NiseriN/iStock via Getty Images

Investment Thesis

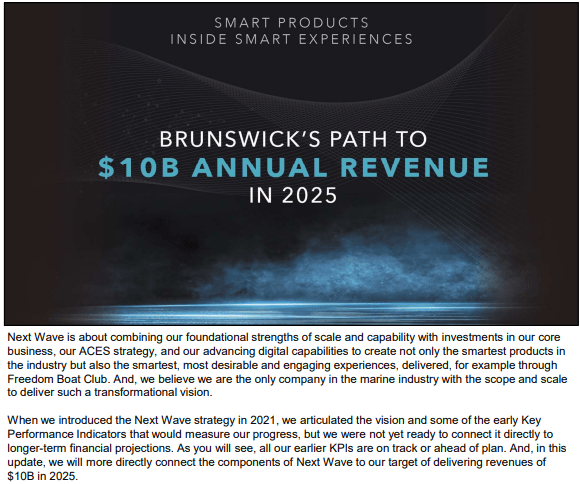

Brunswick Corporation (NYSE:BC) has lost about 20% in share price over the last year. The stock has been on a downward trajectory since July 2021. It is now priced at $74.12 per share, underperforming the market with a margin of about 11%. I attribute the dismal performance to the tough macroeconomic environment.

The company’s strategic measures are progressing and will position it to effectively overcome the tough economic environment and steer future growth. However, the company has macro concerns that it has to navigate to achieve its objectives.

The Company

Brunswick is a multinational manufacturer and marketer of recreational products. Boats and maritime propulsion systems are two examples of this. Besides this, the company also distributes parts and accessories for the marine and RV industries. In addition, it also runs the largest boat club in the world. The company operates in three segments;

Propulsion segment: Majorly, it is in charge of the sales of an extensive selection of inboard, sterndrive, and outboard engines.

Parts & Accessories: The company sells its own and third-party brands of marine parts and accessories worldwide.

Boat segment: Brunswick Boat Group produces and distributes recreational boats within this division. Mostly leisure motorboats.

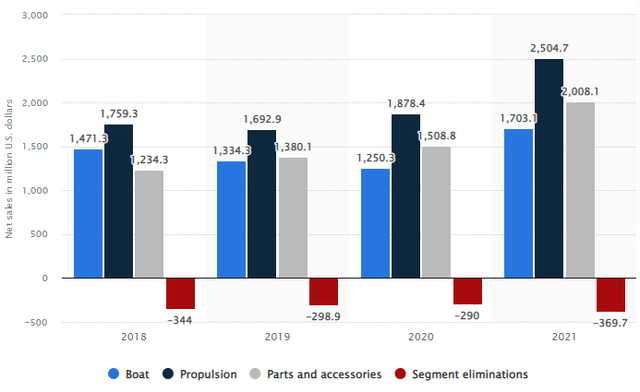

Below is the revenue contribution of each segment since 2018.

Macro Concerns: Inflation and Fuel Prices, and Covid 19

As organizations keep a close eye on both micro and macroenvironment to identify opportunities or threats, BC has some concerns over its macroeconomic environment. For this article, I will focus on the above factors, which the company gave weight to during their Q2 ’22 transcript call.

1. Inflation

The travel and leisure industry, which was previously booming, is now experiencing some setbacks. The industry is currently facing an inflation rate of 11.05%. With these developments, BC isn’t an exclusion. They have already felt the heat of this challenge and are considering responding to the problem using pricing strategies.

Dave Foulkes, “While our businesses continue to experience elevated inflation, any moderation occurring in the back half of the year will factor into our pricing strategies.”

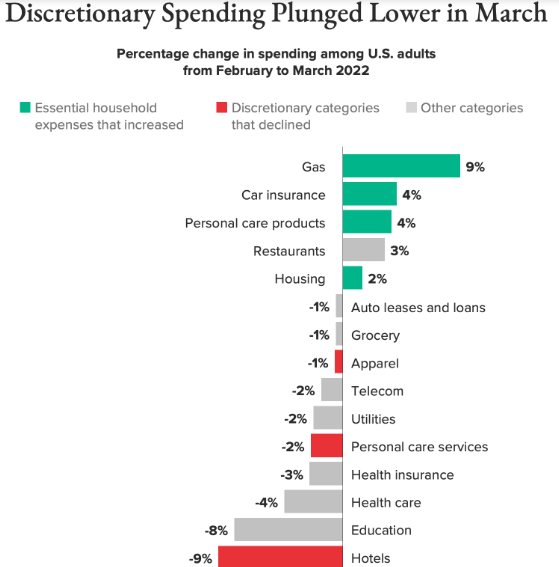

When inflation hits, it takes consumers’ discretionary spending power away. In the US, this has been the case. A study conducted between February and March showed a significant decline in consumers’ discretionary spending. To be specific, recreation expenditure dropped by 21%.

Morning Consult Morning Consult

One of the main reasons for the reductions was the sensitivity of prices. The leisure industry relies on fuel because it involves a lot of traveling. Besides traveling, some recreation facilities are fuel driven. Currently, fuel prices have soared, forcing prices in the leisure industry to rise.

Though inflation concerns BC, it seems the company is not affected adversely. This conclusion is because, in their Q2 2022 transcript call, they reported that the demand for their products remains strong, and also, there are minimal signs that fuel prices are deterring boating. Additionally, in my opinion, BC will overcome this challenge because boating is a recreational activity majorly for the upper class, who possess more disposable income, and are, therefore, to some extent insensitive to prices. I am saying so because BC has reported historic revenues despite the inflation challenge. In their Q2 2022 call, they reported their first quarter with more than $300 million in adjusted operating earnings and record revenue. With this background, investors should not be scared by high inflation rates.

2. Covid 19

Covid 19’s lockdowns profoundly impacted the leisure industry. These covid 19 confinement techniques kept people indoors, limiting outdoor pleasure. The leisure industry rebounded strongly after the financial crisis, and the boating industry is mainly doing rather well. The stock market’s reaction to these changes in the business was profound. At the beginning of the Covid pandemic, shares plummeted but swiftly rebounded as people began spending more time outdoors and recreational vehicle sales soared. As inflation has diminished consumers’ discretionary spending power, many post-pandemic improvements have stagnated and that explains the declining share prices.

If the economy enters a recession, prices may drop further, but I think now is a perfect moment to invest due to attractive pricing. With its long history of dividend increases even during tough economic times, potential investors should expect good returns in the future for the risk they take today.

Innovation: ACES

Innovation is crucial for businesses in the leisure sector if they want to stay competitive. For this article, I will focus on one of BC’s many ground-breaking initiatives: ACES. In 2021, BC unveiled more high-tech products in a broad strategic framework called the ACES strategy, an acronym for Autonomous and Advanced Driver Assistance Systems, Connectivity, Electrification, and Shared Access. The goal is to foster growth and retain boating innovation leadership. Among the new products were battery-based marine powertrains, solutions like self-driving with obstacle sensors, and autonomous docking. “Vessel View,” another product, interfaces with the dashboard to provide a comprehensive view of engine statistics. Brunswick’s “Freedom Boat Club” provides members with a shared fleet of boats at various locations across the United States for a monthly charge.

The company expects $10 billion in yearly revenue by 2025 if they keep implementing the idea piecemeal.

Brunswick

An investor should not just look at the 10 billion estimations in isolation but against the market. Here is my brief on the leisure boat market.

In 2021, the worldwide leisure boat market reached $42.8B. Estimates show that it will increase by 4.7% each year to $64.7B over the period (2022–2030). By 2030, North America will have the largest share of $28.3 B, growing at 4.2%. Though BC’s 10B estimation is good, investors should look at the increasing market, which is more promising in revenues. The company, being innovative, and a leader in the field, is in an excellent position to reap the benefits in this area. If I were to invest in this industry, I would jump at this opportunity to enjoy the benefits now and in the long run.

Strategic Hedging

The firm operates globally and has financial and market risks. They limit risk using normal operating and financing activities and derivatives financial instruments.

1. Cross-Currency Swaps: The company uses cross-currency swaps to hedge Euro exposures in international subsidiaries. The notional value of existing cross-currency swap contracts was $250 million on April 2, 2022, and $200 million on December 31, 2021. In Q1 2022, the company resolved $200.0 million in cross-currency swap contracts, resulting in a $16.7 million deferred gain.

2. Commodity Price: The company hedges Aluminum purchases through commodity swaps. The notional value of outstanding commodity swap contracts was $19.3 million on April 2, 2022, $25.3 million on December 31, 2021, and $14.0 million on April 3, 2021. Changes in fair value are deferred in accumulated other comprehensive losses and realized in the cost of sales in the same period, or periods the hedged transaction affects earnings.

3. Foreign Currency Derivatives: Forward exchange contracts with notional values of $651.8 million, $519.8 million, and $493.9 million were outstanding on April 2, 2022, December 31 2021, and April 3, 2021. April 2, 2022, forward contracts mature in 2023 and involve the Euro, among other currencies. The business expects to reclassify $7.2 million in net earnings from other comprehensive losses to cost of sales by April 2, 2022.

4. Interest Rate Derivatives: The company swapped fixed-for-floating interest rates to convert some of its long-term debt. The company settled its fixed-to-floating interest-rate swaps in the second half of 2019, generating a $2.5 million net deferred gain in debt.

Recent Euro depreciation poses a dilemma for enterprises that sell in Europe and have to convert Euros to USD. The management has also addressed commodity market volatility and managed debt risk. This hedging strategy shows the administration is aware of the threats in its business environment and is trying to contain the situation. However, investors should still watch out because the challenges haven’t been fully mitigated but are reasonably managed.

Conclusion

BC’s industry is one of the worst hit by Covid 19. The company operates in a challenging macroeconomic climate, which it is overcoming with innovation and price strategies. I’m optimistic about the stock since its ideas are viable and durable. I grade the stock as a buy since the company can utilize the rising market with its ACES products.

Be the first to comment