miss_j/iStock via Getty Images

Introduction

We review recent developments on British American Tobacco PLC (NYSE:NYSE:BTI) (referred here as “BAT”) after shares have continued to stagnate in USD over the past few months and remained 13% lower than their peak in February:

|

BAT American Depository Receipt Share Price (Last 1 Year)  Source: Google Finance (12-Sep-22). |

We originally upgraded our rating on BAT to Buy in March 2020. Since then, shares have gained 58% (in GBP, including dividends) in just under 2.5 years.

Our BAT investment case is broadly on track, though the picture has become cloudier since H1 2022. Combustibles volume has weakened significantly in BAT’s core U.S. market. In New Categories, BAT has made real progress in Vapour, but the business faces increasing risks from multiple directions. BAT remains significantly behind in Heat Not Burn and U.S. Modern Oral, while Philip Morris (PM) may become a significant competitor in the U.S. BAT remains mostly a bet on the status quo in the U.S. cigarettes market. Shares are currently at a 10.6x P/E and a 6.2% Dividend Yield. Our forecasts indicate a total return of 47% (13.9% annualized) by 2025 year-end. Buy.

British American Tobacco Buy Case Recap

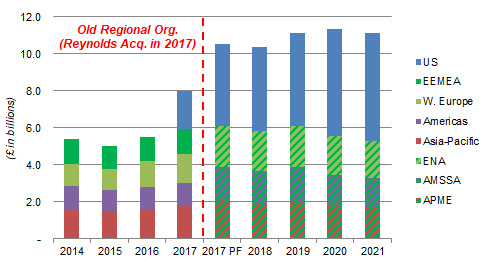

BAT is a global tobacco company, but relies on the U.S. market for half of its segmental Profit from Operations (“PfO”, equivalent to EBIT) and most of its PfO growth; non-U.S. PfO was roughly flat in 2017-19 and fell in 2020 and 2021:

|

BAT Profit from Operations by Region (2014-2021)  Source: BAT company filings. Key: EEMEA = Eastern Europe, Middle East & Africa; ENA = Europe & North Africa; AMSSA = Americas & Sub-Saharan Africa; APME = Asia-Pacific & Middle East. |

Our investment case on BAT is based on the following:

- A broadly stable U.S. cigarette business, where Vapour is the main threat but with only moderate growth (led by BAT)

- Mostly stable non-U.S. cigarette markets, with disruption by IQOS Heated Tobacco having only limited impact on group earnings

- A mid-single-digit ex-currency EPS CAGR over time, thanks to broadly stable cigarette revenues, expanding margins and buybacks, but limited by BAT’s poor performance in New Categories in most markets

- A long-term P/E multiple of 10x, implying a Dividend Yield of 6.5%

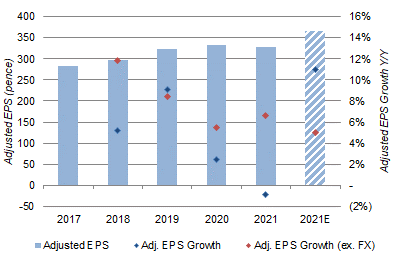

COVID-19 was an overall positive for BAT, as the boost to tobacco consumption in Developed Markets (approx. 75% of BAT revenues) more than offset the hit to that in Emerging Markets (approx. 25%). BAT achieve ex-currency Adjusted EPS growth of 5.5% in 2020 and 6.6% in 2021, and is guiding to one of mid-single-digits in 2022:

|

BAT Adjusted EPS & EPS Growth (2017-22E)  Source: BAT company filings. NB. 2022E guided to mid-single-digit EPS growth ex-FX and 6% FX tailwind for EPS. |

Despite the seemingly similar EPS growth in 2022, the picture has become cloudier this year.

H1 2022 Results Headlines

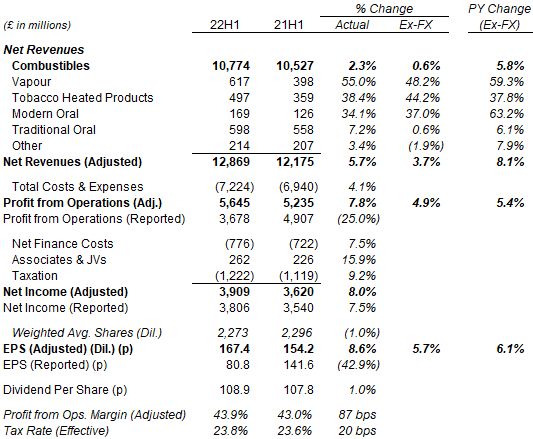

Superficially, detailed H1 2022 results released on July 27 showed the same mid-single-digit (5.7%) ex-currency Adjusted EPS growth that was confirmed by the “pre-close update” on June 9; for U.K. investors, including currency tailwinds, Adjusted EPS grew 8.6% year-on-year:

|

BAT Profit & Loss (H1 2022 vs. Prior Year)  Source: BAT results release (H1 2022). |

Looking more closely, Combustibles revenue growth had decelerated to 0.6% (ex-currency) year-on-year in H1 2022, compared to 5.8% the year before. Combustibles clearly contributed much less to PfO growth.

Instead, PfO growth was largely driven by a small loss in New Categories. Management stated that these were reduced by £281m at constant rates year-on-year, a larger figure than group (ex-currency) PfO growth of £257m (4.9%). This implies that Combustibles PfO actually fell year-on-year at constant rates.

Management stated that the £281m figure represented “more than a 50% reduction in New Category losses”, which meant such losses were still in the hundreds of millions in H1. They further stated that “two-thirds of this profitability improvement was driven by our increasing scale and efficiencies, with one-third driven by pricing”. We are generally suspicious of profit growth from “efficiencies”, as these may simply represent cuts to discretionary spending like marketing rather than genuine profit growth.

Most worryingly, Combustibles volume has weakened significantly in BAT’s core U.S. market.

H1 2022 Results By Region

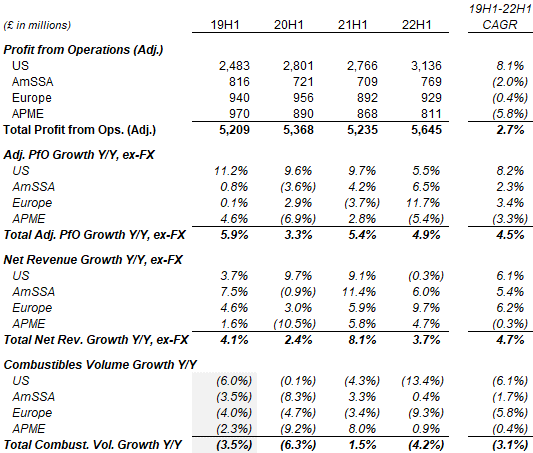

BAT’s Adjusted PfO, Net Revenues and Combustibles volumes for H1 2022 and prior years are as follows:

|

BAT Profits, Revenues & Combustibles Volume By Region  Source: BAT results release (H1 2022). NB. H1 2019 Combustible volume growth rates include both Combustibles and THP. |

The U.S. business only grew Adjusted PfO by 5.5% (ex-currency) year-on-year, a deceleration from the near-10% figures in the past three years. Total Net Revenues actually fell 0.3%, with Combustible revenues falling 3.4%, driven by Combustibles volume falling 13.4% (offset by price mix of “around 10%”). This was much worse than industry volume decline of 10%; it was also much worse than Altria’s (MO) performance, where Smokeable volume fell 8.8% and Smokeable Net Revenues rose 0.7% year-on-year in H1. (All figures are after excise duty.)

Europe grew PfO by 11.7% (ex-currency) year-on-year in H1 2022, rebounding from a 3.7% decline the year before. PfO growth was driven by total Net Revenue growth of 9.7% (£269m), mostly from Tobacco Heated Products (“THP”) growth of 87.5% (£125m) and Combustibles growth of 3.5% (£82m) (the latter despite a 9.3% volume decline). (BAT has continued to include contribution from Russia in its financials.) PfO margin expansion also helped.

APME (Asia-Pacific & Middle East) PfO fell 5.4% year-on-year in H1 2022, largely due to one-off factors. BAT was not able to book the usual accounting profit from annual excise hikes in Australia this year (the rate was left unchanged) and also sold its operations in Iran in August 2021.

AmSSA (Americas & Sub-Saharan Africa) grew PfO by 6.5% (ex-currency) year-on-year, largely thanks to the region’s Emerging Markets (especially South Africa and South America) recovering from COVID-19. Net Revenues grew 6.0%, with Combustibles volume actually up 0.4% year-on-year.

The weakness in U.S. Combustibles is particularly concerning as the region contributed 56% of BAT’s PfO and 90% (£370m out of £410m) of its year-on-year PfO growth in H1 2022.

Growing Risks in Vapour Category

Vapour is BAT’s most successful New Category, but is facing increasing risks from multiple directions.

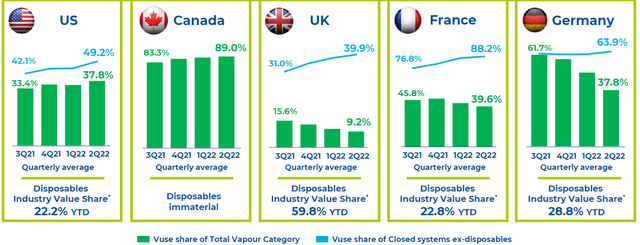

BAT has overtaken Juul in the U.S. Vapour market, and has strong market shares in closed systems sales in others:

|

BAT Vapour Market Share in Key Markets  Source: BAT results presentation (H1 2022). |

However, disposable products represent a growing threat outside the U.S. market. BAT’s Vapour market shares in the U.K. and France are much smaller and declining once disposables are also included. BAT has launched its own Vuse Go disposable product in the U.K. in May, and plans further launches; however, competition may be intensifying. For example, Philip Morris has similarly launched its VEEBA disposable product in Canada during Q2, and plans to enter other markets in the rest of 2022.

BAT’s U.S. Vapour sales are also threatened by recent defeats on patent litigation. On September 7, a jury in North Carolina found that BAT’s Vuse Alto infringed three of Altria’s patents, and ordered BAT to pay $95.2m in past damages (based on a 5.25% royalty rate) for the period up to June 30, 2022. Further, ongoing damages may be awarded in post-trial proceedings. BAT had already lost a similar case in June, when its Vuse Alto and Vuse Solo devices were found by a jury in Virginia to infringe two Philip Morris patents, and $10.7m of damages were awarded.

More fundamentally, BAT devices representing most of the group’s U.S. Vapour sales are still awaiting FDA approvals of their PMTAs (Pre-Marketing Tobacco Product Applications). Thus far BAT has only received Marketing Granted Orders on its Vuse Solo, Vibe and Circo products, which represented a small percentage of its sales, but not its key Vuse Alto products; the FDA has a record of rejecting PMTAs from even established companies, having already issued Marketing Denial Orders on products from Juul and Imperial Brands’ (OTCQX:IMBBY) myblu.

There are thus significant risks that BAT may never be able to develop Vapour into a material profitable business.

Still Behind in Heat Not Burn and Modern Oral

BAT remains far behind Philip Morris in Heat Not Burn and Swedish Match in U.S. Modern Oral.

In Heat Not Burn, Philip Morris’ global H1 volume was 4.5x the size of BAT’s (49.6bn sticks vs. 11.0bn), and its total Net Revenues was nearly 8x the size of BAT’s ($4.62bn vs. £497m). PM’s IQOS remained dominant in each market, for example with 22.9% of the nicotine market in Japan when the whole Heat Not Burn category was at just a third.

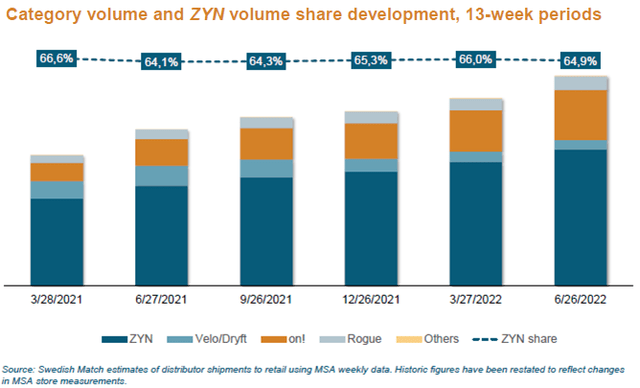

In U.S. Modern Oral, Swedish Match (OTCPK:SWMAY) (currently under a Board-recommended tender offer from PM) had a dominant 64.9% volume share in Q2 2022, while BAT’s Velo/Dryft was at a distant #4 and falling further behind:

|

U.S. Nicotine Pouches Volume & Market Share (Since Q1 2021)  Source: Swedish Match results presentation (Q2 2022). |

BAT is ahead of Swedish Match in Modern Oral in the Nordic. However, the Nordic is a much smaller market and BAT’s lead there paled in significance to its U.S. weakness. (In H1 2022, BAT had total oral tobacco sales of £171m in Europe, less than half of Swedish Match’s total smokefree sales of $456m in the U.S.)

Philip Morris As Potential U.S. Competitor

Philip Morris may become a significant competitor to BAT in the latter’s core U.S. market.

PM management has been vocal about their attraction to the U.S. market, and the pending Swedish Match acquisition would provide PM with a platform to directly sell all of its Reduced Risk Products (including IQOS Heat Not Burn, VEEV Vapour and VEEBA disposable Vapour) there eventually.

In any case, PM continues to expect to resume supply of IQOS products to the U.S. in H1 2023. PM’s CFO also reiterated their view of IQOS’ potential in the U.S. at an investor conference last week:

There is no reason why IQOS is not going to be as successful in Americas as globally … With the U.S., let’s be clear, I think that the U.S. has a fantastic opportunity, but so far we probably do not see the kind of effort drive an impact that is needed to be successful in the U.S.”

Emmanuel Babeau, PM CFO (Barclays conference, September 6)

PM also seems to have hardened its position against Altria in their ongoing license negotiations, as Babeau chose to describe their current agreement as “no longer implementable”:

The fact is that with the ITC decision, the agreement was no longer implementable because there was a number of things in the agreements that were planned … therefore we are today in discussion with Altria to see whether we can, in an amicable manner find an agreement on what the future of IQOS is going to be in the U.S.”

Whatever PM and Altria end up agreeing on, it seems highly likely that IQOS will be marketed much more actively in the U.S. in 2023, potentially threatening BAT’s largest market.

Why British American Tobacco is A Buy

With all the negatives listed for BAT above, why do we sill rate it as a Buy?

We like BAT as a bet on the status quo in the U.S. cigarettes market and a “value” opportunity. With a trailing P/E of just 10.6x and a Dividend Yield of 6.2%, we believe investors can achieve a low-teens annualized return even on undemanding earnings and valuation assumptions.

Valuation: BAT Dividend Yield is 6.2%

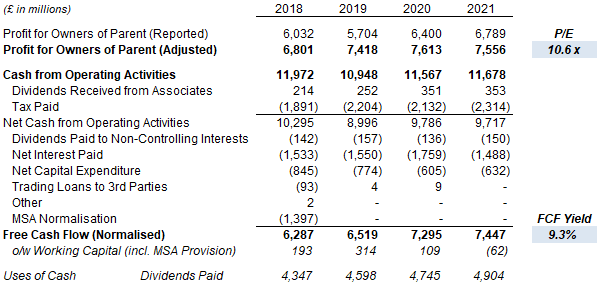

At 3,509.0p, relative to 2021 financials, BAT shares are trading at a 10.6x P/E and a 9.3% Free Cash Flow Yield:

|

BAT Net Income, Cashflow & Valuation (2018-21)  Source: BAT company filings. |

BAT shares pay an annual dividend of 217.8p (54.45p per quarter), implying a Dividend Yield of 6.2%.

Buybacks are on track to reach the targeted £2bn (equivalent to 2.5% of the current market capitalization) in 2022.

British American Tobacco Stock Forecast

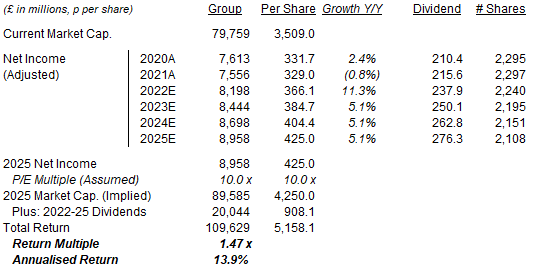

We raise our 2022 EPS forecasts slightly to reflect the higher currency tailwind (in GBP):

- 2022 Net Income growth of 8.5% (was 7.5%)

- From 2023, Net Income growth of 3.0% annually (unchanged)

- Share count to fall by 2.5% annually (unchanged)

- Dividends to grow with EPS on a Payout Ratio of 65% (unchanged)

- 2025 P/E at 10x P/E, representing a Dividend Yield of 6.5%

Our new 2025 EPS forecast is 1% higher than before (421.1p):

|

Illustrative BAT Return Forecasts  Source: Librarian Capital estimates. |

With shares at 3,509.0p, we expect a total return of 47% (13.9% annualized) by 2025 year-end, in just 3 years.

Is British American Tobacco A Buy? Conclusion

We reiterate our Buy rating on BAT, but will monitor the business closely.

We continue to prefer Philip Morris as our top-rated Buy in the Tobacco space.

Be the first to comment