Volatility got you down? PeopleImages

Investment Thesis

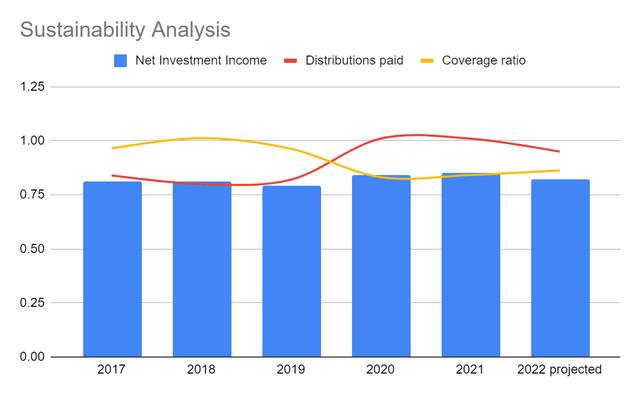

In this article we review the BlackRock Credit Allocation Income Trust (NYSE:BTZ) closed end fund. With the benefit of leverage, this fund can be trusted to deliver a high current yield without sacrificing credit quality. You should be prepared, however, with an asset allocation plan to prepare for the inevitable volatility.

Fund Overview

BTZ is a fixed income CEF that provides diversified exposure to a global portfolio of bonds that are mostly investment grade. As the fund is levered at 33%, it should be noted that there is material allocation to long duration issues and junk bonds. As we’ll see later, the resulting portfolio is highly sensitive to changes in interest rates and also the economic cycle.

Analysis Of The Dividend

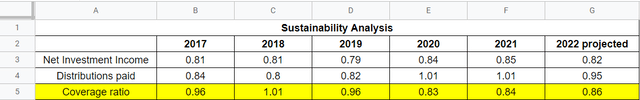

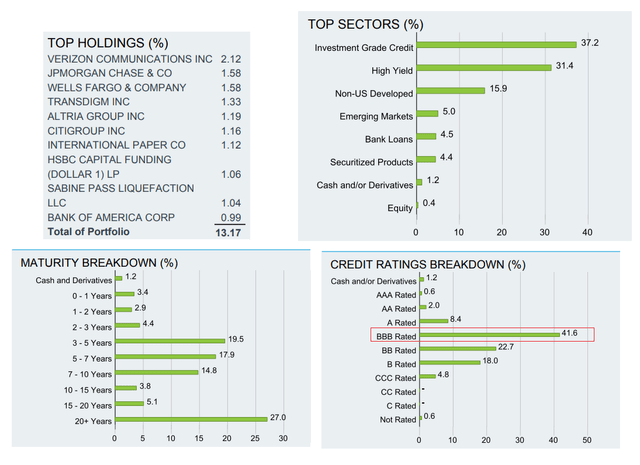

As the main purpose of investing in CEFs is to collect a high current yield, it behooves us to go over the financials to determine if one can rely on the distributions now and in the future.

While past performance doesn’t guarantee future results, you can see that BTZ is battle tested. Having gone through some economic shocks and changing rates, they have actually increased the distributions which is rare for this type of investment vehicle.

Indeed, according to the BTZ annual report, the vast majority of distributions have come from bond interest as opposed to destructive Return of Capital.

BTZ Annual Report BTZ Annual Report

Diving deeper, the trend is also very positive for BTZ. Net Interest Income has remained very stable over the years and they have the distribution well covered from NII alone. The significance of that is that shareholder dilution is unlikely as the fund managers won’t have to raise capital or debt in times of trouble.

Risks and How To Hedge

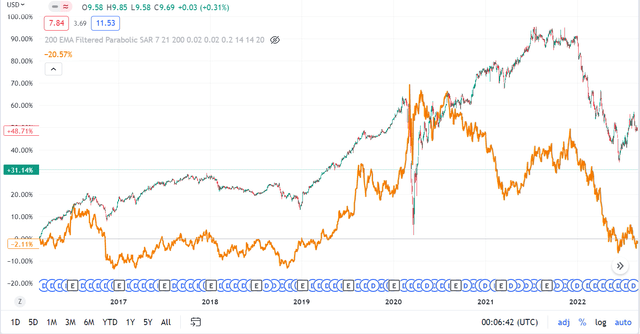

While we have thus far sung the praises of BTZ and BlackRock, the fund is not without risks. Between the use of leverage, exposure to long duration securities, and some junk bond holdings, portfolio performance can incredibly volatile. Indeed, BTZ is down ~35% YTD at the time of this writing and even a 10% yield couldn’t shield you from losses. Furthermore, CEFs can also be challenging because of low trading volume and not being optionable.

Luckily, we have the following pointers to overcome those challenges and enjoy a fruitful investment:

- Appropriate investment horizon

- Diversification

- Rebalancing

As you can see from the above Tradingview chart, BTZ has historically displayed a negative correlation to long duration treasury bonds. If you have the time and patience to let the investment grow, volatility will actually be your biggest benefactor. With periodic rebalancing, you can buy low and sell high.

Of course, portfolio performance will still not be perfect even with periodic rebalancing because treasuries are rate sensitive as well. In other words, both positions can fall in times of rising rates.

Conclusion

All things considered, BTZ can be a great option to deliver high income and capital growth if given the time to grow and is properly diversified. The income stream is very well established and you can surely rely on the distributions in the future.

Be the first to comment