Andrii Yalanskyi

As many investors before me, and after me, I have always been fascinated by Warren Buffet’s story of building a massive conglomerate from the ground up. However, it has always seemed as if it were impossible for myself to replicate due to his business acumen and that it requires the physical purchase of companies. Due to the increased attention to the public markets and further growth of the American economy, opportunities have now presented themselves that had not previously existed in history. These opportunities I am referring to is the plethora of businesses that have now become publicly traded and the exponential growth in stock analysis tools that are right at our fingertips.

As an experiment, I have created a portfolio of what I believe to be a similar structure to that of early-stage Berkshire Hathaway. I have not placed real money into this portfolio as of now but may look to in the near future. I plan on re-visiting this portfolio periodically to monitor it’s growth.

Portfolio Positions

I have carefully curated a handful of stocks that are dominant in niche-markets, have excellent profitability, strong growth prospects, and possess above average brand loyalty. Importantly, all of these companies have strong growth outlooks because of these traits that have been engrained in the business model since their inceptions. My hypothetical portfolio will begin with a total value of $30,000, evenly split across six positions. The six positions:

- Franchise Group (FRG), a conglomerate company in itself with a unique business model of purchasing businesses at low valuations and folding them into the larger company and converting them to franchises. This asset light business model generates large cash flow with consistent revenue while also allowing for synergies.

- Cogent Communications (CCOI) a high-speed internet provider that connects small to mid-sized companies to cloud networks and data storage. They also own data centers, providing services such as data storage and transmission. The vertical integration and cost advantages of CCOI have established it as a market leader in independent communication providers. With recurring revenues and an easily scalable business model, Cogent has been providing market beating returns for over a decade.

- Mister Car Wash (MCW), operating in a well-known high-margin business, has seen substantial growth at is the leader in consolidating the industry. MCW just recently entered the public market and is the first-time passive investors have had the opportunity to take advantage of the significant cash flows that car washes provide. Even better, we can take advantage of further profitability due to the scale of its operations.

- European Wax Center (EWCZ), I have a full detailed article on this company here. Utilizing a similar asset-light model as FRG, European Wax became the first mover in consolidating the professional waxing services industry and has pulled miles ahead of the competition since its IPO in 2021. The simple business model operating in a high-demand industry has historically generated extreme growth and profit, now it is accelerating with all of the tools of the public market at its disposal.

- FIGS (FIGS), typically I do not dabble much in the apparel and textile industry as I believe it is too subject to unpredictable consumer sentiment and fashion changes. However, the cult-like following of Figs scrubs has piqued my interest as it is a celebrity in the medical field. With off the charts consumer sentiment ratings and personal testimonials from friends/family, it is undeniable this company is extremely attractive after an 80% sell-off. The company boasts strong EBITDA margins and is cash flow positive even with the fact it just became public last year. Not only does it have strong margins, it has reaped the benefits of a growing free cash flow, nearly $200 million in cash on the balance sheet, and no debt.

- Carriage Services (CSV), a death care provider that owns and operates several hundred funeral homes and cemeteries. While morbid, this stock fits in perfectly with the portfolio. As one of only a couple publicly listed companies in this space, it is a unique opportunity to capitalize on the rapid consolidation of the industry. A serial acquirer, CSV has added substantial inorganic growth via acquisitions along with organic growth through business optimization. As a specialty provider, Carriage observes large free cash flows and utilizes operating leverage.

By comprising a portfolio with these companies, I have now effectively created a conglomerate generating revenues from a vast array of industries. With these positions I am exposed to pet supplies, health & wellness products, education services, furniture & appliances, logistics, broadband, data storage, personal grooming services, car washes, funeral/death care services, and apparel. If I’m not mistaken, this is a mix of profitable, straightforward businesses that Warren Buffet would approve of.

Allowing us to have greater control of our portfolio, the dividends provided by the cash flow gushing positions of FRG and CCOI, 7.54% and 5.68% respectively, can be used to purchase shares of other positions as we see fit.

Growth

Taking the portfolio as whole, the average estimated growth rate for the next several years is roughly 18%, with a dividend yield of 2.32%, and a dividend growth rate of 10%+. These attractive metrics are due in part to extreme discount valuations on several positions and the benefits of being market leaders. Current standouts are Franchise Group and Carriage Services. Both stocks are sitting well below their historical multiples as well as the industry average. FRG believes it is undervalued so strongly that they recently announced a three year buyback plan that would buy back 1/3 of the entire market cap. CSV has dropped significantly in the last six months along with the rest of the market and partially due to growth fears as death rates decrease after the pandemic. However, the 35% sell off is overblown, especially in a consistent industry.

Dividends

The large dividends produced by FRG and CCOI, coupled with CSV growing dividend we see that the portfolio will produce $697 in dividends during the first year. All three positions have experienced dividend growth rate greater than 15% over the past several years, but we will model a more conservative 10% growth going forward. Without reinvestment, the dividends produced from the portfolio would total $4,255 cumulatively after 5 years, or a 14.2% ROI. I am a heavy proponent of automatic dividend reinvestment in my standard dividend growth portfolio, however taking the opportunity to simulate Buffet’s ability to redistribute earnings within his conglomerate is an attractive consideration. The flexibility to concentrate into certain investments with free cash on hand is a large reason why Berkshire was able to produce its famous annual returns.

Just like Berkshire, we may look to continue adding pieces to our conglomerate via dividend proceeds or new capital to accelerate portfolio growth and total value. Industries and companies that I would maintain on my radar are insurance and materials, more specifically companies such as Ally Financial (ALLY) and Graphic Packaging Holding (GPK). Other opportunities unlocked by sustained, profitable growth is the potential to invest in otherwise inaccessible opportunities once your individual net worth reaches $1,000,000 or greater. This provides you access to closed funds and early round funding such as pre-IPO seed rounds.

Portfolio Value

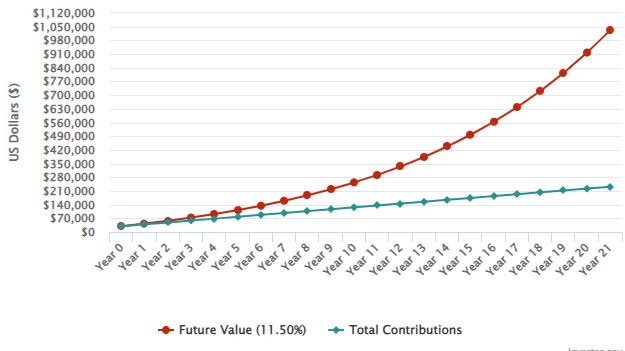

If this hypothetical portfolio were to maintain an 18% internal rate of return without adding any additional capital, it would reach a value of $1,000,000 in 21 years. Obviously, this is a lofty target, but it is still well below Berkshire’s annual return over a 50-year period and we have drastically more tools at our disposal to make informed decisions.

A more realistic route to $1 million would be 11% annual returns and $800 in monthly investments over a 21-year period. This option seems reasonable and is well within the average investor’s ability to do.

Portfolio Growth (Investor.gov)

Summary

I am curious to see if Buffet’s empire is at all repeatable into today’s public market, I will keep an eye on this portfolio over time to see how it is shaping up. I am highly bullish on the positions contained within the portfolio as I believe they provide large free cash flows and operated excellently. Over the decades, it has been proven that specialized companies operating exceptionally well can produce outsized returns just as Geico, See’s Candies, and Berkshire Hathaway’s original textile mill did for Warren. Boring businesses often produce the greatest returns and it is of my opinion that the current sell-off combined with the new opportunities the market has given us, a chance to build generational wealth has been born.

Be the first to comment