Robert Way

Finding dominant market-leading companies that offer substantial value and significant growth potential at reasonable valuations has not been easy lately. However, when considering a company to own for the next five to ten years, one name stands out above the rest, Alibaba (NYSE:BABA). I know Alibaba is a Chinese company. Currently, Chinese stocks are out of favor and are perceived as higher-risk investments. However, I cannot ignore how cheap Alibaba has become. While there is increased risk, there is also substantial reward potential. Investing would be easy if we knew where Alibaba’s stock would be in five to ten years. However, Investing is complex, and the truth is that Alibaba could be at $500, or its stock may not be listed on U.S. stock exchanges several years from now. Nevertheless, delisting fears appear exaggerated, and Alibaba has become remarkably cheap considering its potential. Therefore, the company’s stock could go much higher as it returns to growth, illustrating that it offers significant value to investors and uncertainties fade.

The Value Is There, And It’s Remarkable

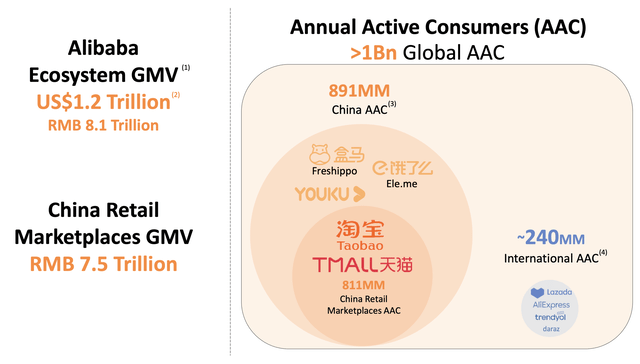

Alibaba’s ecosystem brought in a staggering $1.2 trillion gross merchandise value (“GMV”) in fiscal 2021. Additionally, the company reported more than a billion annual active consumers (“AACs”) in fiscal 2021.

Alibaba GMV (alibabagroup.com )

In comparison, Amazon (AMZN) reported a GMV of $600 billion in 2021. This metric illustrates that the value of goods sold in 2021 (fiscal 2021 for Alibaba) was roughly double on Alibaba’s platforms vs. Amazon’s.

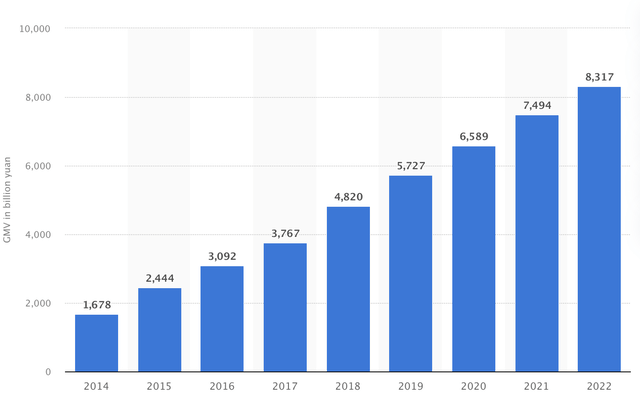

Alibaba GMV – Billions of Yuan (fiscal)

We see the significant GMV growth continuing through fiscal 2022, implying that the company can continue expanding GMV and revenues as it advances. Moreover, as Alibaba’s operations and revenues grow, it should become increasingly more profitable in the coming years.

Valuation – Alibaba Vs. Amazon

We discussed that Alibaba’s GMV essentially doubled Amazon’s in 2021. Despite this sales dynamic, Alibaba is valued at about $237 billion, while Amazon’s market cap is around $1.4 trillion. Therefore, we see a massive disconnect in valuations here, as Alibaba’s GMV was double Amazon’s, but Amazon’s market cap is nearly six times higher than Alibaba’s. Going by this GMV to market cap valuation, we see that Amazon is valued at around 12 x Alibaba now. Looking at other valuation metrics, we see that Alibaba is dramatically undervalued.

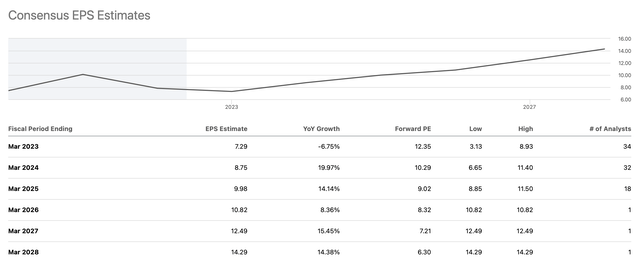

EPS Estimates

EPS Estimates (SeekingAlpha.com )

We see that Alibaba is in a transitory phase of EPS decline. This year’s EPS should come in at about $7.30, roughly a 7% YoY decline. We must consider that temporary earnings declines are typically the best periods to pick up company shares on the cheap, at a deep discount. Alibaba’s share price is down by 72% from its all-time highs. As of writing this article, Alibaba is at about $90, putting its P/E ratio at just 12.3 times this year’s consensus EPS estimates. However, we should see growth, and the company’s substantial EPS potential makes this stock very cheap.

Also, we must consider that during an earnings decline phase, EPS estimates typically get brought down considerably, often by too much, overshooting on the downside. Therefore, there is a high probability that Alibaba can surpass current depressed EPS estimates and could report towards the higher end of the estimated fingers in future years. While consensus estimates are for about $10 for fiscal 2025, I believe Alibaba could report EPS closer to $12. Considering Alibaba’s current stock price, the company may be trading at just 7.5 times forward (fiscal 2025) earnings now.

Growth Will Return

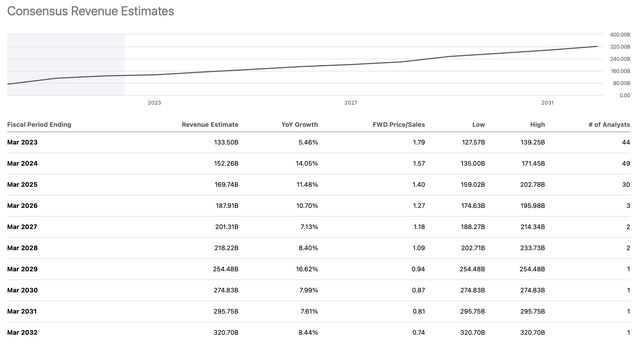

Revenue Estimates

Revenue estimates (SeekingAlpha.com )

Despite the slowdown to around 5-6% YoY revenue growth this year, sales growth should rebound to double-digits as the company advances. Consensus revenue estimates point to approximately $200 billion in fiscal 2027, but this figure may be lowballing Alibaba’s potential. I suspect Alibaba’s sales could hit about $230 billion in 2027, and the company may register approximately $300 billion in revenues by 2030.

The Downside Is Limited

The downside is probably quite limited now because of the negativity that’s been priced into Alibaba over the last two years. We’ve seen massive fines, government crackdowns, Ant IPO controversy, tensions between Jack Ma and Beijing, hedge fund blowups, a slowdown in China’s economy, geopolitical pressures, and more. Alibaba’s market cap has dwindled from nearly $1 trillion to only $237 billion. The company’s P/E valuation has crashed from around 30 to just 12. Therefore, unless something unexpected and considerable transpires (black Swan event), the downside is probably limited now. And still, one uncertainty lurks in the minds of many market participants. Will Alibaba’s stock get delisted?

The Probability Of Delisting Appears Low

Investing is a risk, in any case. We don’t know if a company will report strong earnings, continue growing, or possibly go bankrupt much of the time. However, a recent phenomenon to grip markets is the fear of investing in Chinese stocks. Many Chinese companies were Wall St. darlings in the early and mid-2000s. Alibaba even posted the largest IPO in history for its time, raising a whopping $25 billion. However, much has changed in several years. Investors are no longer clamoring to get into Alibaba. They are running for the doors. So, what has changed?

Chinese Stocks: Out Of Favor – For Now

We’ve seen a worsening in relations between the U.S. and China, economically, geopolitically, and generally. There have been questions regarding the accounting standards used in China. That is why the SEC recently put Alibaba on its HFCAA list. Being put on the SEC’s HFCAA means that if the Chinese government does not permit American regulators to inspect the company’s books within three years, its stock could be delisted from U.S. exchanges. It’s fair to mention that essentially all Chinese companies are on the SEC’s HFCAA list now. So, will all Chinese companies, including Alibaba, be delisted from U.S. stock exchanges? I believe not.

The debate over Chinese auditing firms has gone on for a long time. However, if more than $1 trillion worth of Chinese stocks get delisted from U.S. exchanges, Beijing has a lot to lose. Such a development would set the Chinese economy back many years, possibly leading to increased economic hardship and civil unrest amongst the general population in China. Perhaps the greatest fear of an authoritarian government is public unrest. Therefore, the Chinese government will probably do all it can to keep Chinese shares listed in the U.S., as this dynamic benefits China’s economy. China has recently removed a key hurdle to granting full access to auditors. The Chinese government will probably do more to resolve the auditing issues as we advance.

Additionally, it is not in the U.S.’s interests to boot Chinese companies from its markets, as it would further erode relations. The U.S. and China are tremendous trading partners, with the U.S. importing far more than it exports to China. The U.S. exports roughly $11 billion of goods each month to China while importing $40-50 billion. Last year, the U.S.’s trade deficit with China was more than $350 billion. At the current pace, this year’s trade deficit with China should be about $400 billion. China is one of the U.S.’s biggest trading partners and the U.S. imports more goods from China than from anyone (more than $500 billion in 2021). The U.S. benefits significantly from its trading relationship with China and is likelier to repair relations than ruin them over accounting concerns.

Bottom Line: Where Alibaba Could Be In Several Years

Let’s put aside the delisting fears. Also, we should consider that much of the bad news is behind Alibaba and that brighter days are ahead. Moreover, current earnings and EPS estimates are probably around the bottom. Furthermore, Alibaba should return to growth and could achieve more robust revenue and EPS growth than most estimates are suggesting now. Therefore, we could see Alibaba’s stock move a lot higher.

Here’s where I see shares heading in the long run:

| Year (fiscal) | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue (Billions) | $135 | $158 | $182 | $205 | $230 | $255 | $280 | $305 |

| Revenue growth | 6.6% | 17% | 15% | 13% | 12% | 11% | 10% | 9% |

| EPS | $7.50 | $9.50 | $12 | $14.40 | $17 | $20 | $23.50 | $28 |

| P/E ratio | 12 | 14 | 16 | 18 | 20 | 20 | 19 | 18 |

| Stock price | $90 | $133 | $192 | $260 | $340 | $400 | $447 | $504 |

Source: The Financial Prophet

Provided the depressed atmosphere surrounding Alibaba, current estimates may be on the low end of the spectrum. Therefore, Alibaba may achieve analysts’ higher-end revenue and EPS projections. Also, I am incorporating a gradual increase in Alibaba’s P/E multiple. The company commanded a P/E ratio of 20-30 or higher in previous years. It may return to 20 (or higher) in the coming years as the uncertainty fades and the company returns to growth and increases profitability. Provided Alibaba achieves these estimates, its stock price could reach $500 by 2030 or sooner.

Risks For Alibaba

While I’m bullish on Alibaba, various factors could occur that may derail my bullish thesis for the company. For instance, the CCP could resume its tough stance and clamp down further on Alibaba and other Chinese tech giants. Moreover, despite the optimistic tone from Chinese authorities, U.S. regulators could still decide to delist Alibaba. Increased competition could impact Alibaba’s growth and profits. The company’s growth could be worse than my current anticipation. Also, Alibaba’s profitability could continue to struggle for various reasons. This investment has numerous risks, and shares are very cheap right now. I believe Alibaba remains an elevated risk/high reward investment, and investors should carefully examine the risks before opening a position in Alibaba stock.

Be the first to comment