Sundry Photography

A Quick Take On Bridge Investment Group

Bridge Investment Group Holdings Inc. (NYSE:BRDG) went public in July 2021, raising approximately $300 million in gross proceeds from an IPO that priced at $16.00 per share.

The firm is a vertically integrated investment manager for various real estate verticals focused on the United States.

For investors seeking a significant dividend plus a recession resistant stock, BRDG is a strong candidate for consideration.

At around $18.30 per share, my outlook is a Buy for BRDG.

Bridge Investment Group Overview

Salt Lake City, Utah-based Bridge was founded to develop a nationwide platform to provide institutional and individual investors with exposure to a variety of asset classes within the real estate sector in the United States.

Management is headed by Chief Executive Officer Jonathan Slager, who has been with the firm since its inception and has more than 35 years’ experience in real estate, finance and software companies.

Below is a map of the firm’s asset types and coverage, as of July, 2021:

Asset Map – July 2021 (SEC EDGAR)

The firm seeks to directly operate the properties it owns, which now span 40 U.S. states in both primary and secondary markets.

Bridge has equity and debt investments in multifamily, office, workforce housing, senior housing, logistics and other investment classes.

Bridge’s Market & Competition

Management forecasts a strong need for affordable housing via an informed, socially responsible approach.

Recently, Bridge launched its Logistics Net Lease and Logistics Properties platforms focusing on the acquisition of Class A and B industrial properties in the top 75 MSAs in the U.S. as well as potential development of new properties in infill, last-mile driven markets.

Bridge markets its funds through RIAs (Registered Investment Advisors) and directly to high-net-worth individuals, family offices and institutional investors.

Also, as of July 2021, the company had over 6,500 fund investors representing 57% of committed capital and 115 institutional investors accounting for the other 47%. (Source)

Major competitive or other industry participants include:

-

Asset management firms

-

Commercial banks

-

Broker-dealers

-

Insurance companies

-

Alternative asset management firms

Bridge Investment’s Recent Financial Performance

-

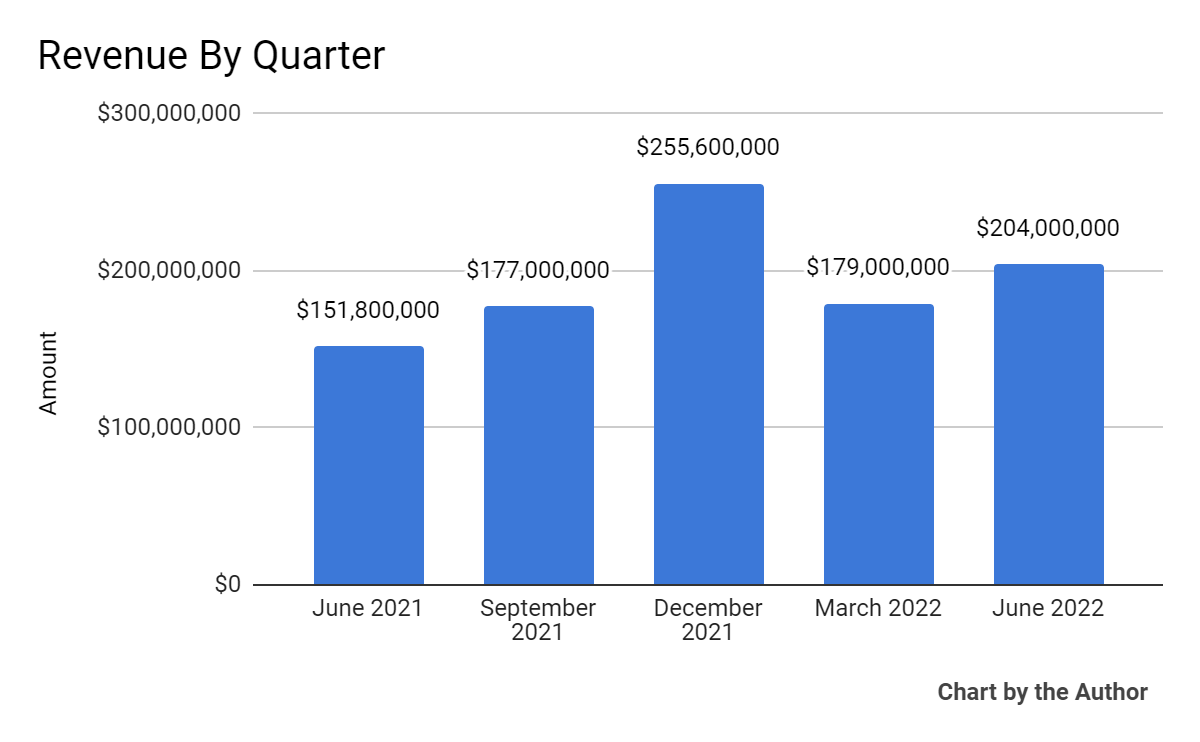

Total revenue by quarter has registered uneven growth:

5 Quarter Total Revenue (Seeking Alpha)

-

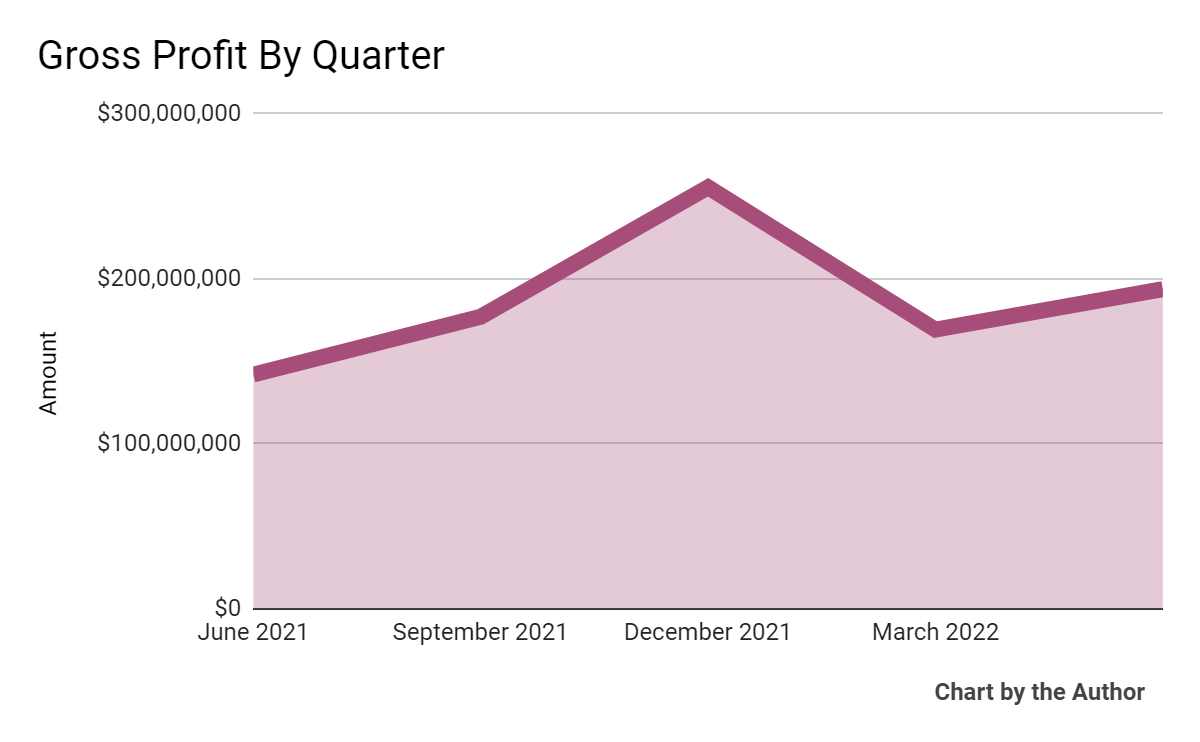

Gross profit by quarter has also been considerably variable over the past 5 quarters:

5 Quarter Gross Profit (Seeking Alpha)

-

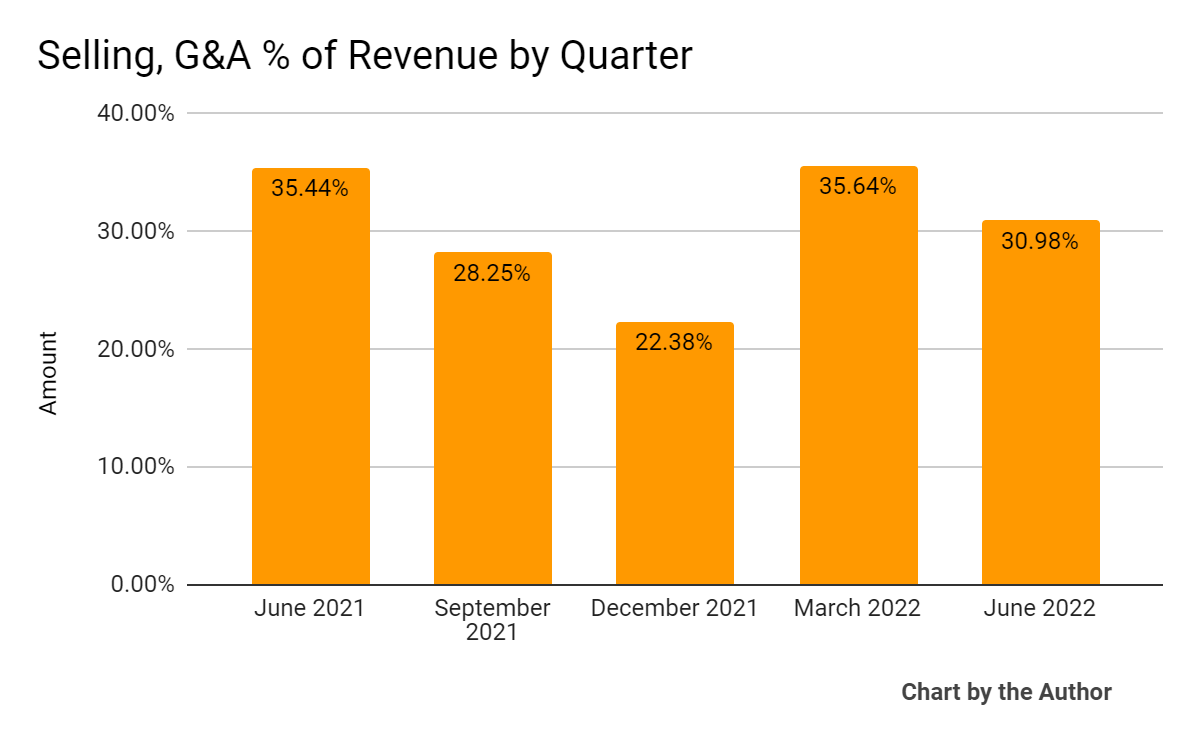

Selling, G&A expenses as a percentage of total revenue by quarter have varied as well:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

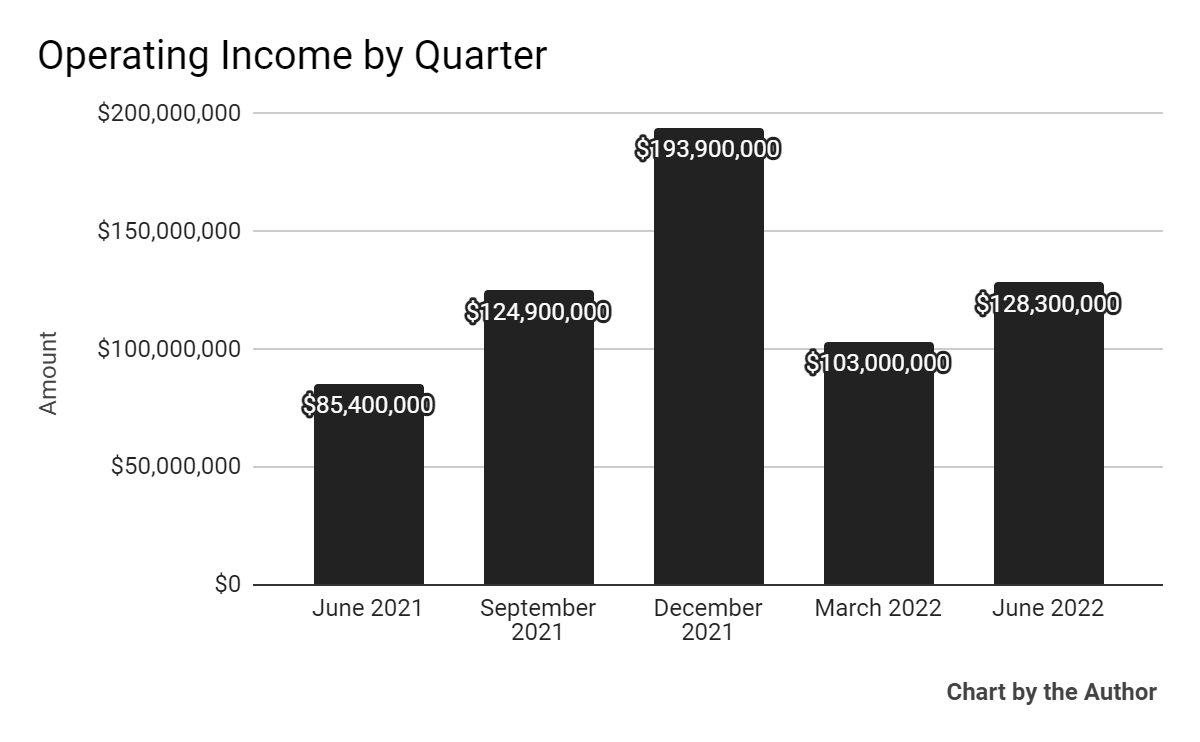

Operating income by quarter has fluctuated substantially:

5 Quarter Operating Income (Seeking Alpha)

-

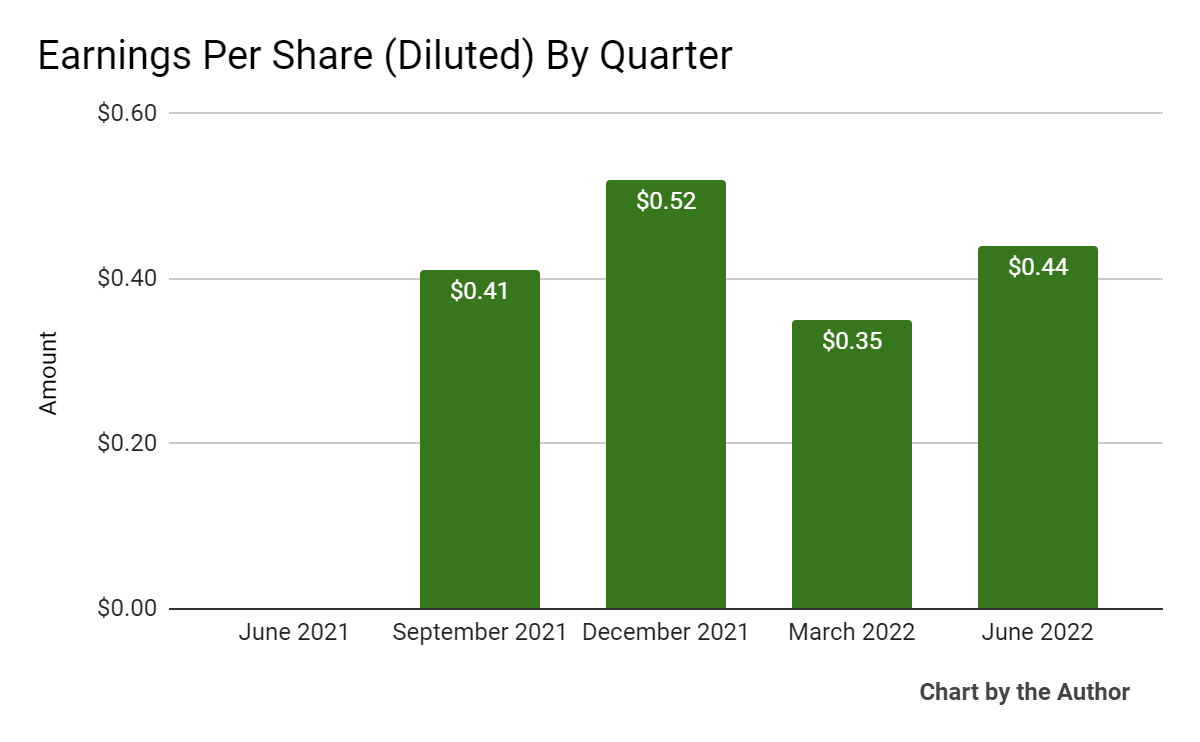

Earnings per share (Diluted) have varied:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

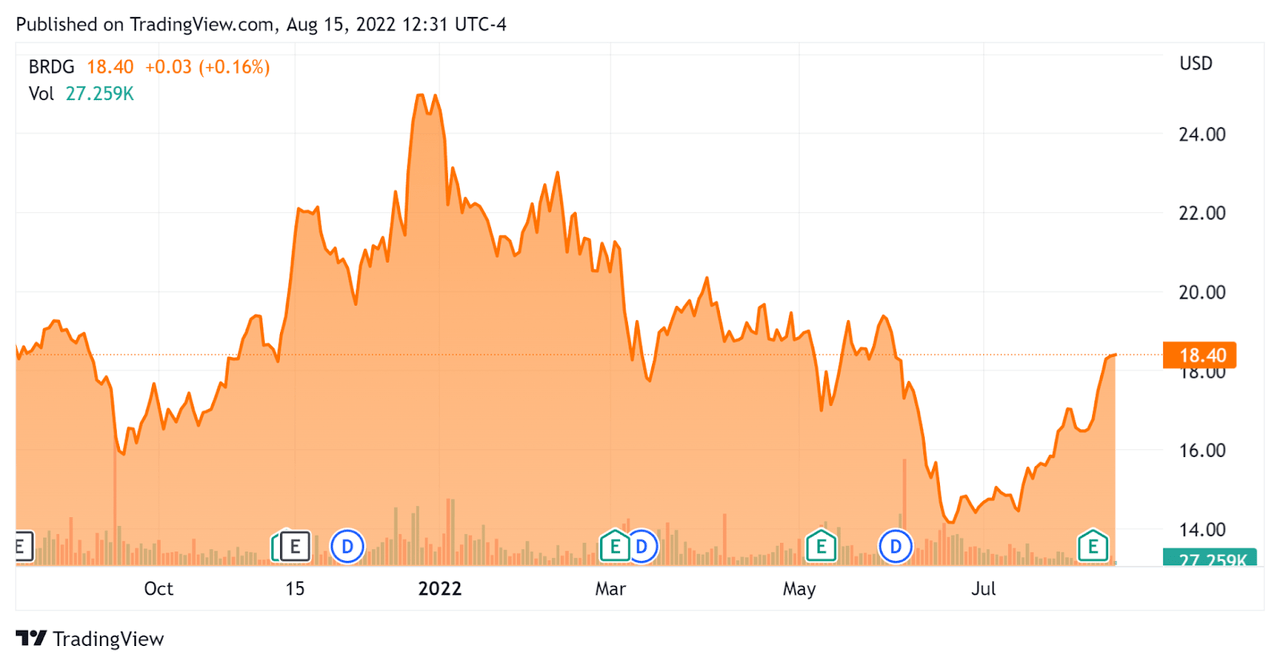

In the past 12 months, BRDG’s stock price has fallen only 1.7% vs. the U.S. S&P 500 index’ drop of around 4.1%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Bridge

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value |

$1,190,000,000 |

|

Market Capitalization |

$2,110,000,000 |

|

Enterprise Value / Sales |

1.46 |

|

Revenue Growth Rate |

80.0% |

|

Operating Cash Flow |

$253,130,000 |

|

Earnings Per Share (Fully Diluted) |

$1.72 |

|

Net Income Margin |

33.6% |

(Source – Seeking Alpha)

Commentary On Bridge

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the growing turbulence in the overall market environment, although its primary focus on residential rental investments is paying off due to strong rent rates from a nationwide housing shortage.

As a result, the company is “currently pursuing 76 development projects virtually all in the multifamily sector.”

The firm is also targeting green energy and PropTech sectors with recent fund closings designed to provide funding for attractive projects and companies.

As to its financial results, fee-earning assets under management [AUM] increased to a level 44% higher year-over-year, to $15.5 billion, with realized performance fees of $33.6 million.

The company is focused on its specialized strategies in the residential and logistics verticals, which it believes have long-term trends in their favor.

However, debt markets are seeing slowdowns in securitizations, resulting in increased spreads and lower leverage, impacting transaction volumes and pricing.

The firm’s forward dividend yield is currently 6.53%, although this figure may not be representative of its actual future yield due to dividend volatility.

Looking ahead, while the company will likely face uncertain markets that are responding to a continued rise in the cost of capital, Bridge appears very well positioned to take advantage of dislocated rental markets and generate substantial returns.

Like a private equity firm that sees “lumpy” earnings, Bridge may produce uneven results in the quarters ahead.

However, for investors seeking a significant dividend plus a recession resistant stock, BRDG is a strong candidate for consideration.

I’m Bullish on Bridge at around $18.30 per share.

Be the first to comment