grandriver

Laredo Petroleum, Inc. (NYSE:LPI) is an independent exploration and production company operating primarily in the Permian Basin of West Texas. The name of this basin should be quite familiar to many of my regular readers as it has been the focal point of America’s shale oil boom and has long been the most prolific hydrocarbon-producing basin in the United States.

The energy industry in general has been one of the few bright spots in the choppy markets that we have been seeing lately, due largely to the surge that we have seen in both crude oil and natural gas prices over the past eighteen months. Laredo Petroleum has not been an exception to this as the stock is up a tremendous 71.81% over the past year. As is the case with most companies in the energy industry, there are some signs that Laredo may still be very undervalued. As such, the best may still be yet to come. This attractive valuation does not mean that the company is without risks, however, but it is working on addressing the few problems that it has and there may be some reasons to believe that it will still prove to be a very good investment today.

About Laredo Petroleum

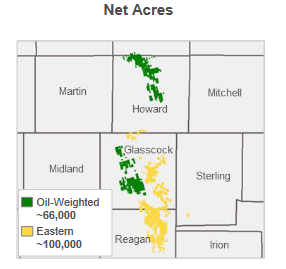

As stated in the introduction, Laredo Petroleum is an independent exploration and production company that operates primarily in the Permian Basin of West Texas. The company currently controls approximately 166,000 net acres in Howard, Glascock, and Reagan Counties, which are all in the western part of the state:

Laredo Petroleum

The Permian Basin has long been the focal point of America’s shale oil boom for a very good reason. It is one of the most hydrocarbon-rich regions of the world. Although the region has been in continuous production since 1924, the United States Energy Information Administration (“EIA”) estimates that it still contains proven reserves of five billion barrels of crude oil and nineteen trillion cubic feet of natural gas. It is worth noting that this estimate is at the prevailing price of both commodities in 2018. As proven reserves only consist of that crude oil and natural gas that can be economically extracted at a given price level, we can assume that the basin’s proven reserves are much higher now considering today’s higher prices.

The enormous reserves present in the Permian Basin is reflected in Laredo Petroleum’s own reserves. Investors frequently overlook a company’s reserves when making their investment decisions but they are critically important. This is because the energy industry is by its very nature an extractive one. Laredo Petroleum literally obtains the oil and natural gas that it sells by pulling the resources out of reservoirs in the ground. As these reservoirs only contain a finite supply of resources, the company must continually discover or otherwise acquire new sources of resources or it will eventually run out of products to sell. As the company’s success at accomplishing this is by no means guaranteed, its reserves dictate how long it can continue to produce before it runs out of resources. As of December 31, 2021, Laredo Petroleum has proven reserves of 315.640 million barrels of oil equivalents. In the second quarter of 2022, Laredo Petroleum produced an average of 87,032 barrels of oil equivalent per day, so its reserves are sufficient to produce for a little less than ten years. This is not a bad figure, although it is less than what some other independents possess. It is reasonably in line with most of the major energy companies, however.

One of the nice things about Laredo Petroleum is that the company’s production is almost perfectly split between crude oil and natural gas. The reason that this is nice to see is that the fundamentals of these two products are very different. In fact, the fundamentals for natural gas are much stronger, as we will see later in this article. This is a far cry from a few years ago when natural gas was considered to be a waste product so it was frequently flared off. We can see this somewhat in the fact that natural gas has seen its price increase much more than crude oil.

Over the past twelve months, West Texas Intermediate crude oil has risen 45.41%, but natural gas at Henry Hub is up a whopping 151.43%. Admittedly, some of the price increase in natural gas is due to the European energy crisis but there are reasons to expect that natural gas prices will continue to remain elevated going forward. This certainly showed in Laredo Petroleum’s second quarter 2022 earnings results as the company’s revenues increased by 90.6% and its net income swung to a profit relative to the year-ago quarter. This has allowed the generate to generate a significant amount of free cash flow. In the second quarter, Laredo Petroleum achieved a levered free cash flow of $152.7 million, which was a record for the company:

| Q2 2022 | Q1 2022 | Q4 2021 | Q3 2021 | Q2 2021 | Q1 2021 | Q4 2020 | Q3 2020 | Q2 2020 | |

| Levered Free Cash Flow | 152.7 | 77.6 | (143.3) | (587.5) | 53.8 | 18.1 | 44.0 | 55.4 | (27.7) |

(all figures in millions of U.S. dollars)

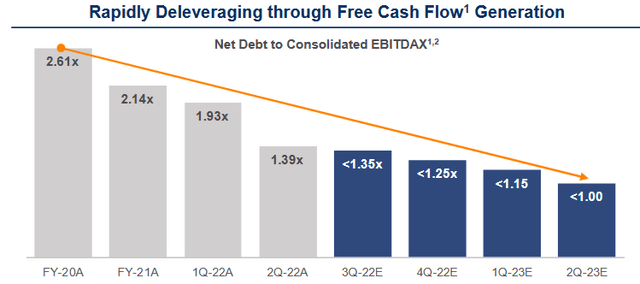

This is very nice to see because ultimately it is free cash flow that allows the company to reward its shareholders. That is because this is the money that is generated by the company’s ordinary operations after it pays all its bills and makes all necessary capital expenditures. This is, therefore, the money that can be used to pay down debt, repurchase stock, or pay a dividend. Laredo Petroleum is opting to pay down debt, although it also instituted a share buyback program in the most recent quarter. We can see this by looking at the company’s leverage ratio, which is also known as the net debt-to-consolidated EBITDAX ratio. This ratio essentially tells us how long it would take the company to completely pay off its debt were it to devote all its pre-tax cash flow to that task. At the end of 2020, Laredo Petroleum’s leverage ratio stood at 2.7x but it has since managed to reduce it significantly. As of the end of the second quarter of 2022, this ratio stood at 1.39x and it expects to have it down to less than 1.0x by the end of the second quarter of 2023:

This is unfortunately one of the biggest risks to the company, particularly as energy prices have declined over the past few weeks and the economy heads into a recession. Unfortunately, a recession could indeed cause resource prices to be lower for the duration of the event. This could cause the company’s free cash flow to come in much lower than the firm expects. Although Laredo Petroleum has made significant progress at improving its leverage, it remains much higher than many peers that have already gotten leverage below 1.0x. This situation could very easily result in Laredo Petroleum being quite a bit riskier than some of its peers should the recession result in significant declines in energy prices for any extended period of time.

Last week, Northern Oil and Gas (NOG) said that it has agreed to acquire about 1,650 net acres of land from Laredo Petroleum for $110 million. At this time, this acreage is not producing, although Laredo Petroleum state that it will begin producing in the near future and should be producing an average of 1,800 barrels of oil equivalents per day by the end of 2023. Unfortunately, that is all that we know about this transaction at this time. It seems likely that this will result in Laredo Petroleum having a lower free cash flow and EBITDAX than it projected in the earnings report because the company’s production will be lower than expected. This could make the company’s debt concerns that were just discussed worse. However, Laredo Petroleum could also use the $110 million to pay off some of its debt and more than offset this problem. At this time, the exact impact on Laredo Petroleum is unknown because it depends on how the company uses the money. An update will be provided in a later article as more information about this transaction becomes available.

Fundamentals Of Crude Oil And Natural Gas

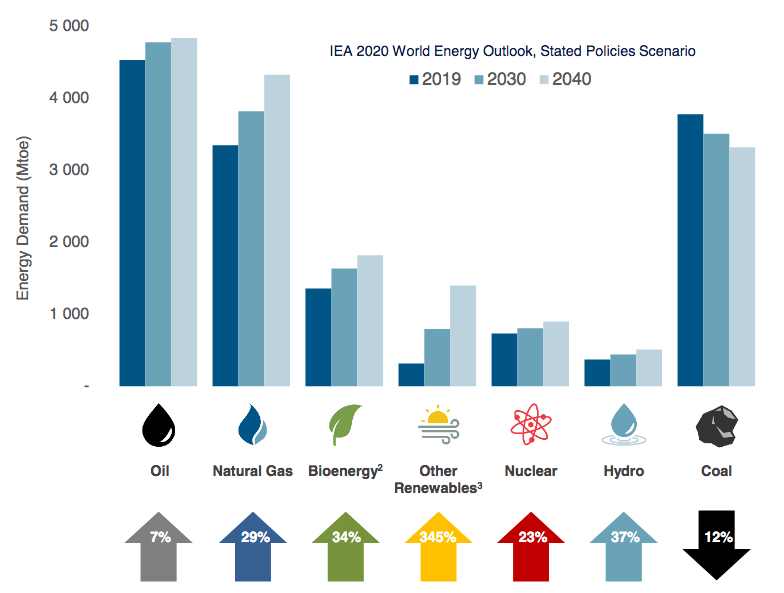

As stated in the introduction, the fundamentals of both crude oil and natural gas are quite strong, although natural gas is significantly stronger. This benefits Laredo Petroleum because the company produces an almost perfectly balanced mixture of crude oil and natural gas. The fact that these resources have strong fundamentals and growing demand is likely to be surprising to some readers because of the fact that numerous governments in both Europe and the United States have been devoting a great deal of effort to reducing the carbon emissions and consumption of fossil fuels within their borders. However, according to the International Energy Agency, the global demand for natural gas will increase by 29% and the global demand for crude oil will increase by 7% over the next twenty years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

The demand growth for natural gas will be driven by the international concerns about climate change. As everyone reading this is likely well aware, these concerns have caused governments all over the world to impose a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective nations. One of the most common strategies being used to accomplish this is to encourage utilities to retire old coal-fired power plants in favor of renewables. However, renewables are not reliable enough to handle the needs of modern society. After all, solar power does not work when the sun is not shining and wind power does not work when the air is still. The common solution to this problem is to supplement renewables with natural gas turbines. This is because natural gas does enjoy the reliability that we expect from the grid but burns cleaner than any other fossil fuel. This is the reason why natural gas is often called a “transitional fuel” since it will help us reduce carbon emissions and ensure the functioning of modern society while we wait for needed advancements in renewable technology.

The case for crude oil demand growth is likely harder to understand given the trends that we are seeing in the Western nations. However, the trends that we see in emerging markets are very different. These nations are expected to see tremendous economic growth over the projection period. This economic growth will have the effect of lifting the citizens of these nations out of poverty and putting them firmly into the middle class. These newly middle-class people will naturally begin to desire a lifestyle that is much closer to what their counterparts in the developed nations enjoy than what they have now. This will result in growing consumption of energy, including energy that is derived from crude oil. As the populations of these nations are substantially larger than the populations of the developed nations, the growing consumption of crude oil here will more than offset the stagnant-to-declining demand of the world’s developed nations.

It appears somewhat unlikely that the production of crude oil and natural gas will increasingly by enough to satisfy this growing demand. One reason for this is that the energy industry has been chronically underinvesting in capacity since crude oil prices collapsed back in 2014, giving way to the bear market that we saw in 2015. This is one reason that the offshore drilling industry never recovered from that event. Indeed, Moody’s recently stated that upstream spending needed to be immediately increased by $542 billion, or 54%, annually in order to avoid a supply shock. In addition to this, midstream capital spending must be significantly increased in order to transport the incremental resources to the market. It seems highly unlikely that the energy industry will increase spending to this degree. After all, it is currently under tremendous pressure by environmental activists and politicians to improve the sustainability of its operations. In addition, investors are demanding higher returns as the energy industry has generally lagged every other sector over the past decade. Thus, we have a situation in which supply growth is likely to lag demand growth and according to economic law, this situation should cause prices to increase. Of course, high energy prices will be quite beneficial to Laredo Petroleum due to it receiving higher prices for its products, although we may decry them as consumers.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of Laredo Petroleum, we can see that it is severely undervalued by looking at its forward price-to-earnings ratio. This ratio essentially tells us how much we will have to pay today for each dollar of earnings that the company will generate over the next year.

According to Zacks Investment Research, Laredo Petroleum has a forward price-to-earnings ratio of 2.79 at the current price. This is incredibly low in today’s market, as most companies have double-digit ratios. However, as I have pointed out before, pretty much everything in the traditional energy industry is incredibly undervalued today. Thus, it may make sense to compare Laredo Petroleum to some of its peers in order to determine which company offers the most attractive relative valuation:

| Company | Forward P/E |

| Laredo Petroleum | 2.79 |

| Continental Resources (CLR) | 5.80 |

| Diamondback Energy (FANG) | 5.01 |

| Devon Energy (DVN) | 7.52 |

| Matador Resources (MTDR) | 5.45 |

(all data sourced from Zacks Investment Research)

As just stated, pretty much every company on this list appears to be incredibly cheap. However, Laredo Petroleum stands out as a clear outlier since it is substantially cheaper than any of its peers. This may admittedly be due to the risks imparted by its debt load. This could also create a very real opportunity, particularly if energy prices do indeed remain high and the company achieves its goal of reducing its leverage down to be inline with its peers by the second quarter of next year. Overall, the company may be worth considering at these levels.

Conclusion

In conclusion, Laredo Petroleum is a relatively small independent exploration and production company that appears to offer significant potential for investment at the current levels. In particular, the company’s valuation should not be ignored. However, it might be riskier than some of its peers due to its debt, but if energy prices remain high then this will not be a problem for very long. That will likely be the case over the long term, but a recession could certainly slow down the firm’s goals. Overall, though, it might be worth considering at the current stock price.

Be the first to comment