DevOps methodology, which eliminates the need for frequent software upgrades. Rather, software undergoes continual updates on its own. This information technology corporation is in charge of the development and distribution of DevOps solutions in the United States. Because of the possibilities provided by the company’s technology, organizations of any size are able to archive, maintain, and administer their software libraries. As a result of these technologies, software engineering teams can now create and deploy new versions of their products rapidly. JFrog offers its clients a tiered subscription strategy that incorporates free trials and open source software. At the conclusion of FY2021, over 500 customers had an ARR of at least $100,000, a considerable rise from the 360 customers who held this position at the end of FY2020. I do not believe that the company’s valuation warrants an investment in the company, given the valuation that is significantly higher than many of its peers.

Company Presentation

Background

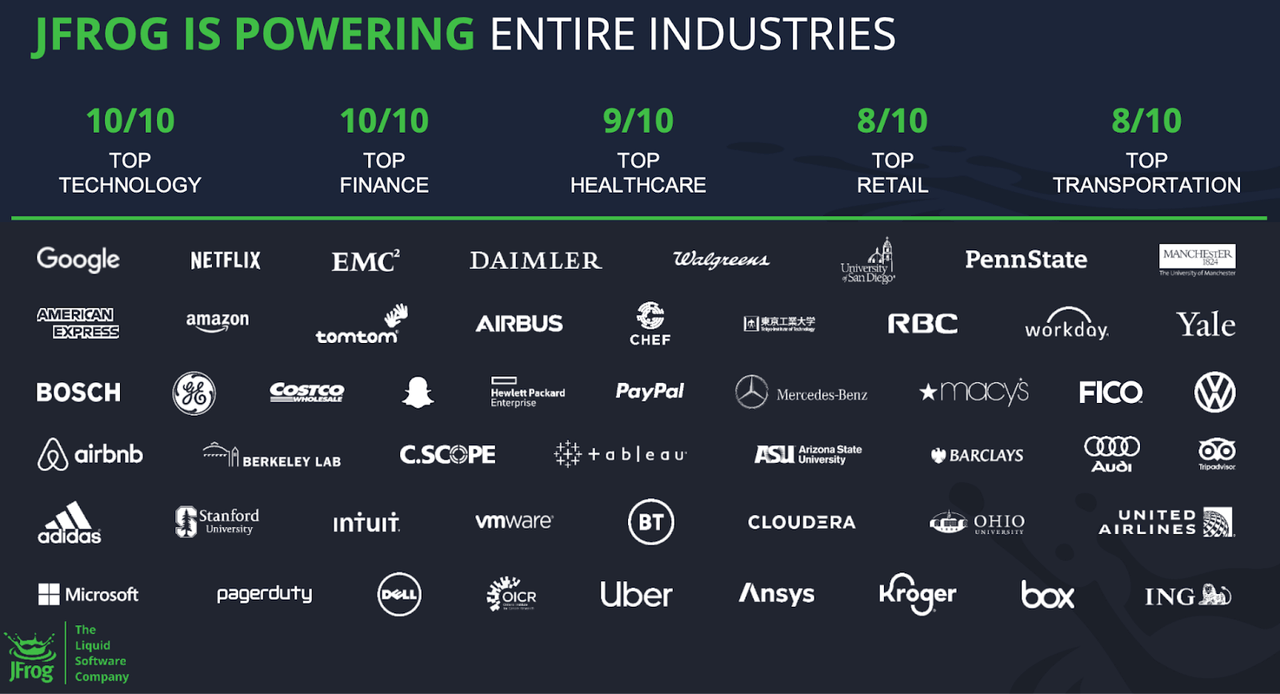

JFrog Ltd.’s proprietary software packages are utilized in order to manage the distribution of software upgrades. In addition to JFrog Artifactory, Pipelines, JFrog Mission Control, Xray, JFrog Distribution, and JFrog Container Registry, the company offers its customers a variety of other products. On AWS, Microsoft (MSFT) Azure, and Google (GOOG) (GOOGL) Cloud, items can be used as open-source software, self-managed services, or as SaaS. Consultation, in-person training, and professional certification are among the given services. Frederic Simon, Shlomi Ben Haim, and Yoav Landman set the foundation for their company in Sunnyvale, California, on April 28, 2008.

Company Presentation

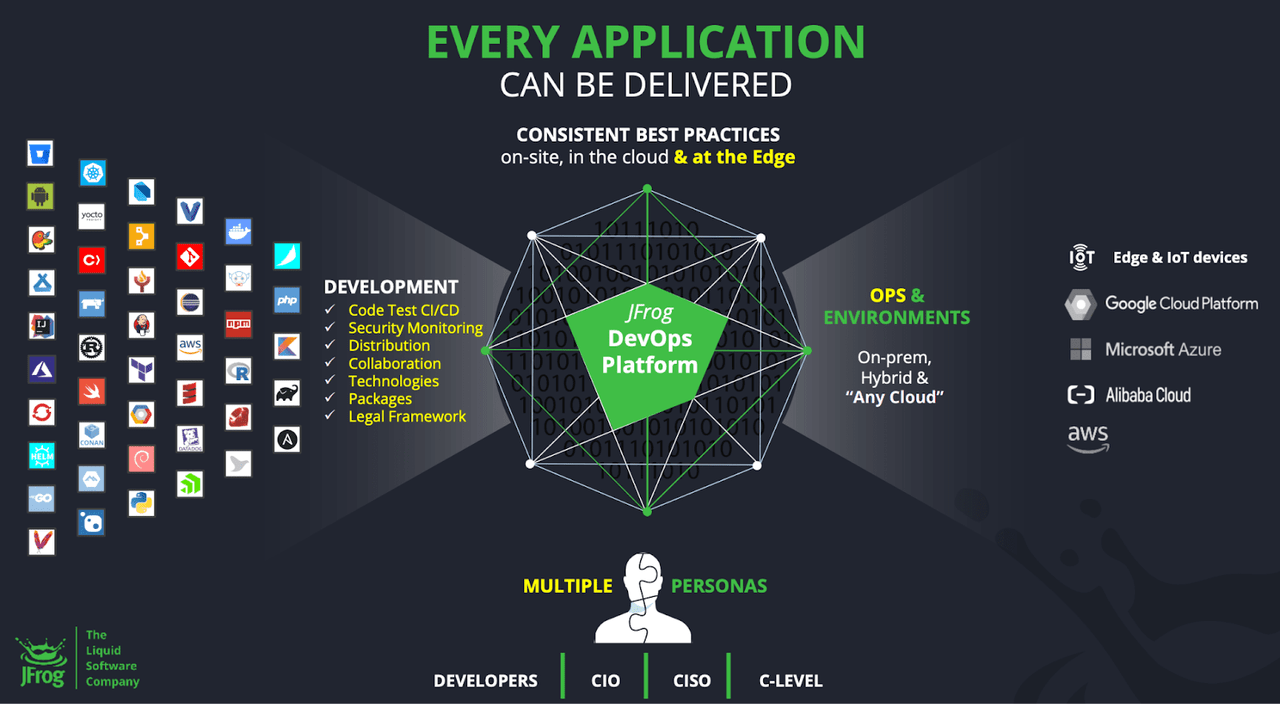

JFrog seems to feel that the concept of updates and patches has become archaic, hence the company focuses on “liquid” software that is continuously upgraded. The DevOps platform offers continuous software release management, which boosts release frequency and velocity while maintaining a high level of security.

As more applications migrate to the cloud and employees access them from a wider variety of devices and places, it becomes increasingly difficult to maintain secure, up-to-date software.

The below investor briefing diagram does a fantastic job of illustrating how everything fits together visually. Everything is presented in an easy-to-understand manner, from the constant upgrades (rather than monthly or yearly ones) to the issues faced by a wide variety of devices and the necessity to interact with a big number of other software programs.

Company Presentation

Financial State of the Company

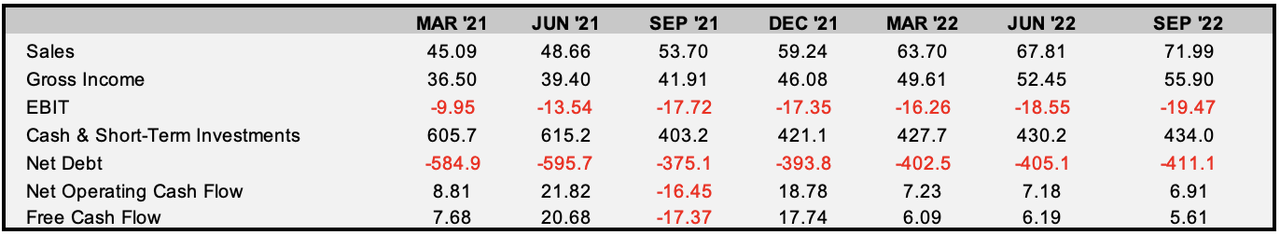

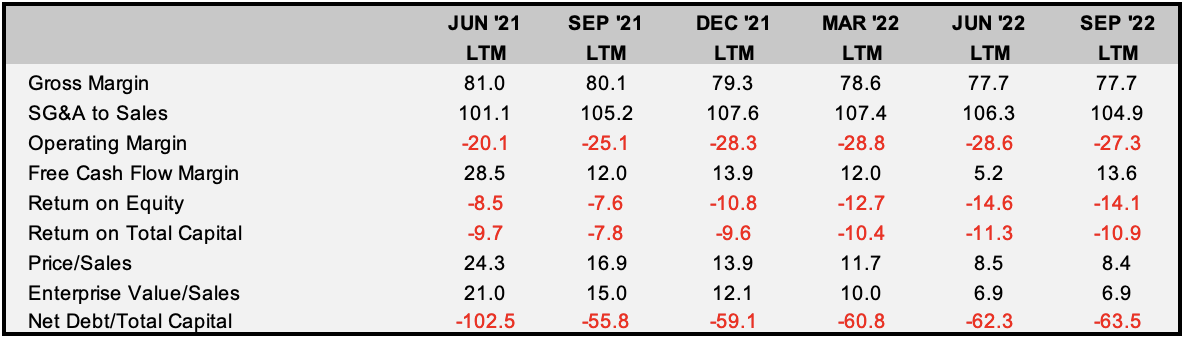

JFrog’s demand has remained robust, resulting in a revenue increase of approximately 85 percent in less than two years. As stated previously, this demand is a result of a particularly important product that JFrog offers. In lieu of this, the company continues to struggle with the growth in operating costs. During the same time frame, March 2021 to September 2022, R&D expenses have doubled, while ‘other SGA’ expenses have continued to put pressure on margins due to rising labor costs. Thus, it appears that near-term operating profitability is contingent on the Federal Reserve’s ability to control inflation and, consequently, labor demand.

FactSet, Author’s Work

Frog continues to exhibit signs of a company that has the ability to facilitate long-term shareholder growth. Given the sustainable nature of demand for their product, the company generates free cash flow that is continually growing. As expected, the company has not materialized this free cash flow into shareholder value, but that is to be expected at this stage of the company’s lifecycle. The issue that I have with this investment is in valuation. Though coming off levels that I believe are “bubble like” in nature for a business in this part of their lifecycle with a P/S ratio of 24.3(!), the current valuation of 8.4x sales is still distinctly way too high for a company that has no near term prospects of returning profitability to shareholders in my opinion.

FactSet, Author’s Work

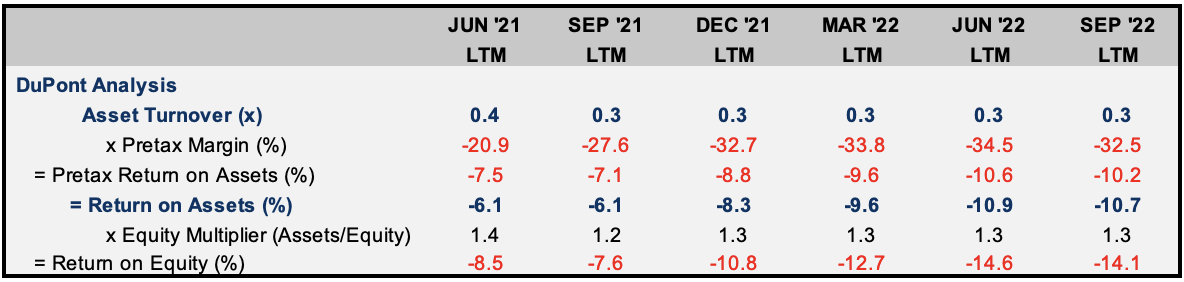

When a company is at this stage of its lifecycle, I believe a DuPont analysis may carry more weight than in many other situations, as it could help investors determine which data point is most important to track. Evidently, the company has maintained a relatively constant level of operating efficiency and leverage. This then sheds light on much of the discussion above around profitability. The company has the operational capacity to be successful, but a clear path to profitability is required.

FactSet, Author’s Work

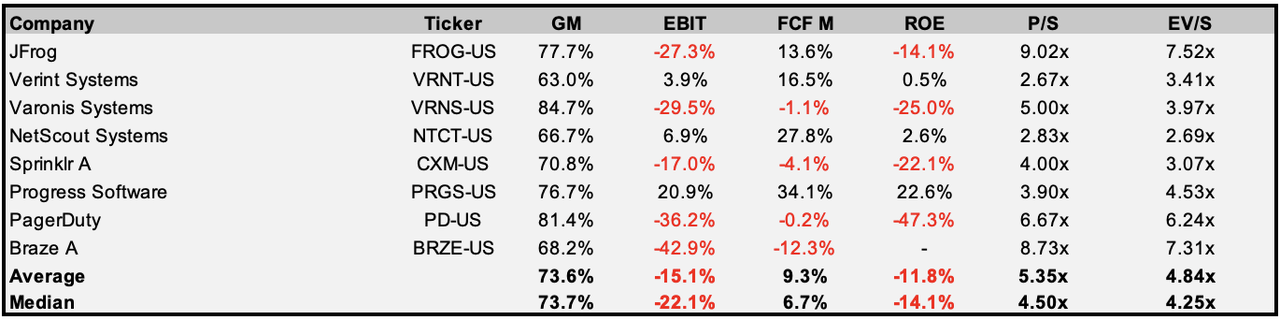

Similar to the company’s relationship to itself, JFrog’s relationship to its competitors reveals a significant disconnect between its fundamentals and its valuation. Comparatively, the company’s operating profitability is below average, but its ability to generate free cash flow is above average. This is significant because the disconnect regarding valuation persists. JFrog has the highest valuation multiples compared to many of its competitors, which I think is not justified through the fundamentals. Although I am confident in the company’s ability to generate shareholder value once profitability is achieved, I do not foresee this occurring in the near future; consequently, I do not believe the valuations below are justified.

FactSet, Author’s Work

Final Thoughts

JFrog takes pride in being a liquid software company, for which it has the backing and product. However, the company’s fundamental issues with profitability pose substantial risks to its near-term performance. Continual inflation and its inherent unpredictability make it nearly impossible to forecast near-term profitability for JFrog. While I do not believe the company will struggle to survive, I do believe that there are many better investing opportunities out there.

Be the first to comment