Eoneren

Investment thesis

Bristol-Myers Squibb (NYSE:BMY) had a good run in the past, generating good results regarding the stock price and fundamentally. In recent history, growth slowed down, which is again seen in the recent Q2 earnings presentation. Since healthcare, and pharmaceuticals, in particular, are known to be recession-proof, Bristol-Myers Squibb performed well this year, outperforming the general market by a good margin. I maintain that slowed growth will hinder the stock from surging higher while they, due to their function as a save-haven, will probably not drop even when the market turns down even more. To explain this, I would focus on the financials instead of the business model, product pipelines or the pharmaceutical market.

Financials

Growth

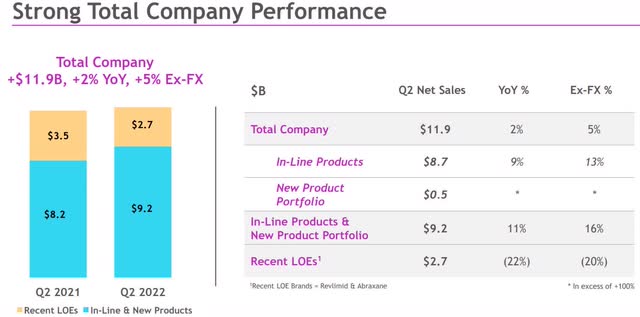

Between 2012 and 2021, BMY grew its sales by 18% and its EBIT by 28% (“CAGR”). These numbers were influenced mainly by acquisitions. Organic growth is around 8% annually, which isn’t great. In Q2 earnings, which were just released, sales grew just 2% YoY (5% without forex changes), and Non-GAAP diluted EPS increased by 18.4% YoY. While I can’t complain about the EPS growth, a measly 2% sales growth is not a good sign. To understand their growth rates, we have to look at the product groups: loss of exclusivity (LOE) products, in-line and new products.

Revenue composition (bms.com/investors)

LOE products are pharmaceuticals whose patents have run out and can be sold by other companies. Therefore prices and demand drops. One of BMY’s LOEs is Revlimid, its former blockbuster product. However, its loss of sales of 22% has greatly upset the 11% growth of its in-line and new products. As of now, LOEs stand for roughly 23% of its overall sales, which is still a significant portion and will therefore upset its overall growth in the coming quarters.

According to BMY’s annual report 2021, Opdualag and CAMZYOS have the potential for $4+ billion in sales, making up roughly 2/3 of Revlimid’s sales. There are other products in the pipeline that will bring in sales in future, but I don’t see anything of them fueling significant growth soon.

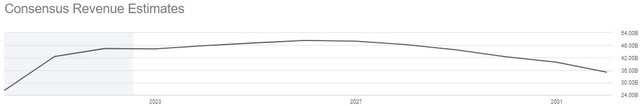

Analyst forecasts also reflect this:

Revenue forecast (seekingalpha.com)

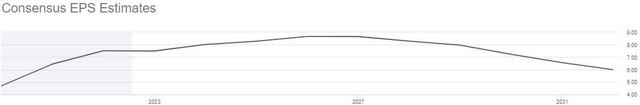

Earnings forecast (seekingalpha.com)

For the year 2025, analysts expect revenue of $50.3 billion which is 8.4% above the 2021 annual revenue and would therefore account for 2.1% revenue growth till 2025. Even when we assume that 2025 revenue is 10% above what the analysts expect, it will account for 4.8% annual growth until 2025. Earnings are expected to be $8.6 billion in 2025, meaning 15.3% total and 3.8% annual upside. Assuming 10% higher earnings, we would get 26.8% total and 6.7% annual upside. Operating cash flow shrank QoQ by 39.5% and YoY by 25.8% to $2.3 billion, so there is no growth either.

That is nothing I think will fuel a significant rise in share price.

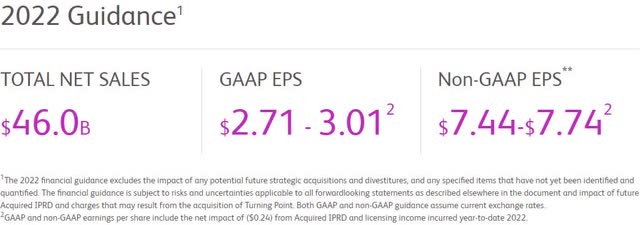

With the Q2 earnings, BMY lowered its full-year guidance to $46 billion in revenue and $7.44-7.74 (7.59 median) Non-GAAP EPS.

2022 guidance (bms.com/investors)

To bring that into perspective, the full-year revenue was $46.395 billion and $7.51 Non-GAAP EPS last year. We see a slight decline in revenue and maybe a bit of growth in EPS.

Why is that? According to its Q2 earnings, it is mainly to reflect forex changes.

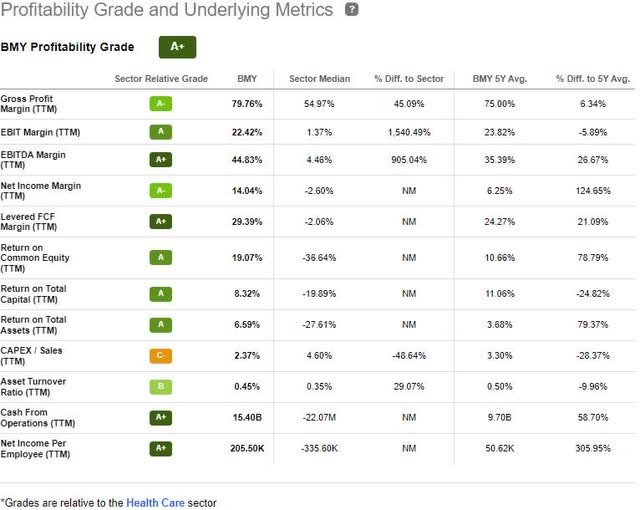

Profitability

BMYs profitability is excellent, earning an A+ in the Seeking Alpha profitability rating. The metrics are almost all above the sector median and mostly above BMYs own five-year average. Just competitors like Abbvie (ABBV) or Merck (MRK) have a few better profitability metrics.

BMY profitability (seekingalpha.com)

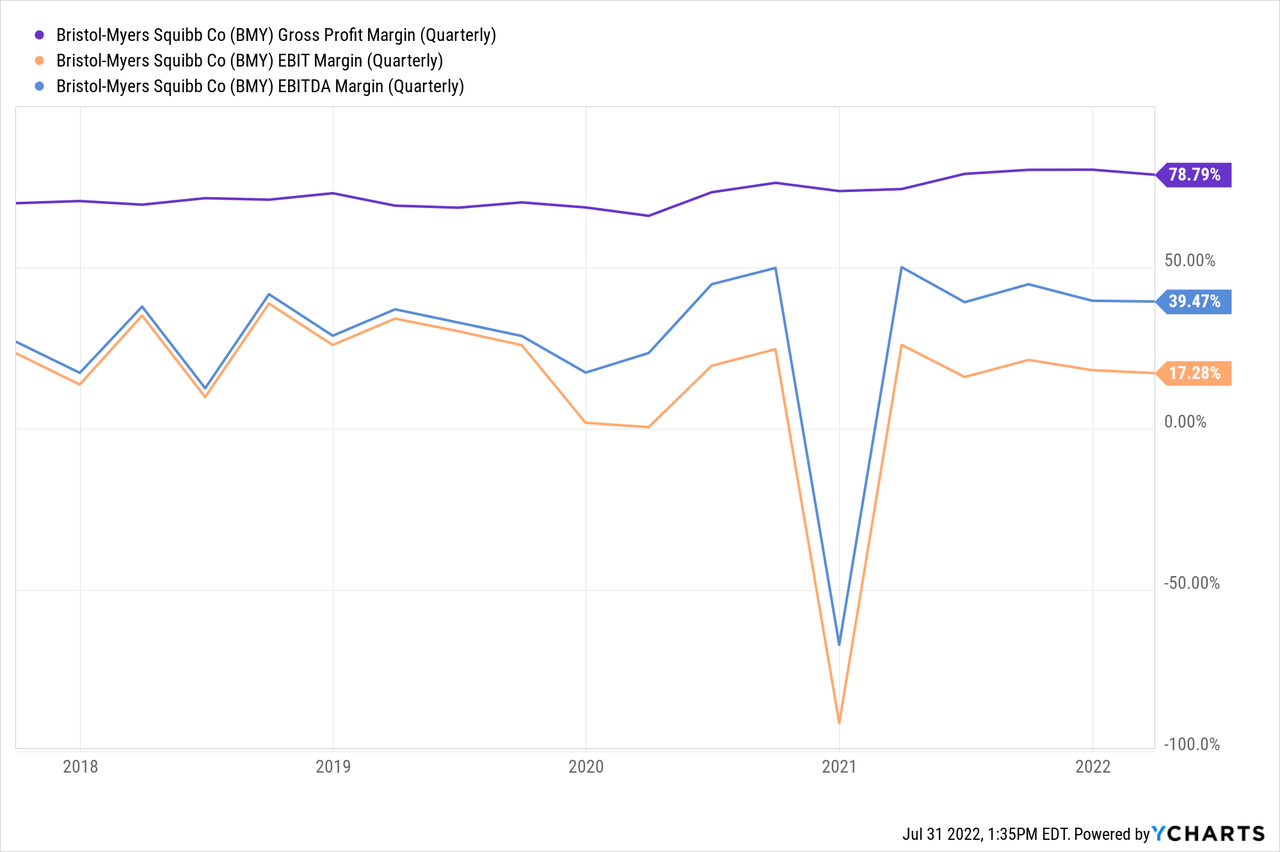

As you can see below, margins have been shrinking since the start of the year. Not much, obviously, but nothing that improves and could create upside in the share price.

Valuation

BMY’s performance wasn’t the best in the last few years, as I will explain later. Meanwhile, the business itself performed very well, leading to an undervaluation.

BMYs dynamic valuation (Aktienfinder.net)

Above, you can see a dynamic view of BMYs valuation. The dashed line represents the ‘fair value adjusted earnings’ and the yellow line the ‘fair value cash flow’. Both are oriented on historical averages. Easy to see that since 2017 the valuation has been rather low.

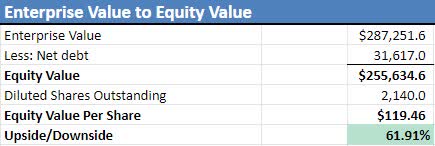

DCF-Model – five years

I have put the following data into my DCF model:

- Revenue growth: 2% until 2026

- EBITDA margin: 40% until 2026

- EBIT margin: 20% until 2026

- Long-term growth rate: 2%

- WACC: 4.55%

My DCF model is very detailed, but these are the most important numbers.

DCF model (Author)

As you can see, my DCF model gives a price target of roughly $120, which implements an upside of 62%.

Performance

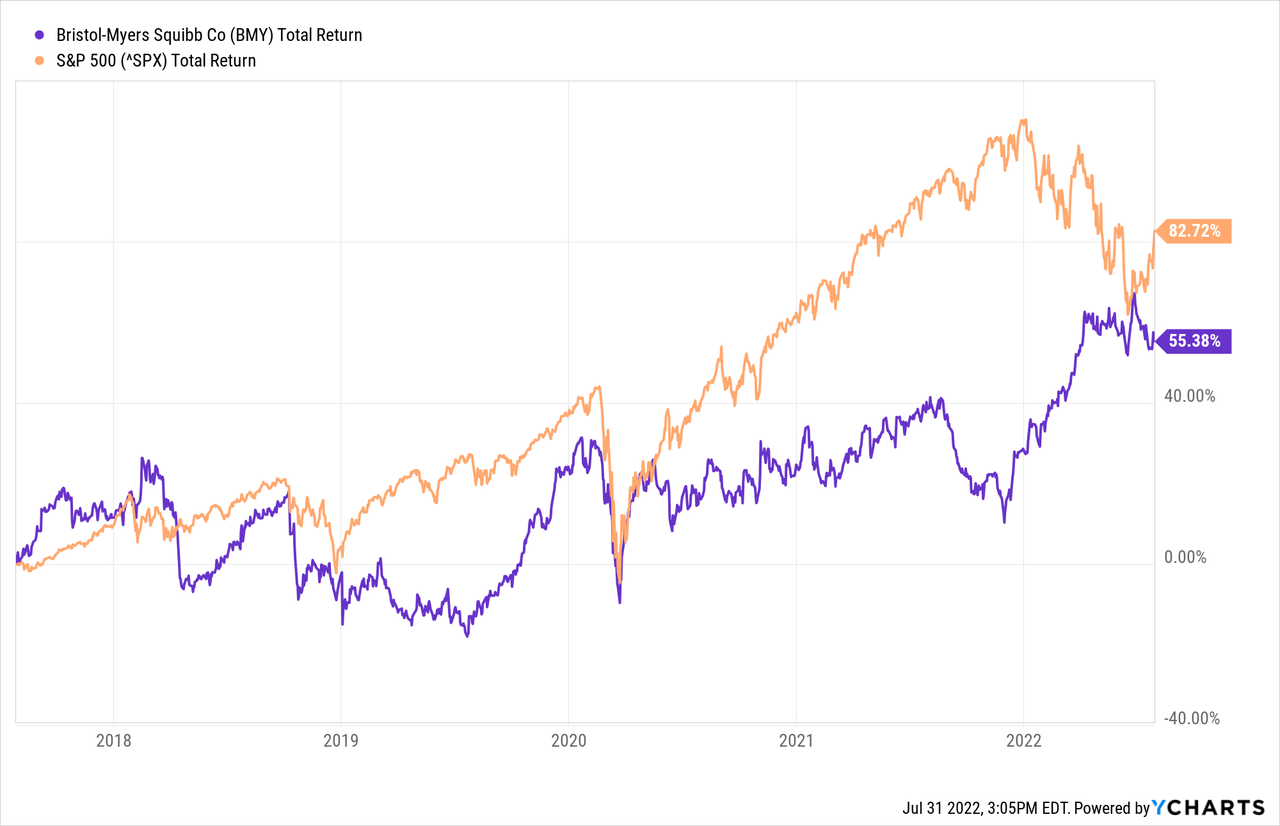

As mentioned earlier, the performance has lacked a bit since 2017, even though it performed very well in the past. Since its inception, BMY has generated a 1200% total return, outperforming the 900% the S&P 500 did in the same timeframe.

Looking at the last five years, you can see that BMY started to catch up with the market at the beginning of this year. Simultaneously, the S&P 500 fell due to inflation, rate hikes, war and recession fears since the beginning of the year. This led to a (short-lived) outperformance, the first since 2018.

This is due to health care stocks known to be a safe haven in times of recession. So investors flew out of the market into healthcare stocks, leading to a performance of 22%, an outperformance of 36% against the S&P 500.

Recession proof?

Healthcare stocks tend to seem recession-proof. This is why the healthcare sector and BMY performed so well YTD. Well, this isn’t entirely true, in my opinion. Most other businesses feel a recession pretty early, leading to an even earlier decline in share price since the market tries to reflect the future (6-9 months). The healthcare sector feels the recession:

- not as much as

- much later than

other sectors.

Meaning, that healthcare stocks aren’t entirely recession-proof; they just decline less and, most importantly, later than other stocks.

Conclusion

It’s not like I think BMY is a bad company. There are many things to like here, like the well-covered dividend of 2.9%, which was raised for 14 years and not lowered for 36 years. Or the debt profile of just 32% (debt to total assets) and the investment grade rating. The product pipeline is well filled, and strategic acquisitions added good value in the past. The valuation is lower than it should be, and until now, BMY has been considered a safe haven in times of recession.

I rate BMY as a hold because its outperformance of 36%, a rise of 22% YTD, already prices in many of these things, like the ‘safe-haven factor’. Furthermore, the reduced guidance and measly growth outlook give no reason for further share price appreciation. I maintain that we must wait for a new catalyst to expect more growth in share price. There could even be a minor correction of that 22% gain due to a loss of the ‘safe-haven factor’ in the future and the possibility of a further reduction in guidance.

On the other hand, BMY is, as stated, a business with very much to like, which is why I don’t think you should sell the stock if you already own it. I just think you shouldn’t buy now because there is more stagnation or downside than upside potential right now.

Be the first to comment