Rawf8

Earnings of BOK Financial Corporation (NASDAQ:BOKF) should surge next year on the back of margin expansion amid a rising rate environment. Further, mid-single-digit loan growth will support the bottom line. Overall, I’m expecting BOK Financial to report earnings of $7.57 per share for 2022 and $8.90 per share for 2023. Compared to my last report on the company, I’ve revised upwards my earnings estimates mostly because I’ve increased my margin estimates. Next year’s target price suggests a small downside from the current market price. Therefore, I’m maintaining a hold rating on BOK Financial.

Raising the Margin Estimate

BOK Financial’s net interest margin grew by 48 basis points in the third quarter following a 32-basis point growth in the second quarter of the year. The third quarter’s performance beat my previous expectations. The ongoing up-rate cycle will further boost the margin in future quarters.

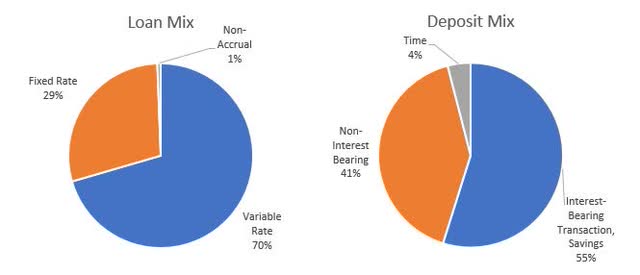

BOK Financial’s loan and deposit mixes are well-positioned for an up-rate cycle. Variable-rate loans made up 70% of total loans while adjustable-rate deposits (transaction and savings) made up 55% of total deposits at the end of September 2022. Therefore, loan repricing will outweigh deposit repricing in the short term, leading to significant margin expansion.

3Q 2022 10-Q Filing

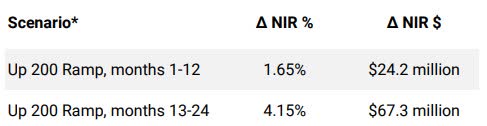

Although the balance sheet positioning paints a very rosy picture of the margin outlook, management isn’t as optimistic. Management has estimated that a 200-basis points hike in rates could boost the net interest income by only 1.65% over 12 months, as mentioned in the earnings presentation.

3Q 2022 Earnings Presentation

Considering these factors, I’m expecting the margin to grow by 15 basis points in the last quarter of 2022 and 10 basis points in 2023. Compared to my last report, I’ve revised upwards my margin estimate because of the third quarter surprise. Further, my interest rate outlook is more hawkish than before.

Outlook on Loan Growth Remains Positive

As expected, loans continued to grow at a strong rate in the third quarter of 2022. The portfolio increased by 2.4% in the quarter, taking the nine-month growth to 8.0%. Going forward, loan growth will likely slow down because of high-interest rates. However, other economic factors will likely support loan growth. Management mentioned in the presentation that it expects mid-to-upper single-digit annualized loan growth.

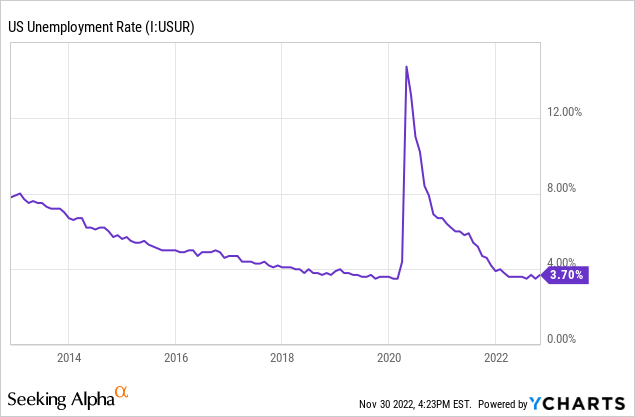

BOK Financial’s loan portfolio is quite geographically diverse as the company has a presence across the Midwest and Southwest. Therefore, the national average unemployment rate is a good gauge of credit demand. As shown below, the rate has persistently been near record lows this year.

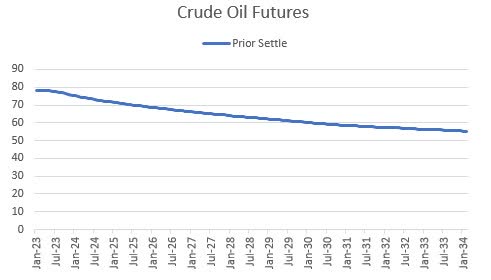

Further, oil prices are an important factor as the energy segment makes up 15% of total loans. The oil futures curve is in backwardation. Nevertheless, oil futures prices are still very high even two years out from today.

CME Group

Considering these factors, I’m expecting the loan portfolio to grow by 2.0% in the last quarter of 2022, taking full-year loan growth to 10%. For 2023, I’m expecting the loan portfolio to grow by 6%.

Meanwhile, I’m expecting deposits to grow somewhat in line with loans. However, securities growth will trail loan growth because the rising rate environment will lower the market value of securities, leading to unrealized mark-to-market losses. As these losses are unrealized, they will skip the income statement and flow into the equity account directly through other comprehensive income. These losses will erode the equity book value, which has already declined by 16% in the first nine months of the year. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net Loans | 21,449 | 21,540 | 22,619 | 19,949 | 21,980 | 23,328 |

| Growth of Net Loans | 26.7% | 0.4% | 5.0% | (11.8)% | 10.2% | 6.1% |

| Other Earning Assets | 12,348 | 15,451 | 18,924 | 24,950 | 15,895 | 15,895 |

| Deposits | 25,264 | 27,621 | 36,144 | 41,242 | 36,489 | 37,970 |

| Borrowings and Sub-Debt | 7,419 | 8,621 | 3,821 | 2,494 | 1,013 | 1,054 |

| Common equity | 4,432 | 4,856 | 5,266 | 5,364 | 4,632 | 5,083 |

| Book Value Per Share ($) | 66.5 | 68.2 | 75.8 | 78.2 | 69.1 | 75.9 |

| Tangible BVPS ($) | 48.7 | 51.7 | 59.1 | 61.6 | 52.3 | 59.1 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Provisioning for Loan Losses Likely to Normalize

In my last report, I projected that BOK Financial will resume provisioning for loan losses in the third quarter, after posting zero net provision expenses in the first half of the year. I estimated a provisioning expense of $4 million for the quarter. BOK ended up smashing my estimate as it reported provision expenses of $15 million for the quarter.

Going forward, I’m expecting provisioning to dip to a more normal level. This is because the portfolio credit risk appears well provisioned for, as allowances made up 1.37% of total loans while non-accrual loans made up 0.60% of total loans. However, the threats of a recession will keep the provisioning from dropping too low.

Considering these factors, I’m expecting net provision expenses to make up 0.14% of total loans in 2023, which is the same as the average for the last five years.

Revising Upwards the Earnings Estimate

Due to the anticipated margin expansion and loan growth, I’m expecting earnings to grow by 17% next year to $8.90 per share. For 2022, I’m expecting BOK Financial to report earnings of $7.57 per share, down 15% year-over-year. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net interest income | 985 | 1,113 | 1,108 | 1,118 | 1,191 | 1,375 |

| Provision for loan losses | 8 | 44 | 223 | (100) | 23 | 32 |

| Non-interest income | 617 | 694 | 844 | 756 | 626 | 690 |

| Non-interest expense | 1,028 | 1,132 | 1,166 | 1,178 | 1,147 | 1,264 |

| Net income – Common Sh. | 446 | 501 | 432 | 614 | 507 | 596 |

| EPS – Diluted ($) | 6.63 | 7.03 | 6.19 | 8.95 | 7.57 | 8.90 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

In my last report on BOK Financial, I estimated earnings of $6.83 per share for 2022 and $7.88 per share for 2023. I’ve increased my earnings estimates for both years mostly because I’ve raised my margin estimates.

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

Maintaining a Hold Rating

BOK Financial is offering a dividend yield of 2.1% at the current quarterly dividend rate of $0.54 per share. The earnings estimate and current dividend suggest a payout ratio of 24% for 2023, which is below the five-year average of 30%. BOK has only recently increased its quarterly dividend, so another hike before the last quarter of next year is unlikely.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value BOK Financial. The stock has traded at an average P/TB ratio of 1.50x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 48.7 | 52.1 | 59.1 | 61.6 | ||

| Average Market Price ($) | 95.7 | 81.2 | 60.2 | 90.6 | ||

| Historical P/TB | 1.96x | 1.56x | 1.02x | 1.47x | 1.50x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $59.10 gives a target price of $88.80 for the end of 2023. This price target implies a 15.2% downside from the November 30 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.30x | 1.40x | 1.50x | 1.60x | 1.70x |

| TBVPS – Dec 2023 ($) | 59.1 | 59.1 | 59.1 | 59.1 | 59.1 |

| Target Price ($) | 77.0 | 82.9 | 88.8 | 94.7 | 100.6 |

| Market Price ($) | 104.7 | 104.7 | 104.7 | 104.7 | 104.7 |

| Upside/(Downside) | (26.5)% | (20.8)% | (15.2)% | (9.5)% | (3.9)% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 11.5x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 6.63 | 7.03 | 6.19 | 8.95 | ||

| Average Market Price ($) | 95.7 | 81.2 | 60.2 | 90.6 | ||

| Historical P/E | 14.4x | 11.5x | 9.7x | 10.1x | 11.5x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $8.90 gives a target price of $101.90 for the end of 2023. This price target implies a 2.6% downside from the November 30 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.5x | 10.5x | 11.5x | 12.5x | 13.5x |

| EPS 2023 ($) | 8.90 | 8.90 | 8.90 | 8.90 | 8.90 |

| Target Price ($) | 84.1 | 93.0 | 101.9 | 110.8 | 119.7 |

| Market Price ($) | 104.7 | 104.7 | 104.7 | 104.7 | 104.7 |

| Upside/(Downside) | (19.6)% | (11.1)% | (2.6)% | 5.9% | 14.4% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $95.40, which implies an 8.9% downside from the current market price. Adding the forward dividend yield gives a total expected return of negative 6.9%. Hence, I’m maintaining a hold rating on BOK Financial Corporation.

Be the first to comment