lucky336

Introduction

This might be my favorite article of the year – or at least in the top 3. After discussing a lot of dividend (growth) stocks and strategies, I believe it’s time for an in-depth article combining some of the strategies we discussed, my macro outlook, and a number of companies that make so much sense to own on a long-term basis. In this article, I will start by giving you a bit of insight into why dividend growth investing makes sense. Then, I will give you my view on the current market and outlook, followed by the presentation of a model portfolio of 10 stocks. These ten stocks are similar to my own portfolio (I own most of them). They form a well-diversified portfolio of dividend growth stocks, providing investors with a good yield, significant (expected) stock market outperformance, safety during bear markets, and a low market correlation.

It’s the same strategy applied when I worked on building my first $100,000 portfolio. Hence, this title isn’t clickbait as I believe these 10 stocks offer the perfect foundation for portfolios for starting dividend (growth) investors.

Moreover, the strategy makes sense for people close to retirement as the yield is everything except for low.

Let’s dive in!

1. Why I Cannot Stop Talking About Quality Dividend Growth

I’m 27. That is definitely one of the reasons why I prefer dividend growth over going all-in on high-yield investments. While every stock in my long-term portfolio pays a dividend, I am a believer in prioritizing growth over high cash flows.

However, I am in no way against high yields. As we’ll discuss in this article, I think a healthy mix of dividend growth and higher-yielding stocks is the sweet spot of long-term investing. Especially in these times (more on that later).

One thing that dividend growers and dividend payers (in general) have in common is that paying a dividend is an indication of quality.

If we ignore companies that distribute dividends with borrowed funds, it’s fair to say that paying a dividend gets companies a stamp of approval. After all, distributing a dividend means being able to successfully operate in a competitive business environment. Even better, it means companies have excess cash they can share with their owners (after all, that should be the point of running a business).

Dividend growth stocks are even better. These companies not only pay a dividend, they even consistently grow that dividend. It means these companies stand the test of time, new innovations, new competitors, you name it.

While dividend growth stocks do not always outperform during bull markets, they provide long-term outperformance with subdued volatility. This is, to a large extent, due to better performance during bear markets when investors sell low-quality stocks before they sell the good stuff in their portfolios.

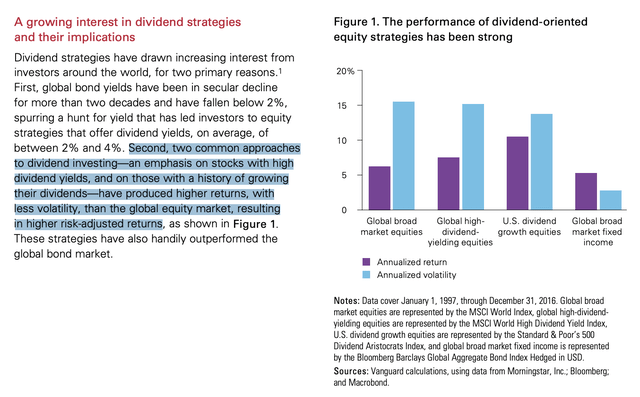

In a recent article, I used the screenshot below, showing that both dividend growth and high-yield equities outperform global equities with subdued volatility.

It’s interesting that high-yield also gets the job done. After all, these equities get a lot of returns from reinvested dividends instead of internal growth.

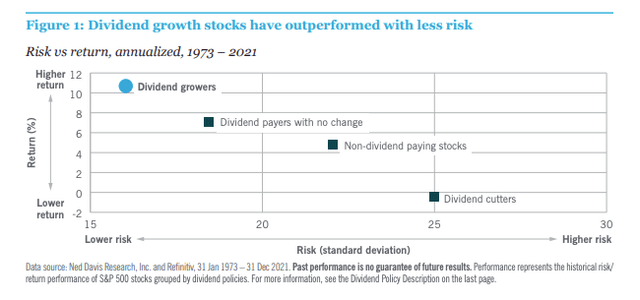

The people at Nuveen also visualized this. Analyzing the performance between 1973 and 2021, they found a wide difference in both risk and return of dividend growers, dividend payers, non-dividend-paying stocks, and dividend cutters.

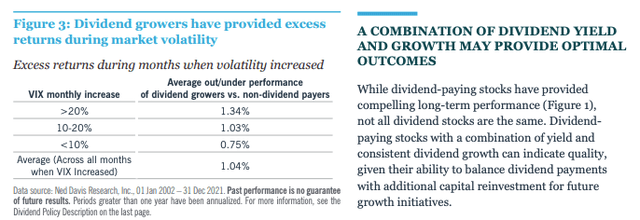

The screenshot below shows that the higher the monthly VIX (volatility) increase, the bigger the outperformance of dividend growers over non-dividend payers. That’s a good confirmation of the “outperformance thanks to bear markets” thesis.

Moreover (and according to Nuveen):

[…], while dividends are not guaranteed and will fluctuate, they have contributed significantly to equity total return over the decades. In fact, from 1930 to 2021, 40% of the annualized total return of the S&P 500® was derived from the payment and reinvestment of dividends, with capital appreciation contributing the rest

With this in mind, I incorporated a mix of dividend growth and high yield in the dividend selection of this article. However, you won’t find me pushing 10%ish yields as I like to look for the sweet spot. That’s stocks with good yields and strong dividend growth.

A decent yield is important because I believe the market might not return to the fantastic period of 2009 and 2021. That’s the second thing we’ll be discussing before we discuss my stock selection.

2. A New Investment Era

After the Fed press conference on December 14, I wrote an article titled “Buckle Up, It’s A New Investment Era”.

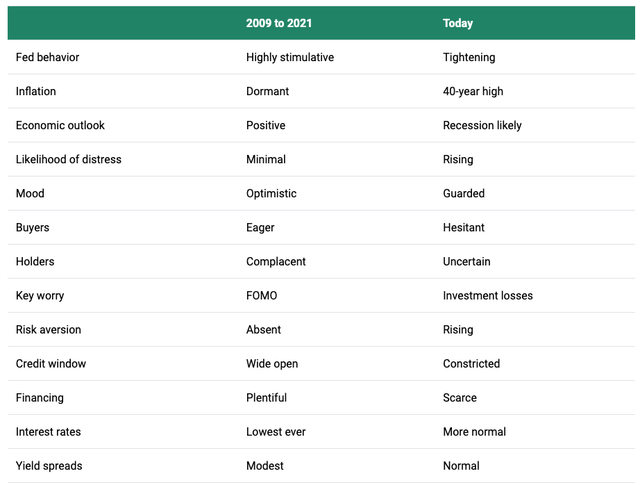

Essentially, we’re in a new situation where interest rates are unlikely to come down to levels we saw between 2009 and 2021. As the Oaktree Capital overview shows, we’re in a situation where inflation is likely to remain high as we have seen a fundamental shift in forces driving market returns.

Prior to 2021, it was easy sailing. Inflation was low, rates were low, global central banks were accommodative, and innovation spurred the tech rally even more.

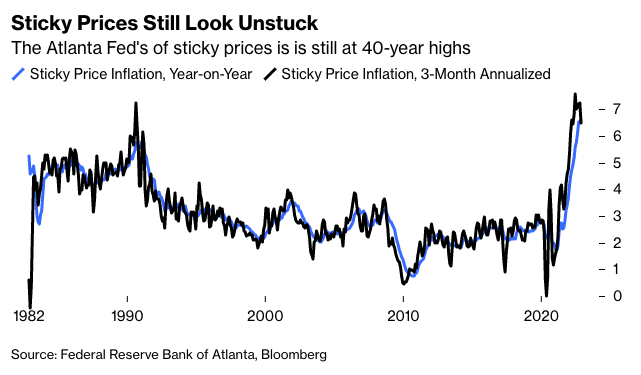

Federal Reserve Bank of Atlanta, Bloomberg

The Oaktree table above was part of a great memo from Howard Marks. Allow me to quote a part of his takeaway:

– While some recent inflation readings have been encouraging in this regard, the labor market is still very tight, wages are rising, and the economy is growing strongly.

– Globalization is slowing or reversing. If this trend continues, we will lose its significant deflationary influence. (Importantly, consumer durables prices declined by 40% over the years 1995-2020, no doubt thanks to less-expensive imports. I estimate that this took 0.6% per year off the rate of inflation.)

– Before declaring victory on inflation, the Fed will need to be convinced not only that inflation has settled near the 2% target, but also that inflationary psychology has been extinguished. To accomplish this, the Fed will likely want to see a positive real fed funds rate – at present, it’s minus 2.2%.

– The Fed faces the question of what to do about its balance sheet, which grew from $4 trillion to almost $9 trillion due to its purchases of bonds. Allowing its holdings of bonds to mature and roll off (or, somewhat less likely, make sales) would withdraw significant liquidity from the economy, restricting growth.

Don’t get me wrong. I’m not bearish. I have zero shorts and almost all of my money is in dividend stocks. The only thing I’m changing is that I keep a bit more cash to buy bigger corrections. Also, I’m buying more high-yield than I did prior to the second half of 2022.

Even in 2020, I already expected this change, which is why I went massively overweight value stocks like energy, defense, and industrials like agriculture machinery and railroads.

Now, this seems to be even more important as dividend-paying stocks are what could enhance long-term portfolios tremendously. Not just in general, but especially because markets might move in a sideways trend on a prolonged basis.

With that said, let’s dive into the dividend selection.

3. A Market Crushing $100,000 Portfolio

I’m pretty excited to show you what I came up with as I went with a selection of stocks that have (among other things):

- Great business models, protecting investors against recessions and competitors

- Healthy balance sheets

- Decent yields

- Strong and consistent dividend growth

In other words, I incorporated the theoretical framework we just discussed in my selection.

The reason I went with $100,000 (also in the model portfolio) is that a $100,000 portfolio is a great start. It was my first target when I started investing. It’s not too much (it is nowhere near enough to retire in most countries), yet it is too much to mess around with.

It’s serious money for most people.

Moreover, $100,000 invested in the right stocks can end up generating a lot of wealth on a long-term basis.

While there are a lot of alternatives, I would feel very comfortable holding the portfolio I’m about to show you.

The Portfolio

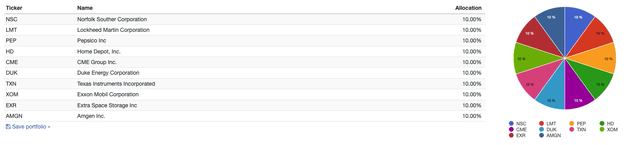

I decided to go with a well-diversified portfolio. I went with 10 different companies operating in 9 sectors. The only sector with two stocks is the industrial sector. One of the stocks in this sector is a defense contractor, which reduces the cyclical risks of going overweight industrials.

The reason why I went with 10 stocks is that it keeps transaction costs low. I also wanted to show that one doesn’t need a lot of stocks to establish a great portfolio.

As the table above shows, each stock accounts for 10% of the portfolio.

The table below shows the companies, their industries, their current dividend yield, and the 10-year average annual dividend growth rate. The data source of the dividend growth rate is Seeking Alpha.

| Stock | Industry | Yield | 10Y Div CAGR |

| Norfolk Southern (NSC) | Railroads | 2.0% | 12.1% |

| Lockheed Martin (LMT) | Aerospace & Defense | 2.5% | 10.6% |

| PepsiCo (PEP) | Beverages – Non-Alcoholic | 2.6% | 7.8% |

| The Home Depot (HD) | Home Improvement Retail | 2.3% | 20.7% |

| CME Group (CME) | Financial Data & Stock Exchanges | 4.9%* | 8.4%** |

| Duke Energy (DUK) | Utilities – Regulated Electric | 3.9% | 2.8% |

| Texas Instruments (TXN) | Semiconductors | 2.8% | 20.6% |

| Exxon Mobil (XOM) | Oil & Gas Integrated | 3.5% | 5.0% |

| Extra Space Storage (EXR) | REIT – Industrial | 3.9% | 21.6% |

| Amgen (AMGN) | Drug Manufacturers – General | 3.2% | 18.4% |

* = This includes the regular annual special dividend

** = Applies to the base dividend only (2.2% yield)

The average dividend yield is 3.2%, which is 20 basis points higher than the Vanguard High Dividend Yield ETF (VYM) of 3.0%. It’s also well above the yield of the Vanguard Dividend Appreciation ETF (VIG) of 1.9%.

The average historic dividend growth rate of this portfolio is 12.8%.

While past results offer no guarantee for future results, a 3.2% average yield and a double-digit dividend growth rate are something to get very excited about.

Before I show you the other results (relative performance and related), let me walk you through the picks. I usually write a few paragraphs on every company including charts and whatnot. However, because we’re dealing with 10 stocks, I will keep it a bit shorter. I will briefly explain why I went with certain picks and use links to Seeking Alpha articles to provide you with some more background in case people want to do their own research.

In this model portfolio, I included two industrial stocks. Norfolk Southern is a railroad with major exposure in the Eastern half of the United States. The company yields roughly 40 basis points less than Union Pacific (UNP), yet I am more bullish on the East due to supply chain re-shoring. This seems to benefit the East more than the West.

The other industrial stock is Lockheed Martin. While it’s an industrial company, it has a very defensive behavior as it’s a defense contractor. It has anti-cyclical revenue growth and long-term contracts with governments. This gives the portfolio stability in bear markets. I could have gone with a stock like Northrop Grumman (NOC). However, I went with LMT because of its higher yield.

The two consumer stocks are Home Depot and PepsiCo. One of them is cyclical, the other is defensive. I could have gone with a consumer staple with a higher yield than PEP, however, I did not want to sacrifice dividend growth.

Duke Energy is a high-yielding utility with exposure to renewables, nuclear, and fossil fuels. I think the stock brings a great risk/reward to the table, despite very slow dividend growth.

I went with Texas Instruments because of its dominant position in the semiconductor supply chain. Moreover, the company benefits from supply chain re-shoring, while bringing tremendous shareholder value to the table. It’s also one of the few tech stocks with a decent yield and high dividend growth.

Exxon, I picked it because it’s a well-diversified energy stock. I did not want to go with a pure-play upstream stock as these tend to sell off a lot during recessions.

Extra Space Storage is the latest addition to my real portfolio. It’s a self-storage company with a perfect mix between a high yield and high dividend growth.

Amgen, I added for the same reasons. In this case, I initially wanted to go with AbbVie (ABBV), which is one of my holdings. However, its stock price history does not go back that far. For the sake of backtesting, I went with a sector peer with similar qualities.

With all of that said, let’s dive into the performance of this portfolio, which is nothing short of stunning. Note that I went with the annual rebalancing option when backtesting. I wanted to smoothen the performance a bit as there are some high-performance outliers.

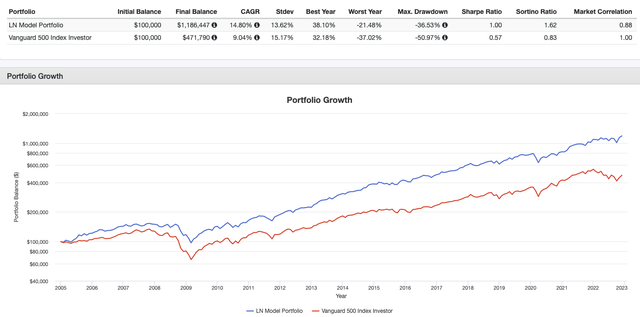

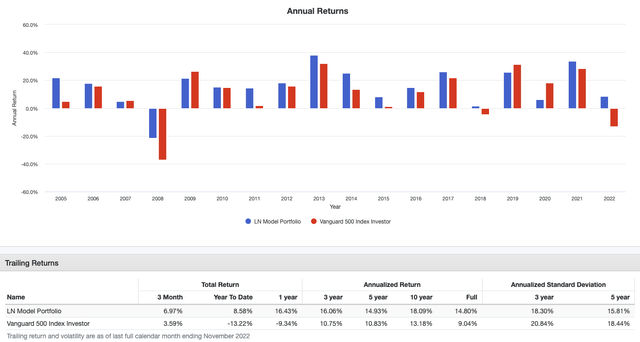

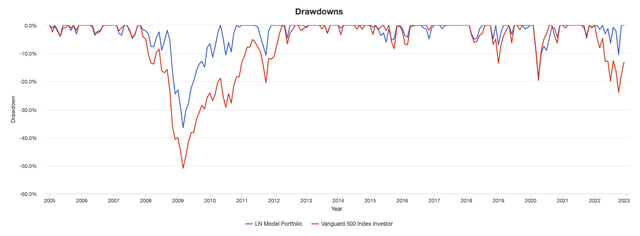

What we’re dealing with is a performance that perfectly confirms the theoretical background we discussed. This portfolio has returned 13.7% per year since 2005, turning $100,000 into $1.2 million. During this period, the S&P 500 has returned 9.0%, which isn’t bad either.

However, it gets better. A lot better. The standard deviation of my model portfolio is 13.6%. That is considerably lower than the S&P 500’s 15.2% standard deviation. Furthermore, we’re comparing a basket of 10 stocks to a basket of 500 stocks. This goes to show that the portfolio composition is doing a great job of protecting investors against high volatility.

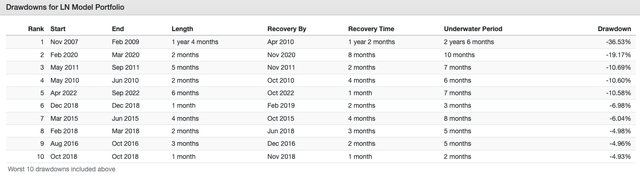

But wait, there’s more. The biggest drawdown of this portfolio is 36.5%. That’s roughly 15 points better than the max drawdown of the market.

Since 2005, the model portfolio has had one down year (2008). This includes 2022 and 2018 when the market tanked due to global growth fears. The market correlation is 88%.

The lower part of the overview above also shows that the model portfolio is consistently outperforming the market with subdued volatility. That’s important. After all, we don’t want a portfolio that looks superior because of a few outlier years.

As the numbers below show, the portfolio never had a drawdown that lasted longer than 1 year and 4 months (Great Financial Recession).

On a monthly closing basis, the portfolio had four “major” drawdowns since 2010. That’s a terrific performance.

As I said a few times, this isn’t a guarantee for anything. However, the odds are on the side of the portfolio.

- The model portfolio is well-diversified including many defensive stocks.

- It has a very decent yield.

- Dividend growth is high (even if it falls a bit due to economic headwinds).

- Portfolio volatility is low.

- Returns are outperforming the market in bear and bull markets.

I expect that this portfolio will continue to hold up very well in the current environment. Moreover, if my outlook is even remotely right (flat capital gains on a longer-term basis), investors will continue to benefit from a decent yield and dividend growth.

Takeaway

Backtesting is useful and fun. In 2020, I spent days backtesting different dividend strategies, finding out that the mix between a semi-decent yield and dividend growth is the way to beat the market. I’ve stuck to this strategy ever since, and I haven’t had one single bad night of sleep.

Hence, in this article, I started with a theoretical background. In this case, we discussed the benefits that come with investing in dividend (growth) stocks. The biggest benefits come from subdued volatility and outperformance in bear markets (downside protection). Eventually, this leads to substantial outperformance.

Second, I highlighted why I believe that dividend stocks are key going forward. There is an elevated probability of low capital gains in the years ahead if we’re indeed in a new investment environment.

In light of all of this, I presented a model portfolio consisting of 10 dividend stocks. This well-diversified stock offers a great mix of historic outperformance, a decent yield, high dividend growth, and downside protection.

Investors looking for inspiration, an investing strategy, or stocks to buy for their existing portfolios might benefit from the findings in this article. My dividend portfolio is very similar (see a full list of tickers in my Seeking Alpha bio), and I will continue to invest using the strategy (and stocks) discussed in this article.

With all of that said, feel free to use the comment section for suggestions. Did you like this portfolio? What would you change? Let me know!

Be the first to comment