MixMedia/E+ via Getty Images

Article Thesis

EPR Properties (NYSE:EPR) is a high-quality net lease real estate investment trust that has a unique focus on experiential properties. Due to worries about the performance of some movie theaters, shares are currently trading at a pretty inexpensive valuation. Add an 8% dividend yield, and EPR Properties looks like an attractive income investment and total return pick at the current price.

Company Overview

EPR Properties is a real estate investment trust that operates with net leases and that primarily invests in experiential real estate. That means that its tenants include restaurants, movie theaters, golf clubs, and so on — places where people go to do things, not to buy stuff. That makes EPR Properties’ portfolio relatively resilient versus the Amazon (AMZN) threat — while a book or new shirt is easily bought online, the experience of doing activities with family, friends, etc. is not easily replicated online.

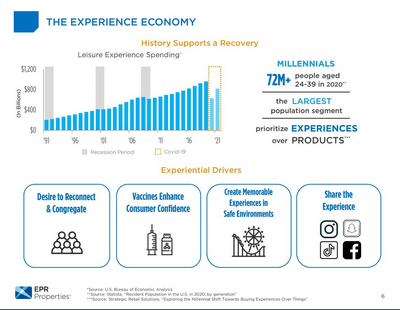

The experiential real estate market is an attractive one to be active in, as the following data shows:

EPR Properties

Not only has leisure experience spending been growing at a compelling pace for decades, prior to the pandemic, but there are also powerful demographic tailwinds at play. Millennials have a clear “experiences over products” mindset, and as they age and become more wealthy, their spending power increases, which should be beneficial for overall experience spending.

The pandemic and the lockdowns that were put in place to combat it hurt experiential spending, as people stayed home instead of going out with friends and family. But as the pandemic is coming to an end, trends should revert back to normal, and as more and more consumers are willing to go out again, experience spending should rise to new heights in the coming years, I believe — past setbacks, such as during the Great Recession, were only temporary, after all, as the underlying long-term trend remained in place.

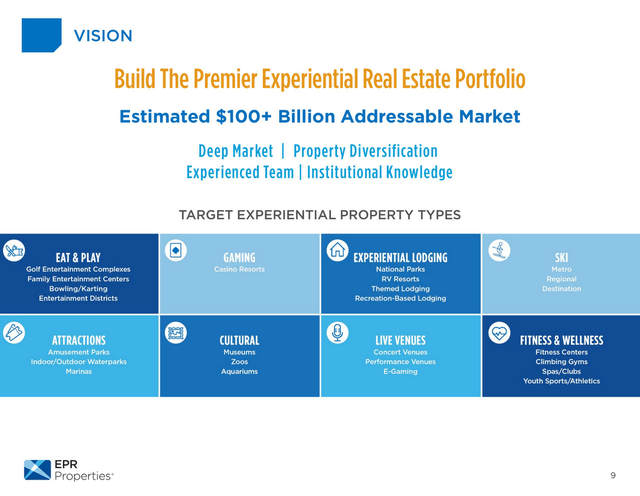

EPR Properties thus is, not surprisingly, eager to follow through on its strategy of consolidating the experiential real estate market. Management believes that the addressable market is worth more than $100 billion, as shown in the following slide:

There’s a lot of diversity when it comes to property types, which has advantages for EPR. When it is able to buy into many different types of experiential real estate, tenant diversification will automatically be high, and many of these businesses are not correlated. Some are health-related, such as fitness centers, others are family attractions, such as zoos, while others such as national park lodging will benefit from the growing outdoors trend that started during the pandemic.

EPR’s experienced team will be a favored partner for willing sellers, and its broad network of owned assets all across the US will make it easy for EPR Properties to source deals in the future. EPR Properties is thus in a good position to roll up or consolidate the experiential real estate market over time. The sheer size of the addressable market will mean that EPR Properties will not hit a growth limit anytime soon, however — which is a good thing for investors.

Worries About Movie Theaters

EPR Properties was initially hit hard during the pandemic, as its shares dropped from close to $80 all the way to $20 — lockdowns hurt EPR’s tenants, and it was far from clear how long these lockdowns and COVID measures would be in place, which is why the initial sell-off in 2020 was not surprising. But pretty soon it became clear that EPR would not run into devastating problems, and shares recovered to more than $55 through the summer of 2022.

Since then, shares have pulled back again, on the back of worries about the performance of movie theaters. Movie theaters obviously had a hard time in 2020 and 2021, and even 2022 will not be a strong year for companies such as AMC Entertainment (AMC). That being said, EPR does not need AMC and its peers to make a lot of money — it’s sufficient when they are able to pay their bills, i.e. the rent they owe EPR.

One of these movie theater companies, UK-based Cineworld (OTCPK:CNWGQ), which is the parent company of Regal Entertainment, the #2 movie theater chain in the US, has recently filed for bankruptcy. That’s bad news for Cineworld’s shareholders, of course, and creditors will most likely also lose some money. But it is far from guaranteed that EPR Properties will be hit meaningfully by this development. A couple of months ago, the company has stated that Regal Entertainment was current on all rent obligations. Here’s what the 8-K filing stated:

EPR 8-K

This suggests that EPR sees a very limited fallout from Cineworld’s bankruptcy, which makes sense to me. Cineworld has filed for Chapter 11 bankruptcy protection, which means the company will be reorganized, not liquidated. If that is the case and the company wants to continue its operations, it obviously still needs movie theaters, thus Regal will remain a tenant for EPR. Getting rid of some debt will allow more breathing room for Cineworld as it will result in lower interest expenses, thereby improving its cash flow picture. But closing down all movie theaters would not make sense under a Chapter 11 reorganization. The theaters that EPR owns are also generally performing much better than the average theater in the US. If anything, Cineworld/Regal would like to end contracts on underperforming locations, but those aren’t the ones that EPR owns.

EPR Properties has also recently (in November) increased its FFO guidance for the current year. They would not have done so if the Cineworld/Regal situation was a major issue for EPR. Instead, a guidance increase suggests that the near-term picture is rather positive. Based on current guidance, funds from operations of $4.60 will be achieved this year, which means that EPR Properties trades at just 9x this year’s funds from operations, which is far from expensive. The following remark from the conference call [CEO Greg Silvers] is also telling, I believe:

“The ongoing strengthening of our portfolio is evident in our customers’ overall rent and interest coverage which is higher than in the comparable period of 2019.”

Overall, these factors make me believe that the current movie theater fears are overblown. That does not mean that movie theater companies are a good investment, and I have absolutely no interest in becoming an AMC shareholder, for example. But these companies need EPR and its higher-end locations, and they will most likely continue to make rent payments, even if their shareholders or creditors may lose some money. This, in turn, means that the current very low valuation EPR trades at could make for a good buying opportunity — be greedy when others are fearful.

EPR Is A Strong Income Pick

EPR Properties offers monthly dividend payments to its owners, which has advantages for retirees and others that live off their portfolio’s income. More important, of course, are other factors, such as the safety of the dividend and the dividend yield.

Based on a monthly payout of $0.275, EPR Properties currently offers a dividend yield of 8.0%. That is pretty high in absolute terms, and it is also very attractive compared to the sub-2% yield the broad market offers right now.

Looking at the company’s dividend safety, we see that the payout ratio, based on this year’s forecasted FFO, is just above 70%, which means the dividend is covered 1.4x. That’s not an ultra-low payout ratio in absolute terms, but not an elevated payout ratio for a REIT, either. In fact, many other REITs pay out more than 70% of their FFO without running into problems.

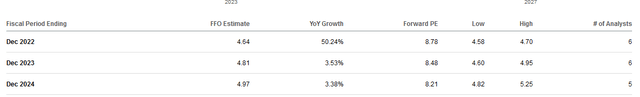

Looking beyond 2022, analysts are currently forecasting meaningful FFO per share growth for both 2023 and 2024:

If those estimates are hit — EPR Properties has a history of outperforming expectations, except for pandemic-impacted 2022 — then the payout ratio will be in the mid-60s in 2024, which would reduce the dividend cut risk further. Overall, I believe that EPR Properties’ dividend is pretty attractive, thanks to a high yield and solid dividend safety.

Takeaway

EPR Properties is active in an attractive segment of the real estate market. Experiential real estate should benefit from the recovery from the pandemic and from long-term growth tailwinds, such as a growing “experiences over things” mindset.

EPR is cheap due to what I believe are overblown worries when it comes to its movie theater tenants. The current share price could allow for some serious upside potential over the coming years — EPR traded at almost twice the current share price before the pandemic hit. On top of that, investors get a high dividend that may not be ultra-safe, but that is also not really at-risk, as the dividend coverage is solid and since coverage ratios should improve further over the coming years.

Be the first to comment