PM Images

Introduction

Broadcom’s (NASDAQ:AVGO) performance in recent years has been nothing short of spectacular, with capital growth outperforming the market almost every year. The stock has averaged double-digit annual growth over the past decade, which is very impressive, given that it has also paid dividends with a payout ratio, that has increased in recent years.

With the stock currently -30% below its all-time high, it may be time to consider adding Broadcom to your watch list.

Broadcom is an American developer, designer, manufacturer and global supplier of a range of semiconductor and software products. The company’s products serve a wide range of customers in the data center, networking, broadband, storage and industrial markets.

The company has been an aggressive acquirer of companies, with notable acquisitions such as the purchase of CA Technologies for $18.9 billion in 2019 and the expected purchase of VMware for $61 billion this year being the largest.

Fundamentals

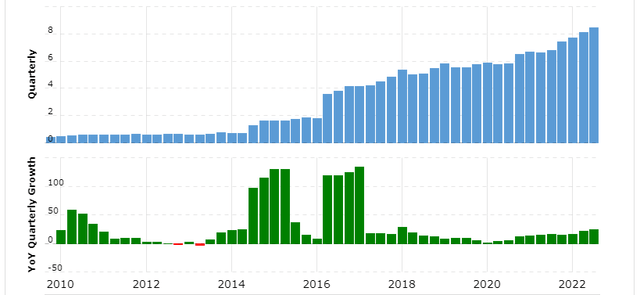

Broadcom’s revenue has grown at a rapid pace. This is largely due to acquisitions. A few have been very large compared to Broadcom itself, when they were acquired, which is clearly reflected in the sudden increase in revenue. Others were smaller with no immediate effect on revenue.

Since the company operates in an industry that is growing organically, I think it’s fair to assume, that growth will continue. However, I suspect the acquisitions will slow down, as the company eventually matures. Continuing to find suitable businesses to acquire will only become harder to do, as Broadcom continues to grow larger.

The most recent example of this would be the failed attempt at its proposed deal to buy Qualcomm, which was shut down by the former president.

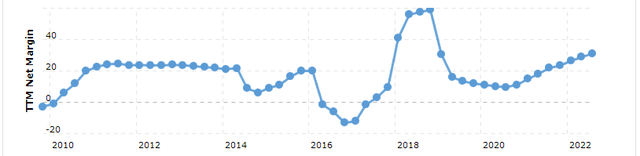

With a rapidly growing top line it is impressive to see, how stable the net profit margin has been. Excluding the 2018 volatility which was due to a non-recurring event, the margin has barely fluctuated. It has actually been increasing in recent years, which underlines the strength of the company and its moat.

The rapidly growing top line combined with a stable net profit margin has produced large amounts of cash at a rapid pace. The cash has primarily been used to buy other companies. The rest of the cash went to a mix of share buybacks and dividend payments, with dividend payments currently accounting for ~50% of earnings. The dividend payout ratio has gone from 20% in 2012 to 50% today.

I think the increasing dividend payout ratio is a sign of the company slowly maturing. As mentioned above, it has become increasingly difficult to find companies for Broadcom to acquire.

However, a higher payout percentage will mean that growth will most likely slowdown in the future, which is something to keep in mind.

Valuation

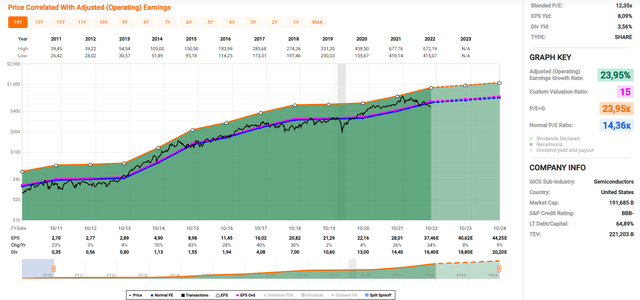

As with a majority of consistently growing companies, a 15- earnings multiple seems reasonable for a fair valuation. This has certainly been the case with Broadcom, which has averaged a multiple of 14.36. The correlation with the 15- earnings multiple has been close with only minor volatility having occurred.

Growth has averaged 24%, but has slowed in recent years. Given that recent years’ growth may have been temporarily boosted due to Covid, which could be seen in the sudden increase in the net profit margin, I would not expect similar growth to continue going forward. This assumption is in line with analysts predicting, that annual EPS growth will be in the high single digits in the near future.

A return to its average earnings multiple of 14.36 would indicate capital gains of ~22%.

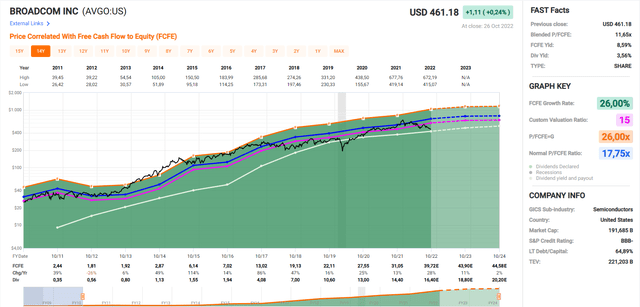

Free cash flow is in line with operating earnings, suggesting that the stock may be undervalued. The stock is again seen trading below its average free cash flow multiple of 17.75. While it would make sense for the market to value the company at a lower multiple to compensate for lower growth, an FCF multiple of 11.6 seems too low.

As seen in the picture below, the dividend is well covered by earnings. The dividend payout ratio has been increasing since dividends were first paid in 2011, and as more of earnings go to dividends, it will slow down future EPS growth.

The current yield of 3.56% is well supported by free cash flow and is unlikely to be reduced. The company will most likely maintain a minimum dividend payout ratio of 50%, meaning that future dividend growth will match the growth in EPS. Double-digit dividend increases can therefore be expected.

Stock Chart

Quick disclaimer: A technical analysis in itself is not a good enough reason to buy a stock but combined with the company’s fundamentals, it can greatly narrow your price target range when you buy.

Since the current Broadcom company is fairly new, we only have a decade of stock chart data available. This means that the 200- moving average has not been formed yet, so only the 50- moving average is available. This multiple has only been touched once. Broadcom’s share price has grown at such a fast pace and at a pace with little volatility, that the moving average has not been used much.

Should it touch the moving average again, which I don’t think is unlikely given the current market weakness, strong support like in 2020 should be expected. I would then consider it very undervalued based on fundamentals and in an area with a high probability of finding support.

Final Thoughts

Broadcom is a great company to own. Fundamentals appear to be stable with a consistent net profit margin and a rapidly growing top line. The company has primarily been reinvesting by pursuing acquisitions, which will eventually slow down. The fact that the payout ratio has increased to 50% is probably due to a lack of better alternatives. Given the low valuation of an earnings multiple of just 12, the money spent on the dividend yields a decent return.

The stock chart in combination with the low multiples provides a good margin of safety at current valuations. With a 3.56% dividend yield, low double-digit growth prospects in the long term, and a good margin of safety at current valuations, I think Broadcom is worth considering.

Be the first to comment