AvigatorPhotographer

Note: I have covered Borr Drilling (NYSE:BORR) previously, so investors should view this as an update to my earlier articles on the company.

Shares of junior offshore driller Borr Drilling are down by approximately 60% over the past six weeks as oil prices have retreated below the $100 level amid increased recession fears and lower-than-expected demand.

Even worse, the company’s debt refinancing efforts haven’t gone as smoothly as suggested by management on the Q1 conference call in late May:

Our refinancing process is ongoing, and we are in discussions with our lenders with a view to complete the refinancing before the end of the second quarter. Given the strong market fundamentals, multiple options are currently on the table in order to address the maturity profile of our debt position and provide a long-term financing solution.

Some of these options include straight debt solutions, while others involve certain asset sales, of which there is ample interest in our fleet at attractive prices. We are currently working to improve on all refinance conditions given that the market is rapidly and positively evolving and believe a solution is achievable in the coming weeks.

As it has turned out, lenders have not been as accommodative as expected by management and demanded Borr Drilling to raise additional equity and repay some of its approximately $1.9 billion in net debt.

On Thursday, the company provided an update on the ongoing negotiations:

The Company’s board is pleased to announce that agreements in principle have been reached with most of the secured creditors to extend the majority of secured debt to 2025. These agreements are subject to the respective board’s approvals and binding documentation. The company is seeking the required consents and waiver extensions from lenders to complete the transaction. Once these agreements are in place, the Company will have long term financing on approximately $1.4 billion and has also maintained the long-term financing on the 2 new builds in the amount of $260 million. The refinancing is to be largely enabled by the sale of some select assets, and additional equity.

The asset sale includes 3 rigs under construction/contract for which the company has received a binding LOI as previously announced, plus an additional rig that is targeted to be sold in Q42022, after which the rig fleet would consist of 22 delivered rigs plus 2 rigs under construction.

The agreements in principle contemplate partial paydown of the senior secured facility collateralized by 8 rigs from $313 million to $250 million out of which $100 million is subject to successful syndication. In case this facility is reduced to $150 million drawn, then 3 rigs will be unencumbered assets that could be sold to reduce capital requirements. In addition, the agreements in principle contemplate a $30 million paydown of the Hayfin facility.

In a separate news release, Borr Drilling stated its goal to raise up to $250 million in an equity offering subsequent to the company’s Q2 earnings release on August 11:

The proceeds of the potential equity raise are expected to be used to partially paydown certain secured facilities. The company targets to raise up to $250 million in the offering which could be reduced in case of syndication of facilities, additional asset sales or joint ventures at attractive prices can be realized.

With the proposed equity raise still almost four weeks away, the news effectively constitutes an invitation to short the shares.

After Thursday’s sell-off, raising $250 million in equity at an assumed price of $2.50 per share would increase outstanding shares by more than 65%, and with an estimated net asset value (“NAV”) per share of just $1.25, there’s not much that would prevent the stock price from dropping even further over the next couple of weeks.

Please note that restructured competitors like Noble Corporation (NE) or Valaris (VAL) trade at substantial discounts to NAV despite much better liquidity and basically zero net debt.

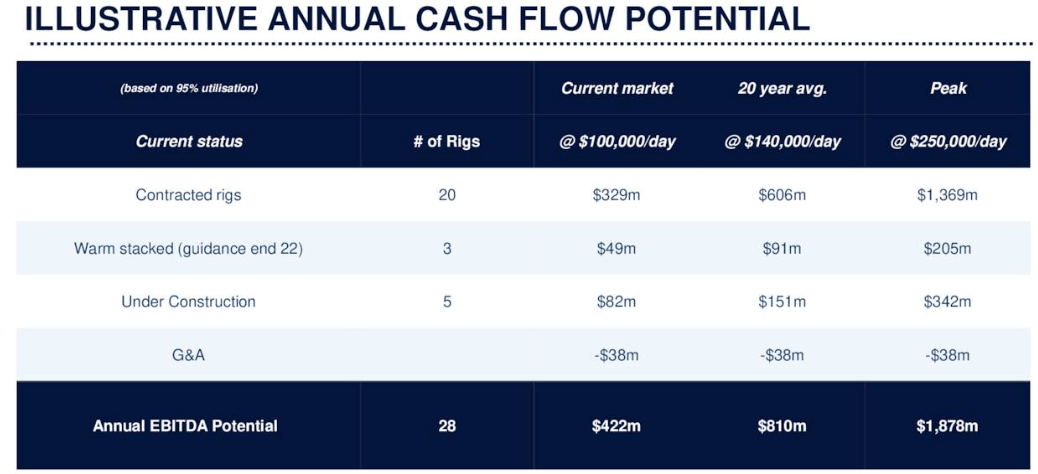

In addition, the required sale of four newbuild rigs will result in the company lacking the earnings power claimed in recent presentations:

Company Presentation

Bottom Line

Clearly, things have not played out as expected by Borr Drilling’s management at the time of the Q1 conference call in late May as lenders demand the company, among other things, raising a very substantial amount of new equity.

The requirement to raise up to $250 million in new equity is likely to result in very substantial dilution to existing shareholders and with ample time for short-sellers to position themselves accordingly, shares might experience additional pressure over the next couple of weeks.

While lower oil prices and a looming recession might impact customer capex budgets going forward, I remain positive on the offshore drilling industry, mostly due to vastly improved supply and demand dynamics.

Once completed, the upcoming debt refinancing should put Borr Drilling in the position to fully exploit favorable jackup rig market dynamics fueled by strong demand from the Middle East.

But given the uncertainties around the potential size and pricing of the proposed offering, I am downgrading the company’s shares from “buy” to “hold” and apologize to my readers for a truly bad call six weeks ago.

Be the first to comment