yosmanor/iStock Editorial via Getty Images

HFI Research

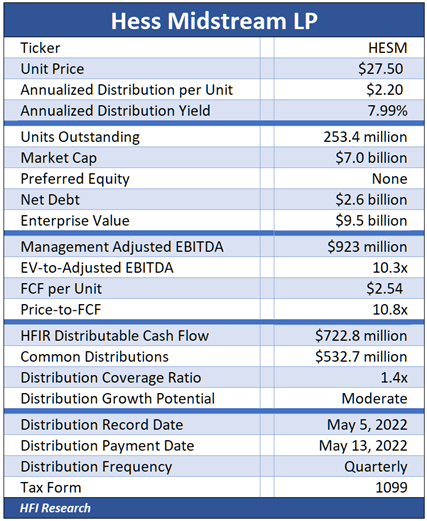

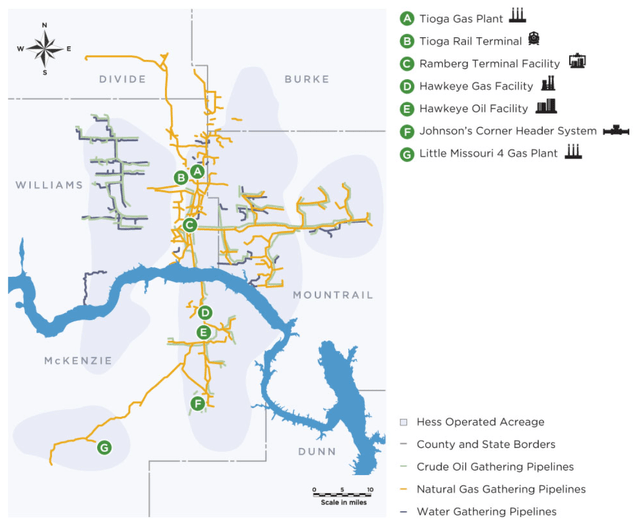

Hess Midstream LP (NYSE:HESM) serves as Hess Corporation’s (HES) midstream gathering and processing vehicle to support its production growth in the Bakken. Hess Corp. has dedicated all of its existing and future oil, natural gas, and produced water activities in the Bakken to HESM. Its asset footprint is shown below.

From a shareholder’s perspective, HESM’s most attractive attribute is its long-term contracts with Hess Corp. These contracts are some of the most attractive among independent gathering and processing (G&P) operators. For one, their fee-based structure minimizes HESM’s direct exposure to commodity prices. The contracts also contain minimum volume commitments (MVCs) that protect HESM’s cash flows in the event Hess Corp.’s Bakken production volumes decline. The value of the MVCs was demonstrated in 2020, when MVC deficiency payments limited the adverse financial impact from Hess Corp’s decision to reduce its Bakken rig count from six to one. Approximately 95% of HESM’s volumes are protected by MVCs in 2022, and HESM expects its throughput to be above its MVCs in 2023 and 2024.

HESM’s contracts also include inflation escalators. Inflation escalators are particularly important in gathering contracts because gathering is a capital-intensive activity that exposes an operator to rising material and labor costs in an inflationary environment.

Superb Capital Allocation

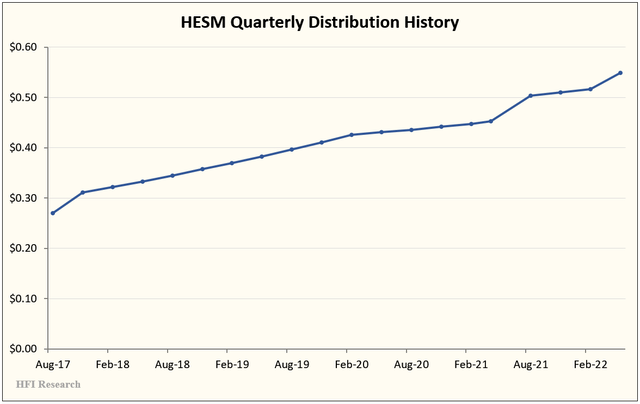

HESM management is among the best capital allocators in the G&P business. Its shareholder-friendly capital allocation was on display in the first quarter. HESM increased its quarterly distribution by 6.3% from the previous quarter and by a whopping 21.3% from the year-ago quarter. The company’s distribution increases have been steady since it came public in 2017 at $23.00 per share.

HESM’s current policy is to increase distributions by 5% annually through at least 2024. The pace of distribution increases will ultimately depend on Hess Corp.’s Bakken production levels, which we expect to remain high in response to elevated oil prices.

At the end of March, HESM repurchased $400 million of its common stock from its sponsors, who sold $662.5 million of HESM shares at $29.50 in a secondary offering. The public bought the remaining $262.5 million of shares. HESM’s repurchases shrink the number of shares over which distributions are spread and allow it to increase distributions per share.

The secondary offering did not change the number of shares outstanding; it simply transferred ownership of HESM shares from its sponsors to the public. The growing number of shares in the public domain will increase the shares’ liquidity and enhances their attractiveness to institutions. Moves like this are among the reasons why Alerian included HESM into its (AMLP) Index.

The Catalyst for Higher Cash Flow

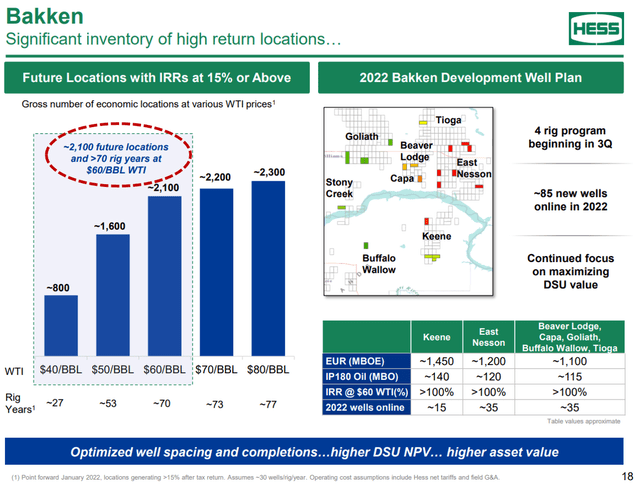

Hess Corp. reports that it has more than 70 years of high-return drilling inventory in the Bakken at current activity levels, as shown in the dotted red line in the slide below. This provides HESM with a long runway of growth.

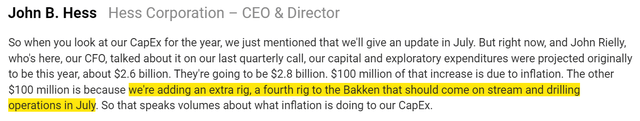

At the moment, Hess Corp is using its Bakken acreage as a cash cow to fund the development of its Guyana joint venture. As recently as the first quarter, Hess Corp. hadn’t decided whether it would add another rig to its Bakken acreage. However, that recently changed. At a recent investment conference, Hess Corp. CEO John Hess announced that the company plans to add a fourth rig to its Bakken acreage in July.

The additional rig will increase HESM’s oil and natural gas gathering and processing volumes. We believe these volumes will help the company achieve the high end of its full-year 2022 Adjusted EBITDA guidance.

The increased activity and its associated revenues will bolster the safety HESM’s current 8.0% distribution yield.

Valuation

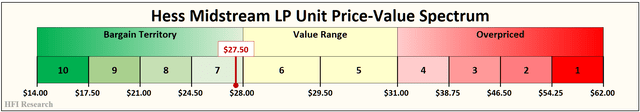

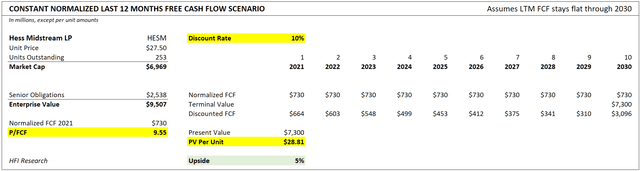

We value HESM shares in the range of $28 to $31. Our price target is the midpoint of the range, or $29.50, which is 7.3% above HESM’s current price of $27.50.

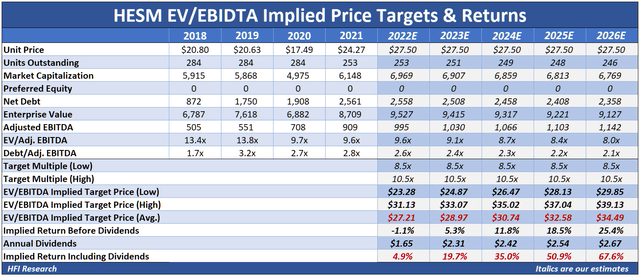

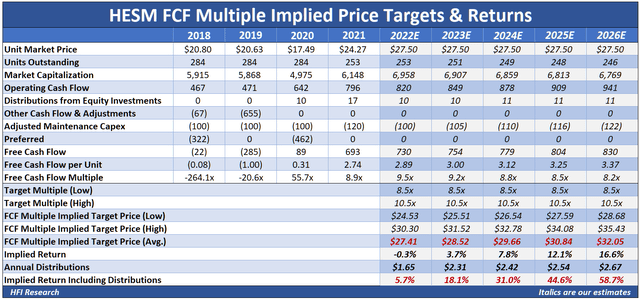

In our valuations, we assume HESM grows Adjusted EBITDA and operating cash flow by 3.5% and that it increases distributions by 5% annually through 2026. We also assume that the company generates a cash flow surplus after distributions of $100 million each year, which we believe is conservative. We assume that HESM allocates $50 million of the cash flow surplus to share repurchases and $50 million to debt reduction each year through 2026.

Our EV/EBITDA valuation indicates the shares are trading 1% below value in 2022. However, given the distribution increases, they generate a 67.6% total return through 2026.

From a free cash flow multiple perspective, the shares are currently trading around fair value, but their current price implies a 58.7% total return through 2026. This represents a 9.9% compound annual growth rate, which we believe will be resistant to inflation due to HESM’s favorable gathering and processing contracts.

Our discounted cash flow valuation indicates the shares are worth $28.81, 5% above their current price.

Conclusion

Among our G&P holdings, HESM has the least upside but the greatest safety. Its 8.0% yield is relatively safe, and we expect distributions to grow over the coming years. We consider HESM an anchor to our other more operationally volatile G&Ps. We plan on being shareholders for the long term and rate HESM shares as a Buy for their safety and income growth prospects.

Be the first to comment