Andrew Burton

We covered Alibaba (NYSE:BABA) this past summer in an article titled: Alibaba Stock: Playing Russian Roulette In China

In that piece we concluded:

While the fundamentals look sound here and the price is dirt cheap, the risk associated with the Chinese Communist Party is so high and potentially completely devastating with many paths that could lead to horrible outcomes for BABA. Ultimately this investment feels too much like playing Russian Roulette to be considered anything but highly speculative. As a result, we remain on the sidelines and are instead taking advantage of numerous high conviction opportunities found among quality inflation and recession resistant business paying high dividend yields.

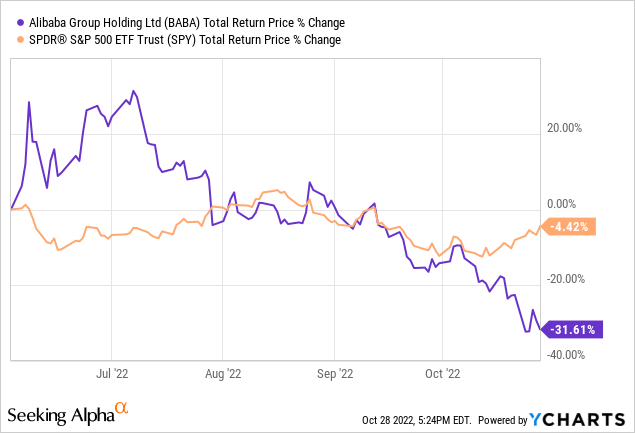

Our caution and aversion to buying the shares paid off as the stock price has plummeted since then, massively underperforming the S&P 500 (SPY) and our High Yield Investor portfolio over that span:

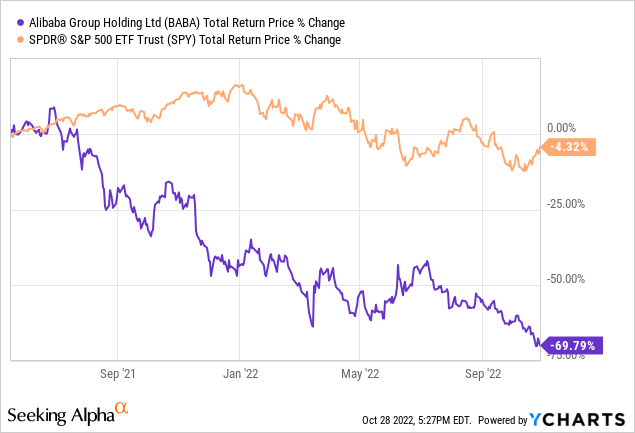

In fact, if you go back to our original coverage of BABA stock back on May 17, 2021 when we concluded that the reward was not worth the risk involved (despite many other analysts, including Charlie Munger claiming it was the opportunity of a lifetime), BABA has lost nearly 70% of its value while our portfolio has generated a positive return since then and SPY has been flattish:

At this point, some are saying that BABA is too cheap to ignore and poised to soar. However, after revisiting what has changed in the investment thesis over the past five months and re-assessing whether an investment in the stock makes sense right now, we have concluded that it is best to remain fearful of investing in BABA despite the mass paranoia in the markets.

Revisiting The Fundamentals

While BABA’s balance sheet remains in stellar shape, with the equivalent of over $69 billion in cash and short-term investments on hand alongside over $27 billion in other current assets to bring its current asset tally to nearly $96.3 billion against $56.1 billion in current liabilities and $92.7 billion in total liabilities. This means that BABA has the increasingly rare distinction of boasting a positive net current asset value, giving it incredible financial flexibility and strength, which is very important given that China is likely already in a recession or at the very least on the cusp of one. When you add to that the increasing geopolitical uncertainty and potential for severe economic strains being placed on the Chinese economy in the event of a war over Taiwan, having a fortress balance sheet like this is invaluable.

After all, Chinese President Xi recently declared to the Chinese people:

We must therefore be more mindful of potential dangers…be prepared to deal with worst-case scenarios, and be ready to withstand high winds, choppy waters, and even dangerous storms.

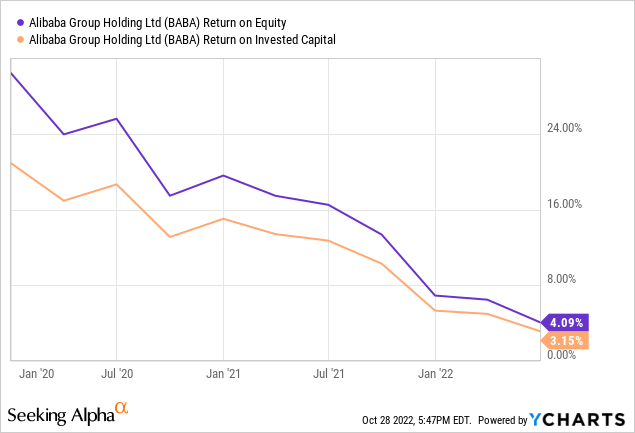

Unfortunately, however, that is where the positive fundamentals stop. As the chart below illustrates, BABA’s return on equity and return on invested capital have plummeted over the past three years, indicating that the business is struggling at the moment.

On top of that, BABA is expected to see its earnings per share continue to decline in 2023 after plummeting by an expected 19.1% in 2022. BABA is expected to resume earnings per share growth in 2024 and beyond, but that is making an enormous assumption of course that the increasingly strained geopolitics of the region do not erupt into a major war that would be all but certain to cause China’s economy to crash and with it BABA’s profits.

Revisiting The Valuation

With all of that said, BABA’s valuation is truly mouth-watering thanks to the collapsing share price. On an EV/EBITDA basis, BABA trades at 6.06x which is roughly one-third of its five year average multiple. On a Price to Normalized Earnings basis, BABA trades at 8.71x which is just slightly over one-third of its five year average multiple. What this means is that if BABA can regain its former growth momentum and profitability metrics, it has enormous upside.

Revisiting The Risks

While the case for undervaluation appears compelling and the balance sheet remains a fortress for the company in the midst of its storm, the risks have unfortunately gotten meaningfully worse.

First of all, it continues to face fierce competition from domestic competitors like JD.com (JD) and Pinduoduo (PDD), which continue to challenge it for market share and upend its pricing power in Chinese and regional markets. As China continues to sink into what is widely expected to be a recession, this pricing power will likely suffer even more as consumer spending power continues to erode due to the tendency of Chinese people to save prodigiously when confronted with economic challenges.

However, the risk that truly concerns us are the soaring geopolitical risks, which have never been higher. China continues to aggressively grow its military capabilities with a clear aim to challenge and surpass Western military might as soon as possible. This military buildup spans across multiple categories, including its nuclear arsenal, its conventional forces (particularly its navy, air force, and missile – including cutting edge hypersonic – technologies), and cyberwarfare.

Now that President Xi has established himself effectively as Chinese dictator for life and removed anyone who might challenge or question his increasingly aggressive foreign policies, the risk of forced “reunification” with Taiwan is soaring higher.

This isn’t merely media fear-mongering either. U.S. military leaders themselves have acknowledged this risk. Whereas they previously said that China would not likely invade Taiwan until later this decade – if at all – they are increasingly expressive concerns that war could break out in the very near future. For example, top U.S. Navy admiral Mike Gilday just warned this month that China could invade Taiwan by the end of the year, or at least by the end of 2023:

When we talk about the 2027 window, in my mind, that has to be a 2022 window or potentially a 2023 window.

This concern was seconded by the U.S. Secretary of State who predicted that China could attempt to take Taiwan on a “much faster timeline” than the U.S. previously expected.

Investor Takeaway

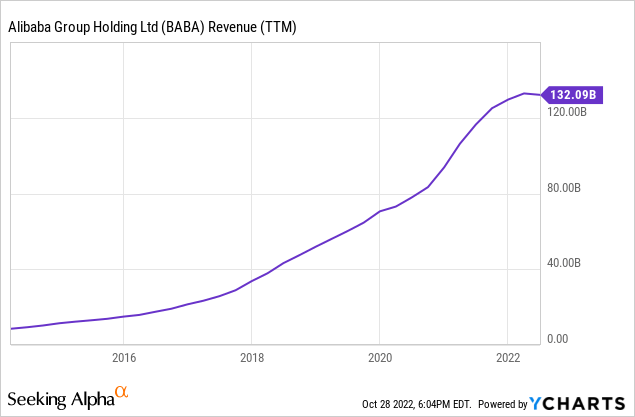

BABA continues to generally grow its top line, even though that growth rate has come to a temporary halt due to COVID-19 headwinds:

It still commands massive retail market share in the world’s most populous and arguably most dynamic economy. It also still possesses impressive technological capabilities, making it the Amazon (AMZN) of Asia with arguably much greater growth potential in the years to come.

If the Chinese Communist Party were delivering on previous Western projections of continuing to open up the country to more democratic reforms, if it was not hurting its own economy with brutally rigid COVID-19 lockdowns, if it did not have an increasingly troubling track record of violating human rights and private property, and it is was following through on its prior promises of a peaceful rise, then BABA would likely command a much richer multiple than it does today and also appear to be a much more appealing investment.

However, given that the geopolitical risk not only remain Russian Roulette-like in nature but appears to be getting ever closer to exploding into a hot war, BABA’s future outlook is nearly impossible to reliably quantify. As a result, it remains a highly risky casino bet on a very unreliable and increasingly hostile authoritarian regime that is arming itself to the teeth. As a result, we are choosing to be fearful when others are fearful and plan to remain on the sidelines when it comes to BABA stock.

Be the first to comment