benedek

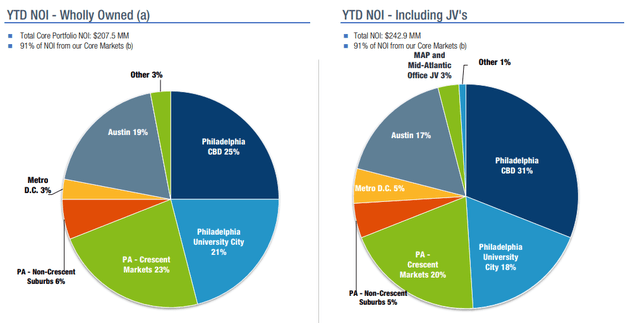

Brandywine Realty Trust (NYSE:BDN) is a real estate investment trust (“REIT”) that has an interest in a portfolio of office, life science, residential, and mixed-use properties. Over 90% of their net operating income (“NOI”) is derived from their core markets, which principally includes three key markets in Pennsylvania, Austin, Texas, and the D.C. Metro.

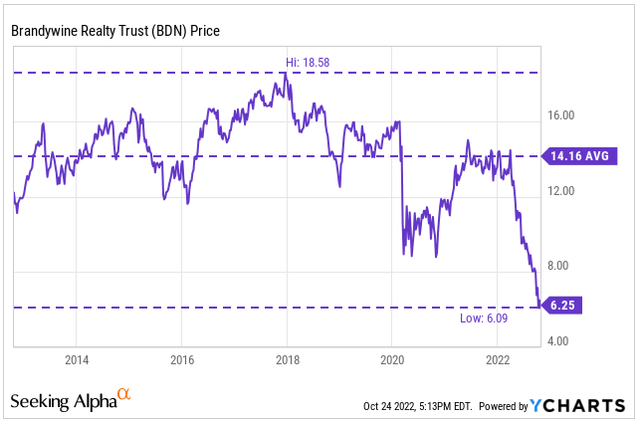

Over the past year, shares have fallen to all-time lows, with a current forward multiple of funds from operations (“FFO”) of about 4.6x after trading at about 9.5x at the end of 2021.

YCharts – Historical Share Price History Of BDN

YTD, shares are down over 50% and trade slightly above their 52-week lows. Though sentiment has been negative, especially in office-related names, the fundamentals in the sector have significantly improved since the worst months of the COVID-19 pandemic in 2020.

For existing shareholders in BDN, the stock offers sizeable upside potential from any broader reversal in sector sentiment. In addition, the company is currently maintaining a dividend payout with a double-digit yield.

While recently reported results validate BDN’s current strategy, they do have near-term debt maturities on net obligations that are currently tracking above internal targets. Though the company’s outlook is stable, it may be prudent to leave shares on the watchlist until the upcoming maturities are satisfied.

Occupancy Levels Above 90% And Beneficiary Of “Flight To Quality” Trend

BDN recently reported Q3FY22 results that came in ahead of expectations. At period end, quarter end occupancy stood at 90.8%, which was 120 basis points (“bps”) better than the second quarter. The spread between leased and physical occupancy also narrowed to 100bps from 250bps in the quarter prior, resulting in greater cash receipts from commencements.

Within their operating markets, which is heavily concentrated in Southeastern Pennsylvania and to a lesser extent, Austin, Texas, management noted continued improvements in physical occupancy levels, to about 60% overall, with a high of 70-75% in the Pennsylvania suburbs.

Overall, these three top markets ended the quarter at a leased and occupied rate of 93.8% and 93%, respectively.

Q3FY22 Investor Supplement – NOI Disaggregation By Market

Hybrid arrangements, as expected, also remain the norm in all their markets, with three days being the customary average. Given the heightened awareness to spacing needs as a result of these new working arrangements, more companies are taking a “flight to quality.” As it relates to BDN, just under half of their new deals during the quarter were from tenants looking to upgrade from lower quality buildings. This is up from about a third last quarter.

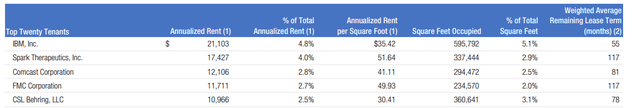

Overall, the company continues to have a diversified tenant base across multiple industries, with no single tenant representing over 5% of total annualized base rents (“ABR”) at the end of Q3FY22. In aggregate, their top twenty account for about 38% of ABR, with their top-5 representing just shy of 17% of that total.

Q3FY22 Investor Presentation – Summary Of Top Five Tenants

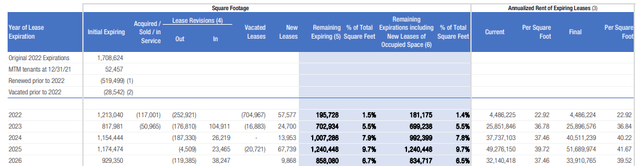

Limited Expirations Serves As Hedge Against Declining Renewal Spreads

Despite sector uncertainties, leasing held up during the quarter, with over 500K square feet (“SF”) of signings, including 300K SF of new leases, at a combined cash spread of 6.9%. Individually, cash spreads on new leases were 12.9%, which is up 90bps sequentially and 250bps YOY. Spreads on renewals, on the other hand, came in at 1%, which is weaker than prior quarters. In the same period last year, for example, reported renewal spreads were 13.1%.

In the upcoming years through 2026, BDN’s expiration exposure is just 7.3%, which is on the lower end compared to other REITs. Though this takes away some mark-to-market opportunity, it does serve as a hedge against declining spreads, particularly on their renewals.

Q3FY22 Investor Supplement – Lease Expiration Schedule

An Active Pipeline But A Pause On New Starts

At the end of the quarter, BDN’s total leasing pipeline was just shy just of 5.0M SF, 3.3M SF of which was attributable to development projects, a 300K SF increase from the prior quarter. Within the remaining pipeline, management did note an improvement in decision timelines to pre-pandemic levels, as well as a modest improvement in conversion rates to 40%, which would be up from the 38% reported last quarter.

Moving forward, all future development starts have been placed on hold due to market uncertainties relating to the cost of debt and cap rates. In addition, management also wants to generate further leasing traction on their existing pipeline before taking on the risk of new developments that aren’t yet fully pre-leased.

While all but one of their wholly owned developments are at or above 85% leased as of mid-October, their joint ventures are currently at a 0% leased rate. Altogether, the company has +$428M tied up in development projects that provide little, if any, contribution to 2022 earnings yet still factor into their quarter end leverage metrics.

Elevated Leverage Levels With Near-Term Maturities

In the current quarter, development’s incremental impact on leverage was approximately 1.2x, resulting in an overall net debt multiple of EBITDA of 7.2x at period end, which is above their targeted range of 6.6x to 6.9x. Over time, however, management does expect leverage to decrease back into the low 6.0x range as developments are stabilized. But at present, leverage is expected to settle at the top end of their range through the end of the year.

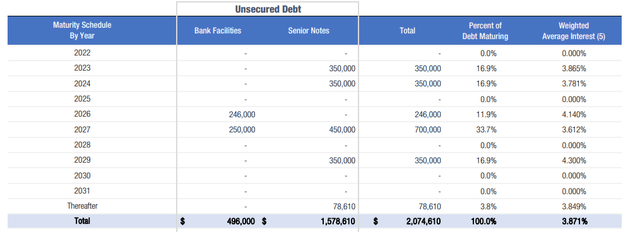

Looking ahead to the remainder of the year, the company expects to have sufficient liquidity to meet their capital commitments, which includes their quarterly dividend payments. They do, however, have two large maturities coming due in early 2023 and 2024 on their wholly owned properties, as well as several maturities on their joint ventures.

Q3FY22 Investor Presentation – Debt Maturity Schedule

Capex Commitments Are Constraining Dividend Coverage

At present, management is assessing various options to increase liquidity ahead of the +$350M maturity in February 2023. While they believe they will be able to refinance with a shorter dated bond, they are also marketing +$200M in properties for sale not only to raise additional funds but to gauge price discovery in the current markets.

Though the current dividend payout represents just over 50% of FFO, it is above 95% when considering cash available for distribution (“CAD”), which is a truer indicator of coverage due to its inclusion of capex commitments and adjustments for straight line rent, among other considerations. This would be up from 84% last quarter and 66% in the same period last year.

For income investors, the double-digit payout is one current draw to the stock. But given current CAD coverage levels and their upcoming maturity in 2023, investors should account for it with caution until an update is provided regarding the rollover of their near-term obligations.

Final Insights

There were several positive developments in BDN’s most recently released earnings report. Despite greater permanency in hybrid working arrangements, for example, physical occupancy levels in BDN’s markets continued to increase, especially from Tuesday to Thursday, where occupancy levels were reported to be between 70-75%.

Overall leased rates also improved to over 90% in the current quarter, driven by continued strength in leasing activity. While total signings were down from the last quarter, the company experienced better conversion rates from tenants that continue to accelerate their decision timelines.

BDN’s operating presence in the Philadelphia CBD, which is one of the top markets in the country for venture capital deals, life sciences, and education is also serving as a draw to tenants that are prioritizing quality in their spacing needs.

The life science opportunity, in particular, is currently being underappreciated by the market, given its current outlook and Philadelphia’s outsized contribution to the sector. Among their current developments focused on the opportunity, the Schuylkill Yards project is one that will likely prove most accretive in the years ahead as it stabilizes.

In the interim, however, leverage levels are likely to remain elevated due to the negligible contribution to earnings from their ongoing developments that require continued funding commitments. This can be a concern, especially in challenging debt markets, where lenders are increasingly hesitant to provide financing to overextended borrowers.

At present, BDN’s debt load is above internal targets. In addition, they have a large maturity in the beginning of 2023. Though they have sufficient liquidity to meet their capital needs through the remainder of the year, they are still proceeding with prudence by marketing properties for sale and pausing vacant development starts in an effort to raise additional funds.

For income investors, the double-digit dividend yield is one draw to the stock, but it’s not sacrosanct. The company does have a solid track record of continuous payments, but the current market environment is highly uncertain, and they do have an upcoming maturity, which necessitates the application of a greater risk premium.

While shares do appear significantly undervalued at 4.6x forward FFO, given improving sector and property-level fundamentals, it may be best to hold on new initiation until an update is provided regarding the satisfaction of their upcoming maturity.

Be the first to comment