RHJ/iStock via Getty Images

Investment Summary

Brilliant Earth Group (NASDAQ:BRLT), an exciting new player in the fragmented diamond industry, is an online retailer of diamond jewelry, offering a vast catalog of jewelry and targeting the expanding Millennial and Gen-Z consumer market. According to BRLT, their primary competitive advantage is their heightened focus on environmental, social, governance (ESG) mission, demonstrated by their tag: Beyond Conflict-Free. They recently went IPO in 2HFY21 through a newly formed shell company that holds 10% economic interest of the underlying Brilliant Earth company. BRLT has experienced rampant 35% YoY revenue growth on the back of increasing marketing spend. BRLT is ultimately a retailer, so the PE multiple of 17x might be difficult to accept, but investors should note earnings have grown at 30% CAGR since 2020. Signet Jewelers (NYSE:SIG), meanwhile, exploded back to record profitability post-lockdown and is now guiding for more normalized earnings, with EPS growth of ~2%, not inclusive of ongoing aggressive buybacks or yield. BRLT and SIG offer favorable returns to different investor types looking for exposure into this growing, consolidating industry.

Diamond Industry Fragmentation and Trends

The diamond industry, and by extension the general jewelry market, is split into two categories: small local shops and large luxury retailers. The largest jewelry retailer in the world is Louis Vuitton (OTCPK:LVMUY), owner of Tiffany and Co., while Signet Jewelers is the largest retailer in the U.S. Despite the strength of these large retailers, most jewelry purchases are actually done with local businesses. In fact, the top ten jewelry groups in the world only account for 12% of the global jewelry market, with SIG capturing just 9% in the U.S. market, exemplifying how fragmented the industry really is.

As with any fragmented market, consolidation eventually occurs as the most successful players grow at scale. The diamond industry is no different, with 2017-2019 seeing record-breaking independent store closures, even before the pandemic wreaked havoc across the nation. Meanwhile, Signet is playing the role of consolidator. Post-lockdown, independent shops are falling further behind, unable to offer consumers the kind of choice, service, and customization that is defining the market, signifying that SIG and BRLT have plenty of market share to capture in their growth outlook.

The jewelry industry in the U.S. and global markets are expected to grow at 1.3% and 7% CAGR through 2025, respectively. There are three primary growth trends for the industry moving forward.

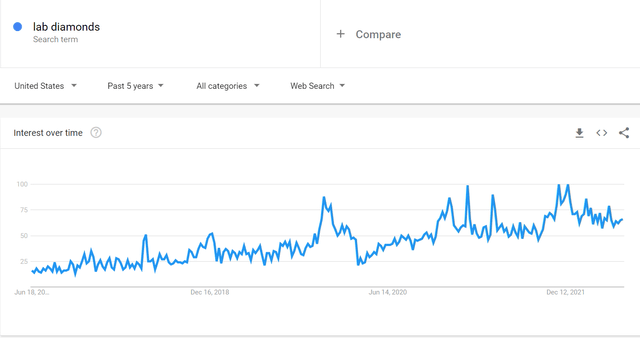

First, the industry growth is mostly driven by the rapid shift in consumer demand for lab-grown diamonds. As Millennials and Gen-Z consumers make up a larger share of economic activity, their consumer tastes toward more ESG-friendly initiatives and product choices has driven lab-grown diamonds to around 7% market share in 2022, and 10% – or $10B – in 2023. A simple Google Search Trend adds further support to this thesis.

Google Search Trend for “Lab Diamonds” (Google)

Second, more and more consumers are willing to engage in jewelry purchases, including higher price point diamond rings, online, with 11% of the market share currently being done online. Online sales are expected to be the primary growth driver for the diamond industry moving forward.

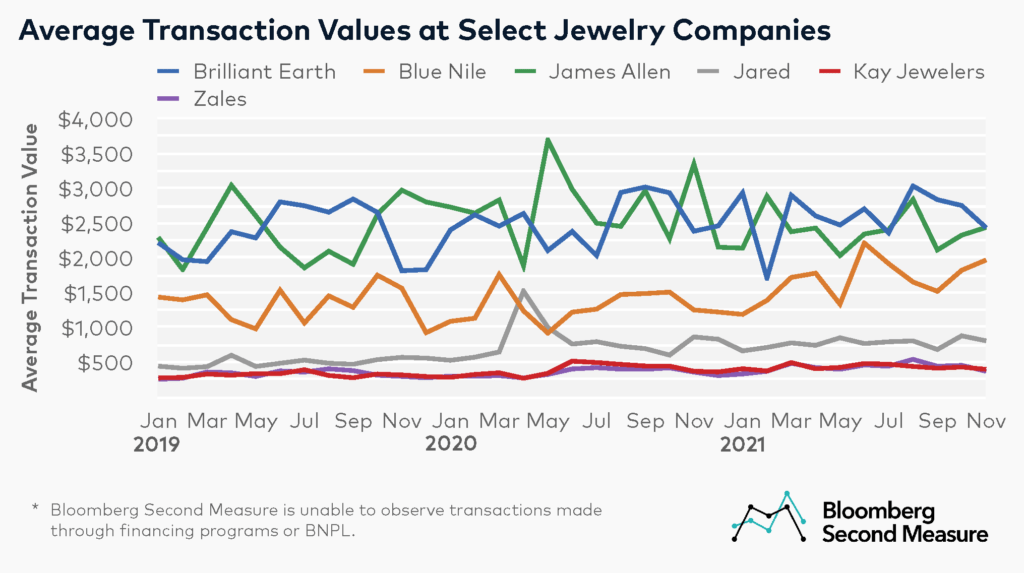

Finally, one might expect that online retailers are capturing market share by driving down costs, since they do not have large capital expenses like traditional retailers. This, however, is not the case, with many online retailers actually having higher average transaction values than traditional retailers:

Jewelry Companies Average Transaction Values (Bloomberg Second Measure)

The higher ATV is due to the third growth trend, and that is the heightened desire for self-expression by Millennial and Gen-Z consumers. In particular, online retailers are better situated to provide customization and personalization for expensive, extremely sentimental purchases. These customization offerings come at a higher price point, explaining the higher ATV.

Though Signet Jewelers has historically been a traditional retailer, they rightly caught on to the trends and have been aggressive in acquiring online retailers to complement their physical showrooms, such as through their acquisition of James Allen and Diamonds Direct. Meanwhile, Brilliant Earth is trying to increase their omnichannel presence by going the other direction: increasing their physical footprint with more showrooms. Both of these retailers offer increasing catalogues of lab-grown diamonds to try to capture the middle-market of the diamond industry and growing lab-grown diamond trend.

Investors do not have many options regarding pure-plays into the diamond industry, though Charles & Colvard (CTHR) provides another option at a significantly smaller market cap than either BRLT or SIG. Like its larger peers, CTHR is also catching on to the lab-grown and online trends; but, CTHR does not offer customization, instead opting to compete against the likes of Tiffany and Co. in the high-end luxury space, via lab-grown diamonds. This is incredibly risky and may prove unsuccessful as they lack the marketing firepower compared to the luxury behemoths or even their lab-grown diamond peers.

Directly antithesis to these retailers, the luxury jewelry behemoths Tiffany and Co. and De Beers are pushing against the lab-grown trend, vocally opposing their value – claiming “Our position is lab-grown diamonds are not a luxury material” – and continuing to push their generations-long marketing agenda for artificially marked-up mined diamonds. This provides an opening for both Signet and Brilliant Earth to stretch their middle-market range to penetrate higher into the luxury regime through the lab-grown diamond angle and capture more market share. In fact, this is exactly what Signet has outlined as one of their primary strategies for growing the company.

Brilliant Earth’s Distinction

To keep this discussion contained, “online retailers” will refer to James Allen (Signet Jewelers), Blue Nile, and Brilliant Earth.

A quick glance at the different online jewelry retailers will demonstrate that there is not much difference among them, with each having their own focus and value-added appeal depending on the consumer. James Allen has a much larger product assortment, customization options, and service offerings while Brilliant Earth has a more ambitious ESG-driven mission. This last point allows Brilliant Earth to price their jewelry at higher average price points, even for the same quality diamond:

Comparison of similar lab-grown diamonds prices (Left: JamesAllen.com; Right: BrilliantEarth.com)

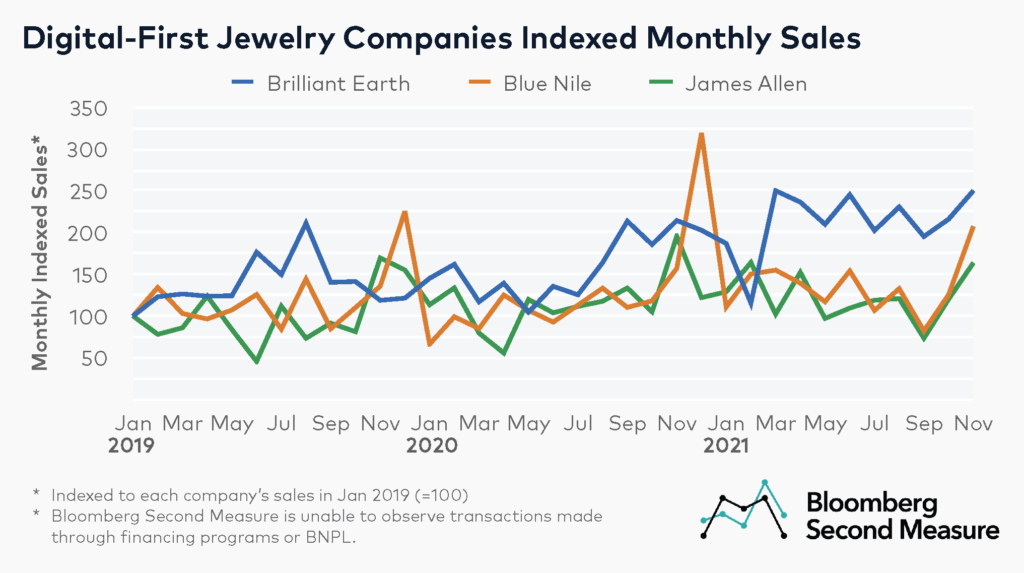

Consumers who place the highest value on ESG-initiatives are still willing to purchase from Brilliant Earth despite the price disparity. The company understands it needs to be a differentiator somehow, and competing on price and catalogue selection against the other online retailers and their powerful backers is a non-starter. Thus, Brilliant Earth focuses on their Beyond Conflict-Free ESG-initiatives, hoping to capture dominant market share within the most socially conscious subgroup of Millennial and Gen-Z consumers – and it seems to be working. Compared to their competitors, Brilliant Earth maintains an elevated level of sales versus other digital-first jewelers, pulling away from the pack:

Online jeweler monthly sales (Bloomberg Second Measure)

Valuation

For purposes of this discussion, financials of BRLT refer to the underlying company, not the shell company that is publicly traded and holds 10% economic interest in the underlying, unless otherwise noted.

For the diamond industry at large, pent-up demand post-lockdown has largely subsided, so an investment in the industry should look a few years out towards the next up-cycle.

BRLT went IPO at the end of 2021 with an absurd valuation of over $1.3B, as most IPOs since 2020 have been. The underlying company brought in $380M in sales in FY21 with a positive net income of $26.26M. At the time of IPO, the valuation was at a ridiculous PE 49x for a retailer. That said, BRLT grew earnings at an impressive 20% YoY from FY20 to FY21, though this is par for the course for the majority of retailers post-lockdown and -stimulus, but that still does not justify the previous valuations. However, since then, BRLT’s share price has come down significantly, to as low as just under $4/share and PE 14x, making the company a more attractive investment for a recent IPO that, unlike the vast majority of tech names, is actually GAAP profitable and cash-flow positive. Looking ahead, BRLT is guiding for $450-$470M in sales for FY22. Using their historical income margins, and the low end of guidance, BRLT is expected to generate $21M in income, a decline of 21%, implying a forward PE of 23x at current prices.

Interestingly, SIG has guided for flattish earnings growth of 2% for FY22, suggesting macro-economic conditions are a bigger company-specific issue for BRLT due to their higher price points. SIG’s earnings growth is in-line with their PE ratio of 5x, however, it does not take into consideration SIG’s aggressive buyback strategy, which has consistently amounted to 4-6% YoY. Coupled with a rapidly growing dividend back to pre-lockdown levels, SIG’s total EPS growth is along the lines of 8-10%, even during this industry down-cycle.

A quick look at BRLT’s balance sheet reveals no red flags. The company has only $23M in long-term debt against a cash holding of $165M. BRLT does not carry a high book value for a retailer because the company operates with an asset-light model and low inventory at hand, which they claim helps them achieve dynamic pricing and lower costs. These are all positive marks as it insulates the company from rising interest rates, allowing the company to use their cash pile to expand their omnichannel presence rather than pay down debt.

At current prices, both BRLT and SIG maintain favorable investment returns using a DCF analysis looking out to 2025 to capture the next industry up-cycle. For BRLT, assume sales CAGR drops from current levels of 30-40% to 25%; EBITDA margin of 10%, same as historical levels; tax rate of 20%; discount factor of 10%; and current EBITDA terminal multiple of 8x. Furthermore, assume that shares are diluted from current levels of 11M free-float shares outstanding to 12M free-float shares outstanding, obtained by extrapolating current SBC levels to 2025. Finally, with 10% economic interest of the underlying, BRLT shares would see CAGR increase of 20% to a target of around $10.4, ex-net cash (+$1.5/share in net-cash attributable to the BRLT entity leads to $11.9/share and 24% CAGR). Certainly, BRLT was a better value proposition when shares were trading under $4, but nonetheless still has upside at these current prices under tempered expectations.

For SIG, the DCF assumptions maintain an EBITDA terminal multiple of 4x (due to lower growth prospects, in-line with historical), 20% tax rate, 10% discount factor, EBITDA margin of 12% (in-line with historical, ex-lockdown era), and CAGR sales rate of 4%. Terminal price at 2025 comes at $120, or CAGR 18% on the back of aggressive buybacks. Inclusive of a growing yield of 1-2% puts SIG total CAGR at 19-20%.

Risks

The primary risk for both SIG and BRLT will be the global powerhouses of De Beers and Louis Vuitton, who have infinite marketing firepower to push back on the ESG trends and limit their growth potential. There is also the risk that lab-grown diamonds simply never catch on beyond the most ESG-conscientious consumers. Continued levels of fragmentation within the diamond industry also remains a risk, acting as headwind to SIG and BRLT capturing increasing market share. Risk of liquidity is minimal owing to both SIG and BRLT’s strong cashflows and balance sheets, enabling both to take advantage of rising rate environment by using cash to expand market share.

Conclusion

With the diamond industry fragmented, there is room for market leaders to grow through consolidation, and for newer players to rise from the pack with differentiated value propositions. This is the case for SIG and BRLT, respectively. Both companies are riding the new diamond industry trends with omnichannel and online commerce, lab-grown diamond generational shift, and customization offerings. With SIG being powered by aggressive buybacks and consolidation and BRLT rapidly capturing market share within a particular subgroup of consumers, both companies offer attractive, tempered return expectations at current valuations. This article concludes by initiating coverage on both SIG and BRLT with a Bullish rating, though the interested investor may need to hold for the next up-cycle to realize the compounded effects.

Be the first to comment