teppakorn tongboonto

Investment Thesis

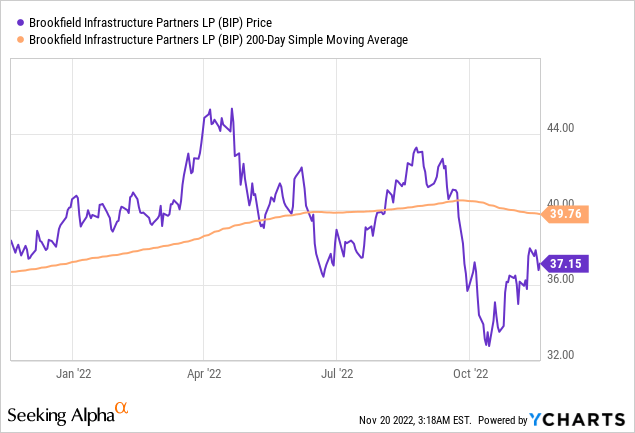

Since my article on the low point of the share price a little over a month ago, the stock has already climbed 13%. Nevertheless, I believe there is still an excellent buying opportunity to invest in Brookfield Infrastructure Partners (NYSE:BIP) for the long term. In the meantime, we have received the Q3 results, where we can see the robust resilience of the company in all market phases.

Quick summary of my previous article

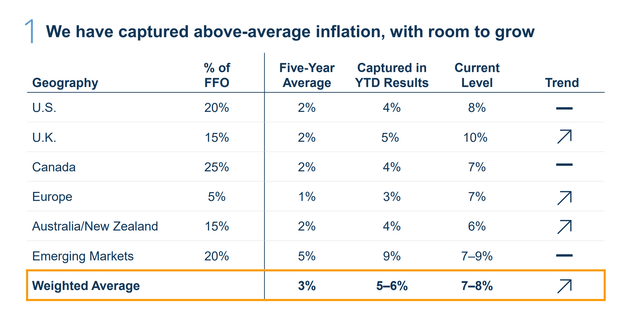

The company was dragged down by recession fears and rising interest rates, which could cause problems for a company as leveraged as BIP. But about 90% of their debt has fixed interest rates. And on the revenue side, a lot of their revenue comes from long-term contracts that are often inflation-linked. The company should not suffer that much from the current situation, maybe even profit from above-average revenue growth – let’s see if that happened.

You make most of your money in a bear market; you just don’t realize it at the time.

Shelby Cullom Davis

Q3 results

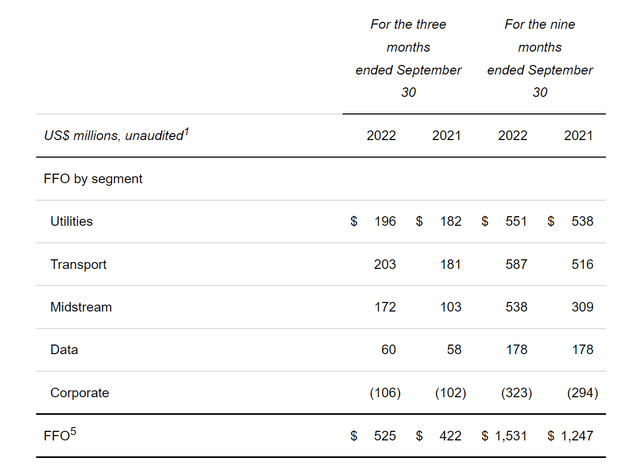

FFO grew in the quarter to $525M from $422M a year ago, or $0.68 per unit, compared to $0.59. For the nine months of 2022, FFO is $1,531M versus $1,247M, or $1.99 per unit versus $1.77. That’s 12% growth, which is a lot for a company that operates with real assets all over the world and generates most of its profit from long-term contracts.

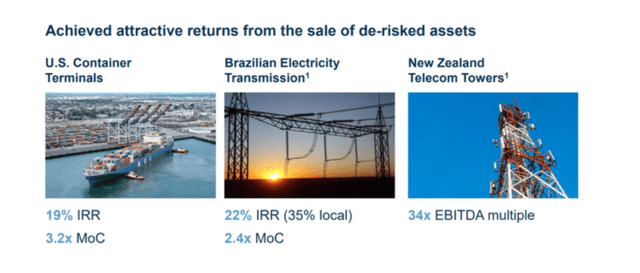

These comparisons from one year to the next are not so trivial with BIP, as constant asset rotation distorts the figures. This year, for example, a US container terminal was sold with an IIR of 19%, which was a very lucrative deal, but subsequently lowered revenues in the transport segment. The asset rotation in 2022 was 10%.

Brookfield Infrastructure Investor Presentation

Therefore, the proportions of the individual segments do not remain the same but change over time, and ultimately it matters to the company how much FFO remains on the bottom line. Of course, the company has to keep up with changing circumstances, which is why it has invested in the data segment for years, including communication towers. The company also invested in midstream when the entire area was very unpopular and cheap and is now reaping the rewards, as seen in the FFO by segment. Currently, the company has 22,000km of pipelines, 600bcf of natural gas storage, and 17 natural gas processing plants.

Our midstream segment generated $172 million of FFO, an approximately 65% increase over the prior year. This result was primarily due to the contribution from our diversified Canadian midstream operations, which only partially contributed in the comparable period. At a base business level, results continue to be strong with high utilization of our infrastructure and elevated market-sensitive revenues.

2023 outlook

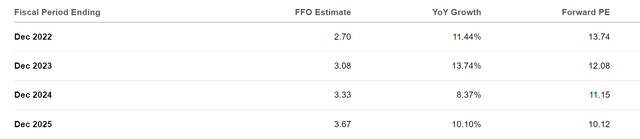

Total FFO for this year is expected to be around $2.70 and next year at least $3.00, another substantial increase. One reason is that the inflation-indexed revenue increases are not yet fully reflected in this year’s results. In addition, the trend towards even higher inflation continues in many countries, as inflation in Europe is very much related to energy prices and less to demand than in the US.

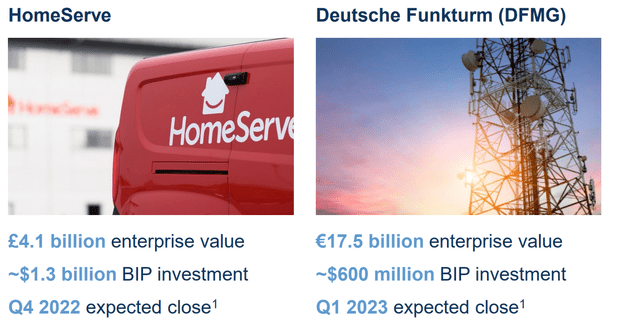

Furthermore, the goal is to complete and integrate the announced acquisitions, HomeServe and DFMG. There is also a big deal with Intel to invest $15 billion for a 49% stake in Intel’s manufacturing expansion in Chandler, Arizona. HomeServe is a home repair company in the UK, and DFMG is a portfolio of 36,000 telecom towers in Germany. Brookfield says there will likely be further takeover opportunities in Europe’s fragmented tower market.

Long term strategy

In the long term, the company expects the three Ds to form the basis for its future investments. These are Digitalization, Decarbonization, and Deglobalization. Brookfield expects that up to $1 trillion will be needed globally in the data segment to expand the existing infrastructure (2022 investor day presentation page 34). Overall, the latest investor presentation sounds like the company will move even more into the data segment in the future, as this is where they see the most opportunities. In addition, deglobalization is expected to result in very high costs for countries, which Brookfield sees as an opportunity. Examples of such sectors are energy independence, supply chains, and semiconductors. Overall, investment opportunities will continue to be plentiful.

Valuation

This year’s FFO of $2.70 and a share price of $37 result in a P/FFO of 13, historically not the cheapest but also not expensive. The current dividend yield is 3.8% and has constantly been increasing for years (5-year growth rate of 6.6% per annum). Over the past ten years, the company has managed to increase its FFO earnings by an average of 11% per year, and it looks very promising that this will continue. Overall, the company seems fairly valued, and in the future, investors can expect roughly the same return as the company can increase its FFO.

Conclusion

I am changing my rating for this article from strong buy to buy, as the valuation has now risen slightly again. However, given the many positive factors, the company remains an attractive investment as a long-term buy and hold. FFO is expected to increase by another 10% in the next year alone. And in general, I like the safety of the company. Does inflation continue to rise? Brookfield profits. Is there a recession? Brookfield can buy up long-term assets more cheaply. Given the current inflation dynamics, the company is growing faster than it states as its long-term goal. Therefore, for me, it is an excellent sleep-well-at-night-stock.

Be the first to comment