CharlieChesvick

Investment Thesis

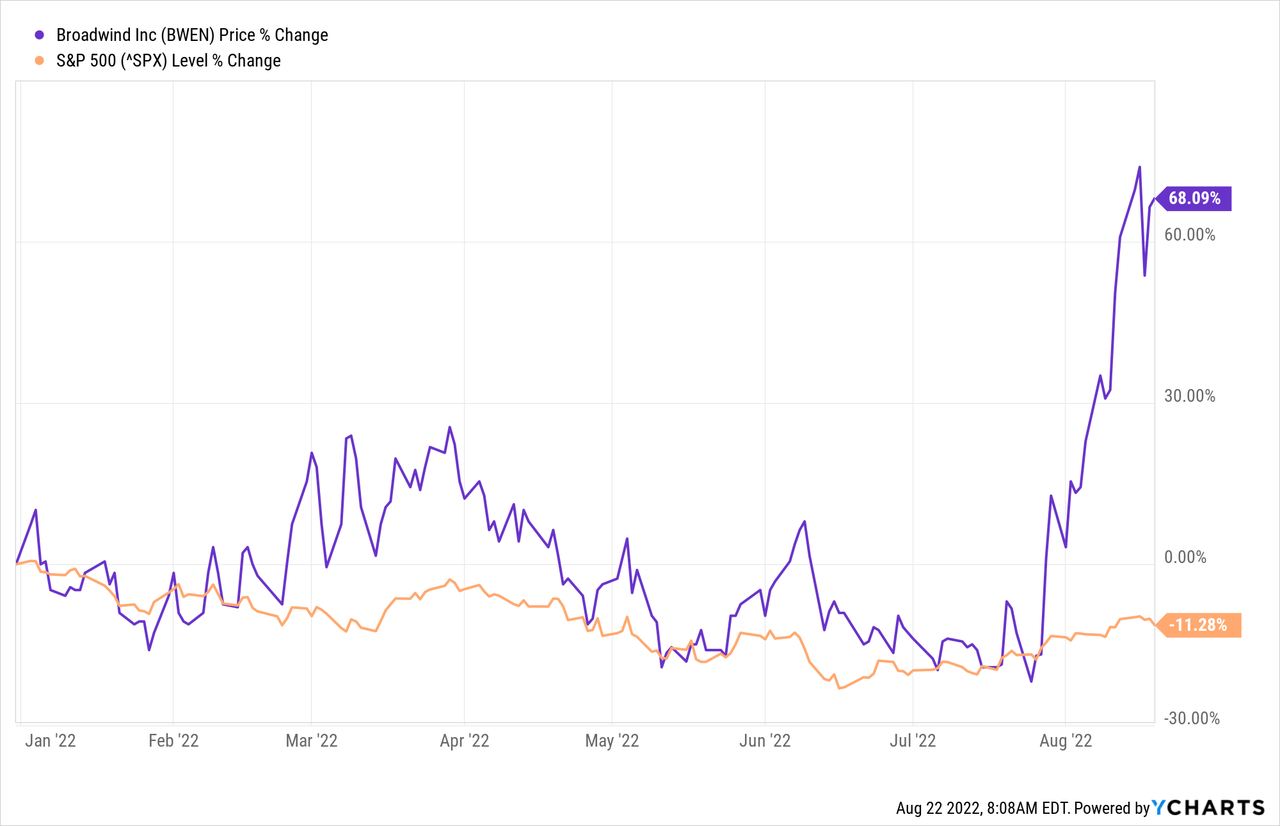

Broadwind Inc. (NASDAQ:BWEN) stock has been highly volatile since the pandemic, outperforming the market by almost 2x in the last 3 years, slight outperformance in the previous 1 year, and significant outperformance YTD. Before that, the company has massively underperformed in the long term.

Since the stock price has almost doubled in the current quarter, investors might wonder whether to hold on to the stock or dump it away to cash in their profits.

The company’s stock has doubled in the past month as a response to the news of the Inflation Reduction Act (IRA), which commits $369 billion in clean energy and climate action spending, including installing over 120 thousand wind turbines by 2030, among other clean energy initiatives.

However, the company’s profitability and balance sheet are weak, leading to significant company risks facilitated by a relatively higher beta, indicating higher volatility and an exacerbated investment risk. These financial statements tell a disturbing story, and despite significant recent opportunities created in the clean energy sector, the idiosyncratic risks far outweigh the systemic rewards.

The recent surge in the share price is a great opportunity for stockholders to cash in their profits and invest in securities with a favorable risk-reward ratio.

The Company

Broadwind is a US-based structure, equipment, & components manufacturer for clean technology and other specialized applications, serving the energy, mining, and infrastructure sectors. The US wind energy sector accounts for 53% of the company’s revenue in H1 2022.

Broadwind’s core operations include heavy fabrications, welding, metal rolling, coatings, gear cutting and shaping, gearbox repair, heat treatment, assembly, engineering, and packaging solutions. These operations are conducted through the Heavy Fabrications, Gearing, and Industrial Solutions segments, which account for 70%, 20%, and 10% of its total revenue.

Troubled Financial Statements

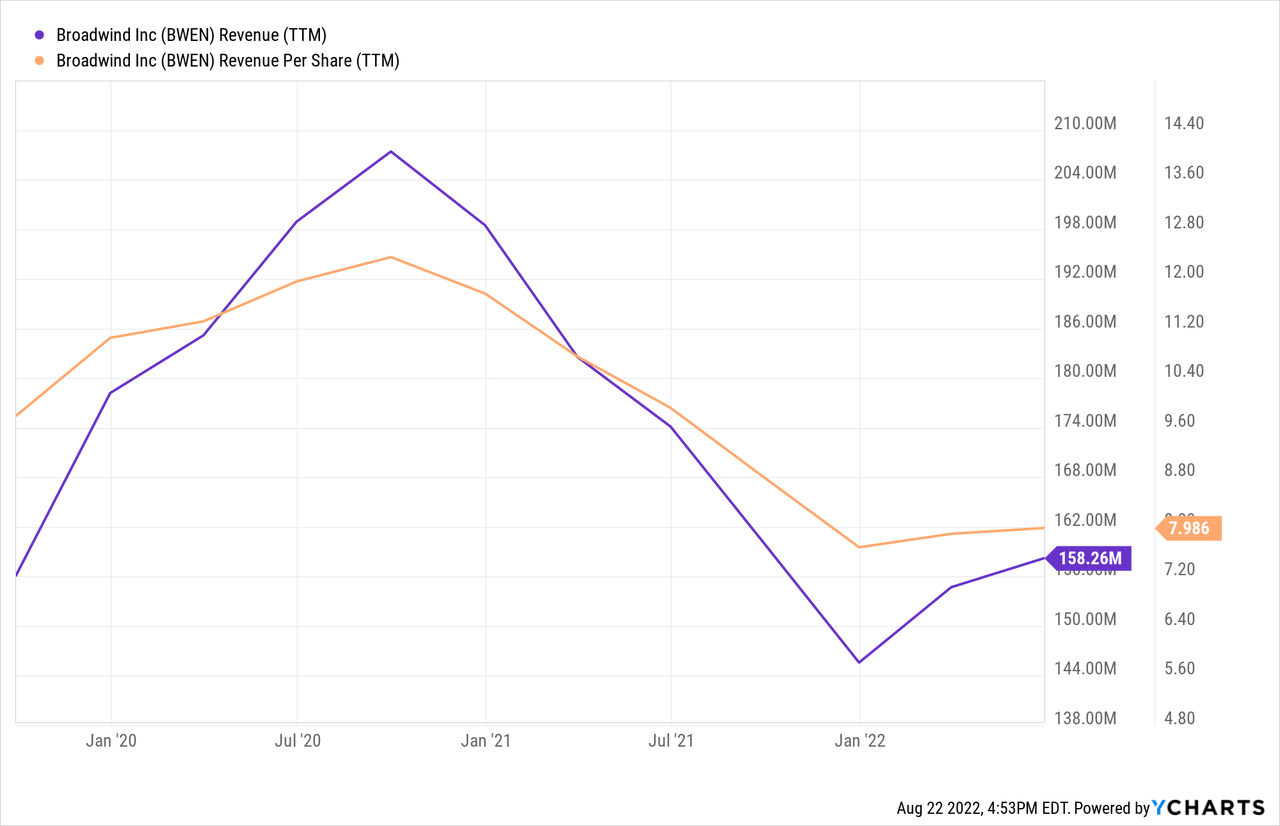

The company’s aggregate revenue grew by 7.6% YoY in the MRQ. The Heavy Fabrication segment’s revenue shrunk by 1%, while the Gearing and Industrial Solutions’ revenues grew by 37% and 43% YoY. This was driven by increased energy, industrial, mining, and natural gas turbine content demand, offset by a temporary tower demand pause as Broadwind’s customers wait to realize the potential incentives from the newly signed IRA, including a production tax credit extension on projects starting construction before 2025.

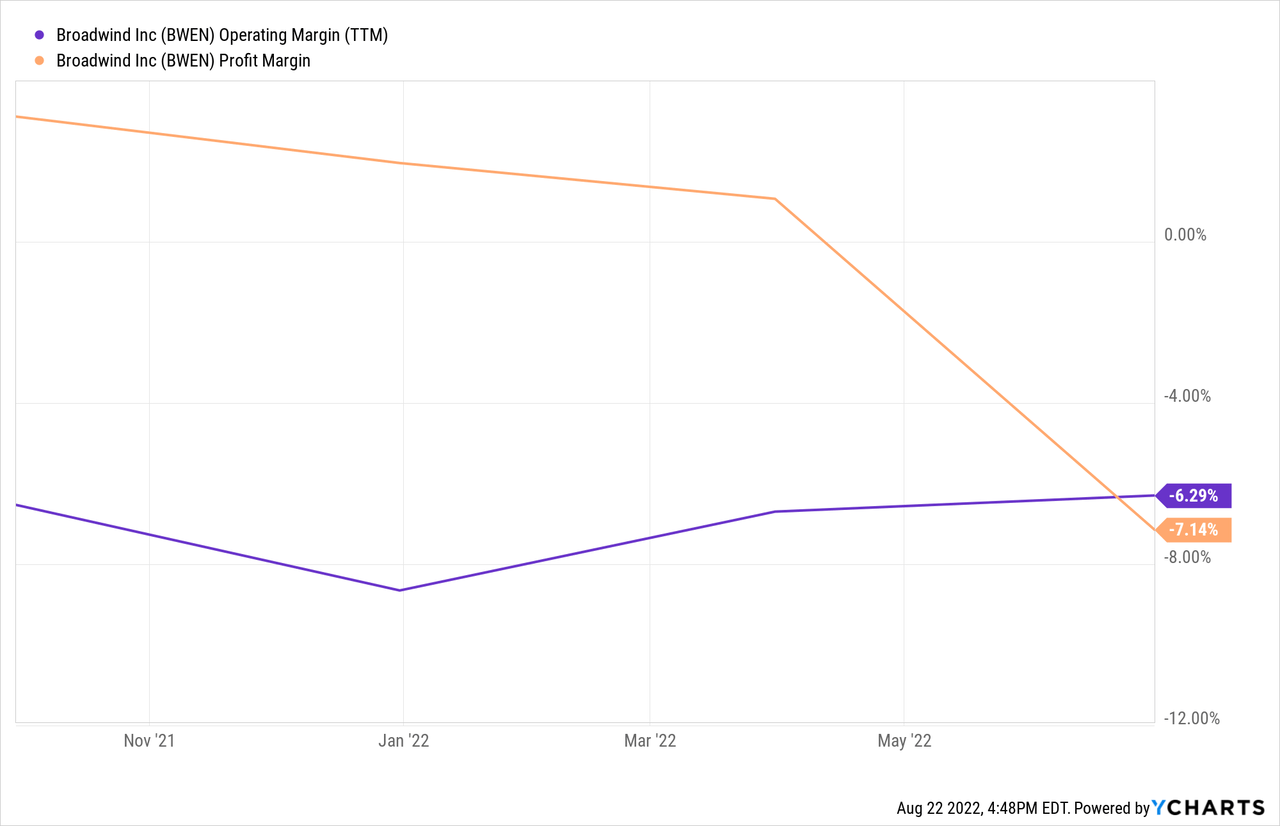

The company’s profitability appears to have taken a significant hit in 2022, with the profit margin sharply declining from 22% to a net loss of 5.4%. The comparisons are aggravated by the $12.7 million financial aid received from the government in 2021 through the Paycheck Protection Program and Employee Retention Credits. However, despite removing these items, the net income still slightly declined because of a 144% increase in net interest expense.

The profitability has improved if we exclude all these items, with the operating loss reducing 17.4% from $2.3 million to $1.9 million and Adjusted EBITDA increasing threefold from $0.1 million to 0.4 million YoY in the MRQ.

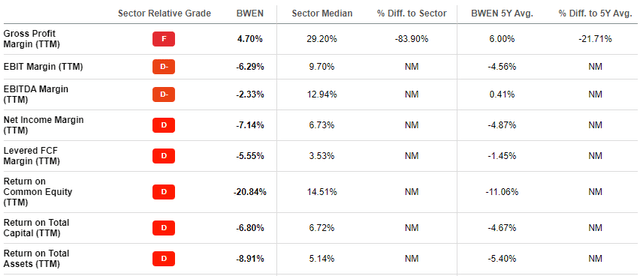

BWEN’s profitability is unimpressive compared to its peers, with its 5-year averages (which would already have accounted for the increased profitability from the government aid) showing a loss. Similarly, its TTM growth metrics are also subpar, significantly underperforming its peers, with its topline showing an over 9% YoY decline and a 5-year revenue CAGR of negative 3.6%.

Seeking Alpha

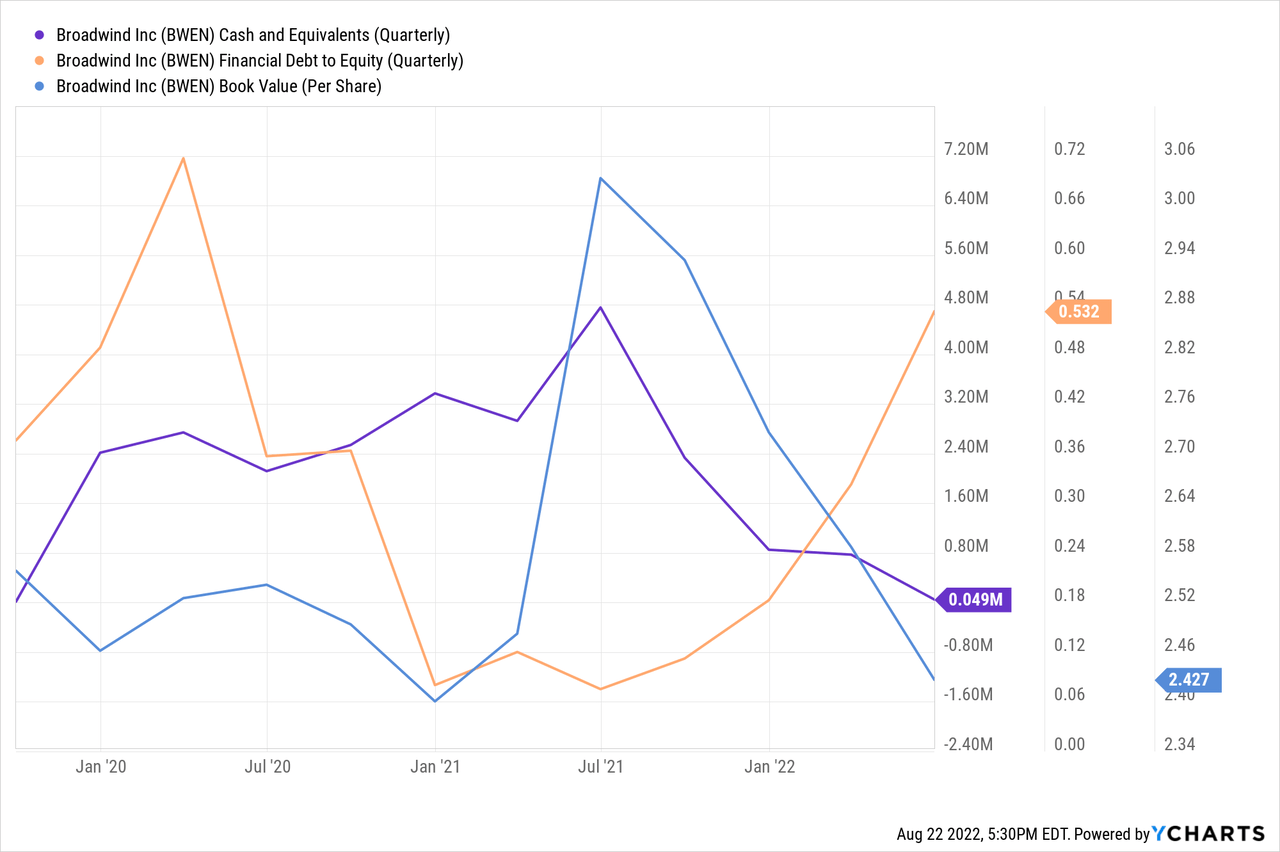

The company’s balance sheet is even more troubling, with a negative Altman Z score of 2.4x, indicating a risk of bankruptcy. Its book value has declined for 4 consecutive quarters, its debt has risen by 54% during the same period, and its liquidity is severely compromised with mere $49 thousand in cash. BWEN recently entered into a new credit agreement with Wells Fargo to address its liquidity issues, but its balance sheet remains weak.

The company is expected to significantly benefit from the IRA as the demand for clean energy components rises. Still, the benefits from this demand will likely be realized by the end of next year. Notably, the economy is expected to go through a recession, which will likely significantly affect customer spending and commitments, especially affecting cyclical stocks and possibly wiping out a portion of order books.

Valuation

The company’s revenue and book value show that the stock is undervalued relative to its peers despite the recent upsurge. Still, it appears overpriced relative to its 5-year average. The historic discounted valuation relative to the sector likely reflects the company’s low market cap, high liquidity, and debt risk.

Seeking Alpha

The company also has had negative cash flows for over a year, with a negative TTM FCF margin since Q1 2021 and negative FCF per share since Q3 2021, leading to a debt to FCF ratio of almost negative 9, indicating a significant solvency risk, which is significantly elevated under the threat of an upcoming recession.

The current valuation may have had a different risk-reward effect if the benefits from the IRA were expected anytime soon, but since the lead time to realize the upside is over a year away, the risks underpinning the stock are too high to be seduced by the apparent discount.

Conclusion

Investing in clean energy stocks is a great way to leverage the recent systemic progress, which has upsurged the industry stocks. The benefits from the IRA amid the switch toward alternative and renewable energy sources are extremely favorable, especially for long-term stockholders.

However, given the macroeconomic uncertainty, investors would benefit from investing in stable stocks with positive outlooks that can properly leverage the systemic rewards. Unfortunately, Broadwind seems to be navigating turbulent waters right now, and investors would be undertaking a highly volatile and risky voyage by investing in the company.

If the company successfully navigates these waters, I expect to see some topline growth by the end of 2023 due to the new market opportunities, resulting in positive future price action. Until then, the risks of this micro-cap stock far outweigh the rewards.

The company may be worth having a second look by the end of next year, but investors should make the best of the current price surge to exit their positions and cash in their profits, investing their funds elsewhere with a better risk-reward mix.

Be the first to comment