iantfoto/E+ via Getty Images

Most countries are doing their best to transition from fossil fuels to renewable energy sources. This secular shift has greatly accelerated since the onset of the pandemic, two years ago. Brookfield Renewable Partners (NYSE:BEP) is ideally positioned to benefit from this trend, as it is one of the largest owners of renewable energy generating facilities in the world. Moreover, Brookfield Renewable Partners has an immense pipeline of growth projects, which will keep the company in its growth trajectory for several more years. In addition, in contrast to most growth stocks, which offer modest distribution yields, Brookfield Renewable Partners is offering a 3.3% distribution yield. As a result, the stock is suitable, not only for growth-oriented investors, but also for income-oriented investors.

Business overview

Brookfield Renewable Partners is one of the largest pure-play renewable power platforms in the world. Its portfolio consists of hydroelectric, wind, solar and storage facilities in North America, South America, Europe and Asia, and totals more than 21,000 megawatts of installed capacity. In addition, the company has a development pipeline of approximately 62,000 megawatts.

Thanks to the nature of its business, Brookfield Renewable Partners has proved resilient throughout the coronavirus crisis. Due to the lockdowns imposed in 2020, oil companies incurred a fierce downturn and most of them reported excessive losses. That was not the case for Brookfield Renewable Partners, as the generation of renewable energy increased in that year.

Even better, the business momentum of Brookfield Renewable Partners has improved since the onset of the pandemic. In the fourth quarter of 2021, the company grew its share of actual generation by 1% and its normalized funds from operations [FFO] per unit by 11%, from $0.37 to $0.41, thanks to the contribution of recently completed growth projects and strong asset availability. In the full year, Brookfield Renewable Partners grew its normalized FFO per unit by 17%, from $1.45 to $1.69.

Growth prospects

As mentioned above, Brookfield Renewable Partners has a development pipeline of about 62,000 megawatts. As this pipeline is nearly triple the current installed capacity of the company, it is evident that the renewable energy giant has immense growth potential ahead and thus it is likely to keep growing its FFO per unit for several years.

The key factor behind the reliable growth trajectory of Brookfield Renewable Partners is the secular shift of the world from fossil fuels to clean energy sources in an effort to protect the environment from climate change.

This shift is likely to accelerate now that Russia has invaded in Ukraine. Europe generates about 35% of its electricity from natural gas provided by Russia. As a result, Europe is extremely dependent on Russia. Now that Russia has invaded in Ukraine, European leaders are doing their best to punish Russia with sanctions and diversify away from that country. They are thus likely to greatly boost their investments in renewable energy projects, in an attempt to drastically reduce the portion of electricity generated by natural gas provided by Russia.

Until a few years ago, the cost of production of renewable energy was greater than the cost of fossil fuels and thus renewable energy projects relied on government subsidies. This has changed in recent years, as the cost of solar and wind energy has markedly decreased thanks to major technological advances.

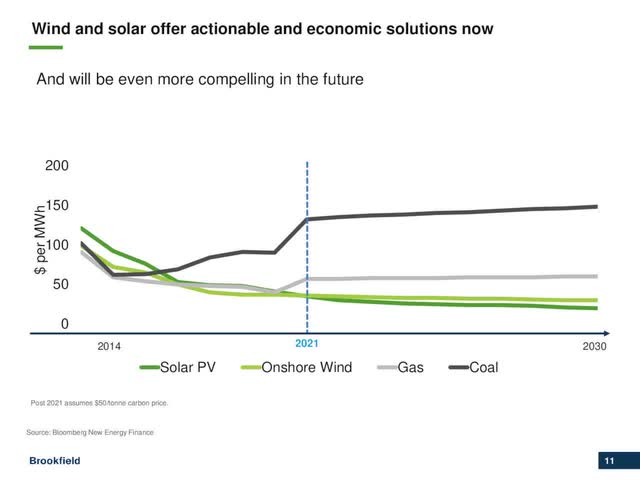

Cost of solar and wind energy (Investor Presentation)

Source: Investor Presentation

As shown in the chart above, the cost of solar and wind energy has become much less than the cost of electricity produced by gas or coal. This is undoubtedly a strong tailwind for the business of Brookfield Renewable Partners.

Management recently stated that it expects to invest $1.0-$1.2 billion per year in growth projects over the next five years. Thanks to this capital plan, it expects to generate 12%-15% average annual returns for the shareholders. As the stock offers a 3.3% distribution yield, management implies 9%-12% average annual growth of FFO per unit. This is certainly an attractive expected return, particularly given the low risk that results from the strength of the business model.

Distribution

Brookfield Renewable Partners has an exceptional growth record. It has grown its FFO per unit at an 8.0% average annual rate over the last eleven years, from $0.72 in 2010 to $1.69 in 2021. Thanks to its sustained growth trajectory, the MLP has grown its distribution at a 6% average annual rate over the last two decades.

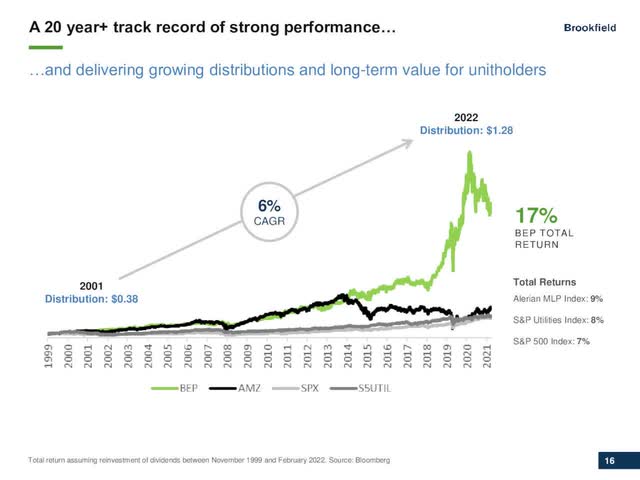

BEP distribution growth record (Investor Presentation)

Source: Investor Presentation

It has also offered a 17% average annual total return to its shareholders over the last two decades. The consistent performance record of the company is a testament to the strong secular trend that supports its business model.

Moreover, Brookfield Renewable Partners has a distribution coverage ratio of 1.3 (=1.69/1.28) and thus it covers its distribution with a material margin of safety. Furthermore, the MLP has an investment-grade credit rating of BBB+, with no material debt maturities over the next four years. As a result, the 3.3% distribution yield of Brookfield Renewable Partners can be considered safe for the foreseeable future, particularly given the resilience of the company to downturns, such as the coronavirus crisis or a potential recession.

BEP Valuation

Based on the FFO per unit of $1.69 posted in 2021, Brookfield Renewable Partners is currently trading at a trailing price-to-FFO ratio of 23.1. This valuation multiple is higher than the historical 10-year average price-to-FFO ratio of 17.0 of the stock.

On the other hand, it is important to note that the stock deserves a premium valuation thanks to its exciting growth potential. Overall, it would probably be prudent for investors to wait for an approximate 10% correction of the stock, towards its technical support around $35, before purchasing it. In this way, they would lock in a 3.7% distribution yield and would enhance their margin of safety.

Final thoughts

Volatility has greatly increased in the stock market this year, primarily due to the surge of inflation and the resultant aggressive response of the Fed, which has begun to raise interest rates at a fast pace. The hawkish response of the Fed may cause a recession in 2022 or 2023. Therefore, investors should make sure they have stocks which are resilient to recessions and have solid growth prospects. Brookfield Renewable Partners certainly meets these criteria.

Be the first to comment