Funtay/iStock via Getty Images

Looking at British American Tobacco (NYSE:BTI), it’s easy why some investors consider the company to be a risky proposition. Why would you want to invest in a product that many people say is on the way out, is unhealthy, and political risk?

Well, that’s the thing with sin stocks – and it’s a similar thing for both alcohol and other products, such as gambling. This is a sin stock, and if you believe that people will continue to drink, gamble, and smoke despite recommendations against doing otherwise… well, then you’re in the right place here.

Over 5% of my portfolio is aimed at sin stocks. Tobacco is a big part of this – as is alcohol – and British American is one of those investments.

Let’s go into a review of the company and see what we can get by investing in BTI here.

British American Tobacco – Revisiting this investment

BTI has a massive upside – it’s suitable starting the article with a comment such as that because I believe that based on legacy sales as well as explosive growth in non-legacy/new growth segments, companies like BTI, Altria (MO), and Philip Morris (PM) are set to deliver massive amounts of return once things start to normalize.

And things are doing just that. While many investors and colleagues were doubtful when I put over $70,000 combined cash in various tobacco companies, all of those investments, since their purchase, have delivered alpha over the market since the investment.

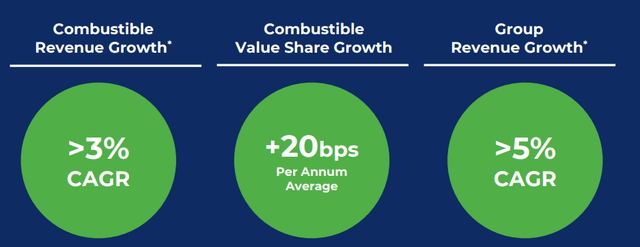

Revenue growth in combustible as well as value share has been going up for 2021 – all the while the company is growing non-combustible growth by 12%, with new category revenues of over £2B, which reflects a 32% CAGR.

BAT Results (BAT/British American IR)

BTI is a solid player whose pricing power enables it to offset more than the overall decline in legacy cigarettes. It has been proving this over and over again for the past few years, despite the nay-sayers. BTI has invested billions in next-generation tobacco products, and the company is on track to deliver its £5B of reported revenue by 2025. Using the Reynolds M&A, BTI gained access to a very attractive portfolio of US-market products and strengthened its vaping brands and smokeless tobacco.

2021 saw near-ridiculous levels of growth that should have seen the company’s share price catapult to new heights. Aside from a 51% new category revenue growth, it managed to lower debt to less than 3x adj. net debt/EBITDA.

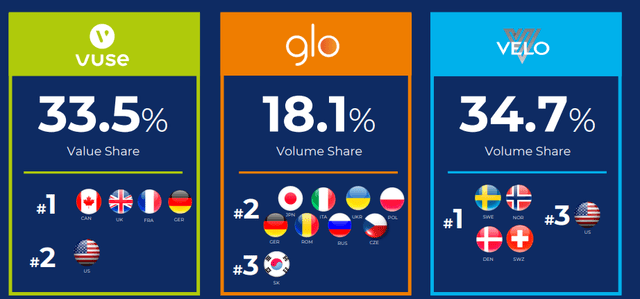

This enabled BTI to guide for more than £2B worth of share buybacks in 2022 alone. The company also reported very strong new category customer growth. This development is being driven by the strong brands of Vuse, glo, and VELO.

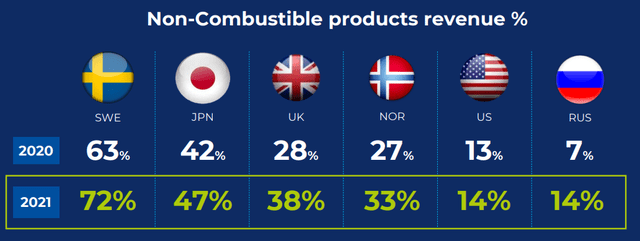

In fact, this global journey in non-combustible has been accelerating, with sales revenue number increases across these multiple markets being even better than in 2020.

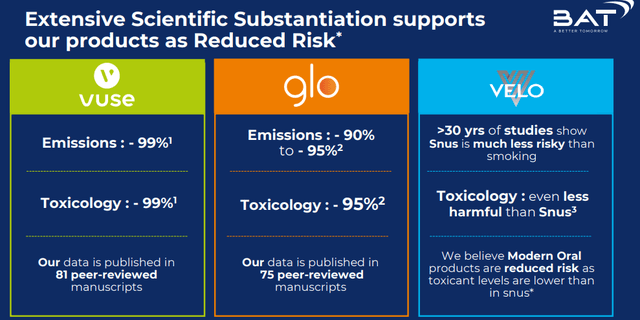

It’s clear that BTI is a company that has successfully managed the ongoing transformation from a legacy tobacco company to new tobacco/smokeless tobacco. The company has built three solid brands which are currently driving growth, and all of these brands include the (for many investors) important ESG. The company has also financed, and published a significant scientific analysis that confirms that the company’s products are, very much, less risky than legacy tobacco.

Leveraging digital and D2C sales makes the company less reliant on third-party sales channels as well, and strong product rates are driving increased conversion to the new products. Over 50% of customers that have tried glo and Vuse have stopped regular smoking as of December 2021, and this is also what is driving the market share growth across much of the company’s categories here.

BTI is successfully converting legacy tobacco users to new product users, and in less than 2 years, Vuse has closed a 27% share gap in the US alone, reflecting just how quickly the company is gaining solid market share, and the brand is already #1 in 7 markets, including Germany, France, UK, Switzerland, and others, achieving retention rates of 99% in priority markets.

In short, the company has shown and delivered the pivotal year that many shareholders and investors were hoping for. Instead of losses, like nay-sayers expected, the company drove sales revenues and profitability up even further, recording OCF conversion rates of over 100% with an average of 101% the last 4 years. Leverage is down from 4X back in 2018 to less than 3x now.

There is very little that can be said not to “be working” in British American Tobacco.

Sure – you could point to the fact that BAT, despite its success, is most certainly lagging PM and IQOS still. None of the company’s results also completely remove or negate the political risk. In the event of regulation forcing something like “plain package” (which is often spoken about), premiumized product portfolios like BTI’s, are going to suffer more like your run-of-the-mill standard tobacco, like Imperial Brands (OTCQX:IMBBY).

There is also, and it’s clear this is not disappearing, the trouble that despite massive RoR the past few months, BTI is just not getting off the ground due to the massive dislike for tobacco stocks in general.

I’m perfectly fine with that. I know BTI’s quality, and I know it’s a great company delivering a product that, in our free society, we have a right to consume.

Because of this, I listen to the numbers. The math. The results – not the fear and the arguments based on emotion and what-ifs.

That set of data tells a very clear story I’ll show you now.

British American Tobacco Valuation

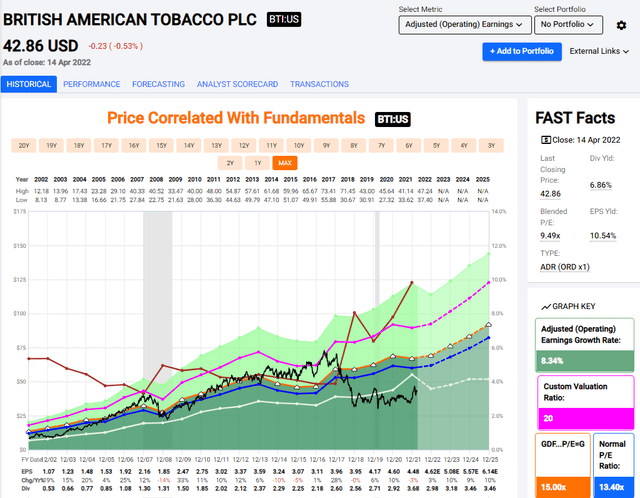

The valuation for this company remains one of the more pressured in the market, despite solid results. Aside from a small dip until 2016 in earnings, the long-term growth rate in EPS has averaged around 8.4% for the past 20 years, making the decline that began in 2017, completely unjustified.

BTI valuation (F.A.S.T. graphs)

Forward EPS growth rates average to around 8% annually until 2025, which even on just a 10x P/E rate would constitute a 17% annualized RoR upside, or 78.9% in 3 years.

This includes a near-7% yield, a BBB+ credit rating and a market cap of almost $100B. There is, to my mind, extremely little downside to investing in BTI even at this valuation, despite it being around 30% more than when I bought most of my position.

The company has continued to underperform most indexes for some time due to the perceived political risks. It’s my view that the market is completely ignoring BTI’s resilience and the huge opportunity presented by the new product category, and despite what you might expect, BTI scores extremely high scores on things like governance, ESG, and Social metrics overall.

Our planet can certainly do without people puffing away at those coffin nails, but while BAT/BTI is moving away from legacy smoking, it’s a better firm than most in terms of all of these things.

This isn’t a very complex thesis. The market has actively undervalued BTI for a very long time – years at this point – similar to other Tobacco firms. I have been investing massively in all of them, now holding tens of thousands of dollars in each, and I’m happily expanding that even further, allowing each of the 3 major companies a limit of 3-5% if valuation calls this to be a good idea.

For now, this is the case.

Using valuation metrics such as conservative DCF based on a 1% top-line growth and even just a 0.5% EBITDA growth, peer valuations of P/E, EV/EBITDA, and a conservative NAV estimate using 12-15x EV/EBITDA multiples for the various geographical segments depending on their sales strength, I view BTI undervalued in every single perspective.

I will not target a PT lower than a 10x 2022E multiple, and that comes to $48.5/share.

Even this price target is one I consider as being low-ball for the coming few years – but given the continued perceived risk in the company (and some of the actual political and competition risk), perhaps this is as high as we should be going here.

Still, that means that there’s a significant continued upside to buying BTI here, and the upside to a 10x P/E in 2025 is significant.

To my mind, there are very few better places to put your money than tobacco at these valuations – and BTI is certainly one of the better does of the picks in tobacco, at an over 10.5% earnings yield and close to a 7% dividend yield with extremely good coverage.

Thesis

My thesis for BTI is simple.

- You’re buying a quality company with superb fundamentals, excellent coverage, excellent dividends, great, 8-9% annual upside, and a proof-of-concept in its new categories division, at a bargain multiple of less than 10x P/E.

- The price target for this company cannot conceivably be considered to be lower than a 10x P/E, making it a $48/share. Keep in mind that historically, BTI has been as high as 15x. The equivalent of that today would be $70/share.

- I view BTI as a “BUY” and one of the safest bets in tobacco. That’s why I keep buying here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

British American Tobacco is a “BUY” here with an upside to a price target of $48/share.

Thank you for reading.

Be the first to comment