Andrii Yalanskyi/iStock via Getty Images

Thesis

The Vanguard Short-Term Bond ETF (NYSEARCA:BSV) is an exchange traded fund that offers a retail investor exposure to the short to intermediate duration U.S. investment-grade bond market. The fund seeks to track the Bloomberg U.S. 1-5 Year Government/Credit Float Adjusted Index which includes U.S. Treasury and agency obligations, as well as investment-grade (rated Baa3 or above by Moody’s) corporate and international dollar-denominated bonds, all having maturities of 1 to 5 years.

The fund has a short to intermediate duration of 2.7 years and a composition which is overweight U.S. Treasuries (68.3% of the portfolio). The fund is down more than -4% on a year to date basis from a total return perspective, significantly underperforming true short-term investment-grade bond cash parking vehicles such as the PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (MINT) which is down only -1.6%. Due to its short duration profile and low yield environment in the past decade, BSV has also posted mediocre long-term annual returns, with the annualized 10-year total return sitting at only 1.16%. For a retail investor, this fund is neither here nor there – it does not represent a short-term cash parking vehicle, nor does it represent a yield generating bond fund to hold for the long term.

In our mind, BSV does not serve as an appropriate portfolio construction tool for a retail investor. There are more appropriate alternatives which are true yield-enhancing cash parking vehicles, and on the bond side there are ETFs such as the iShares 3-7 Year Treasury Bond ETF (IEI) which represent appropriate hedging tools, or investors can gain access to the broader bond market and its higher yields via the Vanguard Total Bond Market Index Fund ETF (BND). We thus rate BSV as Hold and feel this is not an appropriate portfolio construction tool for a retail investor.

Holdings

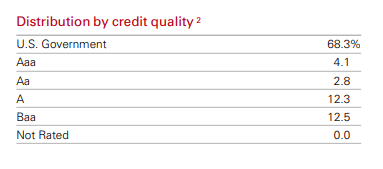

The fund has over 68% of its holdings in U.S. Treasuries:

Credit Quality (Fund Fact Sheet)

We can see that roughly 68% of the portfolio is allocated to AAA U.S. Government securities, with the rest split down the rungs of the investment-grade spectrum. The approach is slightly bar-belled to enhance the yield, with 24.8% of the portfolio in single-A and triple-Baa credits.

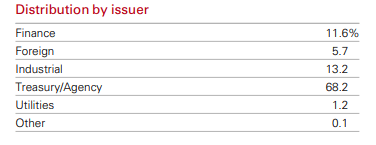

On the non-government bond holdings, the industry allocation is tilted towards financials and industrials:

Issuer Type (Fund Fact Sheet)

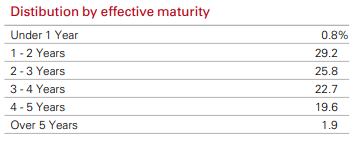

While the fund has a 2.7-year duration profile, its bond maturity ladder is across tenors:

Maturity (Fund Fact Sheet)

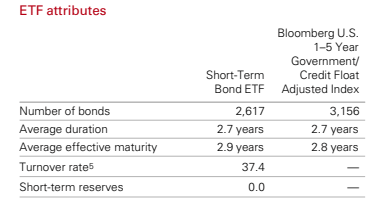

The fund is extremely granular, mimicking the index it is tracking:

Attributes (Fund Fact Sheet)

The fund has over 2,000 constituent bonds, and due to its high credit ratings, we consider the vehicle to embed little to no credit risk. The fund takes solely market risk via the move in the 3-year treasury yield.

Performance

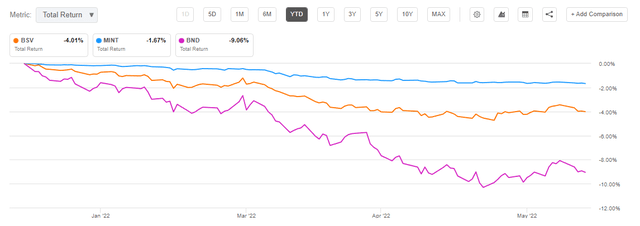

The fund is down more than -4% on a year to date basis from a total return perspective:

YTD Performance (Seeking Alpha)

Given its duration profile, the fund has been affected by the significant rise in treasuries yields so far. The fund has a 2.7 years duration and the 3-year point in the treasuries curve has risen over 200 bps this year, hence the negative total return for the fund ( 2 x 2.7% = -5.4% from rates, mitigated by the fund’s dividend yield).

We can see that true short-term bond cash parking vehicles such as MINT have performances which are very close to flat levels, while longer duration bond vehicles such as BND do indeed expose larger drawdowns. BSV is neither here nor there in this cohort, given its duration profile. Let us take a quick glance at some analytics for the three vehicles:

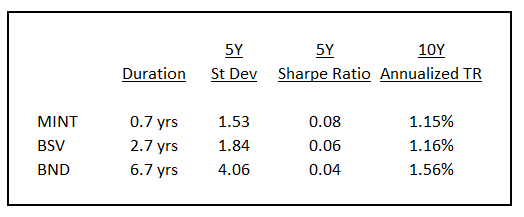

Analytics (Author)

We can see that as duration increases among the funds the downside risk as measured by standard deviation also increases. However, MINT exhibits virtually the same long-term annualized total return as BSV but with much less risk. BND has a larger annualized total return but with greater standard deviation and duration.

Dividend Yield vs 30-day SEC Yield

BSV currently has an attractive 30-day SEC yield of 2.89%, while its dividend yield is only 1.47%. A retail investor needs to focus on the larger, attractive 30-day SEC yield and understand the difference between the two metrics.

Dividend Yield

Usually, financial websites show a trailing 12-months dividend yield when reporting this metric. For example, if you look at BSV on Seeking Alpha, you will notice that the dividend box shows a 1.47% ratio – when looking into the details of how this is calculated (go to the Dividends tab – Dividend History) and you will notice that this metric is actually calculating by adding the dividends paid out in the past 12 months and then annualizing that figure as compared to the current fund market price. In a stable interest rate environment, this metric is suitable, but in an increasing/decreasing interest rate environment, looking at this analytic would be very misleading (as rates go up, the dividend yield would be understating what you are getting, for example).

30-Day SEC Yield

This is the best metric when analyzing a short duration bond fund, given the current interest rate environment and the propensity for some funds to have a roll effect in their bond holdings, where the discount to par is being absorbed by the maturity pull and higher-yielding bonds are bought. This creates an effect of having a much higher 30-day SEC yield when compared to a trailing 12 months dividend yield. The 30-day SEC yield is the best metric to look at when considering short-duration bond funds because it gives you an accurate snapshot of what cash you are actually going to receive based on where the portfolio currently is, and where the market price clears.

Conclusion

BSV is an exchange traded fund that offers a retail investor with exposure to the short to intermediate duration U.S. investment-grade bond market. With a 2.7 years duration, the fund is not an appropriate cash parking vehicle to enhance an investor’s portfolio yield. Constrained by its maturity profile, the vehicle has also posted very low long-term annualized results (below 1.5% on a yearly basis). In our mind, BSV is not an appropriate portfolio construction tool for a retail investor because it does not achieve price stability nor does it offer attractive yields/long-term returns. We have this fund rated as a Hold.

Be the first to comment