Robert vt Hoenderdaal/iStock Editorial via Getty Images

Summary

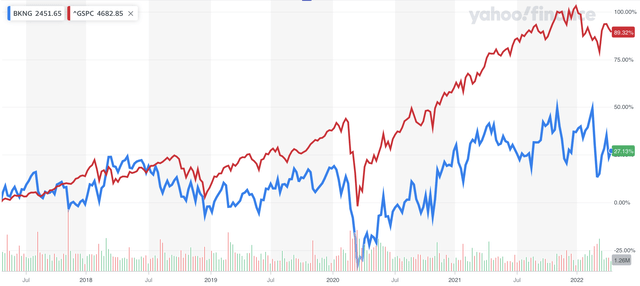

Booking Holdings Inc. (NASDAQ:BKNG) has been facing significant headwinds to its travel-related business since the global Covid-19 pandemic forced governments to impose travel restrictions across the globe, some of which are just being lifted as the world returns to a more normal state of travel.

This is clearly reflected in the company’s relative stock performance compared to the S&P 500, which shows that the relative underperformance was mostly driven during the time period from March 2020 onwards.

Ongoing reopening efforts of international borders and fewer travel restrictions are helping boost the overall demand for travel which should sooner or later boost the overall momentum in travel stocks.

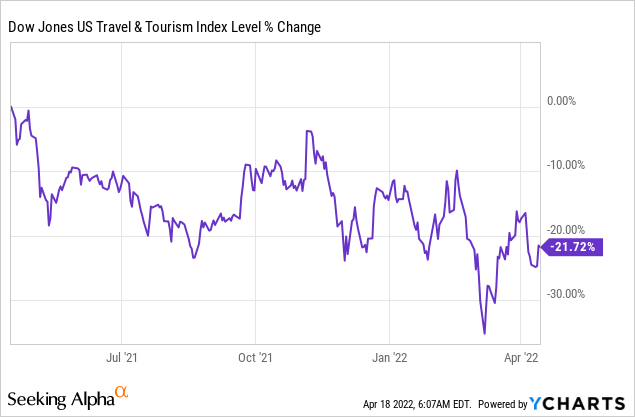

However, such positive developments in the industry have not yet translated into beneficial stock price movements in most travel names. For instance, over the past year, the Dow Jones U.S. Travel & Tourism Index (DJUSTT) is down around 21% and has declined close to 9% since the beginning of 2022.

Analysts believe the upcoming spring and summer holidays should boost travel stocks across the board as people start to make travel plans again. Alongside a flush of consumers eager to return to spending and traveling, we believe that Booking Holdings is well-positioned to benefit from this rebound in travel demand.

However that doesn’t mean that every travel stock is a sound investment. In the current market environment, with high inflation and rising rates, investors are looking for companies with actual earnings power and multiple years of consistent earnings growth. Most importantly, we want growth at a reasonable price (stock valuation). Therefore, we need to make sure that we find companies with consistent growth at exactly those reasonable prices, which brings us to Booking Holdings.

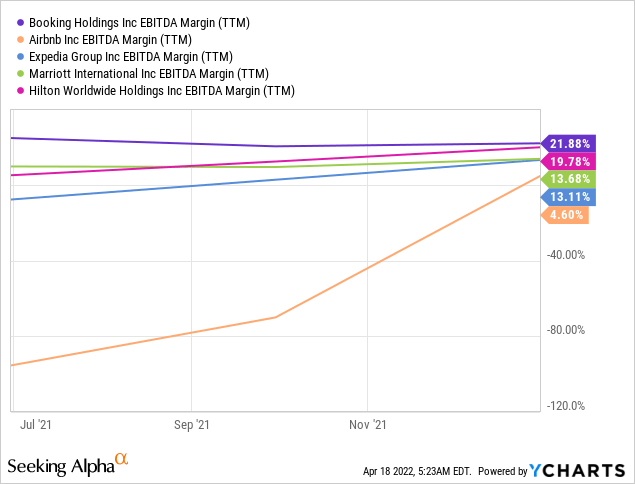

Booking’s forward earnings estimates relative to its topline growth indicate that shares may be undervalued at a PEG ratio of only 0.49 for FY 2023, and with multiple years growth ahead. Booking’s earnings potential is further supported by industry-leading margins.

We initiate an Outperform rating on the stock (see our price target further below).

Financials

In its most recent financial release, Booking Holdings reported strong fourth quarter 2021 revenue and earnings growth that showed a continued recovery from the prior quarters, when the company’s operations were still strongly restricted due to Covid-19.

- Fourth quarter gross travel bookings were $19.0 billion, an increase of 160% from the prior year quarter, and room nights booked in the 4th quarter increased 100% from the prior year quarter;

- Total revenues for the 4th quarter of 2021 were $3.0 billion, an increase of 141% from the prior year quarter;

- Adjusted EBITDA for the 4th quarter of 2021 was $940 million, compared with an adjusted EBITDA loss of $38 million in the 4th quarter of 2020;

- Net income in the 4th quarter of 2021 was $618 million, compared with a net loss of $165 million in the 4th quarter of 2020 (the 4th quarters of 2021 and 2020 include net gains on equity securities of $20 million and $552 million, respectively);

- Net income per diluted common share in the 4th quarter of 2021 was $14.94, compared with net loss per diluted common share of $4.02 in the 4th quarter of 2020.

For the full year of 2021 results were as follows:

- Gross travel bookings of $76.6 billion, an increase of 116% from the prior year;

- Total revenues in 2021 were $11.0 billion, a 61% increase from the prior year;

- Net income for the full-year 2021 was $1.2 billion, compared with $59 million in the prior year. Net income for the full- year 2021 includes net losses of $569 million on equity securities while the results for the full-year 2020 includes net gains of $1.8 billion on equity securities.

- Net income per diluted common share (GAAP basis) for the full-year 2021 was $28.17, compared with $1.44 in the prior year.

- Non-GAAP net income for the full-year 2021 was $1.9 billion, compared with $194 million in the prior year. Non- GAAP net income per diluted common share for the full-year 2021 was $45.77, compared with $4.71 in the prior year.

These are impressive numbers in light of the fact that management noted that the company’s results were still materially impacted due to the ongoing COVID-19 pandemic and the resulting economic conditions and government restrictions. Nevertheless, Booking’s management indicated during the conference call that they are confident in the company’s recovery:

As we look ahead to 2022, I am encouraged by the quick rebound in bookings we have seen so far this year and the level of summer travel on our books. While we expect to see some volatility in trends as a result of the ongoing effects of COVID, I am confident in the continued recovery in travel demand globally as there is clearly a very strong desire to travel among our leisure bookers.

Outlook

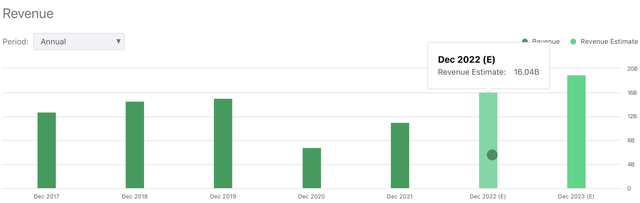

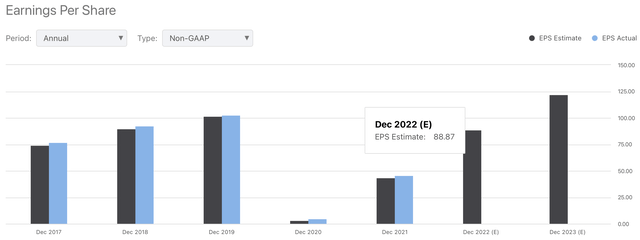

Average earnings estimates imply that Booking will be able to grow its revenue by another 45% to around $16bn during FY 2022 and the bottom-line is expected to grow by around +80% to a Non-GAAP EPS figure of $88.87. Growth for FY 2023, a year where YOY comparisons should be a bit more normalized, is expected to come in at around 18% for revenue and around 37% EPS growth.

It is worth noting that these numbers are just closing the gap to pre-pandemic levels, so there seems to be ample room for future growth and upside surprises. This is supported by the fact that Booking has frequently exceeded analysts estimates for earnings per share.

Valuation

Booking Holdings may be undervalued both on an intrinsic basis as well as from a peer-group comparison.

From an intrinsic value perspective, we look at the PEG ratio (price-to-earnings to EPS growth), which is a well-accepted metric to measure if a company’s bottom-line growth is being fairly valued. A metric below 1 implies a potential undervaluation. Booking’s PEG ratio sits at 0.31 for 2022 and at 0.49 for FY 2023 based on a 2023 forward P/E of 18.27 at the latest share price of $2,227 / share and EPS growth expected at around 37% for 2023.

For comparison, Airbnb’s (ABNB) 2023 forward P/E sits at 83.74 based on an average 2023 consensus EPS growth estimate of 54.9%. This brings the 2023 PEG ratio to 1.52 for Airbnb, implying a slight overvaluation.

Marriot’s (MAR) PEG ratio for 2023 sits at 0.88, based on a 2023 forward P/E of 25.38 and consensus EPS growth of 28.9% for 2023.

In addition, it is worth highlighting that Booking Holdings also carries one of the strongest margin profiles amongst its peer group. This should give investors additional confidence in the EPS growth forecast over the next 2-3 years.

What Analysts Say

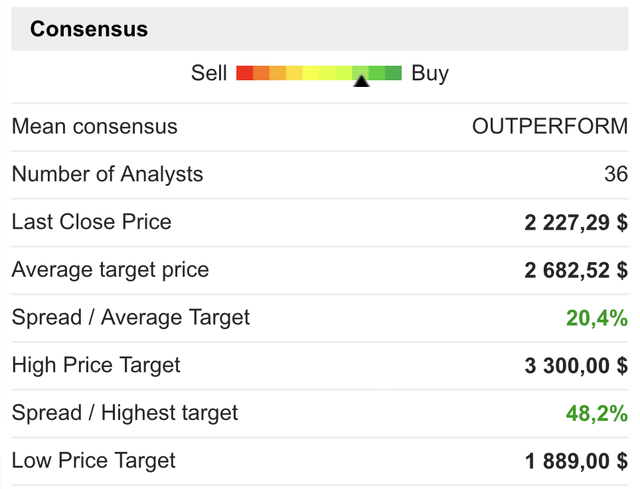

Wall Street analysts seem to be confident in Booking’s ability to grow its bottom-line moving forward.

Oppenheimer recently upgraded Booking Holdings to an Outperform rating and expects the company to sustain a low 20’s P/E multiple for the foreseeable future. The analyst at Oppenheimer raised their ’23E revenue/EPS estimate 4%/10% based on looser international restrictions driving a faster travel recovery, offsetting pockets of geo-political volatility. Oppenheimer projects 65% 2021-2023 EPS growth and sets a price target of $2,560 based on 20X the 2023 EPS estimate. The price target represents 15% upside for BKNG shares.

In addition, analysts from Evercore ISI also assigned an Outperform rating on the stock, assigning a price target to BKNG of $2,900 based on a 25X price-to-earnings multiple and 16X EV-to-EBITDA multiple off 2023 estimates. That price target implies around 30% upside for shares and is above the average analyst price target of $2682.

Conclusion

While a strong travel rebound during the summer-period of 2022 and beyond should benefit the entire travel sector, we believe that Booking Holdings’ stock has the strongest upside potential based on its PEG ratio of 0.49 and its relative margin profile vs. peers.

Recent financial results showed strong top- and bottom-line growth, and further showed that Booking is well on track to a full recovery beyond pre-pandemic levels. Based on a 22x PE multiple and 2023 EPS estimate of $121 / share, we arrive at our FY 2023 price target of $2,662 / share. We initiate an Outperform rating on the stock based on these estimates.

This is in line with current analyst estimates with the average price target sitting at $2,682 / share.

Booking Holdings will be releasing its first quarter 2022 financial results on May 4th 2022.

Be the first to comment