Marko Geber/DigitalVision via Getty Images

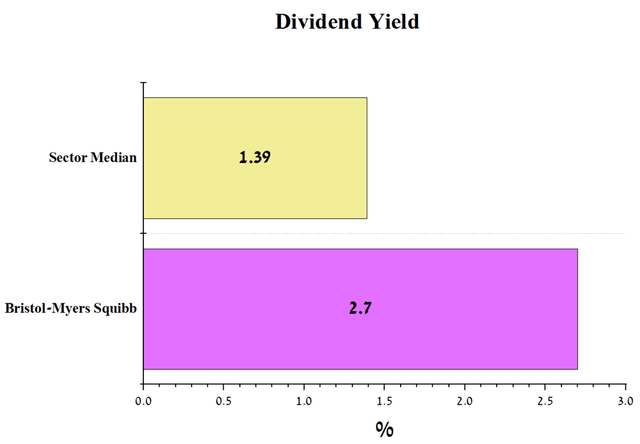

Bristol-Myers Squibb (NYSE:BMY) is one of the largest pharmaceutical companies specializing in the development and commercialization of medicines for the treatment of cancer and cardiovascular diseases. Thanks to an aggressive M&A policy, the company’s portfolio has many medicines, and the top-selling of them are Revlimid, Opdivo, and Eliquis, which are aimed at combating various types of cancer, preventing blood clots, and stroke, and thereby saving millions of lives around the world. A 2.7% dividend yield, quarter-on-quarter growth in operating income, and a rich pipeline make Bristol-Myers Squibb a candidate for investors with a long-term investment strategy after the company’s stock correction.

Company’s Financial Position

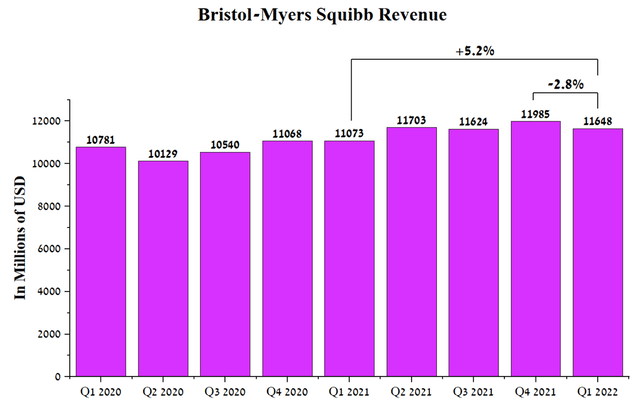

Under the leadership of Giovanni Caforio, the company earned $11,648 million in Q1 2022, up 5.2% from Q1 2021.

Source: Author’s elaboration, based on Seeking Alpha

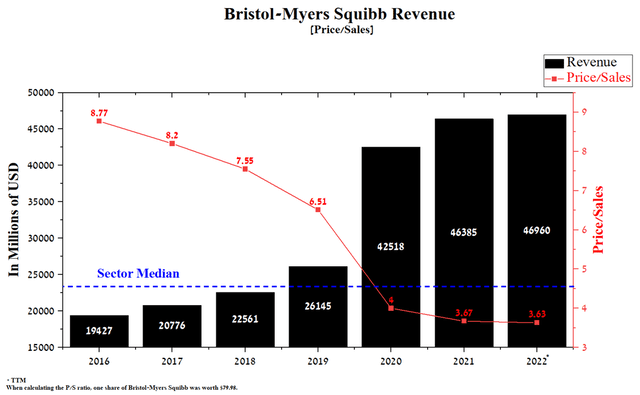

According to Bristol-Myers Squibb management, the company’s revenue will be about $47 billion in 2022, up 1.3% from a year earlier. The modest increase is mainly due to the start of the commercialization of the generic version of Revlimid, and this situation will be analyzed in more detail later in the article. Despite expanding the use of the company’s key drugs, the Price/Sales ratio continues to decline and stands at 3.63 at the end of Q1 2022, which is significantly lower than the average for the pharmaceutical industry. Thus, this indicates that Bristol-Myers Squibb is an undervalued company by Wall Street in this indicator.

Source: Author’s elaboration, based on Seeking Alpha

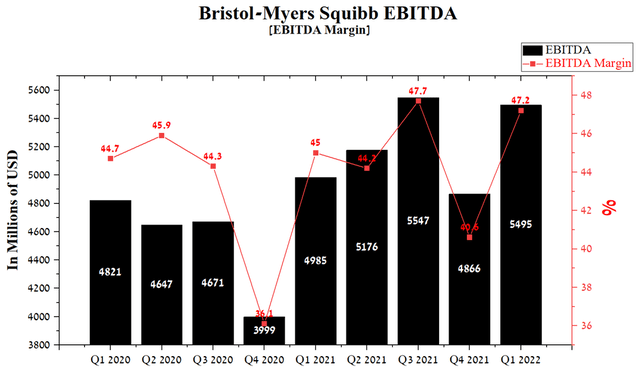

EBITDA was $5,495 million in 1Q 2022, up 10.2% year-on-year. This indicator continues to improve from quarter to quarter, mainly due to the increase in indications for the use of Opdivo and Yervoy in recent years. In addition, since the beginning of the COVID-19 pandemic, the EBITDA margin has remained high and at the end of Q1 2022, this figure was 47.2%, which is one of the largest values in the pharmaceutical industry.

Source: Author’s elaboration, based on Seeking Alpha

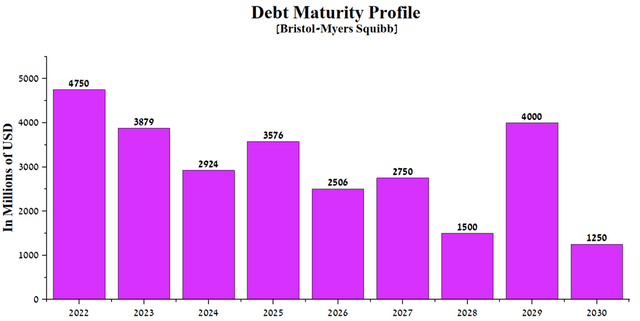

Bristol-Myers Squibb Debt

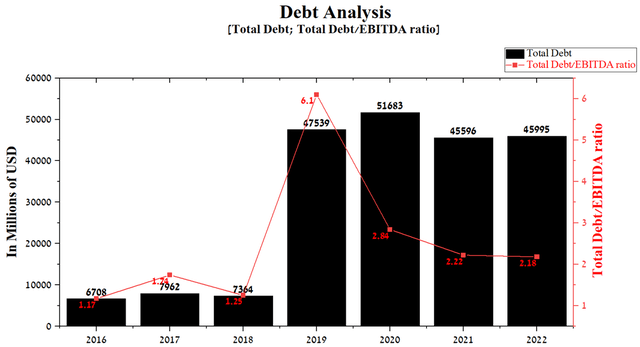

The company has substantially increased its debt in the last five years, and this was due to two major acquisitions. In 2019, Bristol-Myers Squibb acquired Celgene for $74 billion, which led to the need to fund the deal with a $19 billion senior bond issue and a loan agreement with Morgan Stanley and MUFG Bank. The company continued its aggressive M&A policy with the acquisition of MyoKardia for $13.1 billion, which was funded by the company’s cash and a $7 billion senior bond issue. Total debt was $45,995 million in Q1 2022, slightly less than the previous quarter. However, since the closing of these two major deals, the Total Debt/EBITDA ratio has continued to decline to 2.18 in 2022, indicating that there are no significant risks associated with Bristol-Myers Squibb’s debt.

Source: Author’s elaboration, based on Seeking Alpha

Bristol-Myers Squibb has generated more than $10 billion in operating income over the past 12 months, well above the repayments of senior bonds and loans maturing through 2030.

Source: Author’s elaboration, based on 10-K

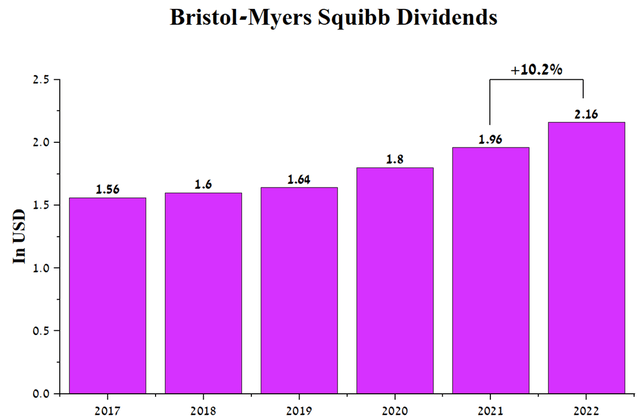

Maintaining a stable financial position for the company allowed Bristol-Myers Squibb management to increase dividend payments over the last 13 years. In 2022, investors should receive $2.16 per share, up 10.2% from a year earlier.

Source: Author’s elaboration, based on Seeking Alpha

The company’s dividend yield of 2.7% is higher than the pharmaceutical industry average, making Bristol-Myers Squibb attractive to large institutional investors.

Source: Author’s elaboration, based on Seeking Alpha

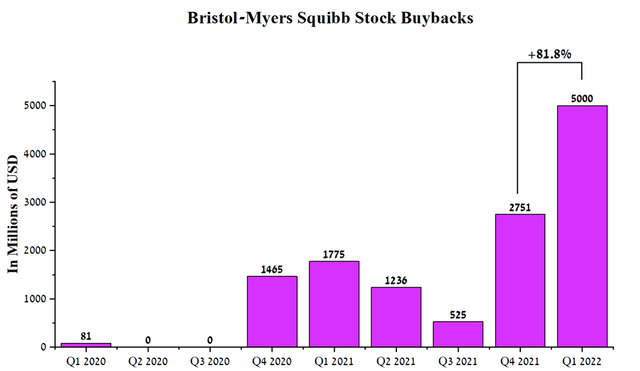

To maintain investment interest in Bristol-Myers Squibb, the company continues the policy of repurchasing its shares. In Q1 2022, Bristol-Myers Squibb repurchased $5 billion of shares, up 81.8% from the previous quarter. In addition, the remaining share repurchase capacity was about $10.2 billion, leaving Bristol-Myers Squibb’s management leverage to prop up the company’s share price during a challenging period of high inflation and Fed rate hikes.

Source: Author’s elaboration, based on quarterly securities reports

Product Pipeline Bristol-Myers Squibb

Through in-house development and acquisitions of major pharmaceutical companies, Bristol-Myers Squibb has dozens of patented drugs aimed at treating cardiovascular, oncological, hematological, and other diseases. In this article, I want to look closely at one of the company’s key blockbusters and a drug that will cause Bristol-Myers Squibb’s revenues to show weak growth in the coming quarters.

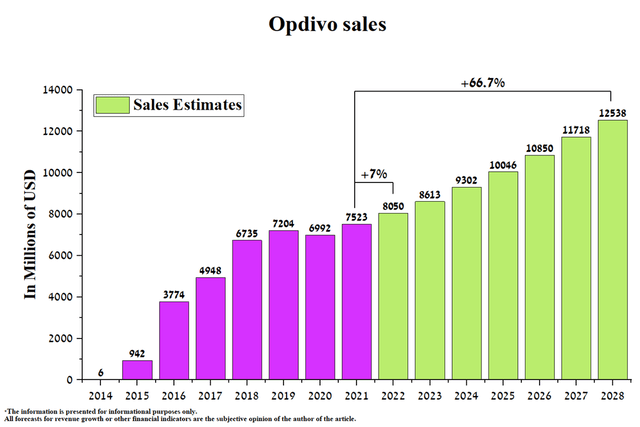

Opdivo is one of the leading PD-1 inhibitors

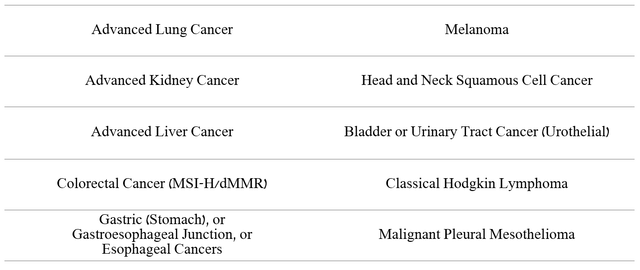

Opdivo (nivolumab) is a medicine that binds to the PD-1 protein to help a person’s immune cells fight cancer cells more effectively. This drug is currently approved for the treatment of many types of cancer.

Source: Author’s elaboration, based on quarterly securities reports

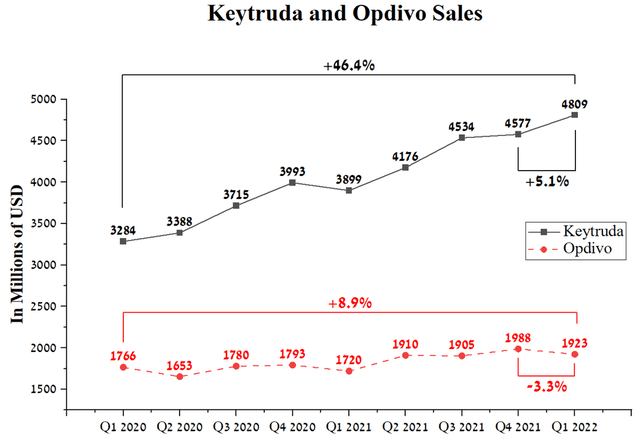

Opdivo is the second-ever approved PD-1 inhibitor, which, like the drug Merck (NYSE:MRK), received FDA approval in 2014. However, due to more indications and first-mover benefits, Keytruda sales are showing more significant sales growth relative to Opdivo. Global sales of Opdivo were $1,923 million in Q1 2022, up 8.9% year-over-year.

Source: Author’s elaboration, based on quarterly securities reports

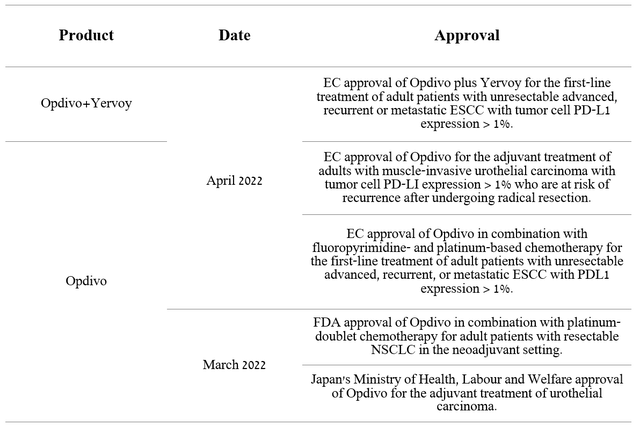

A significant investment by Bristol-Myers Squibb allows Opdivo to maintain a relatively high rate of expansion. So, this medicine has already received five regulatory approvals in 2022.

Source: Author’s elaboration, based on 10-Q

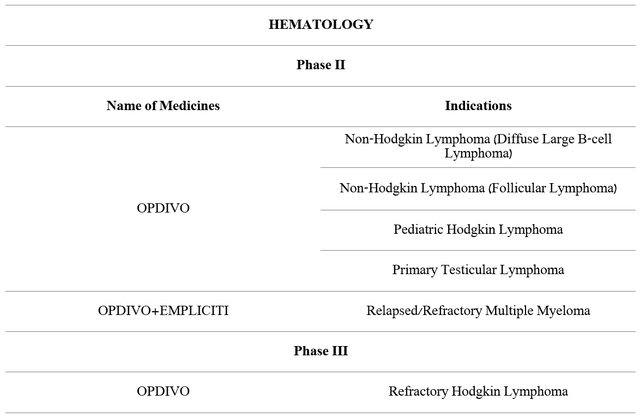

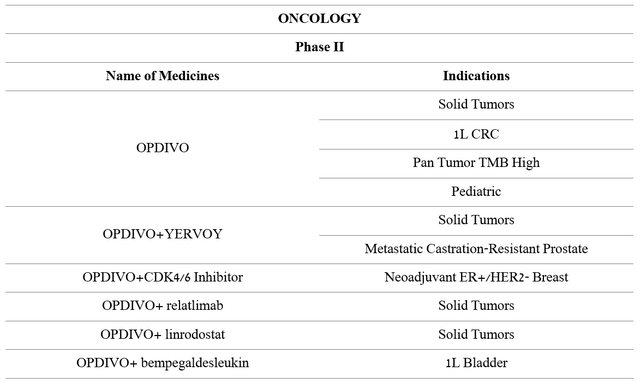

However, Bristol-Myers Squibb management does not intend to rest on the progress that has been made over the past seven years and continues to develop therapies using Opdivo for the treatment of hematological diseases.

Source: Author’s elaboration, based on 10-K

More impressive R&D activity is being observed in the development of Opdivo in combination with other drugs aimed at evaluating the efficacy and safety of the treatment of breast, blood, esophageal, prostate, and other types of cancer. This allows Bristol-Myers Squibb to have a diversified pipeline that helps increase sales of this drug year after year.

Source: Author’s elaboration, based on 10-K

More than twenty phase III clinical trials, which are the final stage before applying for regulatory approval, are currently underway. Moreover, a significant proportion of them evaluates Opdivo as a first-line drug, that is, a therapy that is the standard treatment for patients who are first diagnosed with a particular type of cancer.

Source: Author’s elaboration, based on 10-K

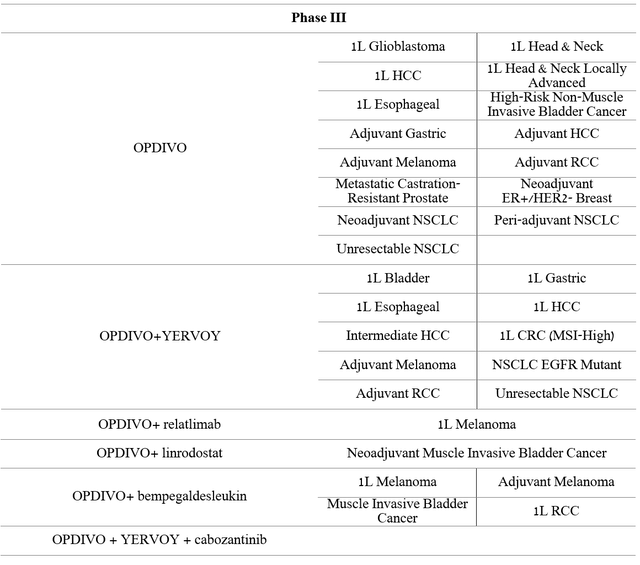

In my estimation, the company is doing the maximum amount of clinical trials where the reward/risk is on Opdivo’s side of the control group. This is done to achieve the greatest number of indications and thereby increase sales of this medicine before the patents expire.

Source: Author’s elaboration, based on 10-K

Given the historical trends in Opdivo sales and the expansion of Bristol-Myers Squibb and Merck’s PD-1 inhibitors, I expect the next Opdivo sales before 2028.

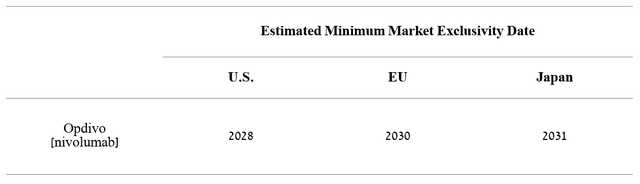

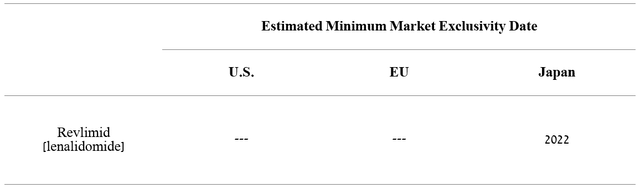

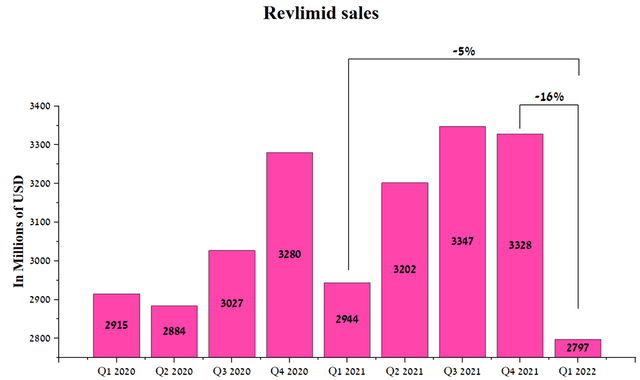

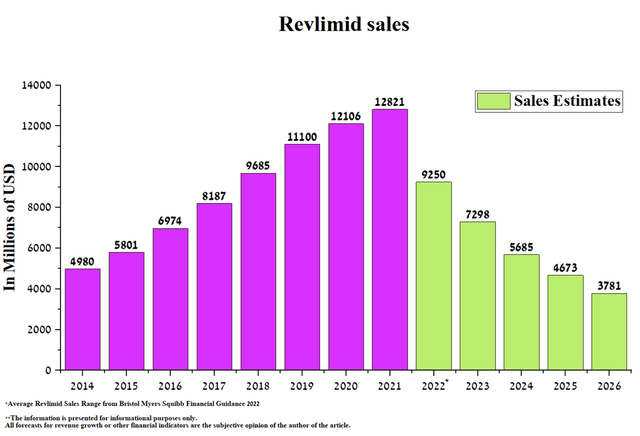

Revlimid is a blockbuster that has lost its exclusivity

Revlimid (lenalidomide) is an immunomodulatory medicine that is used to treat patients with multiple myeloma, anemia in patients with myelodysplastic syndrome, and hematological malignancies. Due to a large number of indications, high efficacy, and oral route of administration, Revlimid has become a blockbuster in a relatively short time, bringing in billions of dollars a year. However, the situation began to change rapidly due to the expiration of patents and the start of sales of a generic version of this drug in 2022.

Source: Author’s elaboration, based on 10-K

As a result, Revlimid’s sales were $2,797 million in Q1 2022, down 16% QoQ.

Source: Author’s elaboration, based on quarterly securities reports

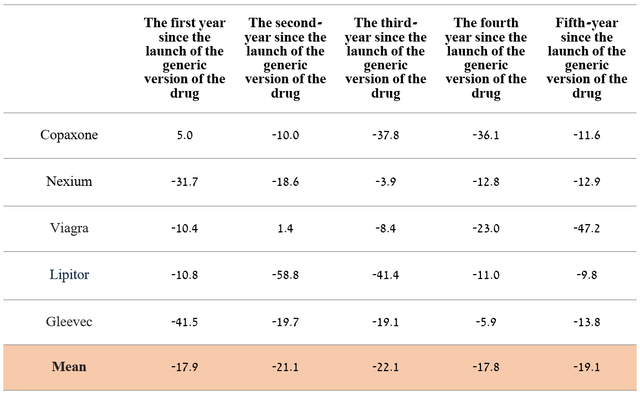

I expect sales of this drug to continue to decline as new generics enter the market and become commercialized in Japan. In order to more accurately predict the rate of decline in Revlimid’s revenue over the next five years, sales of medicines that have lost exclusivity in the past were analyzed.

However, the company’s management expects Revlimid’s sales to be $9-9.5 billion in 2022, about $3.5 billion or 27.9% lower than in 2021.

Thus, I believe that the loss from sales of Revlimid will put pressure on the financial position of Bristol-Myers Squibb and, as a result, on the price of the company’s shares in the coming quarters.

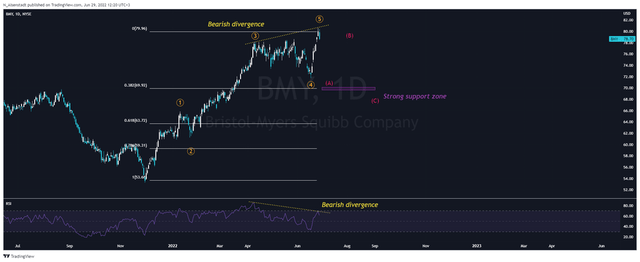

Technical Analysis

On the daily chart, we see the end of the impulse wave that began on December 1, 2021, and propelled the company’s stock up by more than 50%. According to the Elliott Wave Theory, the Bristol-Myers Squibb stock begins to form a corrective movement in wave A. It should be noted that the beginning of the correction from June 27 was foreshadowed by the formation of a bearish divergence, which is one of the powerful patterns in technical analysis. Based on fundamental and technical analysis, I expect Bristol-Myers Squibb’s share price correction to continue to a strong support zone around $68-69 per share.

Risks

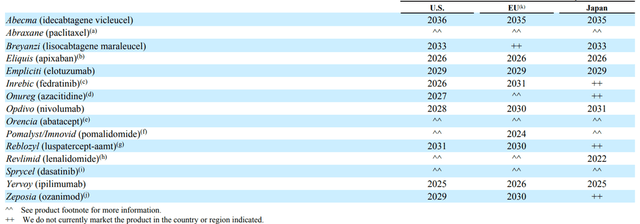

In my opinion, there is a major risk associated with the expiration of patents, which could negatively affect the financial position of Bristol-Myers Squibb in the next five years.

Patent expiration

Patent protection for medicines is critical to maintaining a company’s revenue and operating profit. The patents for one of the company’s best-selling medicines, Yervoy, expire in 2025 in the US and the European Union in 2026. Yervoy’s sales were $2,026 million for 2021, accounting for 4.4% of Bristol-Myers Squibb’s total revenue. Once other pharmaceutical companies start commercializing the generic version of Yervoy, this will negatively impact the company’s cash flow beyond 2025. In general, patents for other drugs expire in the following years.

Source: Author’s elaboration, based on 10-K

Conclusion

Bristol-Myers Squibb is one of the largest pharmaceutical companies with an extensive portfolio of approved medicines that generated about $10 billion in operating profit in 2021, up 26.7% from a year earlier. Thanks to stable cash flow, the company has an active M&A and R&D policy aimed at increasing the number of product candidates that can improve the quality of life of thousands of patients around the world. On the other hand, the loss of Revlimid’s exclusivity will negatively affect the company’s revenue growth in the coming quarters, and taking into account technical analysis, I expect Bristol-Myers Squibb’s share price to correct in the range of $68-69. However, with year-on-year growth in dividend yields, rising EBITDA margins and net income, Bristol-Myers Squibb is an excellent candidate for long-term investors. Based on the catalysts and risks described in the article, I set a target price for the company at $101 per share by 2025.

Be the first to comment