filmestria/iStock Editorial via Getty Images

Thesis

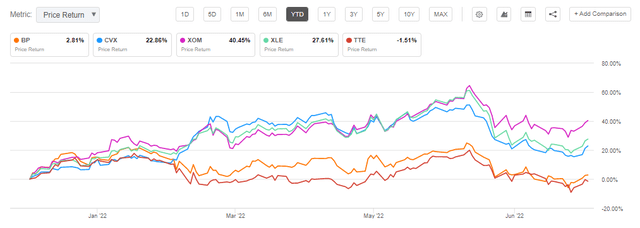

BP p.l.c. (NYSE:BP) has been an underperformer in the energy sector this year. With a stock price which is fairly flat in 2022, BP has “missed the boat” on the massive rally we have seen in energy shares (the energy ETF XLE is up +27% year-to-date, for example). The reasons behind the underperformance are three-fold:

- Underperforming management lacking a clear profitable vision for the company

- Russia assets write-down

- European company subject to local political whims

The company is trying to execute a pivot to “clean energy” amidst one of the largest cyclical rallies in oil prices. BP got hit hard on its Russian assets, and it is unclear at what level it can unload its shares. It wrote off the entire investment, but it is reasonable to assume it will get something back from a Chinese or Indian investor interested in its Rosneft (RNFTF, OJSCY) stake. The outlook is nonetheless getting dimmer here, with the Ukraine conflict still raging and Russia trying to squeeze Europe by cutting gas deliveries and ensuring an unpleasant winter ahead.

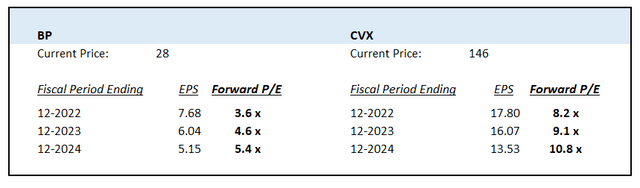

All this turmoil has translated into a much lower P/E ratio for BP when compared to Chevron (CVX), an outstanding U.S. Oil & Gas major:

We can see from the above table, which we compiled using Seeking Alpha data, that BP trades at roughly half the forward P/E ratio that Chevron exposes. BP is still profitable, and we expect it to stay as such. The factors above though have resulted in much lower earnings multiples, which we expect to stick around.

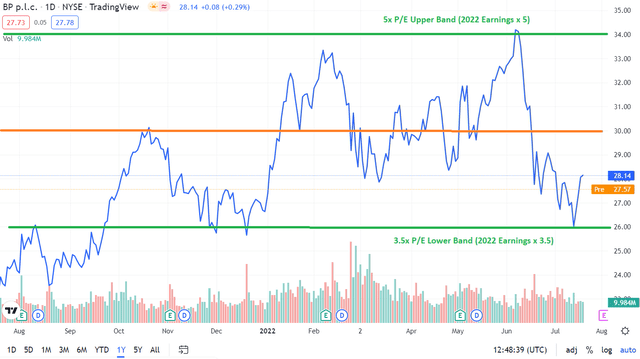

What does this mean from a pricing perspective? The result in the massive debasing in P/E for BP is a constant trading range of $26 – $34 observed in the past year:

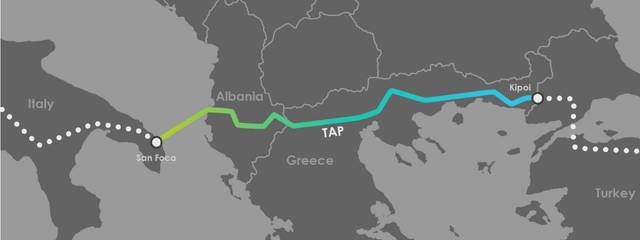

We can see how the stock has alternated between roughly 3.5x earnings and 5x forward earnings. We expect the EPS part of the equation to stay roughly in line with expectations or even record a beat on the back of a rough winter in Europe. As a reminder, BP is a shareholder in the Trans Adriatic Natural Gas Pipeline and similarly holds a stake in the largest natural gas field in Azerbaijan, namely Shah Deniz.

The best way to profit from BP at this stage is to take advantage of the trading range and the high implied volatility. Namely, we will show you below how an at-the-money cash covered put can generate an annualized yield of 24%.

Performance

BP has had a pretty ugly performance in 2022 when compared to its U.S. counterparts:

YTD Performance (Seeking Alpha)

The stock is flat year-to-date, which would be a win in a vacuum, but pales in comparison to the massive rally seen in U.S. energy shares this year.

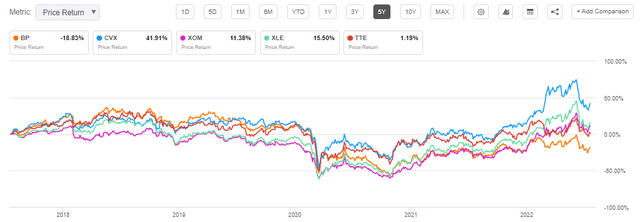

On a 5-year basis, this underperformance is even more glaring:

5-Year Performance (Seeking Alpha)

Strength of the European Operations

BP is a shareholder in the Trans Adriatic Natural Gas Pipeline and similarly holds a stake in the largest natural gas field in Azerbaijan, namely Shah Deniz. The Trans Adriatic Pipeline, a component of the Southern Gas Corridor, transports natural gas to Europe from the Shah Deniz field in Azerbaijan:

BP is one of the main shareholders, together with the State Oil Company of the Azerbaijan Republic: BP (20%), the State Oil Company of the Azerbaijan Republic (SOCAR, 20%), Snam (20%), Fluxys (19%), Enagás (16%), and Swiss energy company Axpo (5%). Given the European over-reliance on Russian natural gas and associated tensions, the TAP pipeline is a critical infrastructure element that ensures Europe can receive supplies from yet another source while supporting the key EU objectives of achieving a sustainable, secure and diversified energy mix.

BP is also the main operator and shareholder (28.8% stake) in the Shah Deniz natural gas field in Azerbaijan, which is the largest gas discovery ever made by BP. Given the run-up in European natural gas prices, this stake coupled with the ability to transport the gas via its TAP pipeline has added tremendous revenue generating capability to BP, both via spot price realization as well as locking in advantageous future delivery contracts.

What is the Trade?

Even if you do not believe that BP will trade at a higher P/E Ratio as seen for American Oil & Gas majors, there is a way to take advantage of the high implied volatility and the established 1-year trading range.

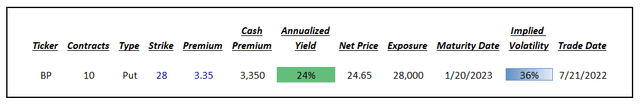

The proposed trade is an at-the-money cash covered put:

The above table outlines how a cash covered put with a January 2023 maturity date provides a $3.35 premium per contract (a contract entails 100 shares), which translates into a $3,350 premium for 10 contracts (maximum exposure here is $28,000).

An investor basically has to purchase 1,000 BP shares on January 20, 2023, if the price of the stock is below 28. If the price is higher, then the premium is realized fully. Translating $3,350 into an annualized yield results in a rate of return of 24%. The strategy is a conservative approach on an outright stock buy, even if the stock is trading at the bottom of a well-defined fundamental range.

Conclusion

BP is a European Oil & Gas major which has experienced a massive P/E debasing based on its muddled strategy. The company was hit hard by its Russian assets write-down and is currently trading at a sub 5x forward P/E ratio. BP has established a nice $26-$34 trading range in the past year, and we expect profitability to stay elevated on the back of high energy prices and the ongoing natural gas squeeze in Europe. For an investor hesitant to go outright long the company’s equity, even at the bottom of the trading range, we present a cash covered put strategy that can deliver annualized yields of 24%.

Be the first to comment