BCFC

Tales of AMC’s (NYSE:AMC) death have been greatly exaggerated, with the company set to realize one of its largest fourth quarters on record on the back of the cumulative box office of Disney’s (DIS) Black Panther: Wakanda Forever, and Avatar: The Way of Water. This will likely push AMC to realize positive cash flow from operations for its fiscal 2022 fourth quarter, a positive development that will provide relief from a debt burden that has been slowly managed down since the pandemic.

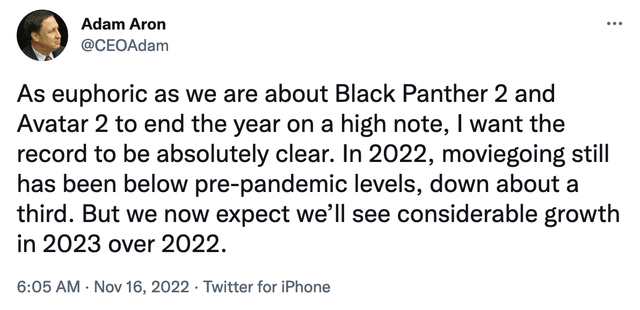

Black Panther: Wakanda Forever, Disney’s sequel to its 2018 blockbuster, debuted with the largest-ever November movie opening, the second-biggest opening for 2022, and the 13th-largest opening of all time. The movie pushed the overall domestic box office to $208 million, the biggest opening weekend in four months. This is as James Cameron’s sequel to his 2009 blockbuster Avatar is set for a mid-December release. Bulls and bears alike now face what will undoubtedly be back-to-back months of new box office records for the fourth quarter. This will critically show that AMC’s malaise can and will be solved by a consistently strong movie slate. Movie-going remains a core consumer pastime, with demand undeterred by the bleak macroeconomic landscape.

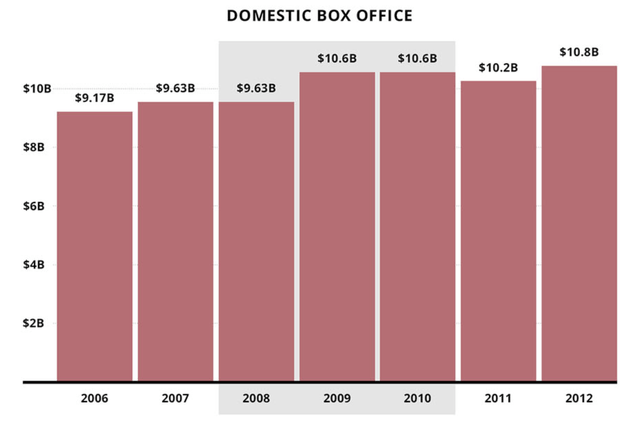

Theatre attendance and the domestic box office have historically remained relatively strong even amidst periods of economic upheaval. Indeed, during the 2008 to 2010 global financial recession the domestic box office actually rose with the movies providing entertainment for millions of US households.

Hence, AMC, like its peers Cineworld (OTCPK:CNNWQ) and Cinemark (CNK), has somewhat of a recession-proof business that should dampen the financial disruption that would be wrought by a potential 2023 recession.

950 Theatres And 10,500 Screens

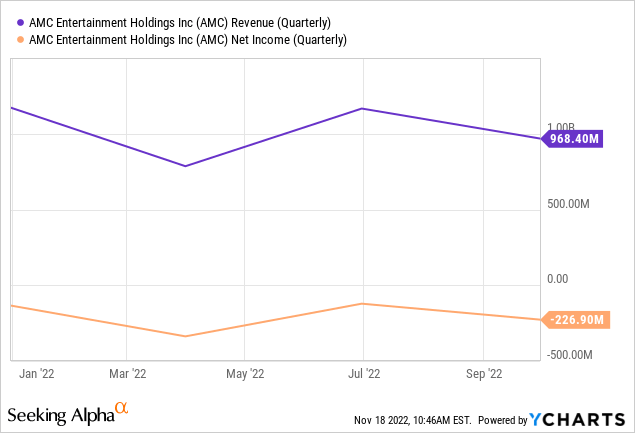

AMC last reported earnings for its fiscal 2022 third quarter saw revenue come in at $968.4 million, a 26.9% increase from its year-ago quarter despite a weaker-than-normal movie slate and a beat by $7.43 million on consensus estimates. The overall box office during the quarter was weak, with the box office posting twelve straight weekends under $100 million. But attendance was healthy with US attendance at 38.33 million, up from 26.70 million last year, with international attendance mainly at its UK-based Odeon unit also growing from the prior year.

This still saw AMC bring in a large net loss of $226.9 million, broadly in line with the year-ago comp. Adjusted EBITDA was just at $12.9 million versus a loss of $5.4 million in the year-ago period. However, interest expenses of $86.1 million during the quarter heavily dampened profitability.

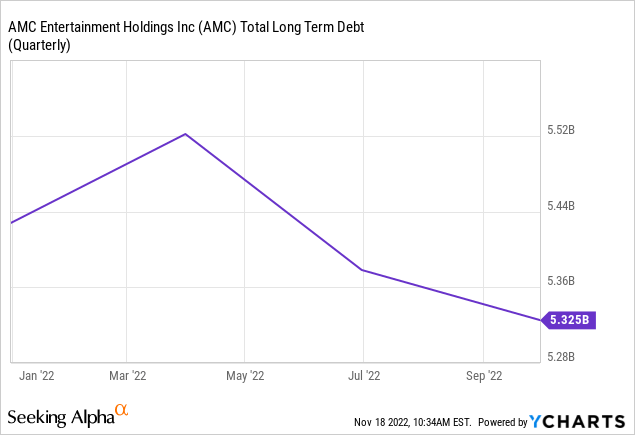

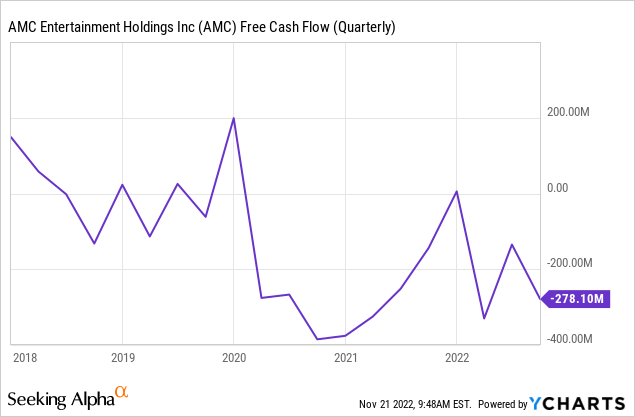

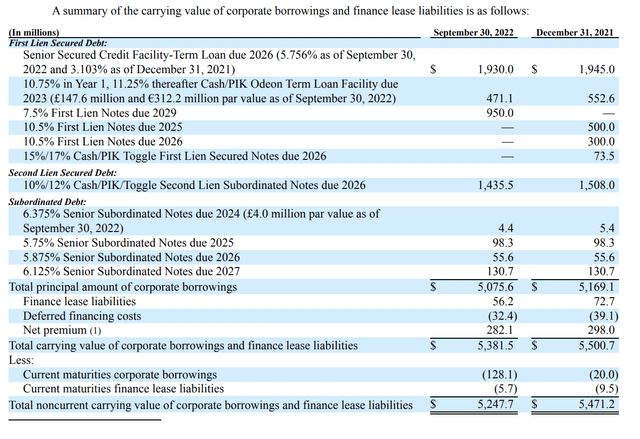

The company has total long-term debt of around $5.3 billion only partially offset by cash and equivalents that stood at $684 million as of the end of the quarter. AMC’s current weakness comes from its large debt burden set against the inherent variability of the annual movie slate. Indeed, the company’s total cash burn from operations during the quarter was $179.2 million, which meant a significant erosion of its cash position.

The company was more intensely profitable in its pre-pandemic years from a cash flow perspective but this is seasonal. Strong movie slates radically increase the likelihood of profitability, and management has guided for the fourth quarter and fiscal 2023 to lead a strong recovery in their underlying cash flow position.

This means strong box office periods like the fourth quarter of this year have a materially enhanced effect on the company’s financials by not only helping to shore up liquidity but also expanding the company’s runway further out. This would allow time for AMC’s box office recovery to fully take hold and for current sentiment to improve. The current market risk-off trade, partially driven by an inverting yield curve, won’t last forever.

Produce Films And They Will Watch

During their third quarter earnings call, AMC was very clear on its near-term priorities. The first is managing their liquidity position to see them fully through their continued recovery from the pandemic. The second is for a continual strengthening of their balance sheet. This has seen the company reduce deferred rent liability to around $196 million from a peak of $470 million in March 2021 and came on the back of a deferred rent payment of $23 million during the quarter.

AMC is also aggressively looking to extend debt maturities and reduce its interest expenses. This saw the company complete a $400 million senior secured notes offering that allowed them to repay in full existing term loan facilities. The refinancing also helped them to reduce their principal debt total by $71.1 million.

The largest of AMC’s borrowings is a first-lien secured debt due in 2026. Due to the rising Fed fund rate, this has seen its annual interest increase from 3.10% as of the end of the last fiscal year to 5.76% at the end of the third quarter. Bears would be right that the rising cost of servicing its debt burden is a reason to avoid the stock, but the debt is not due until 2026 and AMC is guiding to move into positive free cash flows more heavily from next year on the back of an even stronger movie slate.

The company is also chasing incremental sources of revenue and is set to launch an AMC-branded credit card in the first quarter of next year. This should also see an AMC line of popcorn on grocery shelves around the US. These initiatives are important because they’ll help drive incremental revenue growth. Fundamentally, movies like the new Black Panther and Avatar are important because they result in a surge of demand, which render wrong the thesis of movie-going being dead.

Hence, AMC is a buy considering strong fourth quarter results are expected to show a return to positive free cash flow. The current price of $7 seems to have absorbed the peak of negative sentiment, so any move below this would signal a buy point.

Be the first to comment