Prostock-Studio

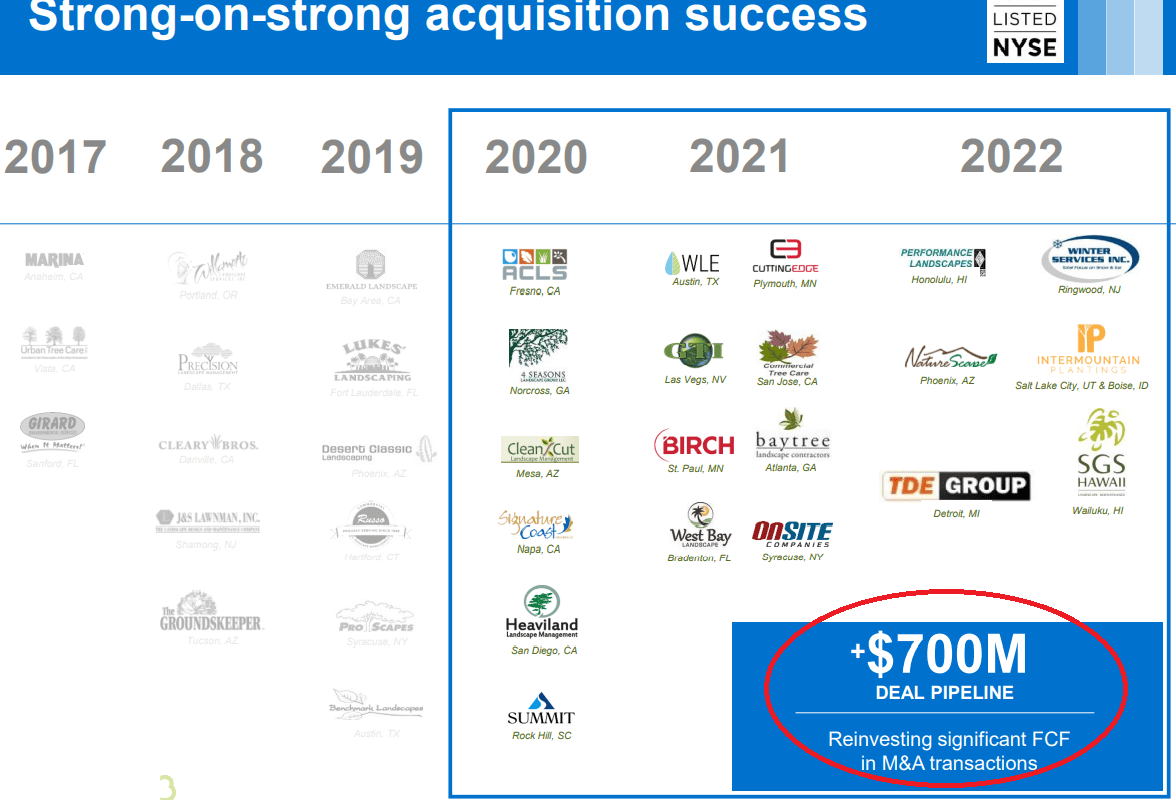

BrightView Holdings, Inc. (NYSE:BV) recently announced incoming deals in the pipeline worth $700 million and beneficial expectations for the year 2022. If we also include great expectations of market analysts about future free cash flow growth and the incoming increase in land market share, BrightView is a must-follow stock. Under conservative conditions that include reinvestment of free cash flow, I believe that the stock is quite undervalued. Yes, I do see some risks from the total amount of leverage; however, the company is a gift at the current market price.

BrightView

BrightView bills itself as the largest provider of commercial landscaping services in the United States. The range of services offered is quite significant including landscape maintenance and enhancements, tree care, and landscape development.

Source: 10-K

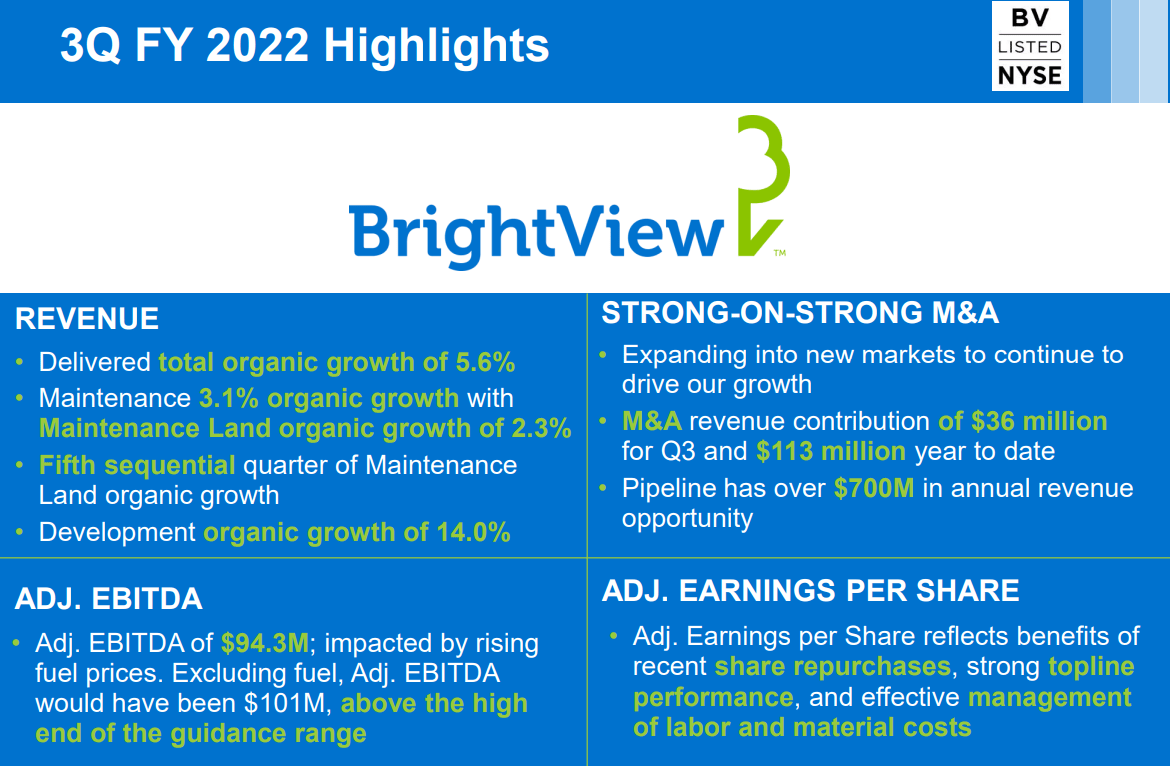

The company entered my radar after delivering impressive figures in Q3 2022. Driven by significant M&A revenue contribution and organic growth of 5.6%, I believe that the market is not correctly reacting to the company’s new financial figures. If we include future revenue guidelines and free cash flow expected, in my view, it is a moment to review the company’s business model.

Source: Quarterly Presentation

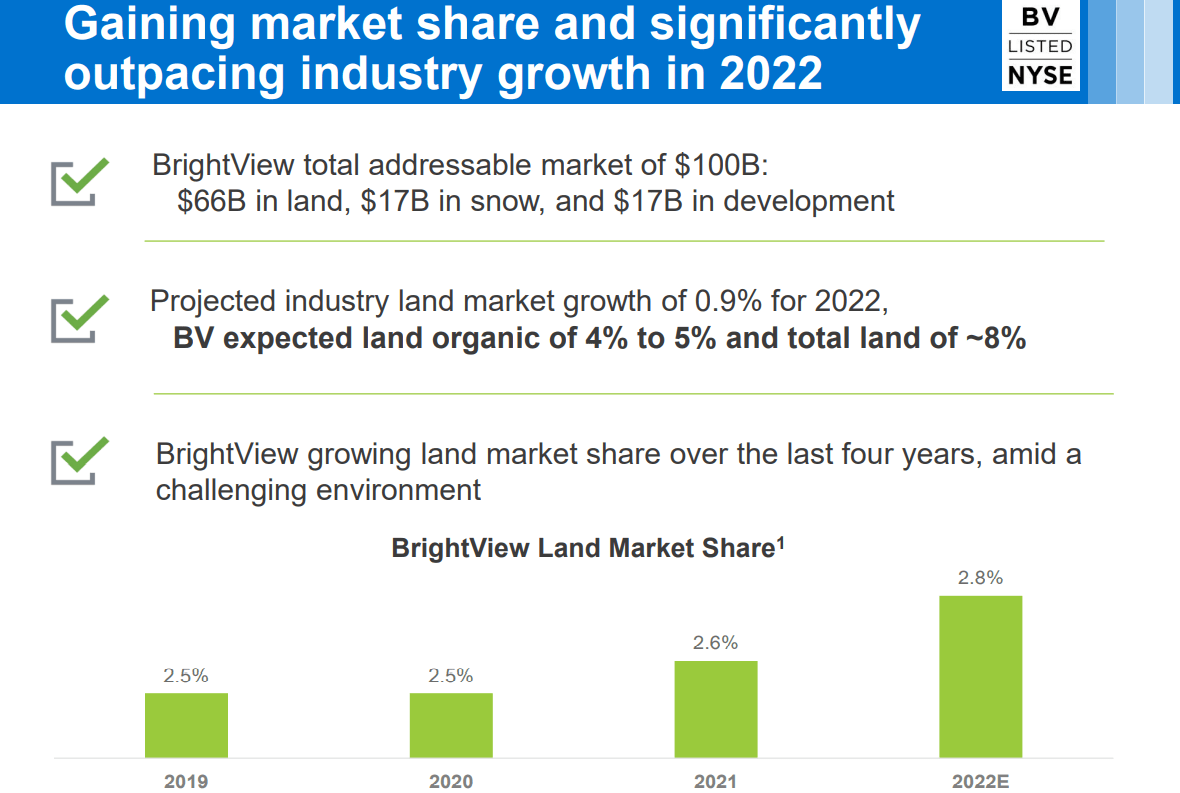

If we also consider the total addressable market and growing market share, BrightView looks even more interesting. The company believes that it is currently targeting an addressable market of $100 billion, and expects to report land market share of close to 2.8% in 2022.

Source: Quarterly Presentation

Great Expectations For 2022 From Management And Growing Free Cash Flow Market Estimates

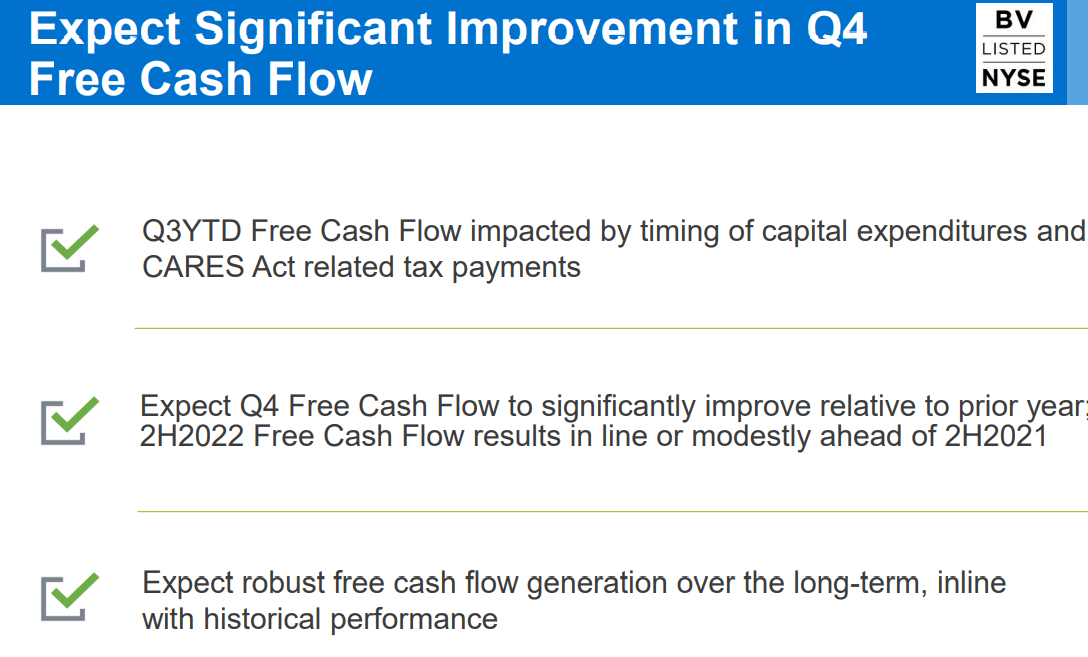

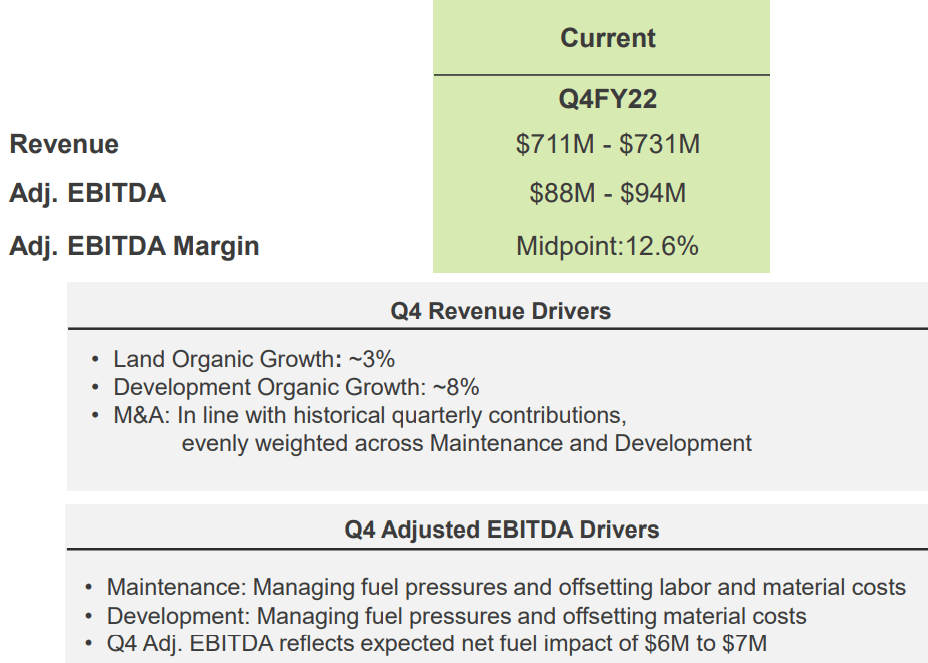

The company was quite optimistic about Q4 2022. In a recent presentation, management noted that free cash flow is expected to increase significantly thanks to capital expenditures changes and CARES Act related tax payments. New figures could bring significant stock demand to the market, so I believe that investors should have a look at the estimates delivered by management.

Source: Quarterly Presentation

Revenue for Q4 2022 is expected to stand at close to $711-$731 million, with an adjusted EBITDA margin close to 12.6%. Management believes that impact from changes in the price of fuel, M&A, and material costs are some of the drivers for the new financial figures.

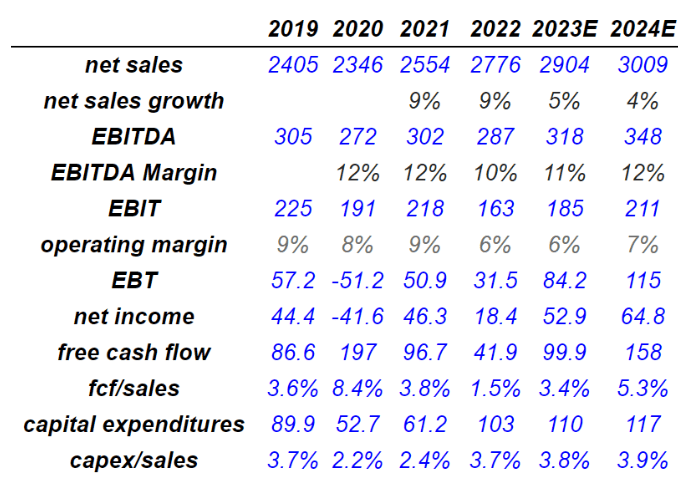

Source: Quarterly Presentation

Motivated by the numbers released by management, I discover that investment analysts are also quite optimistic about the future. From 2022 to 2024, sales growth is expected in the range of 9% to 4%, EBITDA margin would stand at 10%-12%, and the operating margin would stay at 6%-7%. It is worth noting that the net income is expected to grow from $18 million in 2022 to $64 million in 2024. Finally, many analysts also believe that free cash flow could grow from $41 million in 2022 to $158 million in 2024.

Source: Seeking Alpha

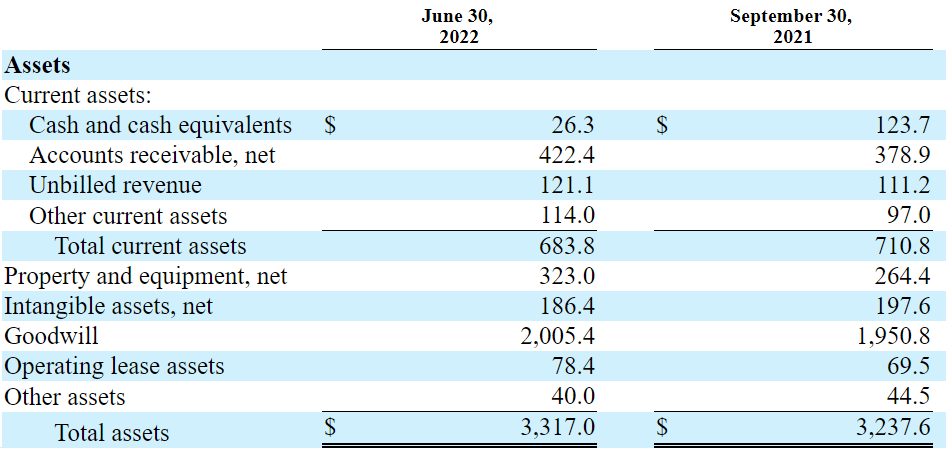

Balance Sheet

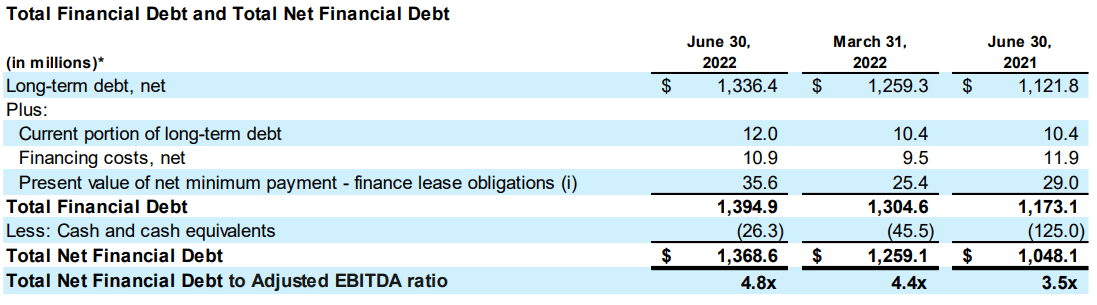

As of June 30, 2022, cash of $26.3 million were reported with accounts receivable worth $422.4 million and total current assets of $683.8 million. With that, the most interesting are the company’s intangible assets. Management reported intangible assets worth $186.4 million and goodwill of $2 billion. With these numbers in mind, I would expect some goodwill impairment risks in the coming years.

10-Q

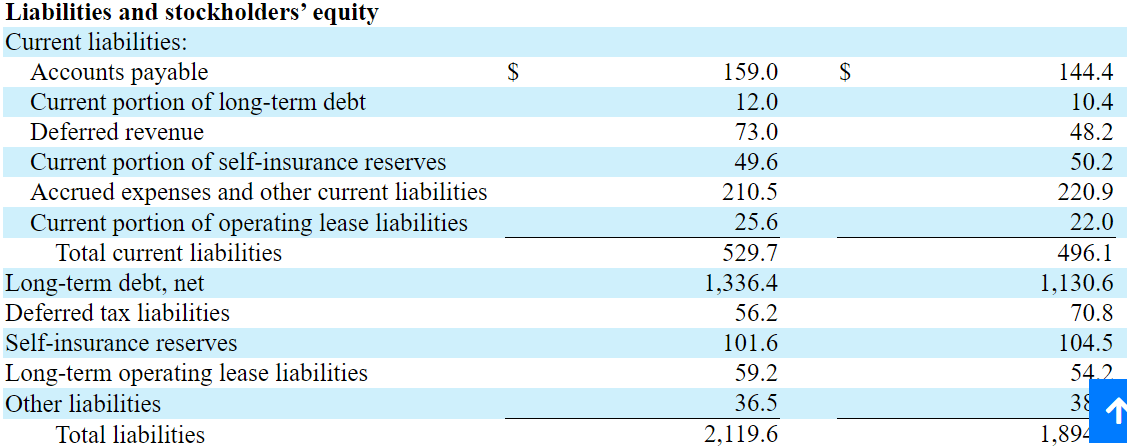

With account payables worth $159 million, current portion of long term debt of $12 million, and deferred income of $73 million, I don’t believe that the company’s obligations are very relevant in the short term.

Total current liabilities stand at $529 million. The long term debt is equal to $1.3 billion, which represents a significant part of the total liabilities worth $2 billion. Considering the total amount of debt, I decided to carefully study the total amount of leverage.

10-Q

As of June 30, 2022, the net financial debt to adjusted EBITDA stands at close to 4.8x. Some investors may not find themselves comfortable with this figure. In my view, considering the increase in free cash flow expected for the future, the total amount of debt is not that significant.

10-Q

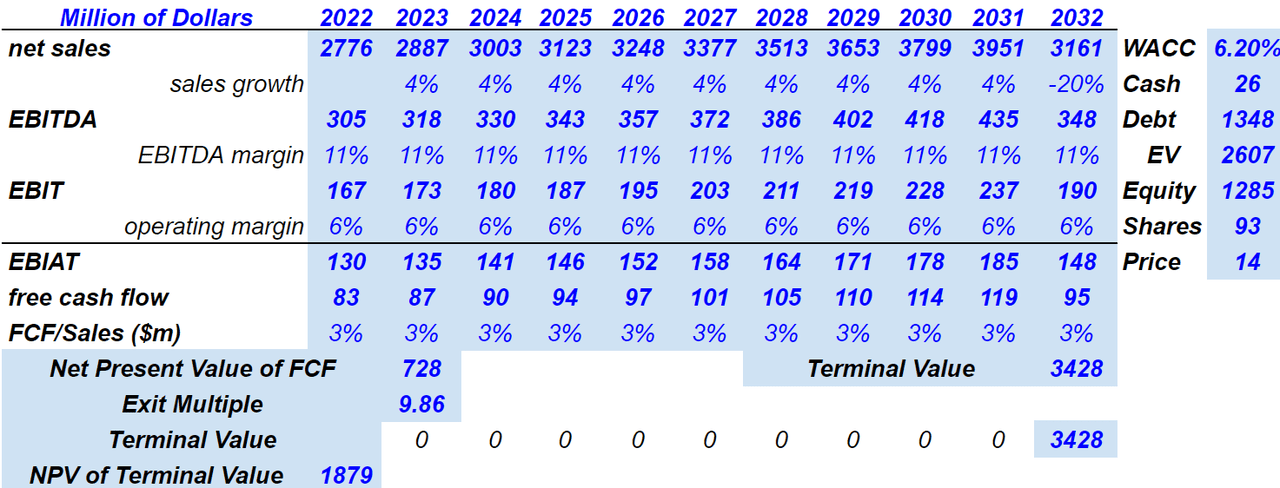

I expect that the company will, by 2032, present a net sales of $3.161 billion, an EBITDA of $348 million, with an EBITDA margin of 11%. I estimate an EBIT of $190 million and an operating margin of 6%. The EBIAT is estimated to be $148 million. In addition to a free cash flow of $95 million and the FCF/sales of 3%, the net present value of FCF will be $728 million. My DCF also includes a terminal value of $3.428 billion. Finally, I anticipate an exit multiple of 9x, and with a WACC of 6.20%, I obtained EV of $2.607 billion, an equity of $1.285 billion, and a fair price of $14.

My DCF Model

My Base Case Scenario Includes Reinvesting FCF In New Acquisitions And Correct Management Of Inflation, Which Would Imply A Valuation Of $19-$20 Per Share

Under my base case scenario, I assumed that BrightView will successfully acquire more companies in the near future. I believe that the financial sponsors of BrightView will offer more financing to the company. In this regard, let’s note that the company expects to use future free cash flow for different acquisitions. Management noted a deal pipeline of $700 million.

Source: Quarterly Presentation

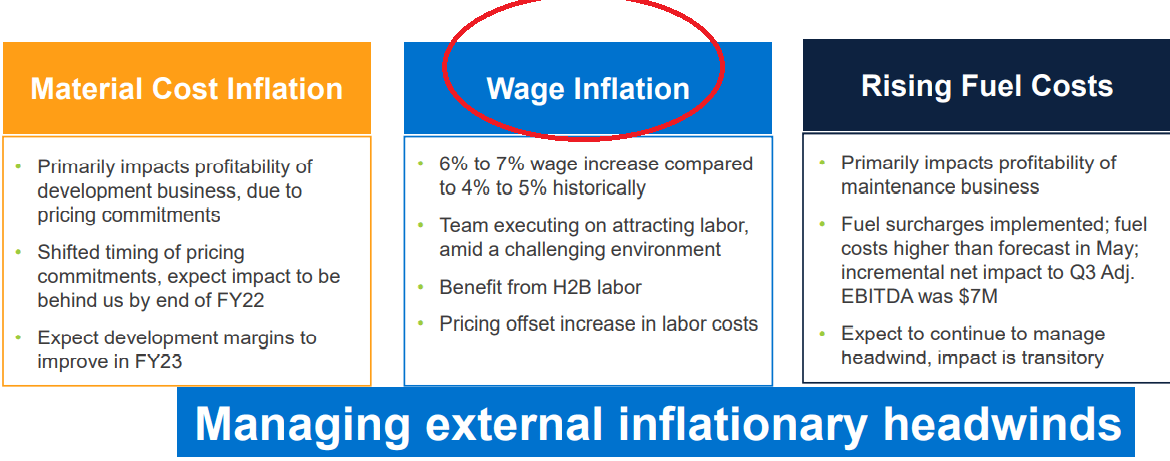

Under this case scenario, I also assumed that BrightView will successfully manage material cost and wage inflation. Besides, I assumed that in the future, rising fuel costs would not significantly harm the company’s profitability. Note that in 2022, the company noted that these costs were under control.

Source: Quarterly Presentation

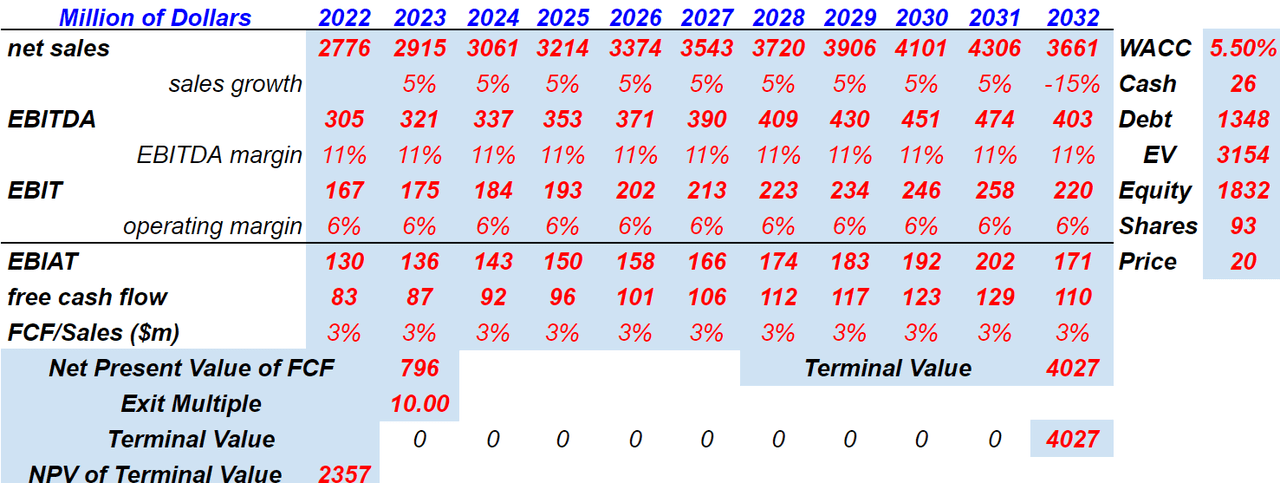

Under this case scenario, for 2032, I forecast a net sales of $3.6 billion and an EBITDA of $403 million, with an EBITDA margin of 11%. I expect EBIT to be $220 million, with an operating margin of 6%. The EBIAT would be $171 million, with a free cash flow worth $110 million and FCF/sales of 3%.

My DCF Model

My results also include a net present value of future FCF of $796 million and a NPV of terminal value of $2.3 billion. With a discount of 5.50%, I obtained an enterprise value of $3.1 billion and equity worth $1.8 billion. Finally, with a share count of 93 million, the implied price would be $20 per share.

My Worst Case Scenario Implies $5 Per Share

Under my worst case scenario, I included assumptions that may drive the company’s revenue growth and profitability down. In my view, a deterioration in the macroeconomic expectations could bring significant revenue declines, and push the company’s EBITDA margins down.

During an economic downturn, our customers may decrease their spending on landscape services by seeking to reduce expenditures for landscape services. Source: 10-K

BrightView makes a lot of money thanks to outsourcing of services. In my view, if clients decide that the services offered don’t meet the necessary standards, they may decide to stop working with BrightView. Let’s note that the company signs long term agreements, but clients can cancel their subscriptions easily.

If a significant number of our existing customers reduced their outsourcing and elected to perform the services themselves, such loss of customers could have a material adverse impact on our business, financial position, results of operations and cash flows.

In our maintenance services segment, we primarily provide services pursuant to agreements that are cancelable by either party upon 30-days’ notice. Consequently, our customers can unilaterally terminate all services pursuant to the terms of our service agreements, without penalty. Source: 10-K

BrightView may have some difficulties in finding new profitable acquisitions. Let’s keep in mind that management already accepted that there are too many actors in the industry, which may be too small to be acquired. Without profitable acquisitions, I wouldn’t expect significant revenue growth in the coming years.

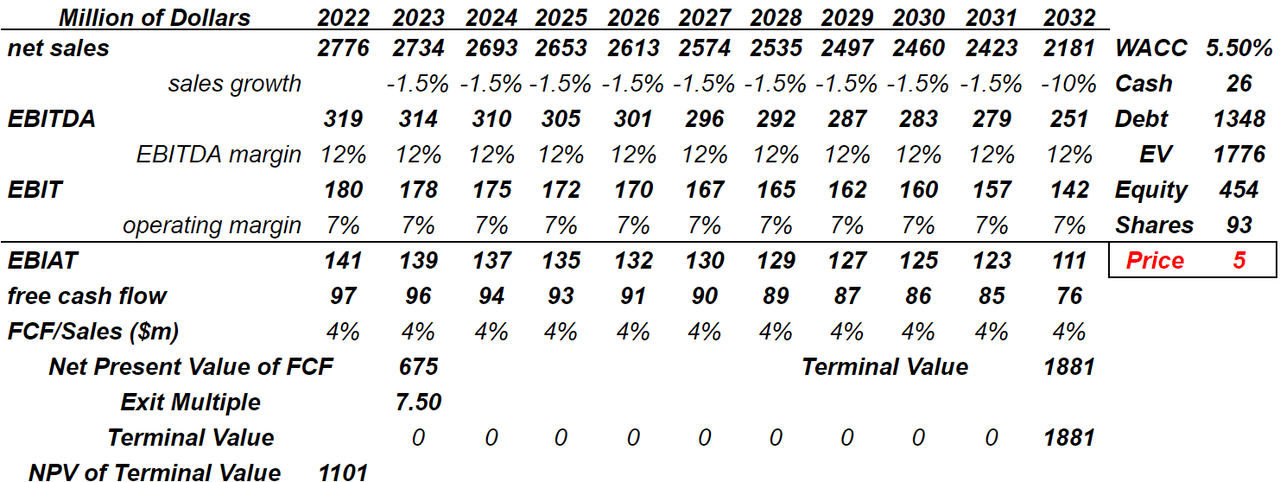

Under this scenario, in 2032, I assumed net sales of $2.1 billion, an EBITDA of $251 million with an EBITDA margin of 12%, and 2032 EBIT worth $142 million. I also anticipated an EBIAT of $111 million and a free cash flow of $76 million with an FCF/sales of 4%.

My DCF Model

My results would include a net present value of future free cash flow worth $675 million, a terminal value of $1.8 billion, and NPV of the terminal value of $1.1 billion. With a WACC of 5.50%, I forecasted an enterprise value of $1.7 billion and an equity of $454 million. The implied fair price would be $5 per share.

Conclusion

BrightView Holdings, Inc. is trading quite undervalued. In my view, with a pipeline of $700 million M&A deals and beneficial expectations for 2023 and 2024, BrightView would be worth more than $19 per share. In my opinion, with sufficient free cash flow reinvested in mergers and acquisitions, the current net debt leverage may not be that worrying. Besides, if management can continue to manage inflation as in the past, I wouldn’t worry about future decreases in the EBITDA margin. In sum, there are risks, but at the current market price, these risks seem small.

Be the first to comment