RobynRoper/E+ via Getty Images

Boxed, Inc. (NYSE:BOXD) is approaching its 10th anniversary as an online retailer specializing in household staples and food pantry items. While sales climbed over the last several years amid the e-commerce boom, the company was not been able to translate that momentum into a financially viable model. Indeed, revenues are down this year with a widening loss leaving shares off a disastrous -95% year-to-date in 2022.

The company just reported its latest quarterly result highlighted by some deep financial challenges likely to continue leaving some serious doubt about the long-term sustainability of the business. The only thing we’re seeing inside BOXD is the number of red flags that should serve as a warning for investors to stay away.

BOXD Earnings Recap

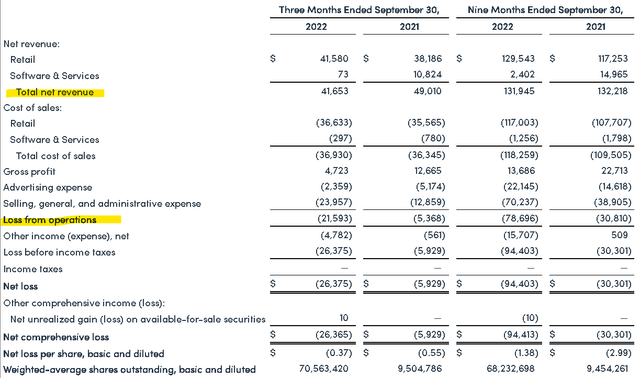

BOXD Q3 revenue of $41.7 million declined by 15% year-over-year. Within that figure, retail sales increased by 1% from Q3 2021 although the bigger impact was the limited contribution of the software & services segment related to its “Spresso” e-commerce management platform that is licensed to other companies. Management explains that a large $10 million deal in 2021 left a difficult comparison with an understanding that the sales trends feature some quarterly variability. On this point, the expectation is that a new customer engagement will add to some top-line boost going forward.

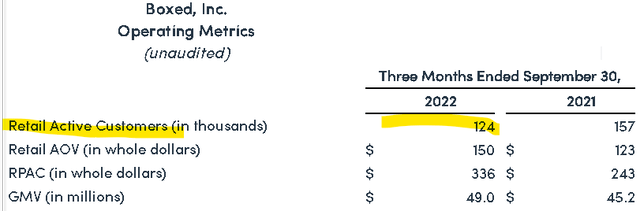

The company messaging has been to focus on some strong points. The average order value on the site reached a record $150, from $123 in Q3 2021. Similarly, the retail net revenue per active customer increased to $336 from $243. Boxed is also finding some success in serving more business-to-business (B2B) customers, where gross merchandise value climbed by 37% y/y in Q3.

On the other hand, the total number of active customers declined by 21% to 124k compared to 157 in the period last year. The readout is that Boxed is serving fewer customers, but the most loyal shoppers are spending a bit more on regular purchases.

The bigger question is if any improvement from here or the marginally positive silver linings will be enough to fill the hole of the large recurring loss. The challenge is evident looking at the Q3 operating loss that reached -$21.6 million compared to -$5.4 million in Q3 2021. A nearly 86% increase in SG&A following the company’s December 2021 SPAC merger added significant expenses. The adjusted EBITDA loss of -$16.3 million also widened from -$3.0 million in the period last year.

The company ended the quarter with $39.4 million in cash including a portion of “restricted cash” against $44 million in long-term debt. There is also a separate $81 million in liabilities related to PIPE convertible notes. All this is in the context of a business that burned about $10.4 million in cash in Q3, meaning liquidity will need to be addressed over the next few quarters likely through another capital raise.

In terms of guidance, management expects full-year revenue in the range of $165 million to $180 million. This implies approximately flat Q4 sales compared to Q3. The expectation is that the 2022 adjusted EBITDA loss ends in the range of -$65 million to -$80 million, compared to -$61 million year to date.

BOXD Stock Price Forecast

We’re bearish on BOXD as we just don’t see the company picking up the growth momentum necessary to jumpstart a real turnaround. The skepticism we have is whether Boxed offers a compelling shopping proposition to potential customers that are capable of competing with the segment leaders like Amazon.com (AMZN) and Walmart Inc. (WMT) that can offer more value across their ecosystem of services. There’s little reason to see why the ongoing decline of active customers at Boxed will reverse or even stabilize.

Based on our estimate and the current gross margin of 12%, retail revenues would need to more than double from the current quarterly level to approach a breakeven adjusted EBITDA. Again, this is a difficult market segment where even Amazon struggles with e-commerce profitability amid current macro headwinds.

With a current market cap of under $50 million, BOXD is an example of a highly speculative “penny stock”, where the extreme risk likely outweighs any upside potential. If there is a bullish case, Boxed will need to demonstrate progress in monetizing its software services segment and further scale its B2B wholesaling initiatives as quickly as possible.

In summary, our recommendation is to avoid the stock with the visibility for a growth renaissance being poor, particularly with the company needing to cut costs and manage liquidity. From the current share price level under $0.70 per share, we won’t be surprised at a reverse-split type of corporate action alongside further dilutive share issuance into 2023 will keep downside pressure on the stock.

Be the first to comment