krblokhin/iStock Editorial via Getty Images

“There are decades when nothing happens; and there are weeks when decades happen”.

There have been decades when nothing has happened in the US to fix old and decaying infrastructure.

During those decades China has proved Lenin correct by building vast amounts of new infrastructure in weeks, relatively speaking.

The political will to outgrow China’s subsequent growth combined with company actions could change that US track record fast.

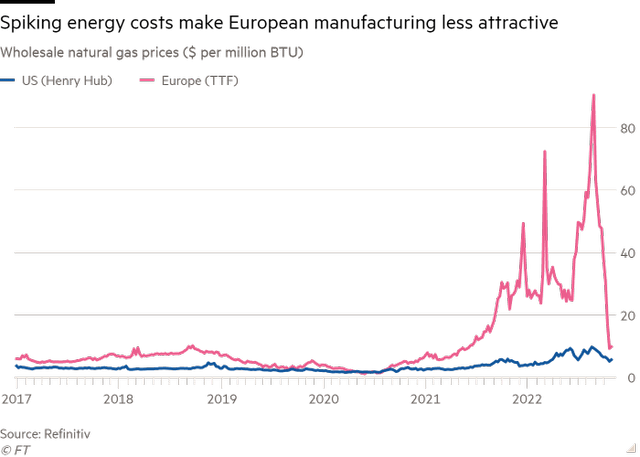

I borrowed that opening quote from Lenin who knew about such things as leader of the Russian Revolution. Things happened fast there then fell apart over decades since and continue to do so as another ruthless Russian – President Putin – has proved with his invasion of Ukraine that “there are weeks when decades happen”. That action pushed up the price of natural gas in Europe overnight and is pushing some companies to the US where they are building new factories to take advantage of low shale gas prices there. Others are decoupling from China and building new factories in the US. That provides new opportunities for Ashtead/Sunbelt (OTCPK:ASHTF) and other such companies like United Rentals (URI) and Herc Holdings (HRI) – the first and third largest machinery rental companies in the US.

Lenin’s saying also proved correct long ago in the US as can be seen in the building of the country into the world’s number one economy based on infrastructure building – rail, roads etc – over a relatively short time in the 19th and early 20th centuries with little built since. Nor has that essential ageing asset been maintained properly meaning more opportunities for Ashtead/Sunbelt from politically driven programmes.

Partly that US political drive has been motivated by China where in the 1980s new leaders in China again proved Lenin’s point right that “there are weeks when decades happen”.

Hong Kong today

The hard to find yellowish-colour building just right of centre in this photo of Hong Kong is the Mandarin Hotel. It is around 24 stories high. I was there for its grand opening in 1963 – celebrated by fireworks invented thousands of years before in China – when it was the tallest building in the whole of Asia!

That is as hard to believe as it is to find it today just 60 year later.

The difference between China today and earlier and fast developments in the US is the sheer scale and even faster speed of what is happening there that few in the west can comprehend and this provides both threats and opportunities. The building of modern New York started in 1898.

I shall write a bit more about current ongoing rapid infrastructure building in China later but this is not an article about China. It is about Ashtead/Sunbelt and the huge number of new construction projects in the US that are under construction or coming due to those events I touched on above. I will join try to make a complete picture from those many pieces on some of those later as well but first will expand on Ashtead/Sunbelt a company that should be a larger winner over the coming months and years from that new construction revolution in the US.

Ashtead/Sunbelt

Ashtead is a mostly unknown name in the US but it trades under the name Sunbelt and that name is well known both there and in Canada. It uses the same name in the UK where it is a British registered company but is growing much, much faster in North America and maybe will move there one day together with its main stock exchange listing. The fact that it in 2020 it changed the name of its operating company in the UK from A Plant (the A stood for Ashtead) to Sunbelt could be part of such a move. That is pure speculation by me but, given the mess the UK is in, it could happen.

There is no significant tax advantage in the UK and tax rates there are anyway likely to increase because of the sad state of the UK government’s finances.

It is also managed from the US by its CEO – a US citizen named Brendan Horgan – who operates from Sunbelt Inc’s Head Office in Fort Mill, South Carolina where he is also the CEO. Most of its machinery is made by US companies and most of the customers are there too. One could say that “British” Ashtead is as American as apple pie.

For now, staying in the UK and having its super US$ profits made even better when converted into weak British pounds adds to its advantages over US competitors.

For the sake of simplicity I will use AHT to represent this company in the rest of this article. AHT is the symbol Ashtead is listed under on its home exchange – the London stock exchange – where I own it.

The Company rents a full range of construction and industrial equipment across a variety of applications to a diverse customer base but mainly to general industrial and construction orientated customers. Sunbelt UK is the largest equipment rental company in the UK with 181 stores. Sunbelt US has 991 stores in 47 states clustered in various metropolitan areas from Washington DC, and Baltimore on the Atlantic Coast through Miami, Tampa and Orlando in Florida to Los Angeles and Seattle on the West Coast. It operates in the Canadian market under the Sunbelt Rentals brand with 93 stores spread across Alberta, British Colombia, Ontario, Manitoba and Saskatchewan.

United Rental is larger and I have seen it featured several times in SA articles but do not recall any mention of AHT. I like URI but prefer AHT as it is superior in many way including growing the top line faster, as these financial highlights show: URI Financials; AHT Financials.

Year on year United Rentals Inc grew revenues 13.90% from 8.53bn to 9.72bn while net income improved 55.73% from 890.00m to 1.39bn. ROE was 32.9%.

Year on year Ashtead Group PLC grew net income 35.97% from 920.10m to 1.25bn primarily through revenue growth (6.64bn to 7.96bn). While the costs associated with cost of goods, selling, general and administrative and debt all increased as a percentage of sales, the 19.94% growth in revenues contributed enough to still see net income improve. ROE was 26.85%.

Latest quarterly results show more growth for both…

AHT

| 2022$m | 2021$m | Growth1% | |

| Revenue | 2,259 | 1,852 | 25% |

|---|---|---|---|

| Rental revenue | 2,075 | 1,669 | 26% |

| EBITDA | 1,039 | 860 | 22% |

| Operating profit | 594 | 477 | 26% |

| Adjusted2 profit before taxation | 555 | 437 | 29% |

| Profit before taxation | 527 | 416 | 28% |

URI

| REVENUE AND GROSS PROFIT | |||||

|---|---|---|---|---|---|

| Total revenue | 3,051 | 2,771 | 2,524 | 2,776 | 2,596 |

| OPERATING EXPENSES | |||||

| Cost of revenue total | 1,685 | 1,621 | 1,532 | 1,615 | 1,493 |

| Selling, general and admin. expenses, total | 356 | 343 | 323 | 322 | 326 |

| Depreciation/amortization | 90 | 91 | 97 | 93 | 98 |

| Unusual expense(income) | (1) | 1.00 | 0 | 1.00 | 0 |

| Other operating expenses, total | — | — | — | — | — |

| Total operating expense | 2,130 | 2,056 | 1,952 | 2,031 | 1,917 |

| Operating income | 921 | 715 | 572 | 745 | 679 |

| Other, net | 1.00 | 6.00 | 5.00 | (8) | 3.00 |

| INCOME TAXES, MINORITY INTEREST AND EXTRA ITEMS | |||||

| Net income before taxes | 816 | 608 | 483 | 644 | 550 |

| Provision for income taxes | 210 |

Both companies announced share buybacks of around $1.25bn.

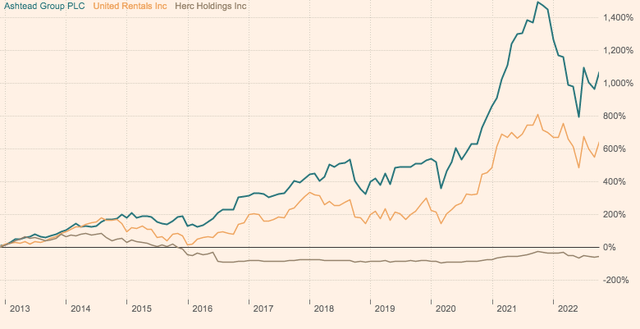

Herc seems to be ex-growth perhaps because of the drive of both AHT and URI.

Since both companies are doing well and will make good investments my main preference for AHT is primarily top line growth driven. URI’s 5 year revenue growth was 41%. AHT’s was 120%! Full year revenue growth this financial year is expected by management to be between 17% and 20%, up from a previous forecast of 13% to 16%. Even at that lower 17% – if repeated over the next 5 years – that means growth of nearly 120% again! There a few companies of that size growing as fast!

AHT also pays a 1.48% dividend. That dividend does not sound large but it can be paid in USD if an investor elects to have it paid that way. It is also increasing. In 2022, Ashtead Group PLC reported a dividend of 0.84 USD, which represents a 43.75% increase over last year. The 14 Financial Times analysts covering the company expect dividends of 0.89 USD for the upcoming fiscal year, an increase of 6.81%.

URI does not pay a dividend.

Importantly too, AHT profits grow even more when its large US figures are translated into the ever declining British pound for reporting purposes. URI does not have that advantage.

The political chaos in the UK has driven the ever declining British pound down even more!

When the last quarter results were published the exchange was…

| Friday 29 July 2022 | £1 GBP = $1.2179 |

The rate as I write is…

| Friday 28 October 2022 | £1 GBP = $1.1613 |

That is a drop of 4.6% in just 3 months!

At the start of this year the rate was…

| Monday 3 January 2022 | £1 GBP = $1.3482 |

A decline in the value of the pound of nearly 12% in less than one year!

More information on financials and the company generally can be found on Ashtead’s website.

I cannot see that pound decline changing any time soon given the weak economic situation in the UK and nor do I see the enormous opportunities for AHT in the US do anything other than keep growing for a long time to come due to…

America’s New Industrial Age

When I started researching to back my investment in AHT I knew that many positive things were happening in the US but as the more I dug deeper – without renting an AHT shovel! – the more amazed I became. The whole picture is almost unbelievable and I shall try to summarise some of the many parts here.

Readers in the US might see even more at their local level than I can see from afar.

I shall start from even further afar with happenings in China that are partly the motivator for the US political catch up push.

China

Until the 1980s China was a poor backwater. Today China is the factory of the world producing a quarter of the world’s manufacturing output, up from a mere 3% in the 1980s.

In a recent three year period China’s construction sector consumed more cement than the U.S. used in the entire 20th century! In 10 years China built a network of high speed rail that exceeds the total built in the rest of the world with not an inch yet built in the U.S., to my knowledge. Today China is doing it again to get it out of its self-inflicted zero Covid slowdown and is splashing out trillions of dollars on critical infrastructure.

This comprehensive article in the South China Morning Post titled What are China’s major infrastructure projects in an economically fraught 2022? tells more.

None on that will help AHT but the US playing catch up will…

The US

It has a lot of catching up to do. This bridge collapse in Pittsburgh was possibly due to neglect…

Getty Images

The situation covering all the US is detailed in this Infrastructure Report by the American Society of Civil Engineers.

Political decoupling and corporate de-risking with China plus other factors are bringing change fast to the US. I am not expert on US politics but one does not need to be to sense that a Republican victory in the midterm elections may speed up measures taken against China.

Among many factors useful for AHT are…

Foreign Direct Investment is soaring

China was nearly catching up with the US but that rise sparked political pressures to reverse the trend. Last year, with China struggling under its “zero Covid” strategy, the US was easily back as world number one, surging to $367bn in foreign inflows – more than double the $181bn taken in by the Chinese economy. And 2022 is shaping up to be another banner year, with at least 12 “megaprojects” – investments worth at least $1bn – announced by overseas investors in the US, totalling $34.9bn in capital expenditure.

That money is going to give lots of new business to AHT. It is spread across the US and even bring back prosperity to the rustbelt.

I found the FDI information in the Financial Times that recently published a very comprehensive study on which US cities are attracting that foreign capital: Investing in America.

Recipient cities will also have to both restore and build new infrastructure to make that work effectively.

Chicago has announced a $3.4bn infrastructure plan. It badly needs it! The city and the surrounding region are home to many of the nation’s oldest highways, rail lines and water networks. Interstate 94, the first highway in this area, was ready for morning commutes starting in 1951. The Loop elevated line, which opened in 1897, is more than a half-century older. Chicago’s waterway system is older than both.

Part of the money is coming from the $1trillion bipartisan infrastructure law approved in Nov 2021.

New factory building

A mix of reasons that mainly relate to decoupling with China – including chip wars – is bringing billions to new factory building in the US. I found some of the following linked reports on SA:

– BAE Systems (OTCPK:BAESF) has opened a new $150M Austin, Texas facility.

– Micron (MU) will invest up to $100B in a massive New York chipmaking plant

– Samsung (OTCPK:SSNLF) is currently building an advanced chip making plant in Taylor, Texas that will be open in 2024. The company has reportedly been considering sites for as many as 11 different factories in Texas in an investment that could be worth as much as $200B.

– John Deere (DE) is investing $29.8m to shift production from China to Louisiana.

Every major car maker is spending billions in the US to build EV factories.

– Samsung is building a $2.5 billion EV battery factory in Indiana.

– General Motors (GM) is spending $7bn to convert an existing factory to make EVs.

– Ford (F) has begun construction of $5.6B EV-focused facility in Haywood County, Tennessee. Another similar sized one is being built in Kentucky.

– Hyundai (OTCPK:HYMLF) will break ground in Georgia later this month on its first EV dedicated US plant worth $5.5bn.

– BMW (OTCPK:BMWYY) is making a $1.7B investment for electric vehicle production in South Carolina. BMW Group Chairman Oliver Zipse called the South Caroline EV commitment the biggest single investment the German automaker has made.

– Volkswagen (OTCPK:VWAGY) is spending $7.1B to boost EV production in the US.

– Stellantis (STLA) and Samsung (OTCPK:SSNLF) have a JV to build a $2.5 billion battery factory in Indiana.

Europe’s energy crisis

This was caused by Putin driving up natural gas prices and is causing chemical and steel companies to expand their US operations to take advantage of low US prices. Perversely, those prices are considered high in the US so President Biden is encouraging producers to increase Capex so they can produce more. If they do that will mean more opportunities for AHT.

Those US prices are so low that Europe and Asia want more so big investments are being made in building LNG export facilities on US coasts and the pipelines to feed them. That will cost billions.

This chart shows more than words can…

Also all those factories and facilities will need power supplies and grid connections and roads and rail to get the products delivered but the power supply system is in a mess.

The Inflation Reduction Act of 2022 will help fix that and other things starved of investment.

US Ageing Power Supply System

The average age of the installed base is forty years old, with more than a quarter of the grid fifty years old or older.

MarshMclennan said this in a report 2 years ago: “Over the next three decades, we estimate that upward of a hundred and forty thousand miles of transmission lines will come due for replacement. To simply upgrade this infrastructure and maintain the status quo would require an investment of more than seven hundred billion dollars, by our calculations.”

All those new factories and other growth investments plus more and more EVs hitting the highways add huge demand to an already overloaded and creaking system from un-catered for demand caused by such things as population growth of around 112 million in the past 40 years plus the huge demand from data centre cooling systems – things that were not even invented when the system was designed.

US ageing rail network

Much of that is even older than the power supply system and improvements will be crucial to support those many investments.

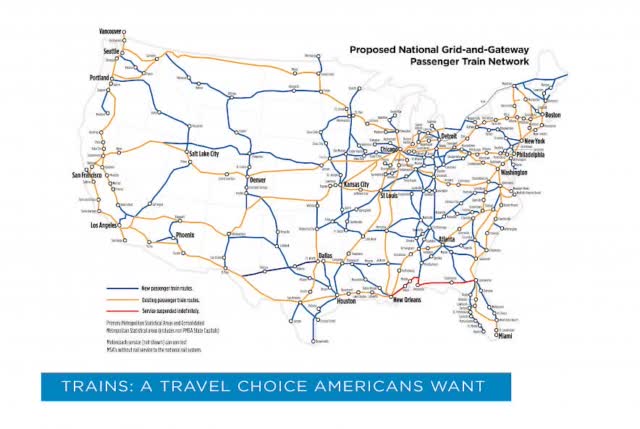

The US rail passengers association has big ambitions for that as this network plan from their website shows:

US rail passengers association

It is easy to brush those off as just railways but it must be remembered that rail is what opened up the US following its invention in Britain way back in the 1st Industrial Revolution days.

Fixing that will also bring plenty of work to AHT. Others will benefit too and this is how I see…

Competition from other equipment rental companies.

I mentioned URI as the other most important one and that number three in the US – Herc – has gone ex growth.

That shows in this last 10 year chart of how they view AHT, Herc and URI. AHT is the clear winner and Herc has gone nowhere except down:

Sunbelt’s US growth is coming from some market growth but also from acquisitions and eating into other rental companies market shares. There is also opportunity in the fragmentation that exists in the US. That top three rental companies control around 25% of the US by sales. The top 100 account for less than half. Ashtead sees even more potential to expand by acquisition and has the financial strength to do so. Thus much of the competition also provides opportunity.

The US is still heavily equipment owner oriented and that provides opportunity too as there is little point owning a very expensive machine and have it sitting around doing nothing sometimes and especially during recessions – losing value at the same time – when you could simply return it to a rental company.

So much for the positives, how do other things look? Such as…

Valuation and Risks

Valuation.

I very much like its ROE of 26.85% and PE of 17.25. Warren Buffet has made a few more pennies than I and that PE is one of his guides to a well valued company. I use URI for my comparisons and theirs is only 11.39.

Analysts at the Financial Times give AHT this share price valuation in the coming 12 months:

High: Plus 44.8%. Med: Plus 19.4% Low: -10.9%.

CNBC has no forecasts.

There is no Quant rating.

Given that the share price has gone down by 24% YTD I find those positive forecasts easily achievable. AHT has outperformed most large companies this year and will continue to do so.

I take a look at past performance and the many future opportunities to form my own opinion helped my management’s guidance on growth.

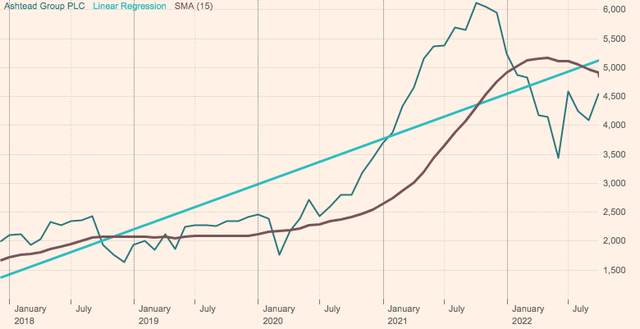

Past performance shows this:

The Simple Moving Average and Linear Regression would get us the FT’s medium value of £54.33. The October 2021 high point was £61.24. The FT’s high forecast is £65.89.

As I write the price is £46.93 and the exchange is GBP1=USD1.16.

I cannot see the FT’s low forecast of minus 10.9% happening and taking the price down to £40.54 but, as with all investments, there are…

Risks

Monetary Madness. In my view the Fed is the biggest risk!

The U.S. is already in a technical recession following two straight quarters of negative real GDP growth (-1.6% in Q1 and -0.6% in Q2). Any decision on a formal recession is left up to NBER’s Business Cycle Dating Committee, which has been responsible for setting the dates of peaks and troughs of the U.S. economy since 1978. The funny thing is that the committee generally waits a while after a recession has begun to officially pronounce it, and on occasion, even after it is already over.

Inflation is fading. The Fed is ignoring some of its own inflation gauges! The New York Fed’s underlying inflation gauge – UIG has largely been ignored for decades. The Atlanta Fed tracks nine other indices for inflation that aim to strip out noise. They show inflation somewhere between 4.7 and 7.3 per cent in September.

The UIG peaked in March 2022, stabilised at high levels and has been gradually falling since July.

With rates now restrictive, that suggests it’s time for Fed officials to consider slowing their tightening path.

Hopefully those points will bring some balance back into the Fed’s decision making.

Until then that brings us to the other main risk for AHT…

Recession. The US and UK home construction industry has been in recession for around one year already. That sector is normally a big customer for AHT’s equipment but AHT has sailed through that, so far. Given that the US, UK and Canada have a massive shortage of homes any restart of building one day will bring in more business for AHT.

Many of the major projects I mention will not stop once started and they will take AHT through bad times. The biggest risk is smaller customers going bust in a recession leaving AHT with bad debts and unused machinery. Given management’s recent better results guidance it would seem that is not perceived to be a big risk.

Taking those points together and I conclude that investors will…

Build Back Better with Ashtead/Sunbelt

There is no doubt in my mind that the US is heading into a new Industrial Age and the snail’s pace getting to this point will morph into a hare going forward and proving Lenin right: “There are decades when nothing happens; and there are weeks when decades happen”.

Most of those happenings take several years from start to finish meaning AHT’s equipment will be earning money for a long time as they help build the US back better.

If there is a recession then some smaller equipment rental companies will go bust so AHT can take over their business. Recessions are a good time for strong companies to gain market share!

I mentioned this improved guidance above “Full year revenue growth this financial year is expected by management to be between 17% and 20%, up from a previous forecast of 13% to 16%. Even at that lower rate of 17%, if repeated over the next 5 years that means growth of nearly 120%!

That management confidence is supported by one of AHT’s main suppliers: Caterpillar (CAT) in its recent report.

And moving freight to and from factories and customers around the country by rail has given railcar makers Greenbriar (GBX) and Trinity (TRN) excellent results including bulging, multi-year order books.

It might be speculation on my part but logic points to a move of AHT’s registration from the financial district of London to where the main customers, suppliers and are management in the US where it would have a main board listing. If that happens the stock price will lift off without the help of a forklift.

Until then AHT will remain a British company that is as American as apple pie and I believe that above high forecast for the share price gain of plus 44.8% will be achieved. Thus AHT will be helping the US Build Back Better and, likewise, the portfolios of AHT investors.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment