a-poselenov/iStock via Getty Images

Let’s take a look at the expectations built into the bond market these days.

First, we see that the term structure of interest rates is slightly negative, indicating the possibility that the economy will go into a recession in the near future, but the downturn will only be modest.

Second, we see that the inflationary expectations built into current bond yields indicate that very little inflation is expected over the next five- to ten years and that there is very little expected change in expected inflation over the next five to ten-year period.

Current inflation in the United States? Well, it has been around 8.2 percent, year-over-year.

The current inflationary expectations built into the bond market are just over 2.50 percent. Five-year inflationary expectations have averaged right around 2.65 percent over the past week and ten-year inflationary expectations have averaged just over 2.6 percent.

Not only are inflationary expectations low, but they are very similar for the full period under review. That is, they don’t rise much anytime over the next ten years.

In terms of what the investment world seems to believe, the battle against inflation will not be a very great one, any recession that might happen will be quite shallow and not very long, and the inflation, itself, will be modest and short-lived.

And, maybe that is why the stock market seems to be as buoyant as it has been.

But, what does this say about what the investment community feels about the Federal Reserve’s battle against inflation?

Well, these data seem to indicate that the Fed’s battle against inflation is not going to be that tough or that long.

Do you believe this?

Alternative Scenario

What would be another view we might draw of this picture?

Well, maybe interest rates are still too low.

The total yield on the 10-year U.S. Treasury note averaged right about 4.20 percent over the past five days.

Might it be possible that this yield is way too low?

What might cause that?

Could it be that interest rates have been excessively low in recent times? In recent years?

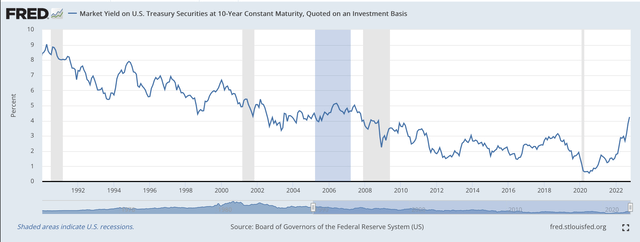

Market Yield 10-year Treasury Note (Federal Reserve)

Notice that before the Great Recession, the yield on the 10-year Treasury note very seldom dropped below 4.00 percent.

Since the Great Recession, the yield on the 10-year Treasury note hardly got above 3.00 percent.

And, since the Great Recession, the United States had the longest period of economic expansion since the end of World War II.

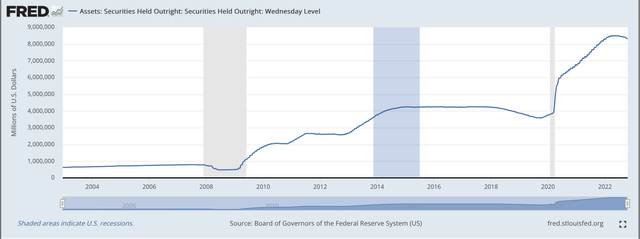

Since the Great Recession, the United States has experienced, under the leadership of Fed Chair Ben Bernanke, three rounds of quantitative easing, where the Fed proudly erred on the side of monetary ease, and under Fed Chair Jerome Powell, a massive year-and-one-half of quantitative easing, where everything possible was thrown into the monetary system to avoid a financial collapse.

The Federal Reserve, at one time, held more than $8.5 trillion in securities purchased outright.

Federal Reserve: Securities Purchased Outright (Federal Reserve)

Before the Great Recession, the Fed held under $900 billion of securities purchased outright.

There has been a change in the environment.

The financial system, over the past fifteen years or so, has seen a massive change in the way that the Federal Reserve does things.

As a consequence, there is a lot more liquidity in the banking system, in the financial system, than there ever was before.

Has this resulted in longer-term interest rates being lower, relative to everything else going on in the economy, that ever before?

Is there a “liquidity factor” that should be accounted for in the yield on the 10-year U.S. Treasury note, that before the Great Recession was missing?

Could this “liquidity factor” be something that the Federal Reserve needs to take into account when conducting its battle against inflation?

Federal Reserve Tightening

In recent posts concerning the operations of the Federal Reserve, I have raised the concern that the amount of tightening that the Fed really needs to do is much greater than what it has proposed.

That is, the Fed has pumped a lot of liquidity into the banking system, since 2008, and especially since 2020.

How much of this money does the Fed need to remove before the economic system actually feels some monetary tightness, enough tightness to cause the inflationary pressure we are now experiencing to lessen?

Maybe what the investment community is now saying in the information we are getting from the bond markets is that the plans the Fed has expressed to combat inflation and bring the inflation rate back to 2.00 percent are too modest. The Federal Reserve must do much more.

The yield on the 10-year U.S. Treasury note is only around 4.20 percent. But, this is with the financial markets flooded with liquidity injected into the system over the past 15 years.

What if the yield on the 10-year U.S. Treasury note should be around 6.20 percent at this stage of the battle…or, even higher?

This is the concern I have.

Because of the events of the past 15 years, and especially of the events of the past 2 years, maybe the financial system and the economy are so out-of-equilibrium that the adjustments needed to be made to the economy are much larger than we now expect.

This is consistent with other parts of the economy and the financial system. The data we are experiencing are not related to each other in the way they were previously.

Maybe this is a sign of just how disjointed the economy and the financial system are.

If this is the case, then the policymakers have a much tougher job ahead of them than they might imagine.

And, consequently, investors and business leaders have a much tough job ahead of themselves than they might imagine.

Maybe this is why the data we review don’t seem to provide us with conclusions like they once did.

Maybe inflationary expectations should be much higher than we currently estimate them to be.

Be the first to comment