kevron2001

Introduction

I first wrote about Bristol-Myers Squibb (NYSE:BMY) and Gilead Sciences (NASDAQ:GILD) in April 2022. In late July and early August, I posted updates on their Q2 results, in which I discussed their portfolios and pipelines in detail. In this update, I will provide my assessment of the companies’ Q3 results and present updated valuations based on discounted cash flow models and multiples approaches.

A Brief Note On Currency Effects

Due to the strengthening of the U.S. dollar, currency-related headwinds have become an often-used excuse for why companies miss earnings and revenue estimates. Since both Gilead and Bristol-Myers have significant exposure to non-U.S. dollar markets, it is understandable that they report negative currency-related impacts. However, Gilead appears somewhat better insulated from currency effects, with 70.6% of sales in the U.S. versus 63.0% for Bristol-Myers in 2021.

Of course, this theoretically makes the former more vulnerable to unfavorable legislation related to the Inflation Reduction Act. Those interested are referred to a to-the-point analysis by PricewaterhouseCoopers, and maybe also my somewhat longer ago analysis of concentration risks of several big pharma companies.

Currency-related effects were of course noticeable in BMY’s and GILD’s Q3 results, but as noted above, that is to be expected and certainly nothing to be afraid of. Like most – if not all – international companies, Gilead and Bristol-Myers have highly sophisticated treasury departments that hedge currency risks either directly through appropriate financial instruments or indirectly through balance sheet hedges. However, such hedges work only to a limited extent, since both companies ultimately report their figures in U.S. dollars, and they also come at a considerable cost. A strong dollar, of course, puts pressure on sales and earnings (BMY, for example, reported a negative effect of 3% on third-quarter sales), but compared to other industries, the major pharmaceutical companies are in a superior position, as the purchase of most therapeutics cannot be postponed simply for currency- and thus inflation-related reasons. This is one of the main reasons why I have placed an emphasis on building solid exposure to pharmaceutical companies in 2021 and why I still find myself on the buy side occasionally.

Earnings And Portfolio Update – GILD

Gilead reported good results after the market close on October 27. Quarterly revenue was up 11% excluding what I would call “windfall” revenue from Gilead’s COVID-19 therapy Veklury (remdesivir). Clearly, the company’s HIV portfolio and its oncology portfolio (Trodelvy, Yescarta, Tecartus) are gaining momentum. As a result, management raised sales and earnings guidance. Midpoint 2022 sales are now expected to reach $26.05 billion (+5.3% from previous guidance), but this is largely due to better-than-expected Veklury sales. Excluding the COVID-19 treatment, the sales forecast was raised by only 1.8%. Adjusted earnings per share (EPS) guidance was raised 7.6%, and the company now expects median EPS of $7.05, resulting in a forward price-to-earnings ratio of 10 – hardly expensive, but quite normal for the still unloved “post-Sovaldi Gilead”, which remains range-bound in the $60-$75 corridor.

Veklury sales were down 52% year-over-year, hardly surprising given that the number of severe cases of COVID-19 is getting smaller and comparison with Q3 2021 is difficult. However, while the company expected only $2.5 billion in related revenue in 2022 previously, it now expects $3.4 billion. Given that SARS-CoV-2 is obviously a seasonal virus, the increased guidance does not strike me as particularly surprising, but speaks to management’s attitude of under-promising and over-delivering. The same is true, for example, of Abbott’s management, which expected considerably lower sales of SARS-CoV-2 diagnostics than in 2021, but also significantly beat its own guidance in the third quarter (see my recent update).

However, this is not the time to get overly optimistic and buy Gilead for its COVID-19 therapy – Veklury’s days are certainly numbered, primarily because of other antiviral treatments, but also because of the increasingly lower number of severe cases of COVID-19. Rather, investors should view the gains from the antiviral as windfall cash flows that close the company’s gap to stronger HIV- and especially oncology-related cash flows in the future.

Sales of hepatitis B and D virus (HBV, HDV) treatments grew in the mid-single digits, but are still not meaningful with only about a quarter of a billion in quarterly sales. In hepatitis C virus (HCV) treatments, Gilead saw 22% year-over-year growth. To avoid misplaced optimism, the growth was largely due to the settlement of a rebate claim in Europe. The quarterly revenue of $524 million is not particularly significant and underscores that Gilead’s former cash cow is yielding less and less milk.

While Gilead’s HCV franchise is understandably a thing of the past, the company’s HIV portfolio continues to deliver a strong performance. In my last article, I referred to Gilead’s HIV portfolio as its “money printer,” and I believe that remains true, as evidenced by its 7% year-over-year revenue growth and more than 64% share of the company’s total quarterly revenue. The increase in HIV sales (Biktarvy, Genvoya, Descovy) stems from higher demand, in part due to the pandemic coming to an end. However, also the relatively new long-acting injectable lenacapavir is starting to make a significant contribution, having received its first approval in Europe (Sunlenca). Given the heavy focus on antivirals in general and HIV therapeutics in particular, it is hardly surprising that CEO Daniel O’Day is staying the course of shifting the company’s revenue streams from an excessive focus on antivirals to cancer therapies.

As I mentioned in my last article, Yescarta (axicabtagene ciloleucel) and Tecartus (brexucabtagene autoleucel), which Gilead acquired through Kite in 2017, are trying investors’ patience. However, management sees growing demand for cell therapies, highlighted by year-over-year growth rates of 81% and 72%, respectively. However, the two cancer therapies combined generated quarterly sales of only about $400 million.

Trodelvy is another cancer therapy (sacituzumab govitecan) that Gilead acquired under the leadership of Daniel O’Day. Quarterly sales of $180 are still nothing to cheer about, considering Gilead acquired Immunomedics for an implied valuation of $21 billion. Quarterly sales were up 79% year-over-year, which is slightly below half-year sales growth. However, there is still a long way to go before Trodelvy can be called a blockbuster (2021 sales were only $380 million), which it may yet become thanks to its expected strong use as a therapy for HR-positive, HER2-negative breast cancer. In any case, I think it is fair to say that Gilead overpaid for Trodelvy with the information currently available.

Earnings And Portfolio Update – BMY

Like Gilead, Bristol-Myers reported solid Q3 results. The company reported a 3% decline in quarterly sales, already accounting for the discussed – and expected – currency headwinds. This is certainly a strong performance for such an internationally diversified company, which is often said to focus on drugs with impending loss of exclusivity (LOEs) or those for which generics or biosimilars are already available.

Besides currency, the main reason for the decline in sales was Revlimid (lenalidomide, treatment for multiple myeloma). Competition from generic manufacturers is becoming increasingly fierce, which is hardly surprising given the simple chemical structure of the drug (a thalidomide derivative). In Q2, sales declined 22% to $2.5 billion, a stepped-up sales decline from the previous quarter due to generics having entered the market. In Q3, the decline accelerated further and BMY generated only $2.4 billion in product sales, a 28% year-over-year decline. It should be noted that this faster decline is only marginally attributable to exchange rate effects (i.e., 1 percentage point). Nonetheless, BMY still expects full-year Revlimid sales of $9.0 to $9.5 billion, and it therefore seems likely that BMY is under-promising to over-deliver. With Q1-Q3 revenue of $7.7 billion, the company would only need to generate $1.5 billion in Q4 to meet the midpoint guidance – a pretty low bar to clear. One could hypothesize that previously agreed upon volume-limiting agreements with generic manufacturers such as Natco Pharma in the U.S. are expiring and are therefore responsible for the accelerated decline. However, according to p. 7 of BMY’s 2021 10-K, Natco has only been granted a license to sell lenalidomide in unlimited quantities in the U.S. beginning January 31, 2026.

Eliquis (apixaban), BMY’s blockbuster anticoagulant, is co-marketed with Pfizer (PFE) and continues to post healthy sales growth (10% on a quarterly basis, 12% on a nine-month basis, year-over-year), but of course currency effects played a major role due to strong emphasis on Europe. Excluding currency effects, Eliquis sales would have increased by 16% and 17%, respectively, which nicely underscores the increase in the dollar index in the third quarter.

Bristol’s third most important blockbuster is Opdivo (nivolumab), a checkpoint inhibitor used to treat various types of cancer. Sales growth was satisfactory in the high single digits, especially given the strength of Merck’s (MRK) Keytruda (pembrolizumab), which is used as a therapy for similar indications and is expected to be the top-selling drug with projected sales of nearly $25 billion by 2026. It also seems worth mentioning that BMY’s management is skillfully marketing nivolumab along with other biologics to treat various indications such as unresectable or metastatic melanoma.

Other key cash flow generating assets such as Pomalyst/Imnovid (multiple myeloma treatment, thalidomide derivative), Orencia (rheumatoid arthritis, biologic), Sprycel (leukemia, small molecule) and Yervoy (melanoma, biologic) continue to experience healthy low to mid-single digit growth.

As will be discussed later, analysts expect BMY to report only moderate sales growth over the next few years, followed by a significant decline in later years. Personally, I think this is a relatively conservative stance, underlined by BMY’s acquired and rapidly growing portfolio of new oncology products (Reblozyl +30% 9M YoY, Abecma +177% 9M YoY, Onureg +81% 9M YoY, and Breyanzi +170% 9M YoY) and the promising multiple sclerosis drug Zeposia (+99% 9M YoY). Of course, it is a bit early for praise, as BMY’s new product portfolio accounted for only $1.4 billion (4% of total sales) in the first nine months of 2022. However, Reblozyl, Abecma, Onureg, Breyanzi and Zeposia should nicely offset declining sales due to LOEs, as they are expected to deliver peak sales of over $10 billion.

Finally, it seems worth noting that BMY completed its acquisition of Turning Point Therapeutics in the third quarter, further strengthening its oncology portfolio with the potentially best-in-class tyrosine kinase inhibitor repotrectinib (non-small cell lung cancer). BMY also reported good news on the immunology front, as the FDA approved Sotyktu (deucravacitinib) as a first-line oral biologic for the treatment of moderate-to-severe plaque psoriasis, but without a black box warning – investors in AbbVie (ABBV) and Amgen (AMGN) should take notice.

A Comparative Valuation Of BMY and GILD

As expected, large pharmaceutical companies proved to be defensive investments during the bear market of 2022. Since I first reported on GILD in April 2022, the stock has gained nearly 19% while the S&P has fallen nearly 15%. BMY has been treading water since I first reported on the company in April, but still outperformed the S&P 500 by over 16%. This is by no means an allusion to my seeming ability to time the market – I consider this impossible and measure returns over the long term, i.e., years or decades. Rather, these comparisons are meant to illustrate that Gilead, in particular, has become significantly more expensive. One should also keep in mind that the Inflation Reduction Act will have a negative impact on earnings and cash flows, which will lower the intrinsic value of U.S.-exposed pharmaceutical companies somewhat. However, anything beyond a low-single-percentage decline in value seems too conservative, as Morningstar analyst Karen Andersen also noted in mid-September.

For these reasons, I wanted to share an updated valuation of the two companies and outline whether GILD and BMY are still on my shopping list. Now that both companies have reported their third quarter results, we have a better view of full-year cash flows, also taking into account analyst estimates for the next few years. Note that analyst forecasts for BMY in previous years were fairly accurate, as I discussed in my first article, while Gilead’s earnings were quite difficult to predict, due first to the significantly underestimated success of the company’s HCV franchise, followed by exuberant analyst optimism, and finally a lack of appreciation for Veklury’s earnings potential.

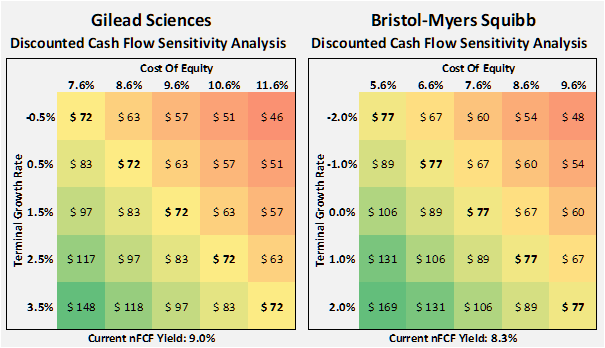

GILD will generate approximately $26 billion in revenue in 2022, and the company is expected to offset declining revenue from Veklury and its HCV portfolio well with its strong HIV portfolio and promising cancer therapies. Long-term revenue growth is expected to be in the low single digits, resulting in cumulative revenue of approximately $265 billion by 2031. Transferring the low single-digit sales growth to Gilead’s nFCF profile (free cash flow, normalized with respect to working capital movements and adjusted for stock-based compensation) on a one-for-one basis appears quite conservative. Gilead’s free cash flow margin has been very volatile (37% ± 12% since 2012), and the baseline nFCF used in my model is based on a margin of 30%, well below Gilead’s long-term average. This suggests that the discounted cash flow model is likely too conservative and includes an inherent margin of safety if Gilead’s portfolio contains a solid blockbuster here or there. Assuming that an investor would find a cost of equity of 9.6% (5% equity risk premium over long-term treasuries) acceptable, Gilead’s nFCF would have to grow at a terminal rate of 1.5% per year to justify the current share price (Figure 1, left). That is hardly an aggressive expectation, especially given the progress of Gilead’s portfolio as described in this article and in my last earnings update.

BMY is expected to generate cumulative revenues of $450 billion by 2031, an average of $45 billion per year. Analysts expect moderate revenue growth over the next few years and have modeled for a relatively steep patent cliff in later years. This seems reasonable but, more importantly, conservative, as BMY could also surprise on the upside given the strong oncology pipeline it obtained through Celgene. With BMY’s expected average 2020-2022 nFCF of $13.5 billion, the stock’s normalized free cash flow (nFCF) yield is currently 8.3%, which can hardly be considered expensive. However, it should be remembered that BMY was trading at a nFCF yield of over 10% in late 2021, when the cash flow power of the combined BMY/Celgene entity was already clearly visible. Taking into account the relatively conservative revenue projection, I think it is a fair, albeit conservative assumption to also expect essentially flat free cash flow over the next 10 years. As shown in the right part of Figure 1, the stock currently appears fairly valued based on a terminal growth rate of 0%. The 200 basis point lower cost of equity relative to Gilead appears reasonable given BMY’s much better diversification, size, and cash flow visibility. However, if the company surprises to the upside, which does not seem unrealistic given conservative analyst expectations and strong pipeline, the stock is significantly undervalued. I don’t think 2% terminal growth is too optimistic for a world-class company like BMY (i.e., a fair value of over $100).

Figure 1: Discounted cash flow sensitivity analyses for Gilead Sciences (left) and Bristol-Myers Squibb (right) (own work)

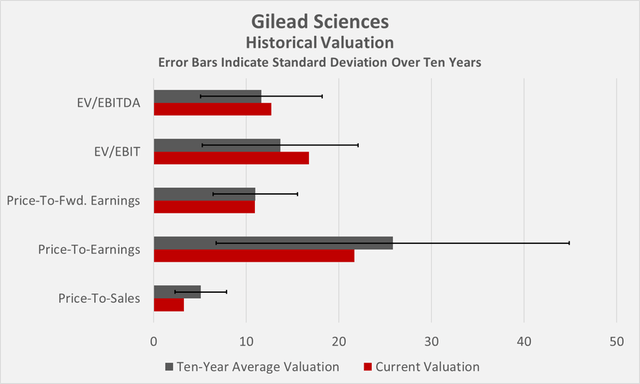

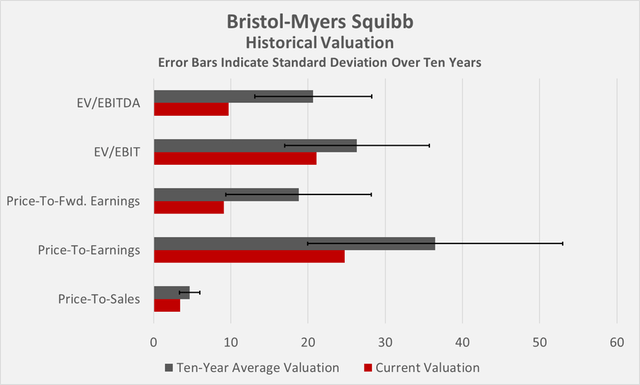

To give you a different view of the current valuations of GILD and BMY, historical valuations based on sales and earnings multiples are shown in Figure 2 and Figure 3, respectively. While Gilead appears fairly valued, BMY actually appears undervalued. However, it should be noted that, for one thing, the standard deviations are very high and that the historical valuation of BMY should be viewed particularly critically, as the company only acquired Celgene in 2019. The investor service firm Morningstar considers Gilead and Bristol-Myers to be 8% undervalued (four stars, medium uncertainty) and 14% overvalued (three stars, medium uncertainty), respectively.

Figure 2: Historical, multiples-based valuation of GILD using data from 2012 to 2021 (own work, based on data by Morningstar)

Figure 3: Historical, multiples-based valuation of BMY using data from 2012 to 2021 (own work, based on data by Morningstar)

Conclusion

Both Gilead and Bristol-Myers delivered solid Q3 results. Big pharma stocks continue to provide excellent protection in an otherwise very volatile market and in this rather obvious late stage of the economic cycle.

While BMY’s portfolio is already very well diversified thanks to Giovanni Caforio and his team, who are very opportunistic and continue to have a good knack for acquisitions, Gilead remains more speculative and requires patience. To be fair, however, O’Day has a clear vision, and we are beginning to see tangible signs that the company’s oncology portfolio is gaining traction. The valuation difference between the two stocks is well deserved, but I don’t think either is expensive.

Given the stock’s strong performance, I’m understandably less optimistic about Gilead than I was in April 2022, but with a free cash flow yield of 9%, the stock is still a solid value. However, I am not currently a buyer for the simple reason that I already own a full position. BMY is also range-bound as it seems, and I see no immediate reason for a breakout. I continue to buy shares on temporary weakness (as I did recently in early September), but I am no longer an aggressive buyer as I already own a near full position.

Thank you very much for taking the time to read my article. In case of any questions or comments, I am very happy to hear from you in the comments section below.

Be the first to comment