DNY59

Thesis

BlackRock Science and Technology Trust II (NYSE:BSTZ) is a closed end fund focused on software and semiconductor stocks with an emphasis on private investments. BSTZ is up more than 8% in the past two business days on the back of a significant relief rally in tech. Emblematic of the relief rally driven by short covering is the fact that the GS Unprofitable Tech basket rallied more than 20% in the past two business days. ARKK falls in the same category, rallying over 24% since the CPI print. Yes, you read that figure correctly.

What has changed? Is the Fed about to pivot? Is inflation dead and we should expect lower rates? The answers to these questions are “not much”, “no” and “no”. We are just witnessing a market desperate for good news that took out a massive number of short sellers and put buyers on the back of a good CPI print. A bear market is a nasty and surprising affair. It tends to come back and maul all market participants through its fluctuations. If a bear market was a constant move down in prices it would be a very easy market to trade, and tons of profits would be minted. Instead of “buy the dip” one would just “sell the rip” and buy puts. Unfortunately this is not how the real world works. In the real world there are lots of folks who tend to sell short or buy puts when the VIX is high and there is no end in sight to a downturn, basically at the intermediate bottoms. What tends to happen afterwards is that the same people suddenly find themselves in deep holes as bear market rallies develop, and they tend to cover their positions and fuel the fire rally.

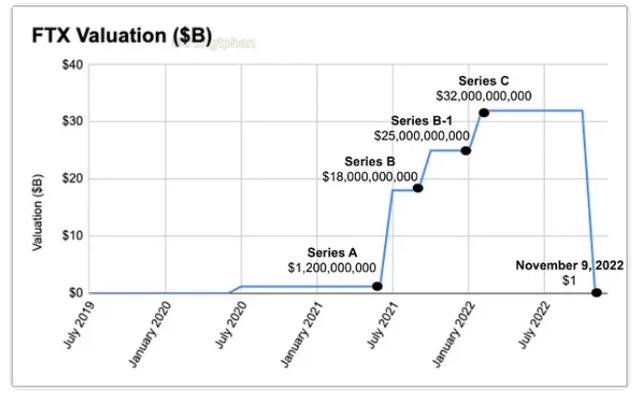

We are witnessing the same price action now in BSTZ, and generally in unprofitable tech. More worryingly though for BSTZ, a CEF with substantial private investments exposure, is the FXT development. FXT just filed for bankruptcy, after supposedly being worth more than $32 billion only a week ago:

How is this possible you might ask? Unconfirmed reports of fraud are emerging for FTX, with out of this world facts about basis processes such as audit, which was performed by an obscure firm with a Metaverse office (yes, the Meta company Metaverse).

The takeaway here for a savvy investor is that in the gung-ho days of 2020/2021, anything that was tech related received an inordinate amount of capital with not enough due diligence done on the company, its auditors and its regulatory frameworks. Higher rates and specifically for crypto, lower valuation for crypto tokens, and now bringing to light the uncomfortable reality that some of these companies were not necessarily what they were pitching to be. From mild cases of grossly overstated valuations, to the more serious fraud cases like what FTX might end up being.

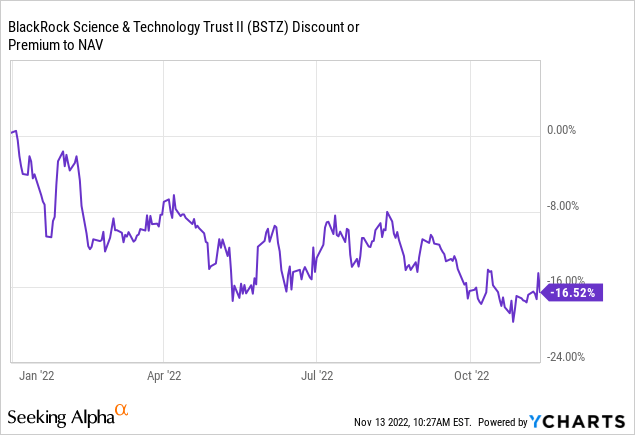

Premium/Discount to NAV

BSTZ’s discount to NAV has not budged despite the overall euphoria:

This tells us that investors are starting to realize the inherent risks associated with portfolios containing large private investment chunks. In a normalized market environment with no question marks surrounding valuations, we would have expected the fund to start trading closer to NAV on the back of the market rally. Not here.

Holdings

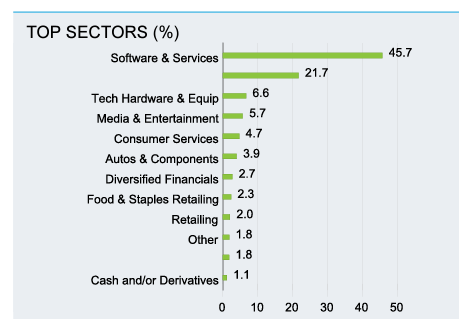

The fund is overweight extremely speculative sectors in the market:

Top Sectors (Fund Fact Sheet)

We can see that the Software and Semiconductors subsectors account for over 65% of the fund. The sudden decrease in crypto prices and the rush out of the asset class will negatively impact the semiconductor industry going forward. The same way the sector saw a bump-up once crypto mining took off, the reverse is happening as we speak. The less value in a token the less interest in mining, which in turn decreases demands for computers and the ancillary semiconductor business.

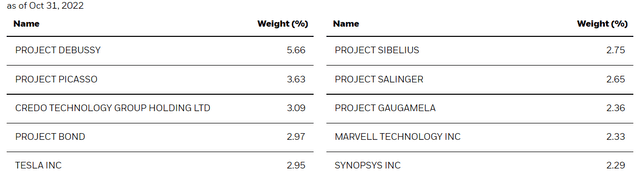

If we look at the fund’s top holdings, we will notice there are quite a few private names present:

Top Holdings (Fund Fact Sheet)

These are highly speculative/high beta names that can overperform in a zero rates market like 2021 but will be very hard to exit in today’s environment. With IPOs virtually disappearing this year, the market is closed for these types of investments. Expect massive gap-downs in price/valuation when the market actually prices any of the private illiquid holdings.

Conclusion

Private investments should be viewed as inherently more risky, opaque and offering asymmetric risks, especially to the downside in this market. FTX is a pre-eminent lesson in capital chasing tech/crypto with no robust control and valuation frameworks. In our opinion, more bankruptcies and companies folding in the space are to follow, since FTX was such a big player in the crypto exchange market, but the lesson to be learned here is that a private investment worth on paper $32 billion last week is now worth zero. BSTZ is an equities CEF that invests in the technology space, with an overweight allocation to private investments. A furious 8% rally in the past two business days has failed to impact the discount to NAV for the CEF, investors correctly understanding that private company valuations are more of an art than a science, with risks tilted to the downside. We believe we are in the middle of yet another vicious bear market rally, and BSTZ is soon to resume its down-trend.

Be the first to comment